This is the second entry in my deep dives sponsored by Tegus series. The goal of these are simple: every month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry. You can find the first deep dive into the risks to the cable industry here.

I’m hoping this series is a screaming success, with readers and myself learning a ton from the interviews and Tegus getting lots of publicity for their product (which I love and is table stakes for fundamental investors) and that I’ll be able to turn these into a regular monthly recurring feature forever. Of course, that involves everyone feeling like they’re getting value from the series, so please check out Tegus if you’re a fundamental investor and haven’t done so already (again, it’s pretty much table stakes for investors at this point).

My first deep dive was into the sector I was most familiar with (cable). For my second post, I figured I’d do a complete 180 and choose a company I had almost no familiarity with, Regeneron. I’ll talk about why in a second, but before I do let me highlight the three Regeneron calls I did (note: for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub!):

Former Employee at Regeneron Pharmaceuticals, Inc

Note: all of the calls were good, but I think this call was particularly interesting.

So why choose Regeneron? Well, I had almost no knowledge of the company, but I’ve had it on my “to research” list for a long time. Three things really got it there:

My buddy Elliot Turner has always been pushing me to look at it, telling me it was a great company with a huge moat trading at a reasonable to downright cheap price.

John Hempton / Bronte Capital’s Q2’21 letter described REGN as the rare growth stock that “comes into a price range we consider worthy of a full-sized position.”

The (sadly retired) GOAT of substacks, Nongaap, covered a very bullish RSU grant REGN gave to their top execs last year.

That’s an insanely interesting combination: multiple investors pitching it as a great company with a huge moat at a reasonable price (or, in some cases, unreasonably cheap; even after a nice run, REGN today trades for <$700/share. 2021 EPS was ~$72/share, so you’re paying <10x EPS for a company with a unique moat and assets as well as a huge net cash balance. Admittedly, 2021 is driven by a COVID bump, but how often do growth pharma companies with unique assets trade at <10x EPS? My friends at Daloopa have a full REGN model available free if you’re interested in diving further into their financials), plus with a governance expert pointing out management’s actions suggested they thought the stock was screamingly cheap / were prepping for long term price appreciation.

So I’ve always meant to dive into REGN, but it’s been a daunting task. Diving into anything pharma related is much, much more complex than diving into, say, a media company or a cable company. If you’ve studied one cable company, you’ve got a great base of knowledge for diving into any telecom worldwide. Obviously, there are market by market differences, but if you’ve looked at one you’ll understand the basic trends, what to look for, etc. for all of the other cable companies and can get up to speed reasonably quickly. The same is not true of pharma or biotech; each company and asset base is generally completely unique and needs to be diligenced separately. The proper way to dive into a pharma company is generally to take every single drug or potential drug of meaningful size they have and do a deep dive diligence into each drug (analyzing the market and potential competitors, patent portfolio, peaks sales range, etc.); doing so can take an enormous amount of time.

Anyway, I’ve always meant to dive into REGN, but life kept getting in the way! So when I announced deep dives sponsored by Tegus, I had REGN at the top of the list for companies I wanted to look into. It’s a fascinating company, and I thought it was a perfect fit to show how some expert calls can help you get up to speed on a company.

And, after diving into REGN, I can see why so many investors are interested in them. An anecdote might help show why: I was actually hoping to have this post up a few weeks ago, but Tegus and I ran into some challenges scheduling calls. For compliance purposes, Tegus generally doesn’t allow for experts who are participating in active clinical trials to do expert calls. Tegus and I had roughly ten false starts where we identified a really perfect expert to interview and then Tegus came back and had to cancel the call because the expert was involved in a drug trial. That’s exceedingly rare; in fact, my account manager told me that she’d never had a company where so many experts got disqualified for working on clinical trials. So, while it made scheduling calls a bit frustrating, I think the fact that so many experts were involved in clinical trials in some form speaks to how unique Regneron is.

So that’s why I was so interested in Regeneron. Let’s dive into the company.

Regeneron is a “fully integrated” biotech. At this point, they’re probably best known for their COVID antibody treatment (which likely saved Trump’s life when he was President and caught COVID). How they made that COVID cocktail in record breaking time is pretty fascinating; it came in part from work they did developing Ebola and MERS treatments, and to develop it in just 10 months would have been absolutely unthinkable a decade ago.

