This is the third entry in my deep dives sponsored by Tegus series. The goal of these are simple: every month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry. You can find the first deep dive into the risks to the cable industry here, and the second into Regeneron here.

I’m hoping this series is a screaming success, with readers and myself learning a ton from the interviews and Tegus getting lots of publicity for their product (which I love and is table stakes for fundamental investors) and that I’ll be able to turn these into a regular monthly recurring feature forever. Of course, that involves everyone feeling like they’re getting value from the series, so please check out Tegus if you’re a fundamental investor and haven’t done so already (again, it’s pretty much table stakes for investors at this point).

For my third post, I decided to dive into Party City (PRTY). I’ll talk about why in a second, but before I do let me highlight the Party City calls I did (note: for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub!):

Alright, so why did I chose Party City for this month’s deep dive?

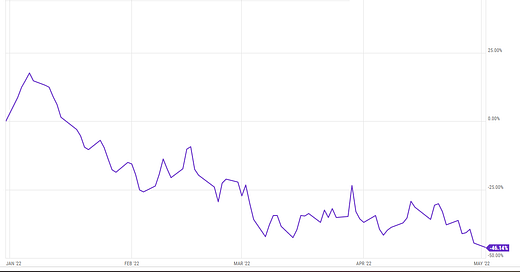

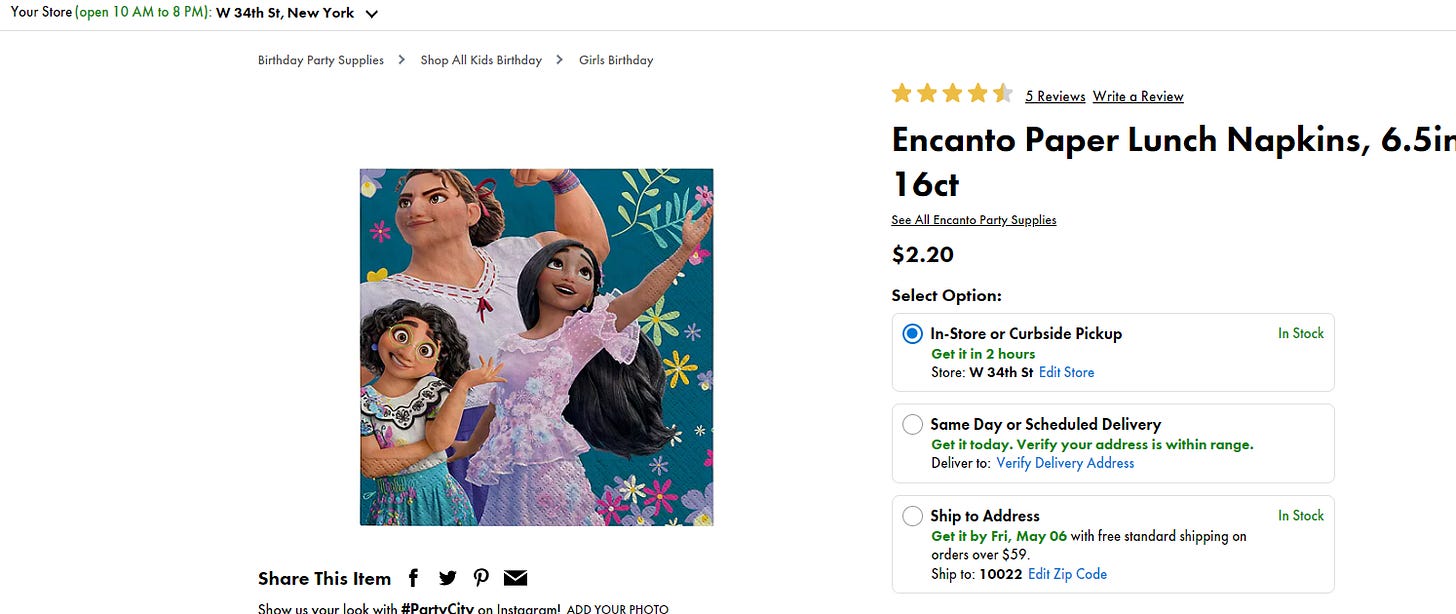

Simple. CAS owns roughly 17% of it and has been buying reasonably aggressively recently. Even after a big drawdown their returns are insane. More than that, I’ve talked to Cliff and his team a few times and they are super sharp (in fact, Cliff was one of the first guests on the podcast, though I’m hoping to have him on again at some point under the new format and with a lot of extra episodes / practice under my belt!). PRTY’s been hammered this year, and I can’t think of a better thesis than “smart investor owns it and is buying more while the stock gets hammered!”

Obviously I’m kidding; I actually didn’t realize CAS was in the stock until after I had done the interviews. But I suspect the reasons I was interested in diving into PRTY are the same reasons CAS is buying.

PRTY had been floating on my radar for a while simply because I believe huge swaths of retail are way too cheap, but what pushed me over the edge to dive into them was an amusing anecdote. My wife and I were driving around, and we saw an abandoned movie theater and Toy-r-Us next to an open Party City store. My wife looked at it and asked “how the heck does Party City make money, and why are their stores so big?” A few days later, I saw this tweet / thesis on PRTY from Buckley Capital (note: a PRTY podcast with them was supposed to go up alongisde this post, but we had to delay. Look for that in hopefully the near future!). Combine that question from my wife with that thesis from Buckley, and I got a little obsessed with PRTY and have spent a good deal of the past month and half researching them.

