Preamble: This is the seventh entry in my deep dives sponsored by Tegus series. The goal of these are simple: every other month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry. You can find the first deep dive into the risks to the cable industry here, the second into Regeneron here, the third into Party City here, the fourth on natural gas and CNX / DEC here, the fifth on the odds Elon needed to close his TWTR deal here, and the sixth on the offshore space here.

I’m hoping this series is a screaming success, with readers and myself learning a ton from the interviews and Tegus getting lots of publicity for their product (which I love and is table stakes for fundamental investors) and that I’ll be able to turn these into a regular bi-monthly recurring feature forever. Of course, that involves everyone feeling like they’re getting value from the series, so please check out Tegus if you’re a fundamental investor and haven’t done so already (again, it’s pretty much table stakes for investors at this point).

And before I get too far ahead of myself, I should note that Tegus has made the three calls I did that formed the basis of this post free to check out for the next year:

Former executive of Century Link / Lumen

In addition, I’ve done two recent podcasts on the cable sector that I’d point you to.

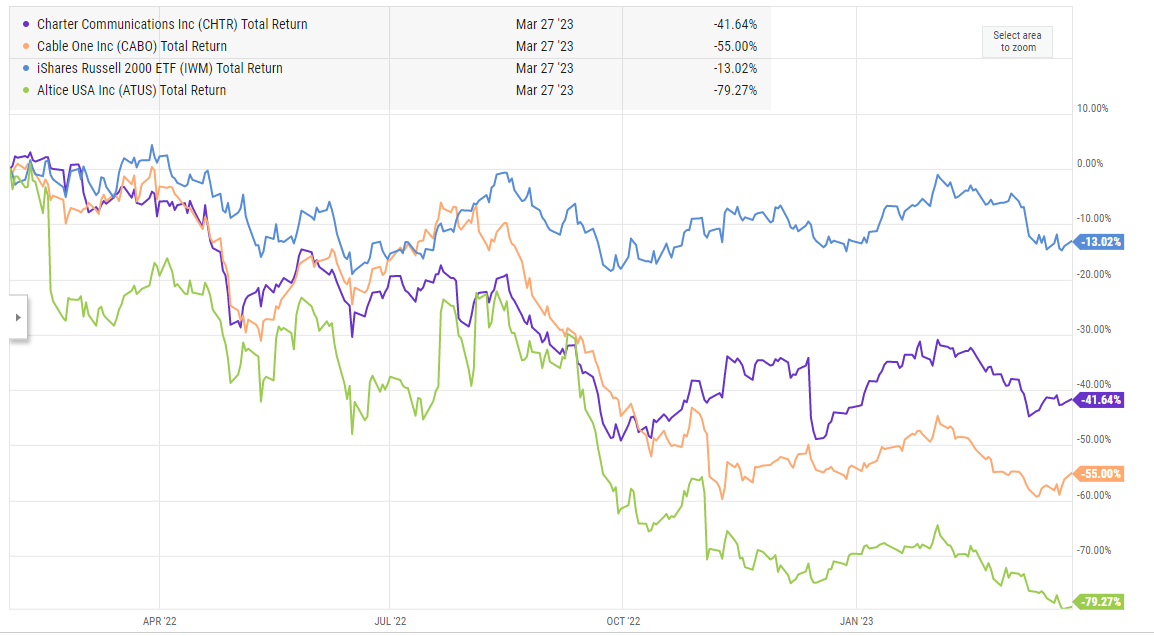

My first deep dive series was on cable in February 2022; I had been quite bullish on the industry and that series did not change my enthusiasm. With the benefit of hindsight, those posts proved…. ill-timed. The entire sector has been demolished since that post:

