Preamble: This is the fifth entry in my deep dives sponsored by Tegus series. The goal of these are simple: every month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry. You can find the first deep dive into the risks to the cable industry here, the second into Regeneron here, the third into Party City here, and the fourth on natural gas and CNX / DEC here.

I’m hoping this series is a screaming success, with readers and myself learning a ton from the interviews and Tegus getting lots of publicity for their product (which I love and is table stakes for fundamental investors) and that I’ll be able to turn these into a regular monthly recurring feature forever. Of course, that involves everyone feeling like they’re getting value from the series, so please check out Tegus if you’re a fundamental investor and haven’t done so already (again, it’s pretty much table stakes for investors at this point).

Sections:

Deep Dive Intro

Key Questions

Will he or won’t he (close)?

Tomfoolery / Case for Elon not closing

Financing and Insolvency Outs

Why doesn’t financing / insolvency give Elon a $1B out?

What would a trial look like / what arguments would get made?

When would Elon argue TWTR went insolvent / financing failed

#1) Deep Dive Intro:

By far the most popular topic on the blog this year has been all of the drama between Twitter and Elon Musk. For those living under a rock, Elon struck a deal to buy Twitter for $54.20/share in late April. In July, he tried to back out of the merger, and Twitter responded swiftly by suing him to close. The trial was supposed to start next week (October 17), but in a major “plot twist” last week Elon changed his mind and decided to go through with the deal.

That left me a little bit out in the wind. I had done tons of research on the original case, and I had already done two Tegus expert interviews for my “Tegus deep dive series” with the plan to post the results and a full overview this week (in front of the trial).

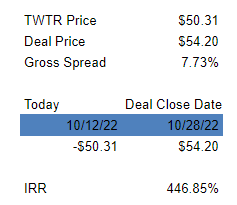

But then something strange happened: I broke my Michael Myers from Halloween rules (don’t consider him dead till you see a body / don’t count consider the deal done until the money is in your account) and took a victory lap on TWTR… yet the market (and everyone I talk to) fears that this deal is not quite done yet. As I write this, TWTR stock is trading for $50/share. That’s a ~8% gross spread for a deal that is scheduled to close in ~2 weeks (or less; don’t forget this could close at any time)! The IRR on the deal to close is… well, using IRR for short time periods can lead to some funny numbers, but goodness is an IRR over 400% an eyepopping number!

Why is the spread so wide? It’s obviously because the market thinks there is still some chance that this deal doesn’t close. Aside from Elon being Elon, reading Musk’s motion to stay the trial makes clear why the market thinks there’s some chance this story isn’t over yet; the motion spends more time talking about Musk’s ability to abort the transaction if the debt doesn’t show up then it does talking about Musk actually wanting to close, and it shifts to bold font to talk about financing outs multiple times.

So just how big of a chance of the deal breaking is the market currently assigning?

Well, we can use the options market to get a good idea. Twitter has $52.50 calls that will pay off for $1.70 if this deal closes ($54.20 deal price less $52.50 strike price); we can use the price of the options across different months to see the odds the market assigns to the deal closing before a given strike expires. For example, the November $52.50 call last traded for $1.23. $1.23 divided by the $1.70 payout gives a 72.4% chance the deal closes.

(I’ll note there are two small caveats for this exercise. First, the calls are a little illiquid, so you can get slightly funky pricing if one call has traded more recently than the other. Second, if Musk does not close the deal at the end of this month and a Chancellor subsequently orders him to close, he will almost certainly have to pay prejudgment interest (PJI), which would increase the per share price from $54.20. The options market is certainly pricing in some possibility of that happening, but I don’t think it’s worth splitting hairs over for the purposes of this exercise).

Anyway, looking at those prices, we can see that the options market is giving Musk an XX% chance that this closes before the November options expiry; basically the only way that could happen is if Musk closes in the current “stay the trial so I can close the deal window”. The market is giving this a 91% chance of the deal closing by March. Doing some math, we can see that in the 28% scenario where this doesn’t close by November, the market thinks TWTR is ~68% to win their case against Elon (the math= (91% to close by march less 72% to close by November) / (28% odds he doesn’t close by November)).

