This is the fourth entry in my deep dives sponsored by Tegus series. The goal of these are simple: every month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry. You can find the first deep dive into the risks to the cable industry here, the second into Regeneron here, and the third into Party City here (that’s actually still a work in progress; I have an update / some pieces I want to finish, but Q1 earnings were so bad I wanted to wait till Q2 to update with a little more clarity).

I’m hoping this series is a screaming success, with readers and myself learning a ton from the interviews and Tegus getting lots of publicity for their product (which I love and is table stakes for fundamental investors) and that I’ll be able to turn these into a regular monthly recurring feature forever. Of course, that involves everyone feeling like they’re getting value from the series, so please check out Tegus if you’re a fundamental investor and haven’t done so already (again, it’s pretty much table stakes for investors at this point).

Before I talk about why I chose the sector and companies I did for this section, let me start by highlighting the expert I did (note: for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub!):

For my fourth post, I wanted to dive into an area I’ve been spending a lot of time on recently: energy. That link (and the ones it links to) recaps all the reasons I’ve been interested in energy, so I won’t bore you with a full recap, but the quick version is that energy prices seem to have reset structurally higher for longer given the geopolitical unrest (Ukraine / Russia) and continued underinvestment by developed countries; despite the higher prices, most energy companies I’m aware of trade for a pretty large discount to the earnings levels they’ll mint at current “energy curve” levels. That discount suggests the market is expressing massive skepticism of either the energy curve (i.e. oil might be average $80 in the next few years at strip prices, but the market thinks it’ll actually be $60) or of management teams capital allocation (the market thinks the companies will make tons of money, but it thinks management will light that money on fire with bad M&A and misguided capital allocation).

Of course, the energy space is massive. A few expert calls isn’t going to make you an expert on what drives oil prices… and that’s not what I’m trying to do anyway.

So for this series, I wanted to focus on some more idiosyncratic names and opportunities in energy. I settled on two specific domestic nat gas names (CNX and Diversified Energy (DEC; trades in London)) on one side, and on the other side I used two calls to get smarter on renewable diesel with a particular focus on Calumet (CLMT) and, to a lesser extent, Vertex Energy (VTNR).

In today’s post, I’m going to talk about the energy names (CNX and DEC): why I focused on them and what I learned from the expert calls. In next week’s post, I’m going to talk about the renewable diesel names.

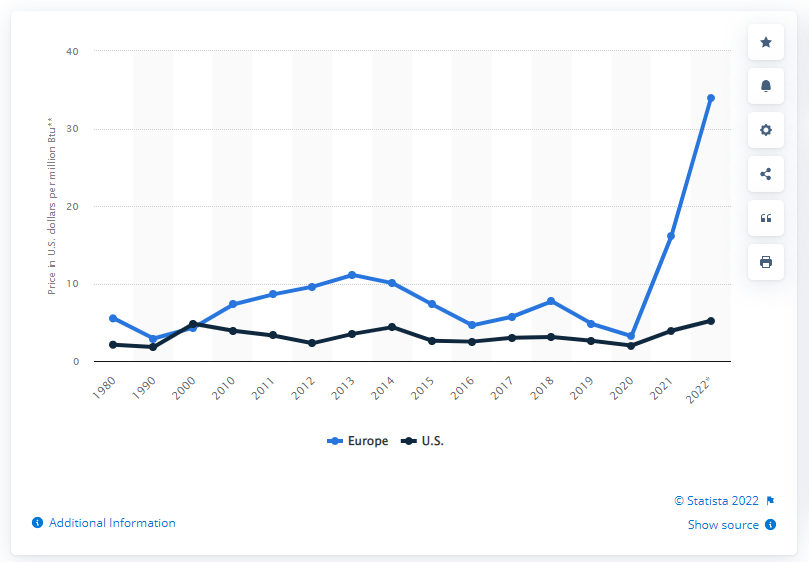

Let’s start with the high level: energy is a really broad space. I could have picked nuclear power producers, or coal miners, or a variety of green energy producers. I settled on upstream oil and gas, but even within that section there’s a huge variety. I could have picked companies that drilled for oil in the Gulf of Mexico or off the coast of Africa. With European natural gas prices going absolutely parabolic due to a nat gas crisis, I could have picked a company with more European nat gas exposure that could capture some of those really high European prices.

Instead, I chose two domestic energy plays largely focused on natural gas (CNX got ~90% of their revenue in 2021 from nat gas, while DEC got ~85%). Why?

On the overall energy side, I just feel most comfortable with the dynamics around natural gas versus other energy (oil, wind, solar, etc.). Many of the solar and wind plays are a bet on government policy and subsidies as much as they are the companies themselves. Oil will be here for a long time… but I struggle with the demand side of the equation. Rising fuel efficiency and electric vehicles will eventually sap demand; that’s probably longer out than the market suspects, but I just haven’t gotten comfortable with the model in my head. In contrast, natural gas is generally used for heating or baseload power generation, so I felt most comfortable about the long term demand for natural gas (particularly as the last of the coal plants retire).

Why chose domestic producers? Natural gas is a regional market; it’s generally moved by pipelines, and while you can ship it overseas through LNG (liquefied natural gas), the process is costly and involves massive infrastructure investment. The U.S. is making exactly that investment in order to supply Europe with LNG in the medium term; LNG terminals create massive demand for domestic supply, and my bet is that over the long term the supply from the U.S. will cause European nat gas prices to fall while providing incremental demand / price support for U.S. prices.