Anyway, background out the way, I’m going to break this post into three parts (though, knowing me, it’ll probably end up running very long and I’ll split it into four or five parts!). In today’s post, I’m going to give the high level bull (and bear) thesis for PRTY. In part two, I’m going to use the expert interviews (plus other sources!) to rebut or support different parts of the bull and bear thesis. And, in part 3, I’m going to wrap the series up with some follow ups / lingering questions I didn’t hit in the first two pieces.

So let’s turn to the PRTY bull and bear thesis. I’ll admit I’m a little biased; PRTY is extremely high risk given the leverage, but I put a small position on after all of this research. Obviously the bull thesis speaks much more to me, though I can see plenty of sides of the bear thesis.

Speaking of the bear thesis, at a high level the bear thesis is pretty simple: PRTY is really levered, and they sell a lot of junk that can be found elsewhere. Why buy party decorations at PRTY when you could get them delivered from Amazon or pick them up while shopping for groceries at Walmart? So the bear case is this is a super levered asset in terminal decline that will go the way of Toys-R-Us in the near future.

The bull case is a little more nuisanced; there’s a lot to it, but the three key parts are:

PRTY is a category dominant specialty retailer, and multiple aspects of them are “un-amazonable” at best or, at worst, not ideal for online retail. There are no perfect peers for PRTY (at least none I’m aware of), but loose “category dominant / amazon resistant” peers would include things like TJX or FIVE, and those tend to trade for impressive multiples (>10x EBITDA), and PRTY should be no exception.

PRTY is a COVID recovery play with huge leverage (both leverage to reopening and leverage in a financial sense). Combine that with a cheap valuation, and you’ve got enormous upside.

PRTY owns the wholesale / distribution side of their business, and some bulls argue that wholesale should trade for a higher multiple than a generic retailer and there’s hidden value in wholesale as financial allocation is shifting profits from wholesale to retail; if you adjusted those profits from retail back to wholesale and gave wholesale a higher multiple, the combination would suggest PRTY has a ton of hidden value / trades at an even larger discount to fair value.

Let’s dive into those three key points:

Bull point #1) PRTY is a category dominant specialty retailer in an “unamazonable” category

Party City consists of two businesses. The retail side is the largest specialty retail party store that sells party supplies (balloons, costumes, paper plates, etc.). The wholesale side is one of the largest distributor of those party supplies.

