Preamble: This is the sixth entry in my deep dives sponsored by Tegus series. The goal of these are simple: every other month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry. You can find the first deep dive into the risks to the cable industry here, the second into Regeneron here, the third into Party City here, the fourth on natural gas and CNX / DEC here, and the fifth on the odds Elon needed to close his TWTR deal here.

I’m hoping this series is a screaming success, with readers and myself learning a ton from the interviews and Tegus getting lots of publicity for their product (which I love and is table stakes for fundamental investors) and that I’ll be able to turn these into a regular bi-monthly recurring feature forever. Of course, that involves everyone feeling like they’re getting value from the series, so please check out Tegus if you’re a fundamental investor and haven’t done so already (again, it’s pretty much table stakes for investors at this point).

And before I get too far ahead of myself, I should note that Tegus has made the three calls I did that formed the basis of this post free to check out for the next year:

As with many of my Tegus deep dives, this post ran long. There’s just a lot to talk about. So I’ll be splitting the post into three parts:

Part 1 (today’s part) will include an overview, some quick industry definitions, the high level thesis in three parts, and a discussion of thesis point #1 (Tight supply and rising utilization will cause rates to rise)

Part 2 (found here) will discuss thesis point #2 (no supply left / supply response to be muted for years / no demand destruction) and thesis point #3 (Offshore is cheap / valuation undemanding even without rising rates).

Thesis point #3 is probably the most important point to the whole thesis (at least it is to me)! But without point #1 & #2, some parts of point #3 don’t make sense!

Part #3 (found here) will go over the bear case, other odds and ends, as well as including any Q&A or feedback on the series I get between now and then.

Overview

If you’ve been following the site / podcast recently, you’ll notice I’ve been hitting you over the head with information on the offshore sector. In particular, you’ll note two (I think excellent) podcasts focused on Tidewater and the offshore space: episode #146 (with Tidewater’s management) and episode #147 (with Judd Arnold).

The reason for discussing them so much is simple: the offshore space appears to be at an inflection point. A combination of high demand and limited potential supply response have created a rising day rate environment. Rates appear to be poised to continue to rise, and even without rising rates the stocks are pretty cheap on current numbers. Management teams and shareholders appear to have gotten discipline on shareholder returns; in the near term, most of cash generation should be going back to shareholders (through dividends or buybacks) or going towards accretive M&A (buying smaller / more distressed players). When you combine cash returns with rising earnings and already cheap stocks…. well, the offshore space could be at an interesting inflection point!

So that’s the overall thesis. It’s a pretty simple one; again, if you listen to the podcasts (it’s not a coincidence those were sponsored by Tegus as well!), the story will come across pretty cleanly.

But everyone needs to gain conviction in an investment thesis in their own way. You generally get conviction on a thesis by doing your own work on it.

I went into those podcasts (and this post) with a lot of conviction in the offshore thesis. For me, these Tegus calls were a big part of why I had already gained so much conviction.

Some quick industry definitions

I’ll try to avoid too much industry jargon throughout these posts, and when I do use any I’ll try to define them. But getting a few quick terms out the way will likely prove helpful.

The offshore space in general refers to anything that is involved in drilling oil offshore and getting it back onshore... but that’s a pretty broad space! The level of technical expertise and equipment for shallow water drilling right off the coast is dramatically different than what you’d need to drilling thousands of feet underwater deep in the ocean. The image below (from this site) shows that pretty nicely.

To put those depths in perspective, consider the slide below (from TALO’s investor deck):

So you could use offshore to refer to lots of things. For example, there are literally hundreds of publicly traded companies that have the right to drill for oil offshore; offshore could refer to any of them!

But those are not who I’m interested in. For the purposes of these articles, I use “offshore” to define the publicly investable offshore supply / equipment space. There are generally two ways to invest in the offshore supply space:

You can invest in the offshore drillers / rigs, who own the actual vessels / assets that go out and drill for oil or pump it out of the ocean. Publicly traded companies here include VAL, NE, DO, and RIG.

