Over the weekend, I put up an article on investing in industries in inflection. The crux of the article is that if you can find and identify a change (an inflection) in something (whether that’s a company or an industry) before the market does, there’s often a heck of a lot of alpha to be made. And I think right now we’re at an inflection point when it comes to merger arbitrage and anti-trust investing; there’s been a sea change, and the market has yet to pick up on it. If I’m right about that inflection, it presents the opportunity for investors to make a heck of a lot of money betting on merger arbitrage going forward.

Anyway, what really spurred that article and that thinking is Microsoft quietly closing their deal to buy Activision last Friday.

I think it’s fair to say that deal closing caps off what has been a banner year for merger arbs. Over the last year or two, regulators have pursued a series of novel antitrust cases where the core theory seemed to be “big companies getting bigger is bad” rather than any traditional antitrust analysis (where consumers or customers generally need to be harmed, likely by higher prices, for there to be an issue), and between ATVI and HZNP (among others) there was a lot of alpha out there if you were willing to do the work and take a view that traditional antitrust would hold / that these novel antitrust cases couldn’t hold up to a reading of the law.

Right on the heels of the WSJ article highlighting a few funds’ (including Pentwater’s) big win in those situations, Matt Levine wrote a piece that I think about a lot. The crux of the piece was the current regulatory environment is great for merger arbs; if they’re good, merger arbs could read the (novel) antitrust complaints, say “that’s not how antitrust works,” and buy the stocks / bet the cases would not hold up in court.

But I don’t think these individual cases / opportunities happened in a vacuum. Over the past few years, we had the government’s suit against AT&T / Time Warner, which was widely watched because the government’s suit seemed so weak / politically driven (and the government was demolished in court). Then last year, we had the Elon / Twitter case (which was very widely covered by this blog) that…. well, let’s be kind, reuse the term “novel” from earlier, and say the Elon / Twitter case represented a novel use of a buyer getting cold feet and trying to get out of a merger.

All of those cases (ATVI, HZNP, TWTR, AT&T / TWX) didn’t just represent unique and novel legal cases to try to block or thwart a merger…. all of them represented unique legal cases to try to block a merger in a mega-cap and extremely liquid stock. Funds could (and did!) easily bet hundreds of millions or even billions of dollars on these cases and (if they were right that the cases would go through) make massive uncorrelated returns.

Let me break down the extremely scientific term I just used: “massive uncorrelated”. The “uncorrelated” piece happens because buying a stock in a legal case creates returns that are unrelated to the stock market. If HZNP wins (or, as they did, settles) their court case, the deal closes and shareholders get $116.50/share. It doesn’t matter if the stock market as a whole has gone up 20% or down 20%; if HZNP wins, their shareholders get $116.50/share.

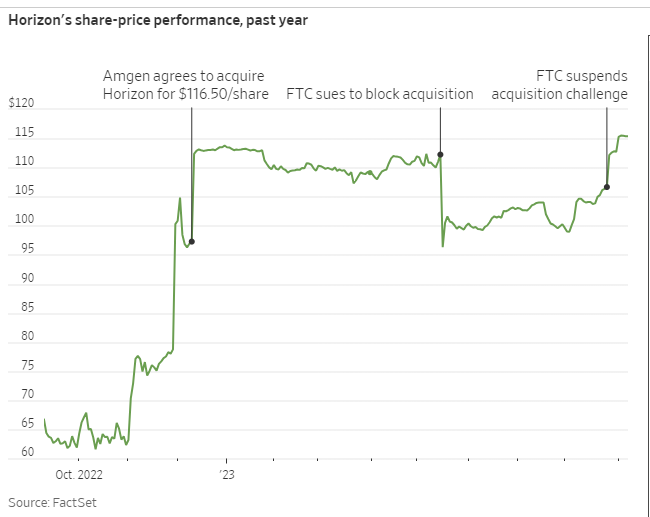

But the more important term there is the (again, highly scientific) term “massive”. If HZNP’s stock was trading for $115.50 and a win would get shareholders $116.50/share, then there’s nothing to see here. But HZNP’s stock consistently traded for ~$100/share after the FTC sued them to block, offering shareholders a ~16.5% return if the deal successfully closed. Remember, the stock market does ~8%/year over the long run, so a 16.5% return inside of a year (as HZNP offered) with no correlation to the broader market is pretty interesting!