I’m going to focus on the retail side here, though the wholesale side is interesting and I’ll be returning to them throughout the write up. Bulls would argue that, as a large specialty store, the retail side should have several competitive advantages that let them build up a nice little edge and earn good return. Those advantages come in a variety of forms, but I think you could break the two main advantages into their balloon advantage and their party supply advantage.

Let’s start by talking about PRTY’s balloon advantage. Balloons are a really unique product for retail. Unfilled, they’re really cheap and easy to ship. But few end users want to get a bunch of unfilled balloons and then fill them themselves, and fully blown up balloons are a disaster to ship because they’re bulky and fragile (if you bought 20 filled balloons and had them shipped to you, that would basically take up a full van and inevitably a few would pop during the delivery). So balloons face a weird future online: you can easily ship them unfilled, but that’s not a product many people want, and if you fill them the cost to ship them is pretty prohibitive.

That combo means balloons should be one of the few products that are close to un-amazonable. The best way to sell them is generally going to be for a consumer to go to a store, pick out their balloons, and have a store fill them up.

So selling balloons should give physical retail an edge over online retail. However, even in the physical world, selling balloons isn’t exactly easy. Most people are only going to have an event that needs balloons filled up once or twice a year, so it’s not exactly a massive repeat purchase that drives traffic, and filling up balloons takes a bunch of time (and space to store the balloons). Balloons are generally going to be associated with parties, which are generally going to be on a weekend, and most people are going to want to pick up the balloons the day of or the day before their party.

What does all that mean? Selling balloons in physical is kind of a logistical nightmare. For most of the week, your “balloon selling space” is going to go unused. Then, suddenly on Saturday morning, 20 different parents are going to want to pick up balloons for their kids’ birthday parties. You’re going to need to have one or two people go in to the store super early to fill the balloons up on time for the parents to pick them up, and then the rest of the week all of that balloon space is going to sit reasonably unused.

That creates a little moat for PRTY. Someone like Walmart isn’t going to dive into balloon sales; they simply have more productive uses for that real estate, and they don’t really need the headache that comes with a quick influx of balloon sales every Saturday morning (WMT does sell and fill balloons at a very small portion of their stores).

So, on the balloon side, I think PRTY has a nice little niche. It’s something that is very difficult to do online, and big box retailers aren’t likely to move into it because it’s not worth the headache or store space. That leaves the space (mostly) to PRTY, which has the potential to create an attractive niche. Selling filled balloons should come with very high gross margins for PRTY, and the need to physically go pick up the balloons drives continued foot traffic for the stores.

The other side of PRTY’s edge is their edge in party supplies. An example is probably the best way to show PRTY’s edge here. Say your kid is turning three, and you’re hosting a birthday party for them. You have three choices: get the supplies from a big box (WMT, Target, Dollar General), get them from Amazon, or get them from Party City.

Maybe you’re like me and you don’t really notice little details. If that’s the case, WMT or Dollar General is probably the place for you. You go and buy 100 paper plates, 100 cups, some decorations, string them up real quick and call it a day (honestly, I’m so space unaware I’d probably skip the decorations in general). Awesome!

But most parents aren’t like me. A lot of parents want to pick a color theme for the party and have all of the cups and plates match the theme. They want specialized decorations. They want to go into a store and spend a little bit of time looking and matching all the decorations, and maybe they want to have some options for all of the decorations. Basically, they want their kid’s party to be special, and they’re willing to put in a little extra time, effort, and money for it.

For those parents, WMT or a big box store isn’t going to be the place to shop. Again, big box stores need to weigh productivity of the space against everything else. They can carry some paper plates and whatever the hottest decorations for that year are, but they’re not going to be able to carry four different shades of blue and deep cuts of decorations (i.e. they’ll carry decorations from all of the current Disney movies, but if your kids favorite Disney movie is a few years old you’re probably out of luck).

So if you want any type of selection or a coherent theme, a big box store isn’t going to be the place for you. You’re probably thinking “simple enough; I can just get everything on Amazon!”