You can invest offshore supply vessel space (OSVs). These companies own things like Platform Supply Vessels (PSVs) that supply offshore platforms and enable offshore drilling to function. This is a much smaller space; the largest player here is Tidewater (TDW) and there aren’t any other public players of note anymore.

Obviously every company is different, and OSVs are materially different assets than offshore drillers. But the drivers of supply and demand are similar enough for both that we can lump them into one bucket and talk about the overall offshore thesis.

And what is the overall offshore thesis?

High level thesis

The high level (bull) thesis for all offshore generally rests on three points

It seems like day rates will rise substantially. Offshore drilling demand is returning; as offshore drilling demand rises, asset utilization is tightening and rates are rising.

Rising rates and utilization generally invites a supply response (new boats are built and older rigs are brought back online)… but after a ~decade of underinvestment due to the last boom/bust cycle, there’s no real supply left to come online and it would take years for new builds to come online. And, given how profitable offshore oil is around today’s levels, there’s unlikely to be a demand response either.

Even if I’m wrong on points #1 and #2 above…. offshore is cheap on today’s day rates / earnings levels! This creates a bit of a “heads I win; tails, I win more scenario.” If rates flatline at current levels, the share prices will probably do well. If rates continue to rise (as I believe is likely / as I hopefully showed in points #1 & #2), the stocks will do really well.

One of the experts put it pretty succinctly:

We're in a little bit of a new world we haven't experienced in many, many years. We are seeing that pendulum finally swinging back in favor of the driller. The last time we saw some hints of recovery, we got flat down with COVID and basically pulled the bottom of the market again.

And so now we're seeing a much more structural improvement in the market. We are seeing a material uptick in demand, coupled with just a global lack of supply, there's just not enough drilling rigs right now to kind of meet the long-term outlook of what these operators need. Everyone talks about the fact that we would just have so much, I would say, lack of spare capacity when it comes to oil and gas. We talk about just all this deferred demand that is now kind of pent up and ready to go.

High level thesis out the way, let’s dig into point #1.

Thesis point #1: Tight supply and rising utilization will cause rates to rise

This is the key near term point for the sector, and likely what attracts most analysts: tight supply and rising demand for offshore have increased utilization, and we’ve gotten to the point where utilization is tight enough that day rates are rising at an accelerated pace.

Let me show that point (and define some of those terms) by creating a hypothetical and very simple market.

Imagine a world where there are only 100 offshore vessels in the entire world. Each offshore vessel costs $1/day to operate (their fixed costs), and offshore vessels are hired exclusively by oil companies producing oil offshore at a rate of one vessel to one well. Oil companies are rational, and they only drill wells at profitable levels. There’s one profitable well for every dollar price of oil; there’s a well that costs $0 to operate, a well that costs $1, etc. So if oil is $2/barrel, two wells operate (the $0 well and the $1 well). If oil is $10, there are 10 worldwide profitable wells that operate. If oil is $30, there are 30 worldwide profitable wells; if oil is $150, there are 150 profitable wells, etc.

Let’s say that oil is currently priced at $40. In that case, there’s only demand for 40 offshore vessels. In that world, ship owners are going to be desperate to get their boats hired. They’ll be willing to rent their boats out at their fixed costs (I.e. $1/day) just to keep boats active and crews employed. 40 lucky vessels will get chosen to operate, the other 60 will be idle, and worldwide utilization will be 40%.'

Imagine the price of oil rises from $40 to $60. Now there are 60 wells getting drilled worldwide…. but, from the ship owner’s perspective, not much has really changed! The world is still awash in excess vessels, and ship owners will still be desperate to get their boats hired. Rates will hover around the marginal cost to operate (still $1/day) even though global utilization has increased from 40% to 60% (60 of the 100 vessels are operating).