To sum, the market is currently pricing

91% that the deal closes in some way, shape, or form,

72% the deal closes under the current stay

In the 28% of time the deal doesn’t close in the current stay,

67% chance TWTR wins

33% Elon wins (with a win being defined as not needing to buy TWTR; if TWTR “won” the case but Elon only had to pay a $1B break fee instead of buying the company for $54.20/share, I think any reasonable party would consider that a massive win for Elon!)

#2) Key Questions

So I wanted to do a deep dive on the current situation by talking to lawyers about the TWTR case. Key questions I wanted to answer were

The market clearly sees some chance Elon goes back on the stay and doesn’t close the deal; is that feasible? Is there some grand legal strategy here?

If Elon does go back on the deal, what will a trial look like now? What arguments will both sides be making?

Elon has seemed scared to go under deposition; he backed out of his first deposition and then threw in the towel before he had to sit. What’s so scary about a deposition?

Are there any hidden tricks in the contract that could shift this case to one side or the other in an unexpected way?

What’s the timing for a trial look like now?

If we do get to a trial, both sides would almost certainly appeal a decision against them. What are the odds of the Supreme Court overturning a decision here, and what timeline would that take?

Is Elon trying to get himself declared a national security risk so that the government blocks the acquisition?

That is not a joke; after reports came out that Elon had a phone call with Putin (which Elon apparently denies), I got dozens of messages from panicked arbs asking if Elon had found a backdoor out for the deal from a national security block. My answer: no. Elon is a U.S. citizen; not only that, but he’s a U.S. citizen with security clearance (secret-level) thanks to SpaceX. Mergers are general blocked on national security grounds from CFIUS, which reviews foreign investments. I believe the government would need to declare Elon a foreign agent before even thinking about a block. Long story short, it’s just not going to happen, and that so many people are worried about it shows you how panicked arbs are / how much respect everyone has for Elon’s ability to wiggle out of everything.

To answer those questions, among many others, I turned to… well, a lot of people. I’ve talked to dozens of arbs, lawyers, professors, and reporters about the TWTR deal. As always, I’d call out Professor Lipton (see her podcast appearance here), Professor Talley, and The Chancery Daily as particularly knowledgeable / helpful on the case, but for our purposes I want to highlight the two Tegus calls I did here:

I also did a podcast with Lionel Hutz that I am releasing concurrently with this post. Lionel has done great work covering TWTR, and he’s covered some other interesting legal situations on his blog (several of which I’ve poked him to take a look at!); be sure to give him a follow.

While I’ll be pulling mainly from those two expert calls and the podcast for this blog, I’ll also throw in anything else I’ve heard / thought about. And I should note that on top of those calls / podcast, I did two Tegus calls before the “plot twist” put the trial on hold; these calls focused on the key arguments that were going to get made in the original trial; I will likely do a summary post on them in the future for history’s sake (if we ever have another MAE trial, I’m going to want to revisit), but given time limitations (I need to get this post up before October 28!), I’m only going to highlight them here:

Anyway, let’s dive in.

#3) Will he or won’t he (close)?

The way I’ve started every expert call / conversation with a lawyer is this: Elon filed for a stay to the trial in order to close the deal, and the Chancellor gave him until October 28. There are two options here: either Elon filed this stay motion with an intent to close, or he filed it with some secret plan to deceive the court and then try to back out of the merger. What are the odds there is some secret plan here?

While all of the lawyers thought Elon was a wild card and there was some chance he didn’t close the deal on time, most of them believed that Elon would only file for this stay if he actually planned on closing.

Why?

Well, first, it’s bad tactics on Elon’s part to pull off a “secret plan” out. I’ll discuss financing a lot more later, but basically the only way Elon files for this stay and then tries to get out of the merger is through a financing or insolvency out. If he tries either of those outs now, Elon will have effectively deceived the Chancellor who will then decide the trial and is absolutely allowed to bring Elon’s motivations / actions into her ruling. How would that make more sense than Elon going through with the original trial, having a long shot chance of winning, appealing the ruling, and then claiming a financing / insolvency out if he loses the appeal? The answer: it wouldn’t make any sense at all! If this was some grand plan to get out on financing, most experts thought the court would see straight through it and eventually force Elon to close on the merger.