While REGN certainly enjoyed a boom from the COVID cocktail (their COVID antibodies generated ~$7.5B in sales in 2021, more than the entire company’s revenue of ~$6.6B in 2019!), REGN is much more than the COVID cocktail. They have two other blockbuster drugs: Eylea, a biologic eye injection that did ~$9.4B in sales in 2021, and Dupixent, a biologic injection that treats a host of issues (including asthma and eczema) that did $6.2B in sales in 2021. REGN also has a massive pipeline of clinical stage drugs that could treat a wide variety of diseases.

But it’s not the specific molecules that REGN owns / produces that makes them so interesting. The things that really set REGN apart are the VelociSuite and the Regeneron Genetics Center. These are unique assets that let REGN develop new drugs significantly faster and cheaper than peers (quote below from this conference):

The important principles to take away here are these approaches can now enable us to do trials with larger effect sizes, think about 65% versus 15%. We can do them faster. These can be precision trials that are less expensive and we get signal, and readouts a lot earlier. So absolutely, this can transform the way we do development and can help us with very difficult fields that haven't been broken in terms of NASH and other difficult fields.

The pharma field is dominated by giants. In 2021, REGN did ~$16B in sales and spent $3B in R&D. Those were, by far, records for REGN (in 2019, they did ~$6.6B in sales and spent $2.5B in R&D), and they’re certainly big numbers…. but they pale in comparison to the giants of the industry. Pfizer, for example, did $81B in revenue in 2021, and spent almost $14B on R&D, so their R&D budget roughly matches REGN’s annual revenue.

It’s not lost on anyone that drug development is insanely expensive and risky. So my main purpose of this dive was to learn more about VelociSuite and the Regeneron Genetics Center: what are they, how are they so effective at reducing cost and risks in trials, and if they’re so great why can’t industry giants with R&D budgets multiples larger than REGN recreate them?

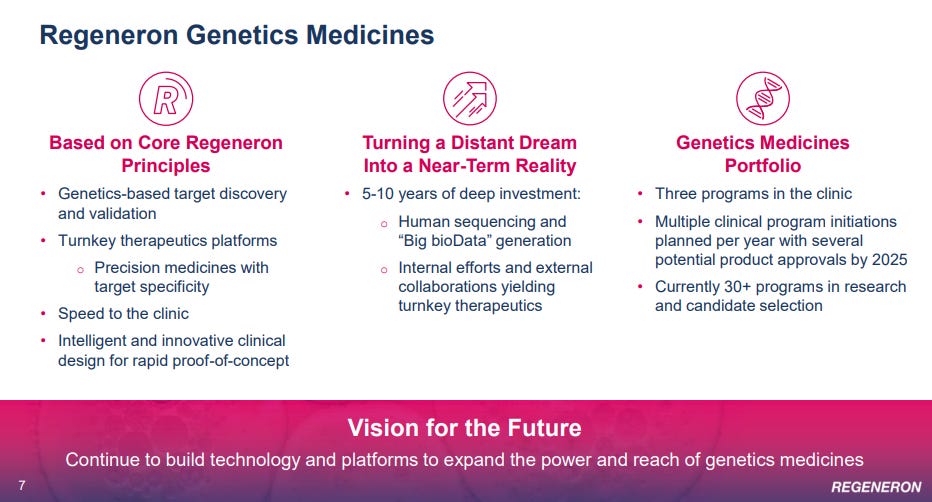

Let’s start with VelociSuite. This suite includes a whole host of technologies (VelocImmune®, VelociGene®, VelociMouse®, VelociMab®, Veloci-Bi®, VelociT®, VelociHum®) and was the core asset behind REGN’s founding. As one of the founders put it:

So to remind you about our history at Regeneron, we founded and built this company on the dream of the power of mouse genetics, and we invented the most powerful technology to engineer the mouse genome, which we called VelociGene. Even in the age of CRISPR, VelociGene remains the most powerful and rapid genome engineering technology in the world. VelociGene allowed us to test genetic variation in the mouse, that is knocking out of genes or humanization and insertion of modified human genes so as to test and validate potential drug targets. And because of this VelociGene capability, we were able to do this testing at an incredible scale, hundreds of potential drug targets a year. This gave us enormous confidence in the targets we were pursuing and helped explain the remarkably high success rates that we ultimately had in the clinic.