But imagine a world where oil is suddenly at $120. Now there’s tons of demand for ships! 120 wells are bidding on ships, but there’s only 100 ships worldwide. Suddenly, ship owners hold all the cards. Their rates are only limited by the marginal economics of a well. With oil at $120, a well that’s profitable at $110 should be willing to bid up to $10 for a ship ($120 in revenue less $110 in costs less $10 for the ship). Of course, that well will be outbid by a well that’s profitable at $105, who is willing to pay up to $15 for a ship…. and they’ll in turn be outbid by a well that’s profitable at $100/barrel, who is willing to pay $20/day.

Obviously this is a massive, massive simplification…. but it’s a good basic model to have in your head to show how rising utilization doesn’t matter too much when utilization is low, but it can lead to sudden spikes to the marginal cost of production when utilization starts to get high / the market gets tight.

The offshore inflection point thesis rests on the market for boats getting tight enough to start to transition from the “day rates at the marginal cost of operating boats” phase into the “day rates only limited by the marginal cost of oil production” range.

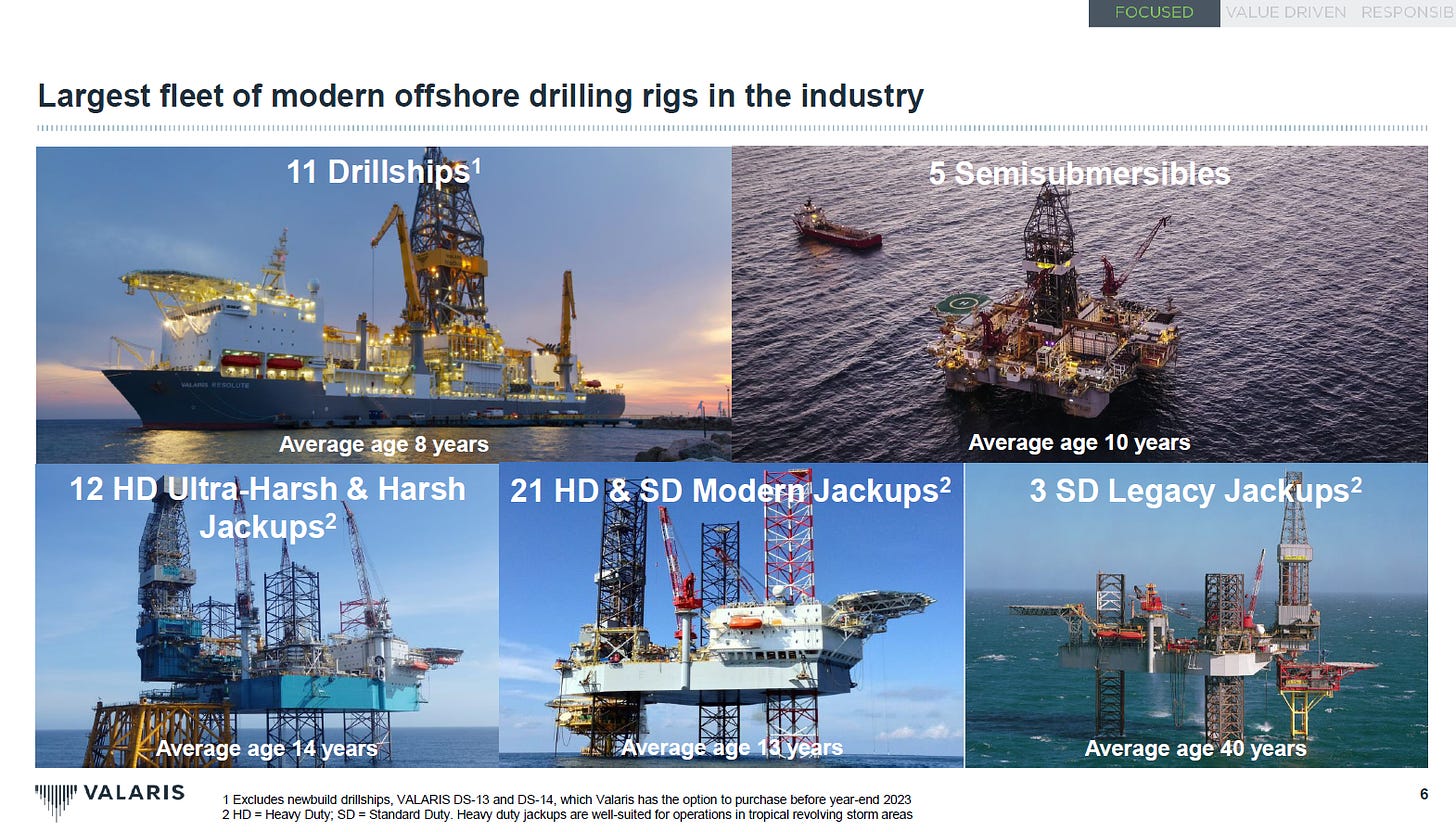

Perhaps the best way to see this is by looking at a few slides from Valaris’s (VAL) q3’22 investor deck (see the “investor pres” link).