Of course, merger arb is a game of probabilities; if the government was successful in suing to block HZNP, the stock would likely trade to where it had traded before the government sued to block them. HZNP’s stock was trading at ~$75/share (on the heels of strong earnings) before a late November leak that multiple companies were looking to acquire HZNP, so it’s reasonable to think the stock would trade back to ~$75 if the deal broke. With $116.50/share upside and $75/share downside, the market was pricing in ~60% chance of HZNP winning the court case.

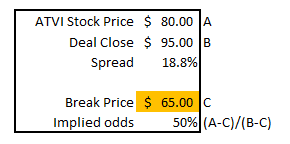

The HZNP case is emblematic of most of the other cases I mentioned earlier; all of these cases have tended to trade at ~50% odds to close (plus or minus maybe 10%). To use just one more example, consider ATVI. The downside in a break for ATVI was a hotly debated topic that shifted throughout the ~18 months the deal was in limbo as the QQQ melted down but ATVI’s performance improved (Diablo IV was a true blockbuster), but for most of the past year ATVI traded for ~$75-80 with most people thinking the downside was in the $60-65 range; with the deal price set at $95/share, that price and downside implied almost perfect 50/50 odds.

You can do similar math for pretty much all of the other big arbs I mentioned (TWTR, TWX, and several others. You could add SPB’s divestiture, VMW, SGEN (still ongoing, though trading much tighter post-HZNP), and more to this list); for all of them, the market priced them at ~50/50 to go through, and they ended up going through.

Now, perhaps this analysis is just resulting. I listed 4-5 examples. There’s a ~6% chance of flipping heads four times in a row; if each of these cases were truly a coin flip, perhaps we’re just living in the best of times for merger arbs where they got 4 heads in a row.

But I’m skeptical that these cases were truly coin flips. From the moment the HZNP suit was filed, most antitrust experts I talked to / heard from said it was a longshot to block (listen to Faber’s report when the HZNP suit hit and you can hear how confident the company was / how skeptical people were the FTC would prevail even before the filing was made fully public). From the outside, it seemed TWTR had a near lock of a case against Elon (my biggest initial fear was not Twitter losing but the board cowering and dropping the case as Elon called them increasingly bad names on TWTR)…. and Elon appeared to agree; he’s admitted he dropped the case because it became apparent he was going to lose!

You can nitpick with any individual odds, and of course I’m writing all of this with the benefit of hindsight (in real time, I can assure you that analyzing / betting on these cases is much more stressful)….. but I think the overall point I’m trying to make is hardly controversial. The market priced each of these cases at ~50/50, and if you really studied these cases and analyzed them you’d come to the conclusion that the actual odds of them happening / going through was much better. That’s what funds like Pentwater were seeing when they bet on HZNP (or what Icahn saw in Twitter last year).

But the point of this article isn’t to relive all of that history or just to use hindsight bias to say “we all should have had bigger Twitter positions and HZNP positions and everything; these were very mispriced bets!”…. though, honestly, yes, we should have all had bigger positions, these were very mispriced bets and that was analyzable in real time!

The point of this article isn’t just to look backwards. It’s to use the past to look forward.

I think something has changed in merger arb land. We’ve hit an inflection (as I discussed over the weekend). In ages past, losing a case was seen as a huge blow for the government. The top brass worried about losses setting bad precedent that made future enforcement more difficult and that lost cases would limit future career moves. Those worries skewed the system dramatically; the government would only go to court on cases that they were overwhelmingly likely to win.