But we also recognize that we needed a new turnkey ways of making new medicines based on these genetic insights that we were getting from the mouse studies. For example, one turnkey approach that we developed was we exploited VelociGene to make our VelocImmune mouse. It was the largest genome engineering project in history, where we precisely replaced over 6 megabases of mouse immune genes with their human genetic counterparts to create the most powerful way of making and selecting for the best fully human antibodies rapidly and in a manufacturing-ready way. So combining mouse genetics, high-throughput mouse genetics, with these turnkey therapeutics approaches allowed us to deliver many important medicines from our laboratories, from EYLEA to DUPIXENT to PRALUENT to the highly effective antibody cocktail treatments for epidemics, initially Ebola and, most recently, COVID-19.

So basically the VelociSuite lets REGN use mice to rapidly come up with and test therapeutics. That’s a huge, huge edge for REGN; as one expert put it:

What is the technology that Regeneron has that other people cannot follow it? Well, this is the main thing I think Regeneron came up with was the VelociSuite. I mean, basically, whatever infections you are thinking of, since Regeneron is an antibody-based company, they were looking for antibodies. And for the antibodies to happen, what is going to happen is, you have to have everything done in a mouse. And again, you have to humanize the antibodies before you can do a clinical trial and get into a human.

Well, Regeneron kind of did it like a fast forward kind of thing, and they already started with the mouse, which is already like a humanized mouse. And for that, they went into the mouse basically and changed the genetic mouse into a human mouse. And I think that gave a big fast forward kind of thing, which is like very difficult. And especially while working in Infectious Disease, I was working with the Staph virus at times.

And as you know, I mean the Staph bacteria, it is really, really bad. And so what we got to do is, with the Staph, we used to get animals from the VelociGene, which have already been humanized. So then when I do all my experiments, I would get antibodies, which are already humanized and I can go ahead and go with the trial. And I think that gave Regeneron biggest advantage over other people.

In case getting mice to develop human antibodies sounds simple, the expert confirmed that it is, in fact, not:

Mouse genes are very different from humans. And so they are very close, not that much of a difference. But if you change the mouse cell into a human, that makes a big difference. And from what they do is, instead of breeding out the mice, they don't breed out the mice. What they do is, they take the cell and they genetically modify it. So you would take a cell in a Petri dish and modify it. And then you would put it back into a mice to become like a humanized mice.

And from then on, when the breeding starts, that is what the breeding will happen and you already have a humanized mice. So if you take it into a different kind of a company, it will take you years to come up with mice like this. And especially, you're talking about like Jackson and all the other companies that already breeds mice, they take at least nine months, while Regeneron would be like very fast, probably within a month.

I’m going to quote a full exchange between me and the expert, because I thought it did such a nice job of illustrating how different “humanized” mice are and why getting them humanized can accelerate development so much:

Tegus Client

Got you. And this might be very silly. But I am not a virologist, but I would think if I had a mouse in my apartment or something and I had COVID, I couldn't pass COVID on to it, right?

Former Employee at Regeneron Pharmaceuticals, Inc.

No, exactly. There's no way.

Tegus Client

If you took one of these humanized mice, and I'm just curious on this. If you took one of these humanized mice and put it in my apartment, could I pass COVID on it? Like, are we basically just talking it's so close to humans?

Former Employee at Regeneron Pharmaceuticals, Inc.

Exactly. Totally, very close to humans. And that makes it such a big difference. And then later on, I'm just going to give you a little bit more details. What's interesting is, now when you look at the different, like what is the actual COVID virus doing? Can I knock-in and knockout? I'm sure you've heard about like knock-in mice and knockout mices, where they take out the gene and take it off and put it back on. With that technology, with VelociGene, it's so easy for them to do it. They just take off one gene and make sure, okay, if that gene has any capability of making this infection happen or not?

So that is what a knock-in and knockout gene happens, and that is very important for any of us to do any kind of study. We just want to know, especially in an antibody kind of department, it's like we want to know what are the different antibodies, what do they do? So if I knock-in a gene and knockout a gene and then give you the animal and then you're like doing studies with them, you will immediately see the effect that this is what the difference is.