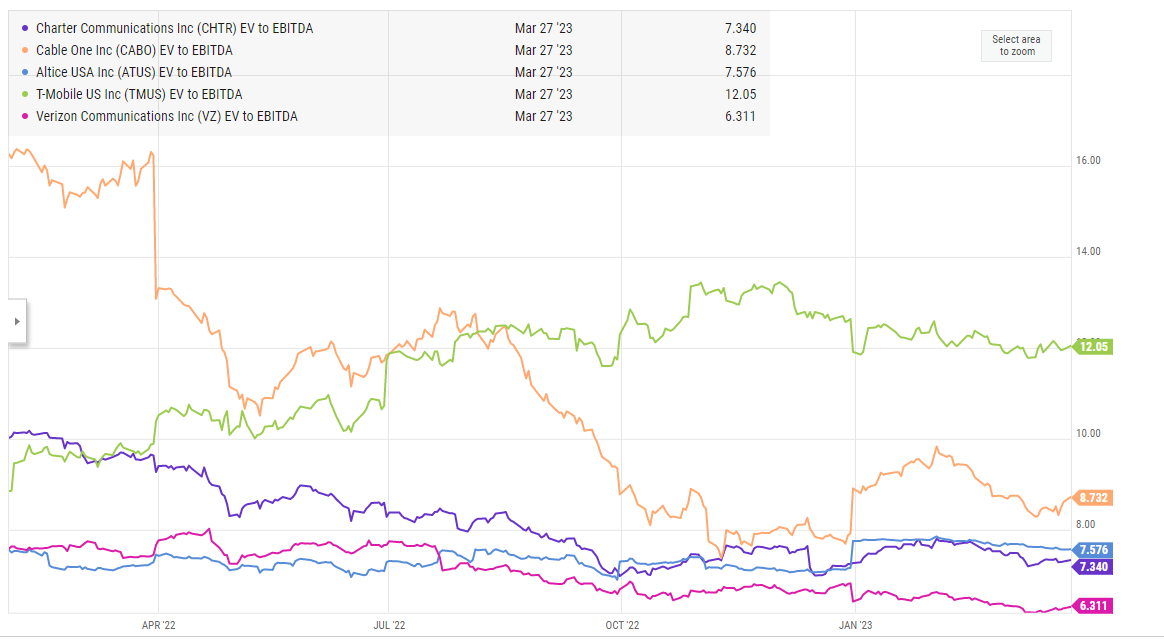

Those charts are just absolute disasters. You can probably blame part of the massive decline on interest rates; cable is a little more sensitive to interest rates than your average company (most cable companies run with some leverage, and at their core the bull case for cable companies is they are like bonds with pricing power. That combination leaves cable companies more vulnerable to interest rates / multiple compression that an average company). But there’s clearly something else going on here; cable companies saw their multiples get slashed drastically, going from ~10x EV / EBITDA (or higher for CABO) to ~7x, which is roughly inline with where T and VZ trade (TMUS, which is still realizing synergies from their merger with S and which has a compelling growth story given their best in class network, lots of spectrum, and their success with fixed wireless trades at a premium).

Cable trading at the same multiple as wireless players is interesting. Things are a little more complex than this, but a simple way to think about wireless / cable multiples would be this: heading into 2022, investors felt confident cable companies would face limited competition. In ~half their markets, the cable company would face fiber to the home (FTTH) or a cable overbuilder and enjoy an effective duopoly, while in the rest of their markets cable would compete only with a DSL player and have an effective monopoly. In contrast, wireless players would compete nationwide in a three player market (TMUS, T, and VZ) that had several other potential entrants (the cable companies were ramping wireless spend, and DISH is always a potential entrant). Cable’s premium multiple reflected their advantaged competitive positioning.

Through 2022, investors came to doubt that positioning. Fixed wireless (aka fixed wireless access, or FWA) took share faster than anyone expected, and FTTH projects got announced at an insane rate. Investors no longer viewed cable as a monopoly / duopoly play; instead, investors started to underwrite cable companies that could face multiple FTTH / fixed wireless competitors in every market. With the added competition, investors took away cable’s premium multiple and instead gave cable companies a multiple in line with legacy wireless players to reflect that worsening outlook.

If you go back to my 2022 piece, my conclusion was that cable would ultimately form a duopoly with FTTH in some markets and have an effective monopoly in the rest, and while FWA would take share at the margins it wasn’t a real threat to cable. Given FWA’s success and the disaster that has been cable’s stock price, I wanted to use this series to dive back into the cable sector and see if the market was right to sell these off so hard to if there could be opportunity in the sector.

So that’s the overview of why I’m revisiting cable; as for structure, I think I’m going to break this cable series into three parts, though that might change as I finish writing the parts!

In the first part (today’s post), I want to lay out the “why now?” bull thesis for cable to whet your appetite.