And you’re right…. but there is an issue. These are generally low dollar value items; 50 papers plates costs something like $5. Amazon is generally not good at very low dollar value items; the cost of picking them from a warehouse and shipping them simply eats into all of their margin. And that’s assuming that the products aren’t getting returned; the costs of handling a return are going to be astronomical for this product versus its selling price (it’s why Amazon will often just give you a refund on a small dollar product and tell you to just keep it versus shipping it back). Plus, these are a product that you generally want to see in person: if you care enough about details that you’re matching color schemes across multiple items at a whole party, you probably want to go in person to see products before you buy to make sure the blue in your plates matches the blue of your napkins (or, alternatively, you’re much more likely to return products if you buy them online because their colors don’t exactly match when you see them in person).

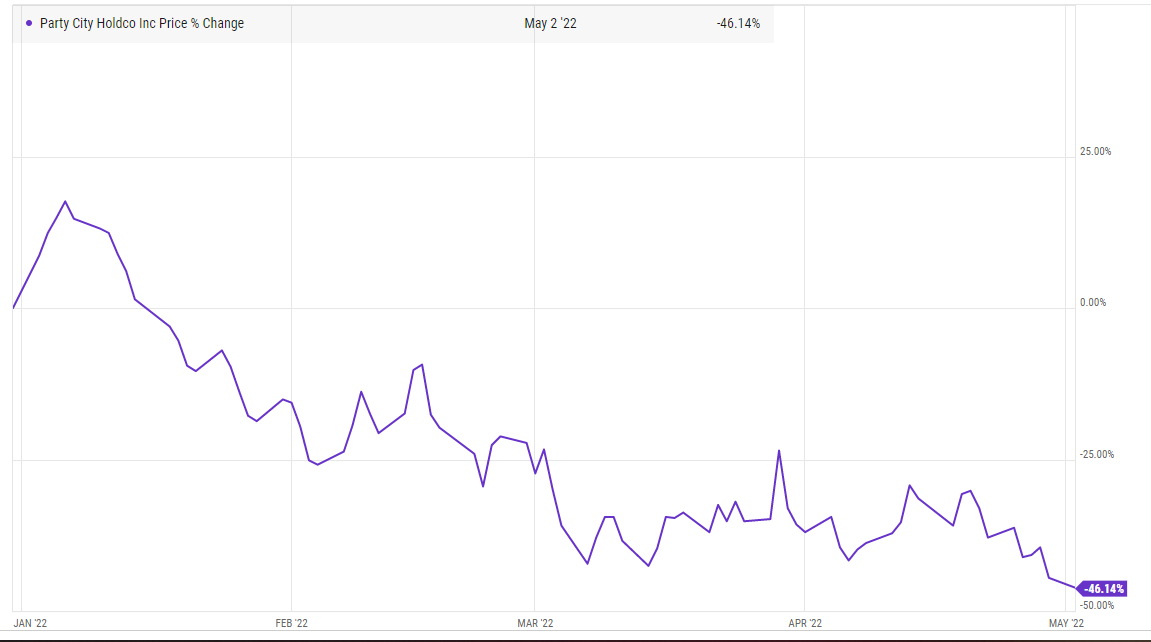

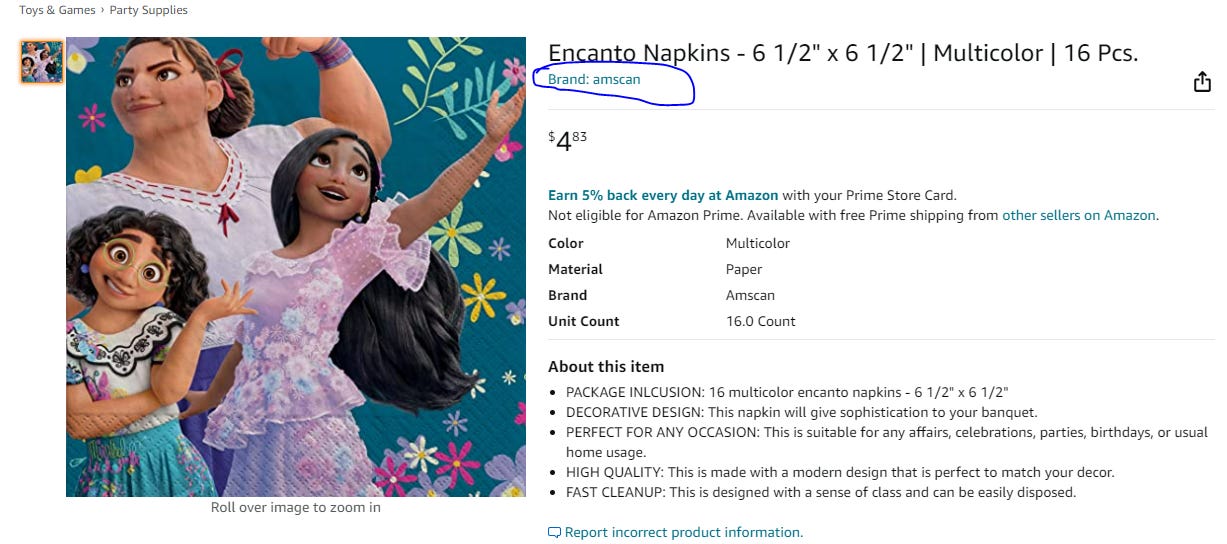

I think you can see that cost advantage if you compare a few items from Party City versus Amazon. For example, here’s a 16 count encanto paper napkin on Party City, and here’s the same one on Amazon (ironically sold by Amscan, Party City’s wholesale side). It costs ~$2.20 to pick that napkin up in-store at PRTY, but $4.80 if you buy it on Amazon. You can find plenty of other examples of this price discrepancy; as just one more example, PRTY’s “sweet 16” dessert plates are cheaper than a similar product on amazon (~35 cent per plate versus ~38 cents per plate) despite being sold in smaller quantities and looking like a nicer product. (Screenshot of Amazon price on top; PRTY price below)