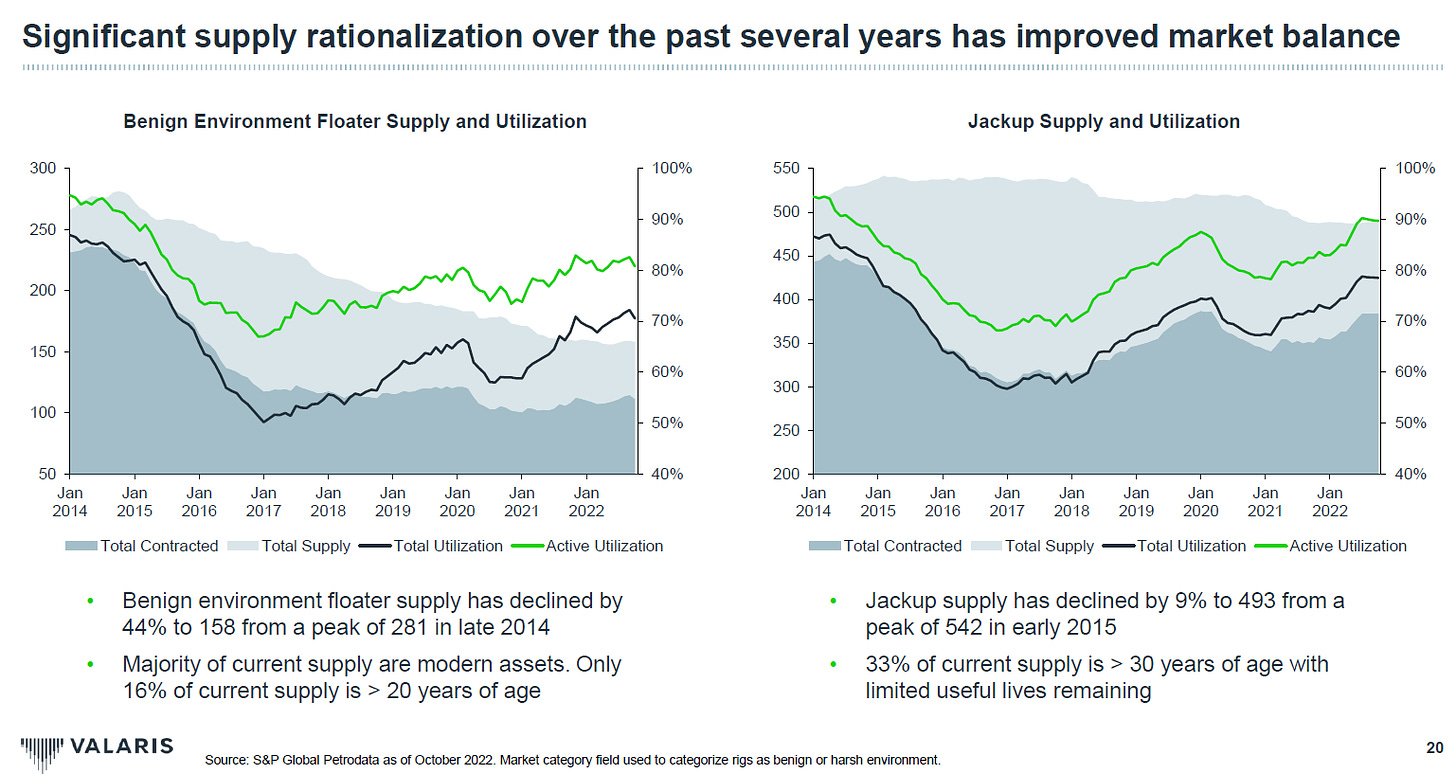

After bottoming at 50-60% utilization in 2017, utilization rates have started to creep up.