Tegus Client

Got you. And just to define that a little further. And again, sorry to go so deep but is one of the advantages like you could have two mice. And obviously, with mice, I don't think there's huge inference of what you're doing with them. But you have two mice, one without a gene and one with a gene and then expose them both to COVID or whatever it is you want and say, okay, this mouse caught it, this mouse didn’t, so now you can do it with 1,000 mice without the gene or something. It seems like if you don't have this gene? Or any thoughts on that?

Former Employee at Regeneron Pharmaceuticals, Inc.

Yes. That's what it is, yes. If you don't have the gene, then that's it, you cannot do it. And I think that is like the biggest, biggest difference that Regeneron has brought it in, which other companies still haven't found out. And that's the reason it takes such a long time for us to do anything. It takes such a long time for other companies to do any kind of studies because while they are waiting for this kind of mouse to arrive, which is like a knock-in and knockout, they're just waiting for other things to arrive before they can do any kind of experiments.

Sorry for so much quote clipping, but I just thought that was such a great exchange and so illustrative of the advantages of Velocisuite I had to include it. Obviously the mice and stuff are cool, but if I had to sum it up the VelociSuite advantage is that it lets Regeneron target specific antibodies and genes and iterate on them much faster than other companies. Time is literally money when it comes to R&D; every extra day of research is another day of paying expensive scientists, lab fees, etc., so VelociSuite gives Regeneron a time advantage that lets them try out more drugs / molecules / antibodies in less time and at lower cost than peers.

The other big REGN asset is the Regeneron Genetics Center (RGC). One of the founders described the RGC as the human extension of the mouse side of VelociSuite

And our vision was to take these same core principles and use them to build the genetic medicines capabilities of the future. We wanted to extend our ability to elucidate the functional implications of genetic variation in mice by creating a complementary capability to explore human genetic variation through mega-scale human sequencing, all linked to electronic medical records and to also incorporate the right toolkit of genetic and medicines to take advantage of these genetic insights that we were sure to gain from all of these efforts. Next slide.

Again, I’ll turn to an expert to describe what the RGC is and why it’s such a big deal:

Regeneron Genetics Center, that came about. And I think that made a huge difference. And I think that came in around like 2017, '18. I think that's when I had started working with them a little bit. And again, as I was telling you, I was working with the bacteria. So I was very interested.

I was working in such a way that some of the diseases that I was looking into, especially the bacterial disease. What I was looking into is like if you shut off one of the genes, it makes a huge difference. Like, to put it in basic words, it's like my blood and your blood is totally different. If I have something else in my blood, it will make the bacteria kill faster than yours.

So for that, I think that Regeneron Genetics Center made a huge, huge difference, for me to get into, because I would get into samples, which is like almost like 200 people, and that would give a huge difference. And I would take that and put it into a mouse strategy, how will I make my mouse model in such a way that I can address these kind of questions.

The head of RGC dove into that history a little deeper at a conference:

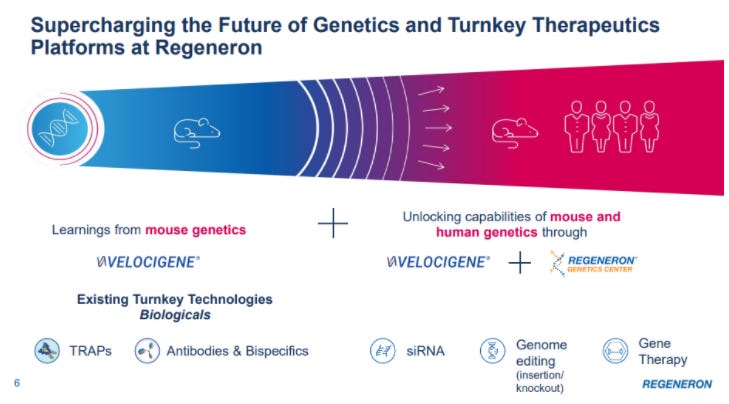

So we started this about 8 years ago, the RGC, a big human genetics initiative at Regeneron, again, based on the foundation and principles that George nicely highlighted and the power of genetics in mouse and human genetics and how it really changes the paradigm in drug discovery and development. Our industry is one that has been marked by a 90% failure rate. And as we look at all the targets of known medicines, approved medicines and experimental medicines, sadly, it's only about 5% to 10% of the genes in our human genome correspond to those drug targets. So clearly, we don't know enough about what our genes are doing, let alone which ones are the best levers for drug targets. I mean that's a really big deal and important differentiating point here. We have the largest database of gene variation linked to health and disease to start to make those connections, understandings and bring forward those drug targets.