I’m not saying this is the largest moat in history. But I do think when you think it through there’s a reason for party stores to have an in-person physical presence and be their own “category” within specialty retail. If you believe that, then PRTY has a reason to exist and, as the largest player in the category, should enjoy some scale economies that lead to profits above their cost of capital over time.

Before moving to point #2, let me move into that “largest player” point. Investors generally like the dominant player in a category because large players get all sorts of advantages over smaller / mom and pop players. For example, someone like Home Depot is going to use their size to get better prices from suppliers than a mom and pop, and their nationwide presence lets them get a marketing / brand edge.

PRTY should enjoy something similar. Their size shoudl let them negotiate much better prices than mom and pops, but PRTY should enjoy two other advantages.

First, their size should let them negotiate licenses that mom and pops don’t have. I believe PRTY has the exclusive license to Disney paper plates for party stores. That doesn’t mean that PRTY has an exclusive license (you can find Disney plates at Walmart or on amazon, though the amazon ones are often sold by a PRTY subsidiary), but it does mean PRTY will have Disney products that a mom and pop competitor won’t have. (PS- obviously these are ads, but look at the first thing that popped up for me when I searched for a few different Disney decorations. PRTY everywhere!).

Second, helium shortages can really weigh on results. If your kid’s having a birthday party Saturday, and you call up Party City and they say “sorry, no balloons”…. well, that’s a lost trip, and you might not go to them the next time you have a birthday party. Helium has been in shortage off and on over the past few years, and it seems we’re currently entering another helium shortage. That’s not great for PRTY…. but their size means they should have better luck securing access to whatever helium is out there versus smaller party stores.

Bull point #2) PRTY is cheap and has huge leverage (both financial leverage and leverage to a recovery / reopening).