In the second part (likely posting later this week), I’ll discuss the bear case (namely rising competition from fiber to the home (FTTH) and particularly fixed wireless) and why I think we might be at a period of peak fear

In the third part (likely posting early next week), I’ll wrap the series up by talking about random cable tidbits and thoughts that I think are important.

So let’s dive straight into part one: why is cable interesting now?

I think the place to start is by saying “after the share price decimation, it’s really cheap versus its cash generation,” and I’ll discuss that in a second. But at a high level I think the answer might be “because insiders actions are saying they’re cheap.”

Consider Charter:

In November, their lead independent director (Eric Zinterhofer) buys >$10m of stock on the open market. That’s a chunky buy, and it’s made more meaningful by his background (he’s been on the board of Charter since 2009 and is the founder of a private equity firm with experience in cable/telecom).

At the end of January, another director (Steven Miron) buys ~$1m of stock. Mr. Miron also has plenty of experience investing in and operating cable/telecom.

At the end of February, Charter loads all of their top brass up with performance based stock options and RSUs that are tied to a pretty aggressive share price schedule.

In the abstract, those might seem like pretty bullish signs…. but if you’re familiar with Charter’s history I think they’re wildly bullish.

Consider the director open market purchases. Both of these directors have been on Charter’s board for years, and both have deep experience investing in telecom/cable companies (it’s worth noting Mr. Miron was the CEO of cable company Bright House Networks from 2008 until it was sold to Charter in 2016)…. and this is the first time either has made an open market purchase of CHTR stock. In fact, as far as I can tell, these purchases are the first time any Charter board member has bought Charter stock on the open market since the TWC / Bright House mergers closed! When insiders start buying for the first time, it’s generally worth paying attention.

Then consider the awards given to the top brass. People who’ve followed CHTR for a long time will note three things about those awards

They are big awards. In total, the awards are worth ~$130m. That’s a lot of money.

It is a lot of money….. but the Chairman, CEO, and CFO all agreed to forgo the performance awards for the next ~5 years in exchange for getting these awards now. Charter has pursued a similar awards strategy before (see p. 29).

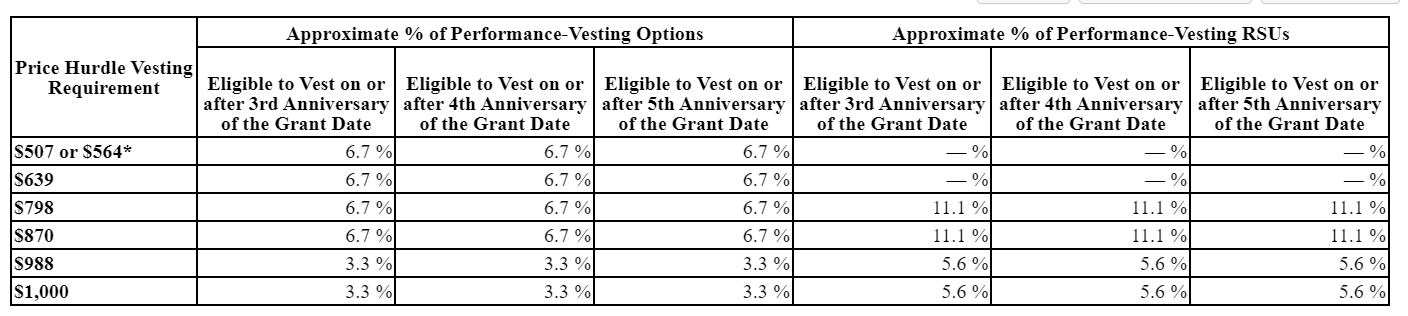

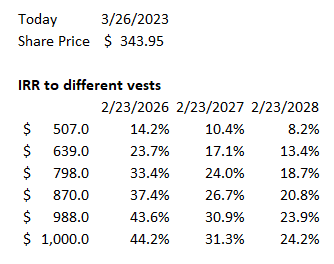

This award grant requires some serious share price appreciation in order to vest. The lowest end of the award would require the stock hitting $507/share by early 2028; that’s an 8% IRR hurdle. And that’s the lowest end! In order to hit the top end, Charter’s stock price would need to be $1k/share; that’d require ~28% annualized returns to hit the longest dated end (the 5 year awards expiring 2028) and >40% annualized returns to hit the shortest end returns (the three year awards expiring 2026).