To do this, you really have to have the right scale. You can't do this in a small fashion, and you can't do this without fully sequencing all of the genes. Our database now is approaching about 2 million individuals who've been sequenced. It's hard to say exactly. But from our friends at Illumina and elsewhere in the field, it's estimated that maybe 5 million people or so have been fully sequenced in the history of next-gen sequencing. So it really puts things into perspective what's happening here in Tarrytown. This does include the largest project to date in the world, which is a 500,000-person U.K. Biobank project. All of our projects are linked to very detailed phenotypic data, health record data, head-to-toe imaging data on lots of individuals, for example. This is an incredibly powerful resource for discovery and development.

REGN’s edge here is big; the CSO noted that the scale and electronic linkage of this project dwarves everyone else:

We have sequenced more than 2 million volunteers to date, representing almost half of all humans ever sequenced. But all of our sequence volunteers are linked to their electronic medical records, creating perhaps the world's largest and most valuable genetics-based big data, data set and which have already led to import new genetics-based drug targets and neurogenetics insights into clinical trial design.

And that scale is important. There are really rare genetics mutations that let a small subset of humans fight specific diseases, and REGN’s huge scale lets them capture those mutations in their data set. As the head of RGC put it,

I love your verbiage there around really disease modifying and not a band aid. The first part of your story, this is one of our favorite examples of protective genetics. And we think about how genetics can inform drug discovery, development. And we simplified and we say, there are mutations like TTR or sickle cell that cause disease. And for rare populations like that, you create therapeutics that try to correct or restore the proper function. This is totally different. This is more down the path of something like PCSK9, where you find rare individuals out there that don't have disease, right? They have -- is almost, we like to have fun, we can call them, it's like superhuman powers, where they're protected from disease. And so once you find those things, you want to create therapies that mimic those powers. So we want to create therapies that will inhibit this target, and hopefully have the same types of beneficial effects on fatty liver disease. And yes, that in a nutshell, the thing we're really excited and hopeful for the potential of this target is that there is human data from human genetics, where you have a dramatic reduction in clinical outcomes of NASH. And we know we can pinpoint it to inflammation and fibrosis, which is really the hallmark of end stage disease of clinically meaningful disease, liver failure, liver cancer, transplants, death. And that's where this gene, this target is having its big punch in reducing those disease processes.

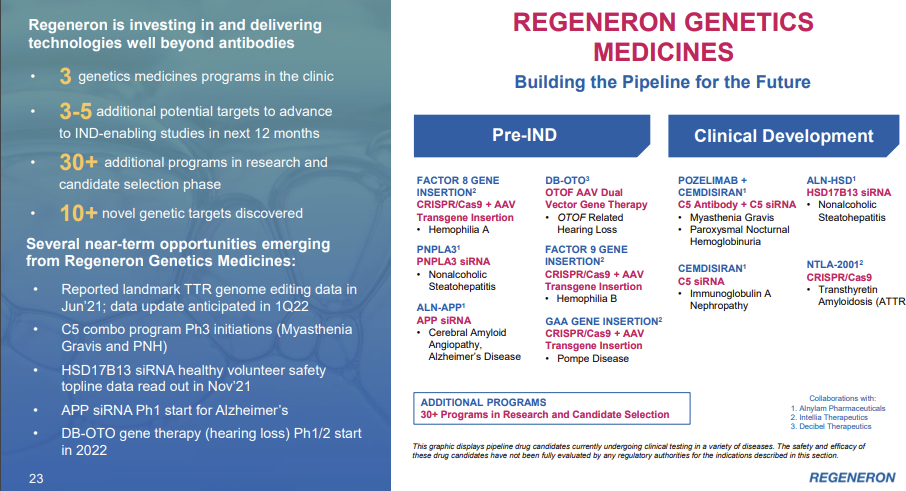

So REGN has a massive lead in genetic sequencing… but they aren’t just sitting still with it. They’re using the lead to partner with other companies and develop the “future of genetics medicines”