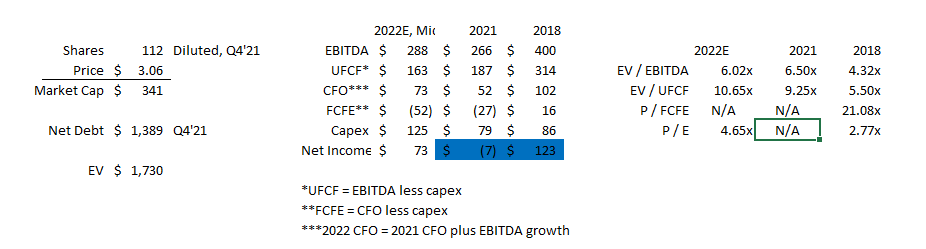

This point is pretty simple. PRTY did $266m in EBITDA in 2021, and the midpoint of their 2022 guidance calls for $288m. Their 2022 guidance also calls for GAAP net income of $73m (again at the midpoint).

PRTY’s current market cap is ~$350m, and their EV is >$1.7B. So you’re not only paying a low multiple for the whole company, but you’re paying a low multiple for a very levered company, which provides for huge upside if things work.

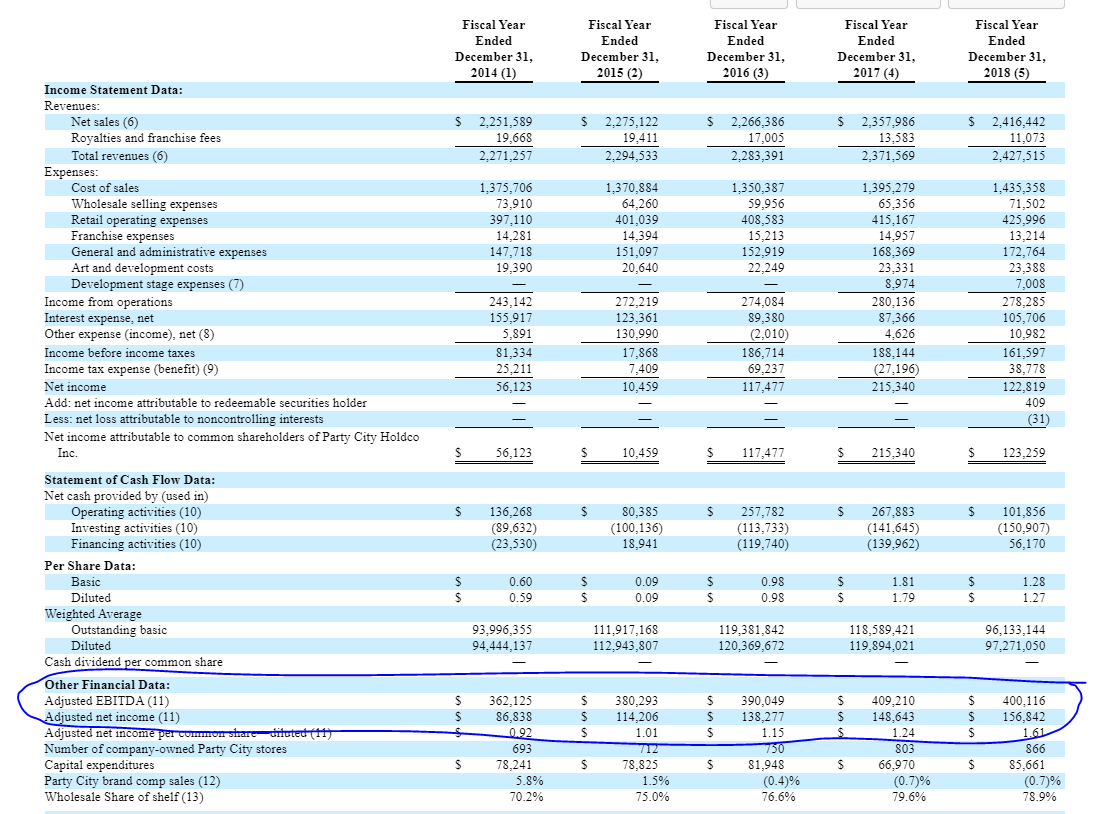

But those multiples actually might be understating things. Back in 2018, PRTY did $400m in EBITDA and $123m in net income, and PRTY was pretty consistently doing >$350m in EBITDA and >$100m in net income every year from 2014-2018 (see table from 2018 10-K below).