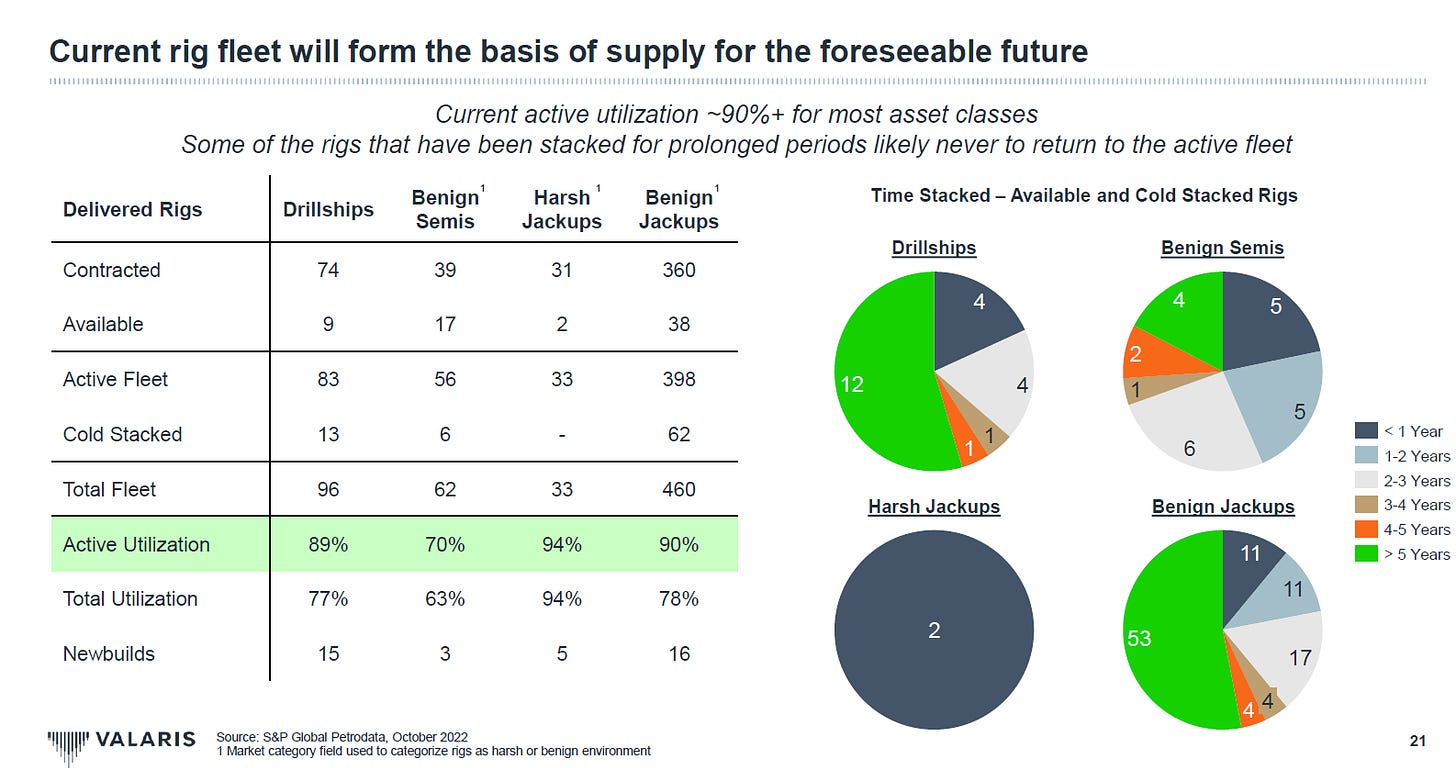

There are two types of utilization numbers: active utilization includes all assets that are currently capable of working; total utilization includes assets that are currently cold stacked but could theoretically be brought online if rates got high enough. Active utilization is currently approaching almost full utilization across multiple asset classes. While there appears to be a little excess supply from cold stacked boats, VAL (as well as many other industry participants) would argue that these cold stacked boats are so old and have been cold stacked for so long that they might not ever come back online…. and, even if they could, supply still looks pretty tight!