The table below shows the IRR for the stock needed to hit different vest levels.

Let me put a little more context around the awards and Charter’s history with similar awards.

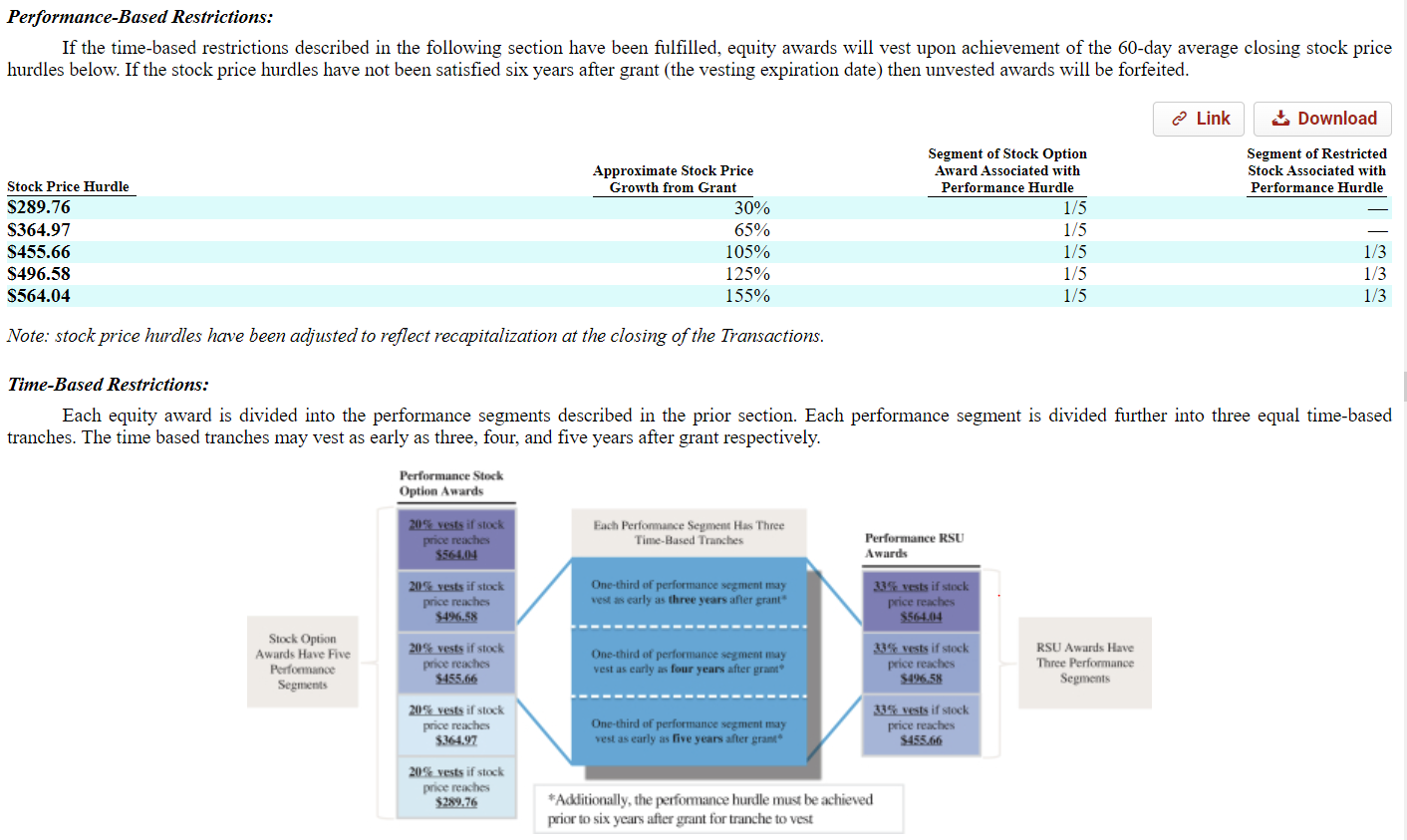

The last time Charter granted similar awards was in 2016 alongside closing their Time Warner and Bright House mergers. Top brass and the board decided to forgo annual performance awards and instead load them all at once into an aggressive share price target. If management hit those targets, they would get very rich. However, Charter’s stock was trading in the low $200s at the time; if the stock did not appreciate significantly in the next five years, management would work each year without receiving annual bonuses / stock awards. These are highly paid fortune 100 C-suite executives, so it’s not like they’d be in the poor house without the awards…. but the opportunity cost of those forgone annual bonuses would be enormous.