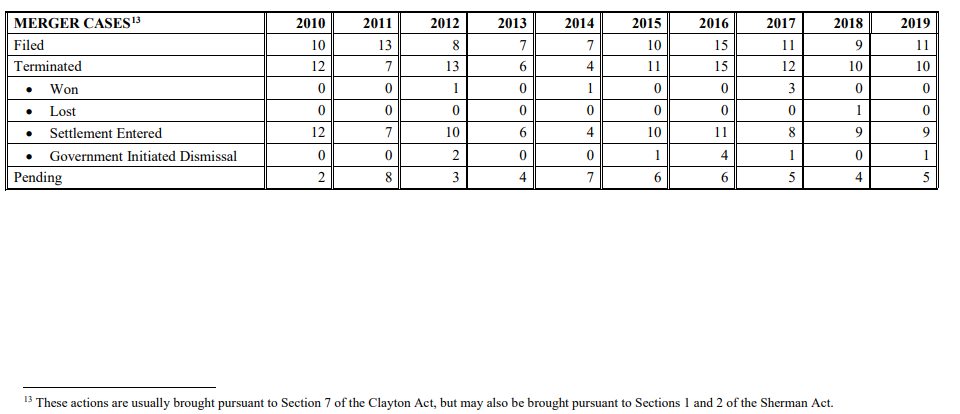

You can see that in the stats; the DoJ publishes their antitrust workload statistics every ten years. I pulled out the antitrust stats below; the government filed roughly 100 antitrust cases from 2010-2019. Remember that this is not an exhaustive list; the DoJ reviewed thousands of mergers over this time period, and I’m sure plenty of them faced pushback from the DoJ that resulted in settlements or terminations before the government needed to go to court. Still, of those 100 cases the DoJ takes to trial, they only take six “all the way through” to a ruling. Of those 6, the DOJ wins 5 of those trials (1 in 2012, 1 on 2014, and 3 in 2017) and lose one (in 2018; that’s the T / TWX deal).

Now, that history is for the DoJ, not FTC…. but the DoJ loses one case in 10 years! Out of a hundred cases they bring!

Think it through, and you can see that the incentives are clearly not to lose cases when you look at those odds. The government is only going to take something through to a full ruling when they are very confident that are going to win; if there’s any question of the outcome, they’ll settle before a ruling so that they don’t have to take an L. The only exception is the T / TWX case, where the DoJ clearly felt political pressure to fight all the way through to the end.

That incentive structure seems to have changed this decade; the DoJ has lost three cases I’m aware of (Booz Allen, United Health, and US Sugar). In just 2 years, they’ve racked up 3x the losses they did in the prior decade!

Is that racking up those losses a good or bad thing for our system? I don’t know; the DoJ (and FTC) appear to believe that they’re losing “the battles” (the individual court cases) but winning “the war” (expanding doctrine to give them more regulatory powers in the future). I’m skeptical that taking a ton of Ls is doing anything for them, but reasonable people can disagree. I’m here to look for investment opportunities, and whether losing these cases is good or bad for the government is far outside that scope!

So what I think you have is a government that is willing to bring much more marginal cases than they have historically felt comfortable doing, and I think we’ve seen that the market is going to price these cases like they were brought by the DoJ / FTC of old (who were scared to lose cases and only brought the best cases that they were almost certain to win). That combination creates ongoing opportunity.

It’s easy to look at HZNP, ATVI, TWTR, etc. closing and say “I missed it; these were so obvious and I should have played them…” but the aggressive regulatory state seems set to continue going forward (and I mean that regardless of who’s in charge; while the Biden admin has overseen this string of cases, let’s not forget the Trump admin was in charge of the T / TWX case and Republicans don’t exactly appear to have the relationship with big business (particularly big tech) that they used to!), and if it does so that will continue to present opportunity until the market stops anchoring these deals as coin flips and starts underwriting them with the government materially likely to lose.

I think it will take a long time for the market to flip that regulatory view.…. we’re talking about a shift from literally decades of “the government doesn’t bring cases unless they’re almost certain to win” to “the government brings losing cases because they think it helps them in some theoretical sense or it gets the people who brings them lots of media attention.” Doesn’t seem to me the type of underwriting that shifts over night; I’d guess it takes years (and, to be clear, investing on this trend takes the work of analyzing each individual case and looking at the broader regulatory landscape to make sure it doesn’t change back to the old viewpoint after they’ve taken enough Ls).

If I’m right about all of that, this investment opportunity could last for years; unfortunately, even with an expanded regulatory state, there’s only a handful of anti-trust challenges every year, so the opportunities won’t be abundant, but when they are there they will be very liquid and you’ll have the chance to swing in size.

So I expect a lot of opportunities in this vein over the coming years, and I’ll likely be writing up more than a few….. but I’d be remiss if I didn’t end this post by talking about current opportunities. I think there are four stocks / mergers that could fit into this bucket:

Seagen (SGEN): Seagen was listed in the WSJ / Pentwater article as one of the stocks they were betting on. As I write this, it trades for ~$214/share and shareholders would get ~$229/share if the deal closes. The only issue is this trades too tight; since the HZNP suit failed, SGEN has traded up materially and I’ve got it trading at ~80-90% implied to go through.