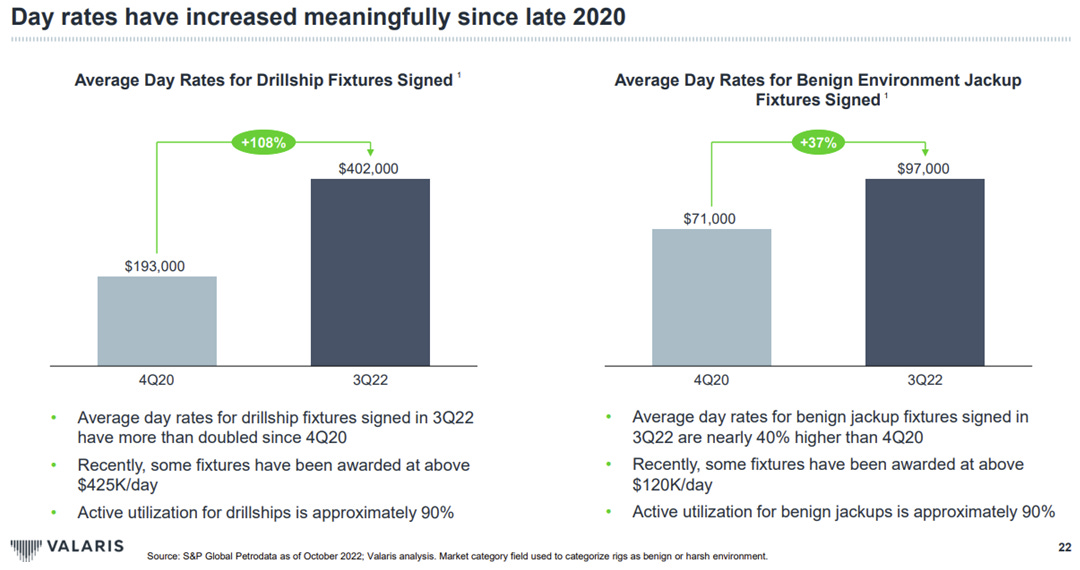

That tightening supply / demand dynamic has resulted in a massive increase in rates. In less than two years, we’ve seen day rates for drillships go from $193k/day to over $400k/day!

And that could just be the beginning; one of the experts I interviewed forecasted rates would “definitely” start with a five by the second half of next year as operators were desperate to lock down rigs.

I'm going to say definitely the second half of next year, starting with five. So you're going to see if an operator desperate has to do a well in H1, somebody is going to be able to go jam it on them. But I think you're probably looking at fixtures happening within the second half of next year.