Management chose to take all of the awards upfront and bet on themselves…. and the bet paid off handsomely. Charter’s stock almost tripled over the next ~5 years, and management would hit all of the performance based targets.

The 2022 proxy summed it up nicely (from p. 31):

Long-term incentive program drives shareholder value — since the completion of the Transactions on May 18, 2016, Charter’s philosophy has been to deliver the largest portion of NEO compensation in the form of long-term incentives tied to stock price appreciation, i.e., stock options. Over this time, Charter’s stock price has grown 187% from $227.41 (the closing price of Charter’s Class A common stock on May 18, 2016) to $651.97 (the closing stock price as of December 31, 2021) and Charter’s corresponding market capitalization grew 78% from $70.2 billion to $125.2 billion. At the time of the Transactions, Charter issued equity awards to Messrs. Rutledge, Bickham, Ellen and Winfrey that only vested upon achievement of certain stock price targets. These price targets (based on the 60-day average closing stock price) were $289.76, $364.97, $455.66, $496.58, and $564.04, representing appreciation of approximately 30% to 155% from the grant price of the awards. Charter achieved the highest price target of $564.04 as of February 26, 2021, and the final tranches of stock options and RSUs granted under the program vested on June 17, 2021, upon the satisfaction of the last time-based vesting criteria of the awards.

So when you look at the new Charter performance awards, you need to consider two things

Management has chosen to forgo 5 years worth of bonuses to get these awards. They need the stock to appreciate ~8%/year over five years just to hit the lowest end of the awards…. and even if they hit that target, the opportunity cost versus just taking normal yearly bonuses is huge. In order for these awards to make sense, management is betting that the stock needs to go up a lot and do so in a pretty tight time frame.

Management has made a similar bet in the past, and that bet paid off in spades. Past performance is absolutely no guarantee of future returns, but when you see a management team that has made a big bet on themselves successfully before make another big bet, you have to think they’re doing it with the odds stacked in their favor…..

Of course, that’s just Charter. This post/series is not Charter specific; it’s about the whole industry…. but I see signs that the whole industry sees similar value.