But even ignoring the bad tactics, most of the lawyers expressed skepticism that team Elon would file this stay motion with some secret backdoor plan. While Elon’s obviously a wildcard with a flexible relationship to the truth, the stay motion itself was filed by Elon’s lawyers. Most (again, not all, but most!) of the experts I talked to expressed doubt that a law firm would feel comfortable deceiving a court so blatantly. The experts thought that for reasons both practical (the law firms rely on Delaware to get business done and are doing hundreds of trials; lying to a court could result in serious sanctions / reputational damage that have negative consequences far in excess of one client, no matter how big that client is) and personal (several of the experts knew the lawyers on Elon’s side and thought of them as upstanding / wouldn’t pull something so blatantly manipulative, and most lawyers have enough respect for the courts that they wouldn’t want to try something like this).

So most (again, not all, but most) of the experts I talked to were skeptical that Elon had some grand plan that started with him filing this motion and ended with him walking. Most believed this was a serious filing that ended with Elon closing on the Twitter deal. (I’ll also note that Elon’s proposed order to stay the trial included lots of language and offers like keeping “Twitter informed on a daily basis as to the status of the Financing” that you probably wouldn’t make if you were lying / planned to back out of the merger at the last second; I discuss this a bit more in section #8)

#4) Tomfoolery / Case for Elon not closing

But this is Elon, and all of the experts admitted there was a chance he tried some Tomfoolery! If Elon doesn’t close the deal on October 28, Elon would have three arguments available to him:

After looking at the numbers again, Elon’s still really concerned about all of the bot / MAE / reps and warranties issues that were going to form the basis of the original trial

Elon is financing the TWTR deal with ~$12.5B of debt; Elon could make a “financing out” argument that the debt was not available so he could not close the deal.

There are actually two ways a financing out could occur: one is that Elon actually tries really, really hard over the next two weeks to raise financing and the markets are just so awful the banks say “nah, we’re walking away” (the “best efforts” route); the other is that Elon emails the banks and says “this deal is really dumb, I hate it, TWTR will never make a dime but this trial is embarassing me so I need to close; wire me the money” and the banks say, “ummm… no” (the “Elon nukes his financing” route).

In order to get the debt, Twitter needs to be solvent, and someone from Elon’s team needs to sign a solvency certificate. This certificate certifies that TWTR is worth more than the debt it’s taking out, and that TWTR is not an imminent bankruptcy risk after the deal closes. Elon could refuse to sign the certificate, which would then blow up his debt and let him get out on financing. (A copy of the solvency certificate is below).

Let’s start with the easiest argument: argument #1 (Elon shifts back to arguing about bots). I haven’t talked to a single person who thinks that happens. Elon has basically thrown in the towel on that one; the trial was already going poorly for him, but if Elon had the Chancellor delay the trial while saying he was going to close and then came back and said “actually, these bots are really concerning,” he would get laughed out of the courtroom. Those arguments are dead.

#5) Financing and Insolvency Outs

So that leaves financing and insolvency as outs Musk could argue if he doesn’t close this month. The arguments here are simple: the TWTR merger agreement includes a $1B termination fee if financing falls through, and Musk’s agreement with X Holdings (the merger sub) specifically says that he only owes the sub $1B if debt financing isn’t there (see screenshot below from Musk’s motion to stay).

So Musk is clearly leaving some room for October 28 to come and for him to say “hey, financing isn’t here. So sorry; here’s a $1B check. Better luck next time.”

All of the experts I talked to were skeptical that Musk could get off on this argument, but they did see some validity to the claims if he tried to do them just given how black and white the merger agreement and contract between X Holdings / Elon are on what happens if the financing drops (Elon can walk for a $1B termination fee).

But, given that “black and whiteness”, why were experts skeptical Elon could get out easily on this claim?

Again, there are three ways Musk could make this claim: he could try really hard over the next three weeks to raise the debt and the banks could refuse to fund, he could subtly (or not so subtly) tank his financing by trash talking TWTR to the lenders and then having the lenders refuse, or he could simply refuse to sign the solvency certificate.