Obviously both of the above are simplifications. Again, energy is a really complex space, and there’s lots of different puts and takes. Plus, outside of GLNG (and maybe NFE, though I haven’t done much there), I’m not aware of any great European Natural Gas plays. I’m sure they’re out there; I just don’t know about them. Mix all that together, and my focus has generally been on domestic natural gas.

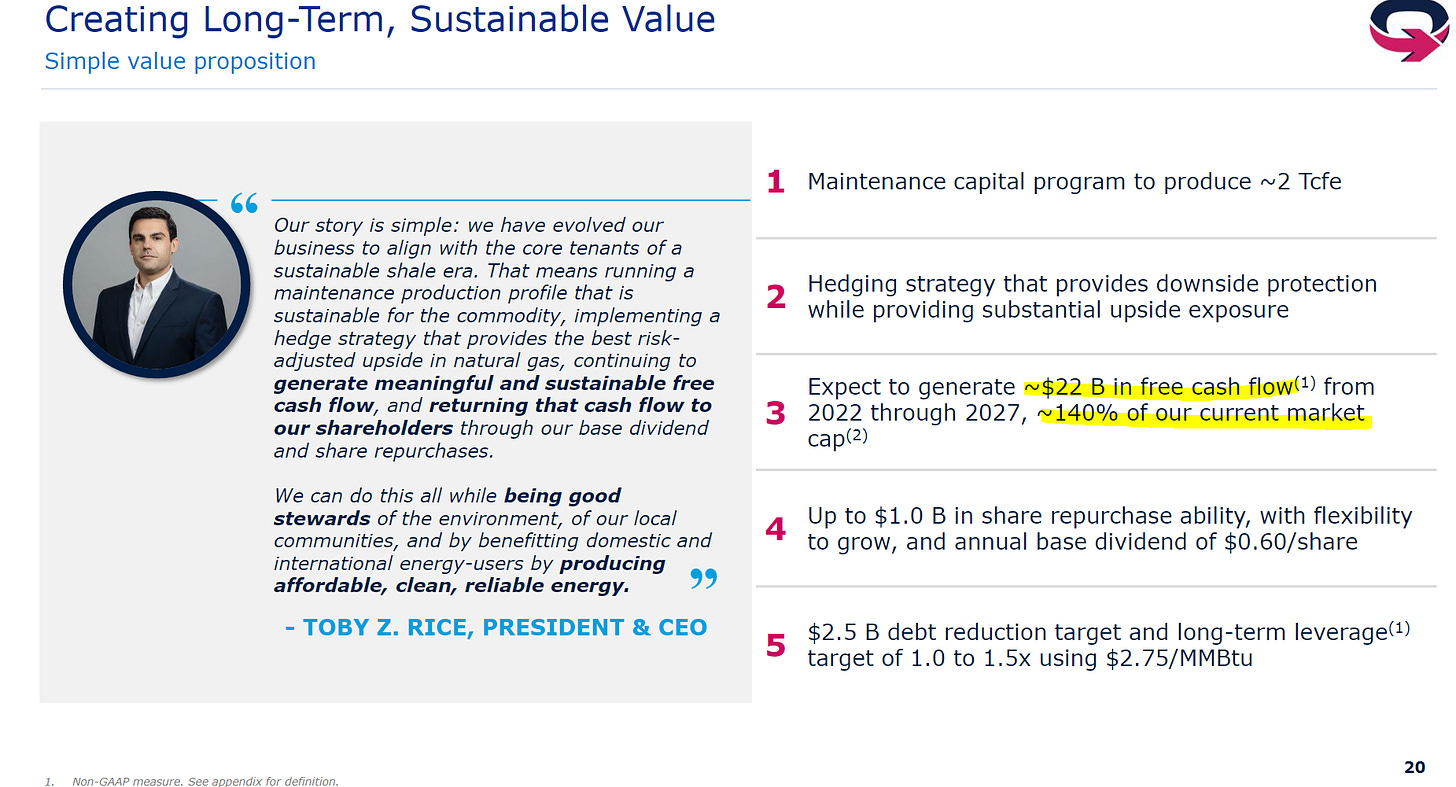

Another reason I focused on domestic natural gas producers? They’re really cheap! I’ve mentioned EQT multiple times in the past, so I won’t belabor them, but the slide below (from their Q2’22 earnings deck) highlights the point nicely: at then-current strip prices, EQT forecasted they’d generate 140% of their market cap in free cash flow from 2022-2027. That’s wild; EQT has significant land / net gas inventory that will produce for decades after the next five years, so at current strip investors could buy EQT and expect to get all of the purchase price and more generated in free cash flow and still own a massive natural gas position that would produce cash flow for decades (again, assuming strip prices didn’t drop!).

So that’s a (very) high level overview of what I find so interesting about domestic nat gas. This post is running crazy long, so I’m going to be back tmr with why I chose CNX and DEC (update: part 2 is now up!), and then in Friday’s post, I’ll dive into what I was looking for in my DEC / CNX expert calls and what I took away from them (update: part 3 is now up!). And I’ll be back next week with the thesis on renewable diesel.

this article did not age well at all

Great topic choice, Andrew!

Nat gas is the energy vertical I was able to get the most comfortable with as well, having initially done work on the LNG shippers ~2yrs ago. Seeing what that meant for the U.S / Asia Nat gas arbitrage guided me to the U.S regionals.

Happen to like CHK