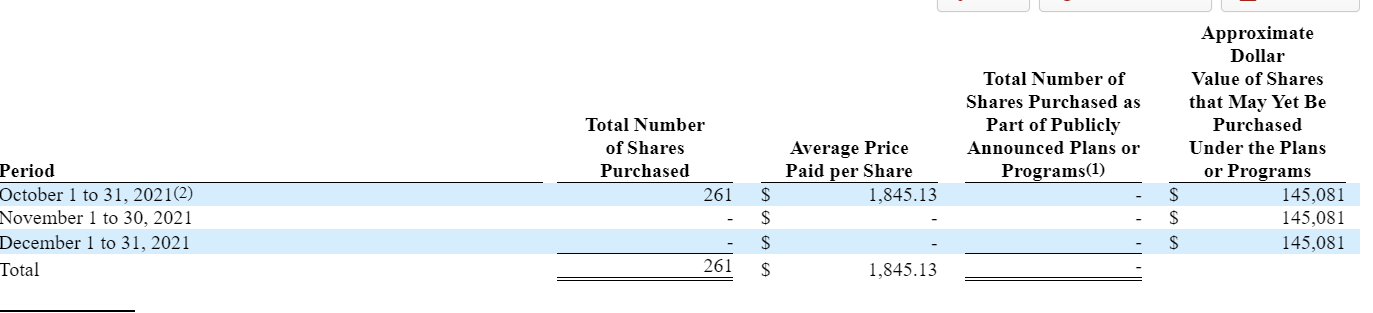

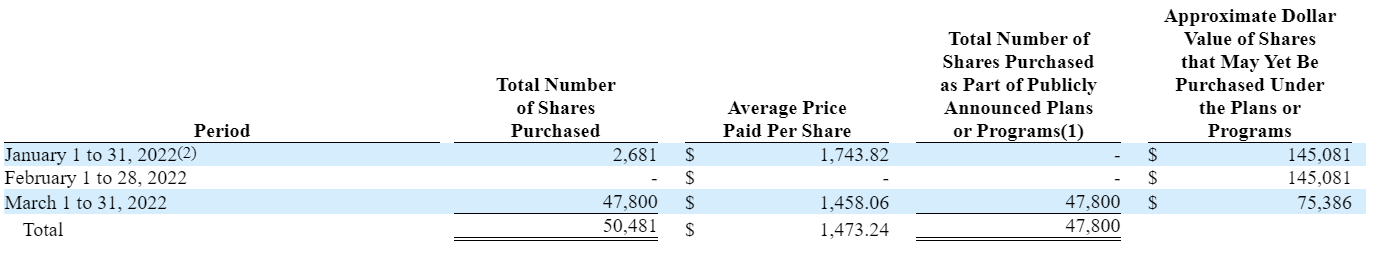

Consider Cable One (CABO). I had their CEO on the podcast recently (see here; she was great), and we discussed a lot of things about the company and industry. For this section’s purposes, the most important thing was how Cable One started buying back shares reasonably aggressively in 2022 after sitting out the repurchase game for years. Every company reports their share repurchase activity (if any) in their 10-K. I’ve pasted CABO’s most recent 5 below; remember that CABO has <6m shares outstanding, so the ramp up from basically no share repurchases when shares are in the high teens to a pretty aggressive rate as shares drop into the low teens and ultimately below $1k/share is very interesting!