Experts were skeptical that any of those three could work because of the “you can’t nuke your own financing” theory. This came up in DecoPac (a precedent case the chancellor ruled on), but the basic way to say this is that the merger agreement calls for all parties to use their “reasonable best efforts” to close the deal (see p. 41), and sabotaging your own financing is in breach of that effort / results in unclean hands.

Now, a key question is what if Elon actually tries really hard for the next three weeks, but the banks just won’t lend the money because the markets are so bad / they’ll lose so much money. What if Elon can show that he sent 100 emails a day every day for the next three weeks to banks and lenders saying, “This is going to be the best investment of my career; I can’t wait to do it and I need your support!” and the banks still refuse to lend?

Even then, experts were skeptical Elon could walk. Basically, his actions and behaviors have been so bad to date (trashing Twitter on twitter in breach of the merger agreement, breaking TWTR’s NDA, etc.) that experts think it would be impossible for Elon to have clean hands when it came to financing at this point.

#6) Why doesn’t financing / insolvency give Elon a $1B out?

Given that both the merger agreement and the agreement between the merger sub and Elon say that Elon can get off for $1B if the financing breaks, how would Elon then be on the hook for specific performance?

There are two theories here:

The first theory is that section 5.4 of the merger agreement (the financing clause) includes a line that, “it is not a condition to the Closing or to any of its obligations under this Agreement that the Equity Investor, Parent, Acquisition Sub and/or any of their respective Affiliates obtain any financing (including the Debt Financing) for any of the transactions contemplated by this Agreement.” A minority of experts thought that line (plus some ambiguity in the specific performance / termination fee sections) left some room for interpretation to the Chancellor, where they could look at that line and say “financing was not a condition to the merger; even though financing broke I am choosing to award specific performance.”

The first theory was controversial… the second theory was not. The vast majority of experts thought this was a pretty clear “pierce the veil” case. Basically, the theory here is financing failed and the deal didn’t close because of Musk’s misconduct; Musk is a party to the merger agreement, so the Chancellor can just say, “too bad financing fell through. It fell through in large part because of your actions, so you’re on the hook for $54.20 Elon!”.

Again, the Decopac case set precedent for this. The Delaware Court of Chancery is a court of equity; if you get out of a contract by destroying the contract through your own actions, they are going to see through that and they have broad powers to hold your feet to the fire.

#7) What would a trial look like / what arguments would get made?

Alright, so far we’ve talked about reasons Musk could try to break the deal and reasons why each couldn’t work. Let’s back up a bit and talk about what arguments each side would make for why they should win, though this will be al ittle duplicative with the sections above.

If Musk breaks the deal, the center piece of his argument is going to be that “the contract calls for a $1B termination fee in a financing fail even if the financing fail was caused by a ‘knowing and intentional breach’”. Again, this was previewed in Musk’s Motion to stay (see the screenshot I clipped earlier). In addition, in a pure financing fail scenario, Musk will likely argue he used his best and the market was just too bad; if he tries an insolvency route, Musk will argue that he truly believes TWTR cannot handle the debt load that his buyout would put on it.

TWTR’s arguments will come back to bad faith / unclean hands (which prevent Musk from breaking the agreement). In addition, on a financing out, Twitter will argue that Musk did not use his best efforts to raise financing, and that financing would have been available if Musk had closed the deal on time. If Musk goes the insolvency route, TWTR will argue that they are clearly not insolvent; Musk agreed to buy them for $44B just a few months ago, and despite some market volatility, there’s no way that TWTR’s value has dropped 75% in a few months. While near term results have been poor (we still haven’t seen Q3 earnings yet, but I’m guessing TWTR’s lenders and Elon did), TWTR will point out that Musk’s original business plan and the bank loans called for near term results to be really poor as Musk gutted the TWTR business model and attempted a switch to more subscription type revenues (or maybe crypto plays based on his text messages; who knows!).

If Musk tries to back out on a straight financing argument, both sides will likely spend most of the trial interrogating banks. They’ll ask the bankers why they couldn’t raise financing. Twitter will ask if Elon’s behavior and tweets had any influence on the debt raise process, as well as if the financing would have been raised successfully if the deal had closed on time. Elon’s side will focus on how awful the markets are; they’ll show the stock charts for companies like SNAP, have the bankers quantify how awful the banks losses would have been, and try to prove that Elon’s actions had no impact on the financing.