Albertson (ACI): ACI is getting bought out by Kroger. The FTC and California are both investigating and likely to sue to block the deal. I actually think this is a good example of normal antitrust; there are clearly issues with the deal, and while I think the divestiture addresses a lot of them, this is an edge case and a suit that would likely have been brought under most antitrust regimes.

iRobot (IRBT): IRBT is getting acquired by Amazon; as I write this, the stock trades for ~$38/share and the deal is priced a $51.75/share. It seems clear the FTC is going to sue to block this deal (they’re already suing Amazon for just being too big!); I think this (potential) IRBT suit is a great example of the opportunities I’m talking about. To my knowledge, there’s no traditional anti-trust argument to prevent Amazon from buying iRobot; I think Amazon would be very likely to beat the FTC in court (I mean that both for the hypothetical IRBT case and the current monopoly case!).

That’s not to say this deal / idea is a slam dunk! The fundamental downside if IRBT losses is large, and we haven’t seen the FTC complaint yet. Honestly, the biggest worry to me is Europe is also investigating this deal (and I’m way less confident / knowledgeable of European regulations or what levers they could pull to block a deal they don’t like; it seems like they’re the real gating factor here). But, on the whole, with a ~35% spread, I think this is a nice example of the opportunities here.

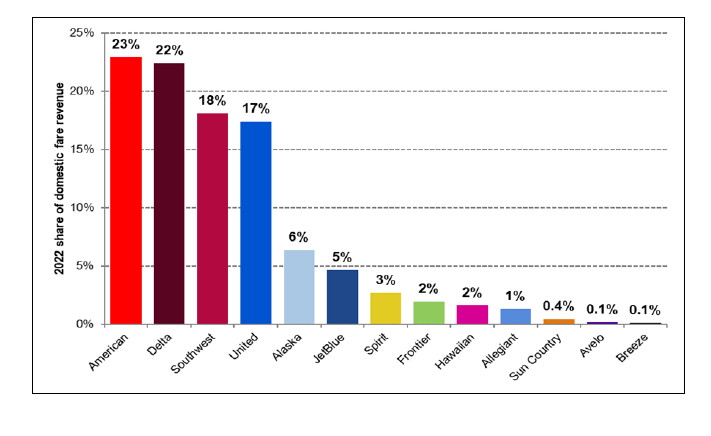

Spirit (SAVE): I’ll refer you to my podcast with Lionel Hutz (as well as extensive write ups on the premium side) for full background, but I think this is another great example (in fact, it’s my favorite example and the only one I currently have a position in…. ok, I have a very small IRBT tracking position too, but SAVE is the only meaningful position!). JetBlue is the ~6th largest airline, and they’re trying to merge with the ~7th largest to create a distant #5. There are some markets where they would have antitrust concerns, but they’ve agreed to divest those markets to Frontier and Allegiant. With those divestitures, I’m pretty sure no prior administration / regulatory regime would have pursued a case here…. but the DoJ is pursuing a case that looks novel to me on several issues. The market is pricing Spirit / JBLU as ~30% to win their case; I think that’s way too low.

I’ll provide a quick disclaimer: I’m not a lawyer, an anti-trust expert, or a financial advisor (what a great time to refer you to our legal disclaimer!). And all of these cases are dealing in probabilities; nothing is ever certain in legal land, there’s always a chance there’s some secret document filed in a redacted exhibit that reveals the case is much worse than public filings would make you think, or a company really botches their defense and a judge makes a novel interpretation in ruling for the government.

But it seems to me that something has changed on the regulatory side, and the market has been slow to pick up on it. People who recognized that early made a fortune in ATVI / HZNP, but I think the opportunity set will remain lucrative for investors who recognize the change and continue to do the work digging into these cases.

Do Spirit’s disappointing earnings change the outlook for the deal?

Hi Andrew thank you very much for your extremely valuable insight on this matter. On $SAVE, how did you get the 30% of winning likelhood bet by the market? $SAVE price has been trending lower since 2022, and even the COVID low was above $10.

Assuming there is no deal, I don't see much room for $SAVE to further drop..? Afterall they still have a chance to sell to Frontier.