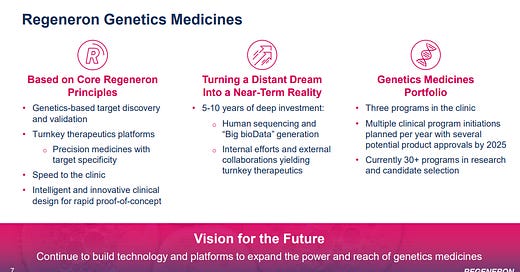

We then took all of this from the Regeneron Genetics Center, and we strategically incorporated a series of selected partners with synergistic genetic capabilities such as Alnylam, that allowed us to develop an siRNA platform; or Intellia, delivering us a CRISPR-based gene knockout and insertion approach. Together with this significant internal effort in developing novel approaches to viral-based gene delivery, we believe we are becoming leaders in the future of genetics medicines with multiple exciting clinical and near clinical programs….

With the Regeneron Genetic Center as our backbone and our growing external partnerships with like-minded companies, such as Alnylam, Intellia and Decibel, we are well-positioned to be at the forefront of the next wave of biotech innovation. While still in its infancy, we think that these groundbreaking technologies, such as siRNAs, CRISPR-based therapies as well as virally directed gene therapy, have the potential to be just as large as the biologics are today.

On Slide 23 is a summary of some of our near and longer-term opportunities emerging from our Regeneron Genetic Medicines capabilities. Our strategy involves creating synergistic partnerships that can synchronize with what we can do internally and which can help further empower and build on, resulting in world-leading turnkey therapeutic solutions that can yield entire pipelines, all going after targets elucidated and validated biogenetics, giving us the highest chance of success in the clinic.

I know I just threw a ton out at you. If I had to sum it up, it would be simply this: VelociSuite and RGC are assets unique to REGN that let them develop drugs faster, cheaper, and smarter than peers. The combo is highly synergistic in discovering new drugs: RGC lets scientists quickly find genes that make a difference in fighting something, and then Velocisuite let’s REGN quickly test that gene and model how different changes will effect the system. Here’s an example one of the experts gave:

I was working with the bacteria. So I was very interested.

I was working in such a way that some of the diseases that I was looking into, especially the bacterial disease. What I was looking into is like if you shut off one of the genes, it makes a huge difference. Like, to put it in basic words, it's like my blood and your blood is totally different. If I have something else in my blood, it will make the bacteria kill faster than yours.

So for that, I think that Regeneron Genetics Center made a huge, huge difference, for me to get into, because I would get into samples, which is like almost like 200 people, and that would give a huge difference. And I would take that and put it into a mouse strategy, how will I make my mouse model in such a way that I can address these kind of questions.

The power and speed of these two working together is probably most evident in how quickly REGN was able to develop COVID antibodies

when COVID came about, I think RGC played a huge, huge, roll along with VelociGene. So I think COVID , at that time, they could get a lot of monoclonal antibodies, and that made a huge difference.

Obviously, velocisuite and RGC are unique and valuable assets. Which again begs the question: why can’t competitors with R&D budgets multiples of REGN’s recreate these assets over time?

REGN’s CSO has suggested that larger companies can’t copy these in part because of their cultures; other pharma companies are more concerned with making money in the short term than investing into the technology for the long term, and because of that concern “big pharma” can’t or won’t match REGN’s investment. In fact, he want so far as to suggest BMS acquired and then killed a potential competitor of REGN’s

we view our partners essentially as extensions of our laboratories. And our folks, led by the leaders that you've heard from, are working hand in hand in all of the collaborations that we're talking about. I think that our strategy very much depends on these partners being independently structured and incentivized.

We don't want to do what, for example, BMS did to Medarex. We think Medarex was a great company. It could have been a great competitor of ours in the human antibody space. But for those of you who've been around long enough to remember, BMS bought them for essentially their first 2 antibodies, their PD-1 and the CTLA-4 antibodies. And you haven't heard anything about that technology since then because they brought it in-house and essentially killed the company. So we don't want that to happen.

There could be some truth to that “our culture eats other’s” theory; in fact, multiple experts suggested that REGN’s culture is an edge in hiring because the best people in the field want to go work for them (similar to how the best in finance generally want to go to Goldman). Still, the “culture as a moat” claim rings a little hollow to me. Again, REGN’s R&D budget is a fraction of big pharma. Despite that money disadvantage, REGN’s built a business and assets that are worth almost $100B. I struggle to believe big pharma wouldn’t throw a few billion dollars/year at this problem every year for the next five years if it could come close to recreating what REGN has.