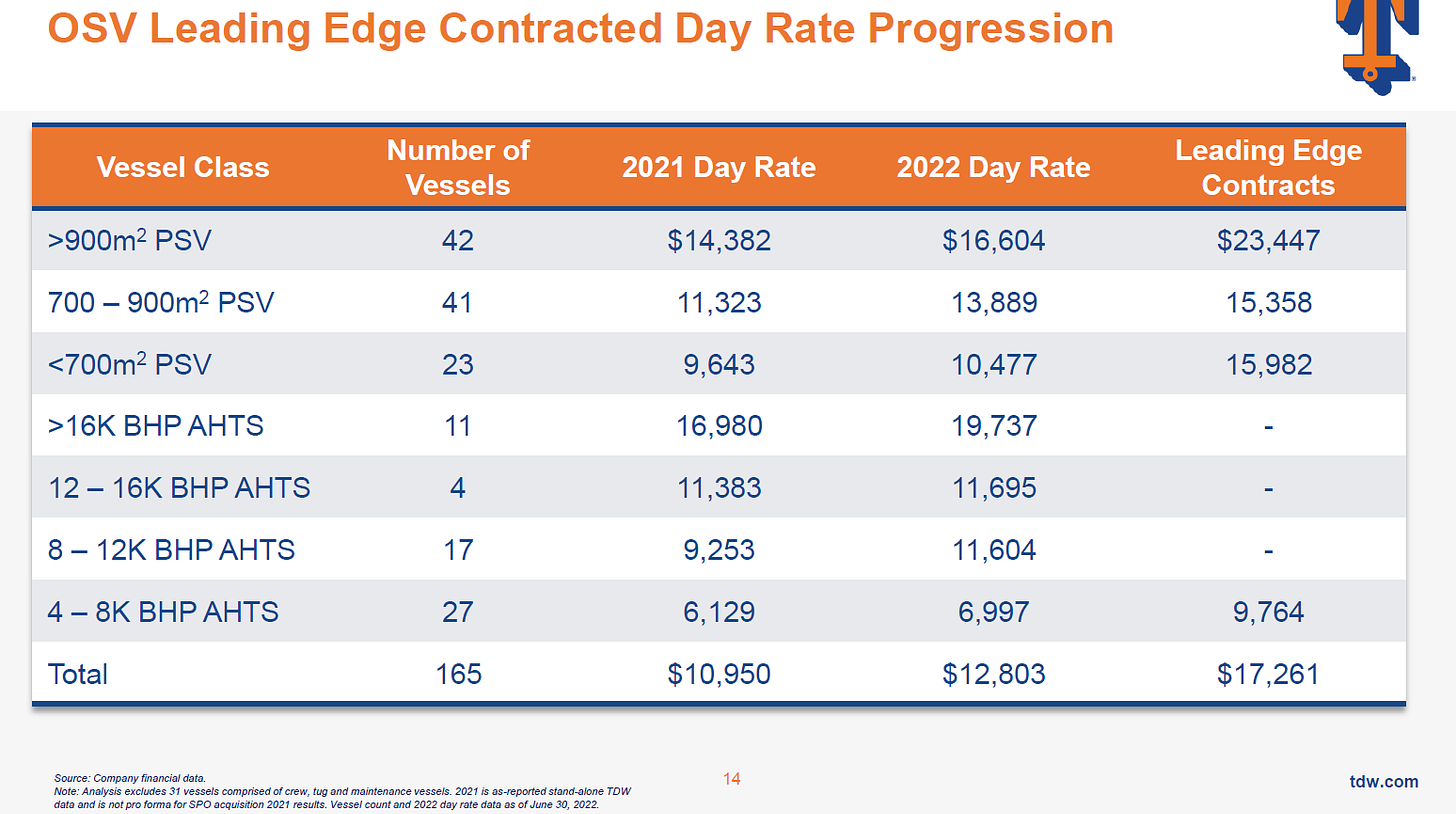

Similar dynamics have held for Tidewater’s OSVs. Average day rates were <$11k in 2021; that’s gone up to ~$12.9k for H1’2022 and over $17k for their most recent set of contracts (note: the slide below is from their Pareto investor presentation in September 2022, so it’s a little stale but the numbers have only gotten better since).