So, if you’re a bull, you say PRTY is too cheap on its current economics… but its economics should get even better as the world continues to improve, and that will drive explosive growth in PRTY’s free cash flow (and, hopefully, the stock price!).

Bull point #3: PRTY owns the wholesale / distribution side of the business, and there’s hidden value there

This one can get a little crazy (it was detailed really well in this VIC write up), but I’ll try to simplify.

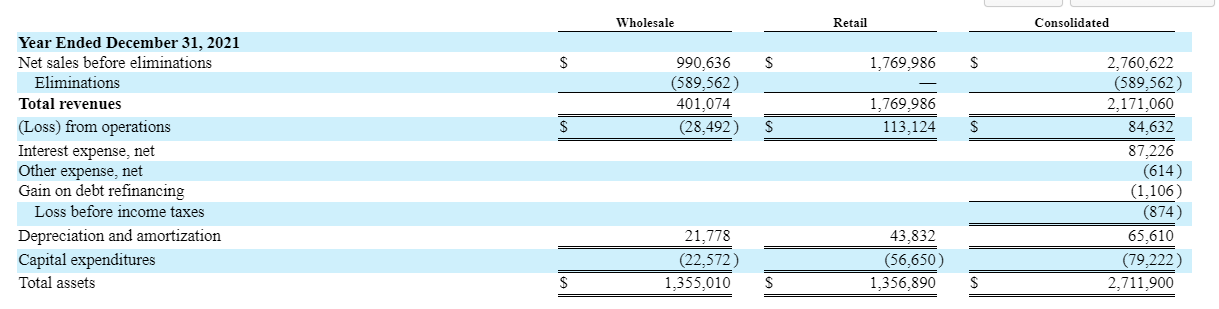

When people think of Party City, they generally think of the retail / consumer facing side. But Party City also owns their wholesale side, which is one of the largest manufactures and distributors of party supplies, balloons, costumes, etc. The wholesale side supplies the bulk of the goods the retail side sells, but wholesale also sells to third parties, and what Party City wholesale sells to Party City retail is eliminated in consolidation so that sales aren’t double counted (table below from PRTY’s 10-K).

The bull argument here is two-fold.

First, bulls argue that the wholesale side should trade for a much higher multiple than the retail side. PRTY’s wholesale side counts people like Target, Michaels, and Kroger as customers. The argument here is that PRTY wholesale is selling a bunch of really small dollar value SKUs to these stores, and the sheer small size and number of SKUs creates a moat that prevents their customers from price shopping too aggressively. And, like PRTY retail, PRTY wholesales sizes gives them access to important license upstart competitors probably couldn’t get. I’ve seen bulls point to the >10x EBITDA that GWW or FAST trade at as suggestions for where a distributor / wholesaler that sells really small dollar value items and dominants its niche can trade at.

The second argument is that PRTY allocates too much of its profits to the wholesale side of the business and not enough to the retail side. This doesn’t matter if retail and wholesale should trade at similar multiples, but it makes a huge difference if you believe wholesale should trade at a premium to retail.

Obviously wholesale margins are currently impacted by lingering COVID effects, so I’ll use PRTY’s 2017 numbers (from p. 101 of this 10-K) to build this case. In 2017, wholesale reported $1.26B of net sales, of which ~half went to the retail business (those are the “eliminations” in the table below). Whoelsale report ~$68m in EBIT, for an EBIT margin of ~5%. Retail does $212m in EBIT on ~$1.74B in sales for an EBIT margin of ~12%.

The argument here is that PRTY is allocating too much of the profits to retail and not enough to the wholesale side. Bulls back that argument up by noting Amscan (the majority of the wholesale side) and PRTY used to be separate business, and Amscan’s margins were way higher when it was a standalone (for example, Amscan did >10% EBIT margins in 2002).