I thought one of the experts gave a more plausible explanation for REGN’s moat on the RGC side: forming partnerships with medical centers for genetic data was a land grab, and REGN recognized that and grabbed all the partnerships before anyone else was aware of the opportunity:

what Regeneron being, they collaborate with a lot of hospitals they did. And especially if you get your hands on to like different tissues and blood samples and saliva, whatever you can think of, that helps a lot. And I think that is a big bank right there, which nobody has touched yet. Because people don't know what to do with them and what happens is they stop with the genotyping, but that sequencing is what RGC gets to done. And I think because of that, they made a huge bank. Hope that makes sense, yes….

nobody looked into this before. And I think that is the reason, if you will go to like Pfizers or the Mercks or the big companies, they definitely have a genetic place where people are looking into all of the genetic sequencing. But the sequencing takes time. It will take you a longer time than you expected while RGC made into one of those.

That early land grab has given REGN a sustainable advantage; the expert suggested what takes REGN ~5 days would take other companies more than a month, and that gap continues to widen. In fact, the expert suggested it would take other companies “another ten years” to get to where REGN is today (and, of course, REGN will be significantly faster by then).

So, at this point, hopefully I’ve convinced you that Regeneron has some unique and valuable assets that let them develop drugs faster, smarter, and cheaper than competitors, and REGN is literally a decade ahead of competitors.

But my worry is that lead isn’t as crucial as it seems. The expert suggested that, five years ago, RGC and veloicuite let REGN do things in six months that competitors couldn’t do. Today, REGN’s lead let’s them do things in five days that take competitors over a month. My worry is that, while REGN can keep a lead, eventually the time difference won’t matter. To take it to the most extreme, if in 10 years REGN can do something in five seconds that takes competitors 30 seconds…. well, that’s still a huge edge, but it probably doesn’t matter much in the grand scheme of a lengthy drug development. More likely, in ten years, REGN will be able to return data in ~2 days that takes competitors five days. The exec suggested that gap is probably right at the limit of where REGN would actually have an edge,

Five days, that doesn't make any difference. But at the same time, you can think about what happens is people are, especially in a research lab. In a research lab, we are almost like a day-to-day kind of thing. It's like we need the information as soon as possible so we can start our next study. And I'm talking about study, meaning it's like 140 animals, 150 animals. That's a lot of money. And if you think about if one information is wrong in this, all the money goes down the drain. So yes, between three to two days, it doesn't make any difference. But when it comes to like ten days to two, yes, it does make a big difference then.

Of course, RGC is not REGN’s only edge. The mice are a huge edge for REGN as well, and, to date, no competitor has been able to copy that technology.

My main thing is Regeneron probably has this capability that other people don't, and I do not know how to emphasize that more than basically, they just go in and change this, which other people cannot do it yet. So I don't know what the proprietary is, but I think that could be a reason why they have not done it. And this is what I'm talking about, like you take a cell and basically modify the gene and that takes a lot of difference.

It's not like, okay, I have a cell in a Petri dish and I'm just going to go in and change it out. That is not the thing. So it has to be done in a totally different way to get it done. And then only you have to again put it back into the mouse and then breed it out. I think that breeding technology is another thing that Regeneron has, which none of the people have come up with yet. So I think that is the main reason, but I cannot exactly tell you what is the one thing that Regeneron has that people couldn't copy.

So, at this point, I hope I’ve got you up to speed with where I am. RGC and VelociSuite are real assets and give REGN a real moat currently, but I still have questions around how durable they’ll prove in the long term. That’s ok; sometimes everything doesn’t have to click at once. REGN’s in my “too hard” pile for now, but it’s crazy interesting, and these calls helped me get up to speed on a fascinating company. I’ll be following REGN going forward; who knows, maybe one day something will click and I’ll take a position!

Odds and ends

I spent all of the post talking about RGC and VelociSuite, and basically none of it talking about REGN’s current portfolio. That was intentional: there are plenty of companies with interesting drugs, but none that I’m aware of with unique assets like RGC and VelociSuite that give a company a sustainable edge in developing therapeutics faster and cheaper. If you’re interested, EYLEA is REGN’s big drug, and this call goes into great detail on the drug, its potential competitors, and how its method of delivery (an injection in the eye) creates a nice little moat.