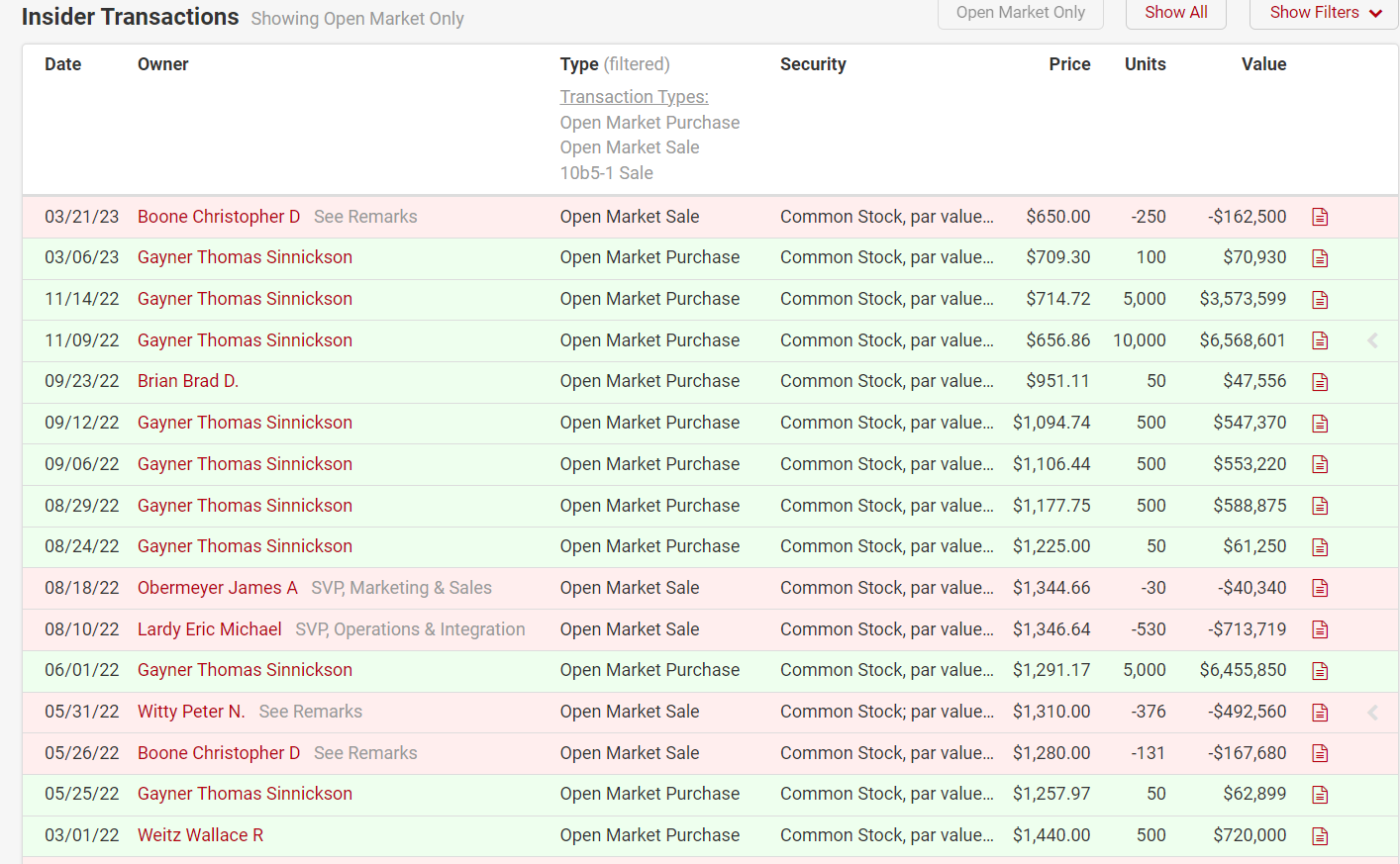

That repurchase trend is obviously an interesting signal… but perhaps more interesting to me is what the board is doing. Tom Gayner is the CEO of Markel and has served on CABO’s board since they were spun off from Graham Holdings in 2015 (he’s also served on Graham holdings board since 2007, so he’s been involved with Cable One in some type of board capacity for over 15 years). In 2022, Tom started buying Cable One stock on the open market. Anytime a respected value investor starts buying shares of a company where they sit on the board, it’s interesting…. but what’s more interesting here is that this is the first time Mr. Gayner has ever bought Cable One shares on the open market. After ~15 years of involvement, Gayner decided that now was the time to buy stock! That’s great patience on his end, and an interesting signal for us!

The publicly traded cable industry isn’t massive; there are really only five players in it (ATUS, CABO, CHTR, CMCSA, and WOW). When two of the five publicly traded companies in your public peer set are buying back shares at a reasonably aggressive pace and have sophisticated board members buying on the open market, that’s an interesting sign!