So the bull argument here is that wholesale is underearning because of how PRTY is reporting profits; if you normalized margins, the wholesale side would earn more and the retail side would earn less. Because wholesale is worth a larger multiple, that reallocation would create a significant amount of value.

To wrap this up, the three core bull points for PRTY are

PRTY is the dominant party specialty store, and that’s a good category to “own” as it’s unamzaonable and has several unique moats.

PRTY is a COVID recovery play with huge leverage (both leverage to reopening and leverage in a financial sense). Combine that with a cheap valuation, and you’ve got enormous upside.

PRTY could have hidden value from their wholesale / retail accounting underestimating the profitability of the more valuable wholesale side.

In part 2 (hopefully posting tomorrow!), I’m going to use the takeaways from my expert calls (plus some other sources) to rebut or support different pieces of the bull thesis, and I’ll follow that up with part 3 sometime later in the week.

Odds and ends

Two quick notes before I go:

It normally goes without saying, but PRTY is a retail stock with a ton of leverage. That significantly increases risk. Please do your own work; nothing on this blog is investing or financial advice; please see our full disclaimer here.

PRTY reports earnings on Monday, May 9th. I generally don’t like to note earnings, but PRTY is quite levered so you can generally see fireworks one way or the other around earnings (Bloomberg informs me the stock averages 20% moves alongside earnings reports, which is a big number but given how levered PRTY is it’s actually a pretty small piece of their EV!). If earnings are awful and the stock is down 50%, or earnings are great and the stock rockets…. well, I don’t think either would materially change the work / thesis presented here, but they are both definitely in play.

As always, everything I write about is a work in progress. I think you can see I’m bullish on PRTY, and I’ve got lots of back up / thoughts from expert calls that will come in part 2. But if you think I’m missing something on the bull or bear side, I’d love to hear from you! I’m always looking to get talked out of an investment thesis if it’s wrong.

Vy interesting. Owned PRTY last year after noting the CAS investment and doing some research. Have debated buying back in given the decrease of late. Thought they'd advance sales a bit more than they did last year, and am a little concerned about historical management performance.

On the Amazon issue, I noticed on the napkin listing on Amazon that Amscan is listed as the mfr and that there are two sellers selling below $5. The others are selling for $7.95 and higher. My business sells on various Amazon US and international sites and it's something I've been doing for 20 years. I do agree that selling cheap items and licensed items are moats for a B&M retailer. Additionally, I know that a lot of PRTY customers go to the physical stores for ideas and buy a variety of items at that time. The idea generation process is a little more difficult on a site like Amazon.

Finally, I'm not sure how sophisticated the PRTY brand management team is re Amazon, but they're missing the boat in a number of ways. The significant price discrepancies on that napkin suggests there may be some counterfeit selling; they should have some employees nonstop looking for counterfeits and unauthorized sellers. Additionally, they have a store page, but most of the Amscan listings don't link to it. In fact, it appears that many of the Amscan product pages were created via spreadsheet upload by someone who forgot to capitalize the brand name - so dumb. There's no consistency of branding on Amazon - is it Amscan, is it Party City??? There's no A+ content on any product page so far as I can tell - more unused branding real estate. Why not have cross sell content on every product page? Party City is a 3P seller of a few items, but most are being sold by other sellers. Why give away Amazon retail margin to Amazon and other 3P sellers? Using Amazon Transparency barcodes, and cutting off the wholesale accounts who are selling on Amazon, PRTY could relatively easily usurp that additional margin and likely expand it a bit given they'd now have pricing control and zero selling competition on almost all of their products. It just doesn't make sense to give away your brand like that. Though the store page is nice, their overall brand management on Amazon is just horrendous. There's a lot of low hanging fruit there. I'm not sure who runs that for them, but it makes me queasy as a SH to see a company missing so many obvious opportunities.

Love your stuff man. With PRTY. There's no cash flow. Can you add/address that in your bear thesis?