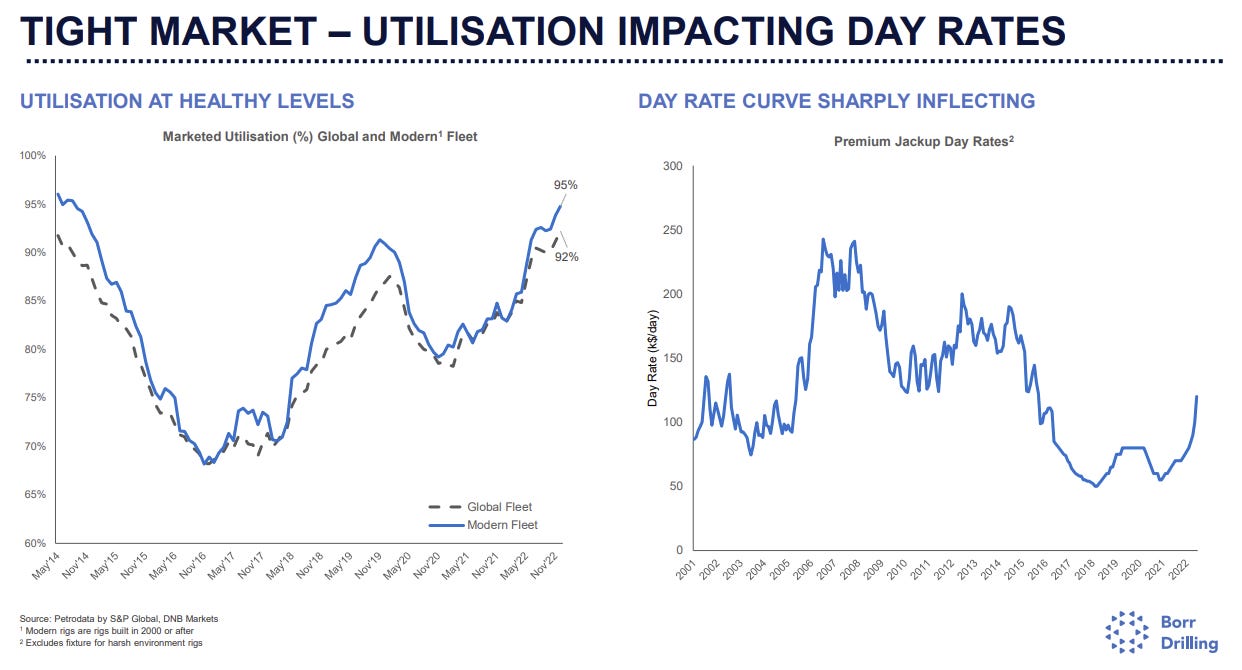

The same TDW deck has the two charts below, which I think work really well in concert with each other. You can see that as utilization plunges below 70%, rates start quickly following towards marginal cost….. but as utilization has recently returned to ~70%, rates have quickly responded.

The slide below (from BORR’s investor deck) shows this point off even more neatly.

Again, these charts are a little stale; they’re from last summer/fall and recent rates / utilization have gotten even better. Still, I think I’ve gotten the general point across: as utilization increases and the market gets tighter, rates start to follow. Utilization has shot up over the past year, and utilization has now gotten high enough to start to drive rates up.

That’s it for part #1. I look forward to seeing you Friday for part #2; if you’re looking for more info on offshore until then, I’d highly encourage you to check out the companion TDW podcasts I released over the last week(episode #146 (with Tidewater’s management) and episode #147 (with Judd Arnold))! And please feel free to lob in questions / comments / thoughts on offshore in the mean time; I’ll try to address them all in part #3 next week.

Loved this. Thanks for sharing

Hi Andrew, I love your expert interview series. Unfortunately, the Tegus links in this particular post don't work for me, they take me to a sign up page instead of the actual interviews. The ones in previous Tegus deep dives work just fine. Could you look into it? Thanks!