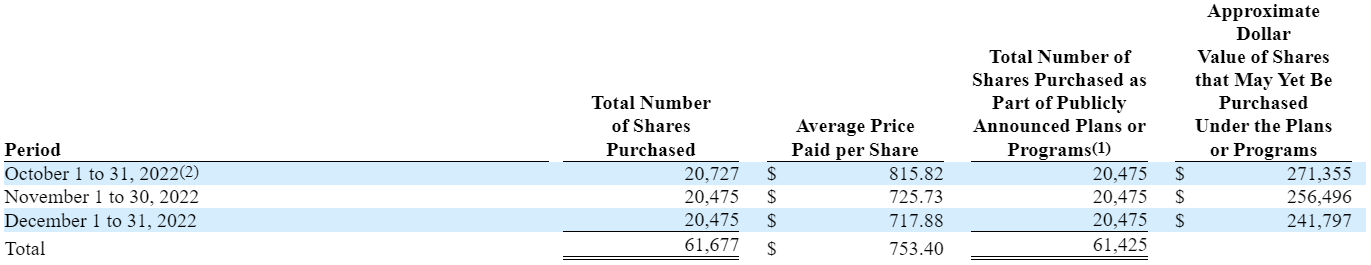

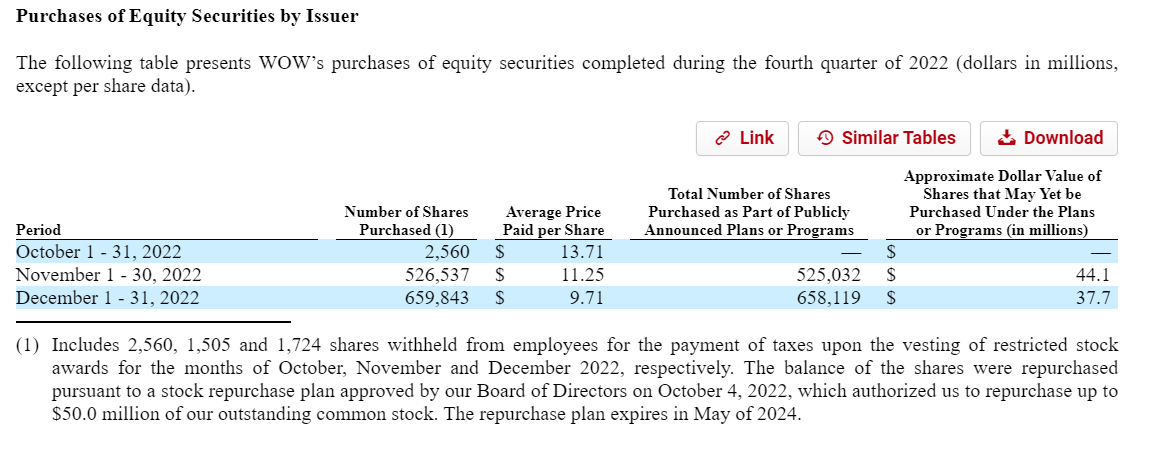

One more sign the industry is cheap. WOW is not a perfect comp versus the other players (it’s an overbuilder and a fraction of the size of the other peers), so take this with a grain of salt…. but their share repurchase activity is interesting. WOW is by far the least levered of the cable players, so they could have been running a reasonably aggressive capital return / share repurchase strategy whenever they wanted to. They also have a private equity firm who owns~37% of their shares and has been in the company for almost ten years at this point, so they are certainly very sensitive to value creation. Despite massively delevering their balance sheet in 2021, WOW sat out the repurchase game… until the end of 2022, when they started aggressively buying back their shares (WOW has <90m shares outstanding, so they suddenly ramped their repurchases up to a level that would have them retiring just under 10% of their shares/year) (table below from WOW’s 10-k).

So, if you look across the whole swath of cable companies, I think you can see that insiders are generally pretty bullish. Share repurchases across the space are generally ramping, and insiders are buying shares on the open market for the first time in ages or pushing years worth of bonus payments into this year to take advantage of depressed share prices.

What is it that insiders are seeing that make them so attracted to the space currently?

The simplest answer is “the stocks are cheap.” Consider Charter: its market cap is currently ~$60B. Free cash flow in 2022 was $6.1B, so it’s trading for <10x P/FCF.

However, I think you can make the argument Charter’s free cash flow is a little depressed. Charter has started a large rural build out program; that should deliver attractive returns in the future, but in the short term it depresses free cash flow. Charter is also ramping up their mobile business; again, the mobile business should create value in the long run, but in the short run it’s a drag on earnings and free cash flow. Charter spent ~$1.8B in capex on the rural build out in 2022 and another ~$400m in mobile capex (see slide 9 of their 2022 earnings); add that back and Charter’s FCF would have been over $8B and they’d be trading at <8x LTM FCF (mobile also generated >$300m in losses in 2022, which probably could also be added back to make Charter look even cheaper if you wanted to).

But it’s more than just simple cheapness. Right now, the market has all sorts of concerns about cable’s business. 2022 was not a great year for cable; for the first time ever, we saw cable companies report broadband customer losses during the back half of the year. Seeing cable companies lose customers for the first time ever sent fears of rising competition from fiber to the home and particularly fixed wireless into absolute overdrive.

Those risks and concerns are real. But I think when cable executives look at those risks as very manageable, and cable executives don’t believe 2022 results are the start of a new trend of broadband losses. Instead, executives look at 2022 as a blip, and they still see their core business as advantaged over basically every other competitor. Over the long term, cable execs are betting the core business will continue to deliver reasonable growth with solid pricing power, and that combination will drive accelerating growth in free cash flow to equity.

There are other things to talk about on the cable bull case; in particular, the cable mobile story has the potential to create a lot of value….. but those things are better discussed after we discuss the risks and threats from fiber and fixed wireless. So I’m going to wrap up part 1 of this post here; I look forward to seeing you later this week for part 2!

PS- my friend Bill Brewster had cable/telecom specialist Craig Moffett on his podcast late last year; that conversation is definitely worth listening to if you’re interested in telecom / media.

I know not related to this article but I am very surprised you haven't done a deep dive into TGNA right now..There still might be a 10% chance deal gets done but if it doesnt this is a $20+ stock on a standalone basis. All debt fixed, first maturity in 2026. Will get $136m break fee+ $500m cash on balance sheet + $1b FCF in 2023/2024. They literally can buyback half the market cap and not add any debt over next 2 years.

Great Write-up again Andrew. While I did not follow you the last time I find it really attractive this time around. Can’t wait for the following Deep Dives and Conclusions