That focus also meant I didn’t spend lots of time talking about all of REGN’s growth opportunities and pipeline drugs. Again, there are tons, and REGN talks about them in lots of their conferences if you’re interested in them. That’s what makes diligencing a pharma/bio company so hard; so many different assets to look at. But what I really wanted to focus on was the assets that made REGN most unique, and (again) to me that was clearly RGC and VelociSuite.

Just to show one example of a growth opportunity: here’s a quote Elliot highlighted for me (from this presentation). Sure, it’s a little technical, but a quote that shows them solving “the third rail of immunology” I think does a great job of highlighting both REGN’s growth possibilities and how unique their assets / tech is.

They need a costimulatory signal, Signal 2, which is usually delivered by a molecule called CD28. CD28 is the canonical costimulatory antigen.

CD28 has a checkered history. About 10 years ago -- or actually a little bit more than 10 years ago, I think it was almost 15 years ago, this company, TeGenero, tried to develop an anti-CD28 for immunologic -- as an immunologic therapy and took it through preclinical models, where it didn't see any worrisome issues and exposed healthy volunteers, half a dozen at the same time, and all of them became very sick, and they had severe cytokine release and several of them almost died. So as a consequence, people felt that you have to avoid CD28.It's like a third rail of immunology that you shouldn't touch.

Our scientists sought out to determine, if you looked at the variety of other molecules and signals on the T cell surface, and there are many, that we believe also play costimulatory roles, which of the molecules is the most important. And repeatedly, they found that, indeed, it is CD28. So we decided to bite the bullet and say, "Okay, let's make a better CD28-engaging molecule." And what we did was create bispecifics that target a tumor antigen and then also target CD28, but that do not activate the CD28 pathway on T cells unless you have this three-part party going on: the costim bispecific, the lymphocyte and the tumor cell. If you just expose the molecule to T cells, it's essentially inert. So we felt that with that, we have a safe approach to do this.

Now why is this important with regard to solid tumors versus hematologic malignancies? Well, the CD28 molecule interacts with the molecule on antigen-presenting cells called B7. And this B7 can be expressed on dendritic cells, macrophages as well as B cells. B cells can be antigen-presenting cells. And the lymphomas that we treat are B-cell lymphomas, DLBCL, follicular lymphoma, multiple myeloma is a B-cell malignancy. And so perhaps one of the reasons why the CD3 engagers or why the CAR-Ts have been successful is that they are getting some of this B7/CD28 costimulation just as a consequence of the disease that's being targeted. Solid tumors that are composed of epithelial cells, by and large, or epithelial derived from epithelial cells or adenomatous cells don't generally express B7. So they don't provide this costimulatory signal.

And what our costim bispecifics do is essentially fake out the immune system and basically put the ability to engage CD28 on the tumor cell. So now you're making the tumor cell a more effective antigen-presenting cell. So you see -- you can combine this with either a CD3 bispecific that will engage Signal 1 and you can combine it with anti-PD-1, which will augment the signaling through the intrinsic TCR that of a T cell that already recognizes the tumor.

I’ve been a little skeptical of corporate culture “moat” for a variety of reasons (Activision was winning best place to work for years on end while employees were apparently spending more time sexually harassing each other than working), but one thing that shined through these calls is REGN does seem to have a good culture. I asked every expert if they would feel comfortable investing in REGN, and each of them was a reasonably enthusiastic “yes.” That doesn’t happen often; expert calls are generally done with former execs or competitors, and there’s a lot of potential for bitterness or anger with that category. Obviously a small sample size, but my experience suggests it’s pretty rare to talk to three formers and have all of them speak highly of a company.

In particular, I’d note the formers gave op management high marks as “very intelligent” and “some of the smartest people I’ve ever met.”

I’m still trying to settle on what company / industry to do for my third entry in this series; if you have suggestions, please feel free to lob them into my DMs.

Very interesting, thanks for putting together. I know there are other companies that have similar mouse-like technologies (LGND is spinning off theirs into a SPAC). But I honestly don’t know how they compare with REGN. But, REGN’s success speaks for itself.

I am admittedly obsessed with this humanized mouse concept. It sounds like something out of Black Mirror but if its actually possible it can have so many useful applications ...