If Musk tries to get out on an insolvency argument, both sides will hire valuation experts to try to prove or disprove that Twitter is worth more than the debt burden the deal would place on it. Musk’s side would show Twitter as a broken business with no hope for sustainable profits; Twitter will point out that was exactly the reason Elon wanted to take Twitter private and turn it around. Twitter will likely spend a lot of time bringing up Elon’s initial pitch for TWTR’s revenue to quintuple by 2028, and they’ll also try to prove that the financing would have been there if Elon had signed the insolvency certificate (basically making the argument, “the banks were fine lending this money; you stopped the deal because you had buyer’s remorse and tried to weaponize a standard part of the merger closing.”

#8: When would Elon argue TWTR went insolvent / financing failed

If Musk tries an insolvency / financing out, there is a very interesting question of when he will argue financing failed / TWTR went insolvent. Musk’s proposed order for staying the trial (which the judge did not adopt, but Musk did file) noted that the “Bank Debt Commitment Letter are in effect” and “the conditions to the completion of the Merger set forth in Article VII have been satisfied.” It also said he would inform the lenders of that statement, and keep Twitter informed of financing on a daily basis.

As noted early, a lot of people (including me!) have suggested that order is written like someone who intends to close the merger. But let’s say Elon does plan to back out of the merger, either through financing or through insolvency. This proposed order raises lots of questions for Elon’s case. In particular, if Elon tries to back out on an insolvency claim, there is going to be a very hard question to Elon of when he first thought Twitter was insolvent.

Elon would have two options. Option #1 is he can say he realized Twitter was insolvent between filing that proposed motion in early October and deal closing. If the market took a real turn in the next week or two (say, down >20% while credit markets seize up), this might be a reasonable argument. Maybe. Otherwise, Elon is going to have a tough time pointing to something that’s changed in the between filing this proposed motion and the (failed) deal closing that lead him to believe Twitter was insolvent. Perhaps his best argument would be, “I never even wondered if Twitter could handle all this debt until the certificate was put in front of me.” Obviously, that’s not a great argument.

Option #2 is Elon could say, “I always knew Twitter was insolvent, and I filed that proposed motion so that I could say Twitter was insolvent and break this contract.” Again, this isn’t going to be a good look for Elon. Judicial Estoppel says you can’t make insistent claims in court proceedings, and I think saying “I’m ready to close” one week and then “this is an insolvent company” two weeks later are definitely going to approach “inconsistent claims” territory. Even short of that, I think a judge is going to have a real hard time swallowing that Elon said “stop the trial; I’m getting ready to close!” and then a few weeks later said “Just kidding; I was just using this as an excuse to weaponize my contract and the court room! I’m out of here!”. And, as discussed earlier, I’m not sure Elon’s lawyers would have signed off on such a brazen plan.

Decopac: a minority of experts thought the Decopac decision was wrong and would have been overturned on appeal, and that if Musk orchestrates a financing out and losses he would hae a shot at an appeal at the Delaware Supreme Court.

Why would elon not sit for a deposition

Does elon’s filing indicate that he thinks TWTR is solvent?

how do you acount for burnt hair asi t relates to best efforts

BCE LBO solvency out?

https://www.reuters.com/article/us-dealtalk-solvency-bce-idINTRE4BA7IU20081211

Great writeup. in regards to Section 5, financing and insolvency out, why is the provision below not all that needs to be said?

“Notwithstanding anything contained in this Agreement to the contrary, the Equity Investor, Parent and Acquisition Sub each acknowledge and affirm that it is not a condition to the Closing or to any of its obligations under this Agreement that the Equity Investor, Parent, Acquisition Sub and/or any of their respective Affiliates obtain any financing (including the Debt Financing) for any of the transactions contemplated by this Agreement.”

It says in no uncertain terms imo, whatever the rest of the agreement says, financing is not a condition to closing. So, what am I missing that all of these attorneys and legal experts are digging deep into the language on a $1 billion breakup free or an insolvency certificate when the agreement seems crystal clear on the subject? I feel like I must be missing something.