Today is the halving, when the number of new Bitcoins minted as a reward for mining gets cut in half. Halvings happen every four years (CNN described it as “bitcoin bros’ World Cup,” which cracks me up); for this halving, we’re going from 6.25 Bitcoins minted every ~10 minutes to 3.125 BTC every ten minutes (or from ~900 a day to 450/day).

The Bitcoin community tends to get really excited about the halving. On top of drawing a ton of eyeballs into crypto (almost every mainstream media site has run multiple articles on the halving this week), Bitcoin has historically performed really well post halving. From this time article:

The halving is designed to make bitcoin more scarce, and ostensibly to push bitcoin’s price upward. And for the last three halvings, that’s exactly what has happened. After bitcoin’s first halving in November 2012, bitcoin’s price rose from $12.35 to $127 five months later. After the second halving in 2016, bitcoin’s price doubled to $1,280 within eight months. And between the third halving in May 2020 and March 2021, bitcoin’s price rose from $8,700 to $60,000.

Anyway, I’ve been really obsessed with the bitcoin miners over the past few weeks; that obsession includes a podcast with one of the miners, a really interesting Tegus panel with some mining insiders, a few posts on crypto (and the potential for a manic cycle), and a (premium) stock idea.

Given that obsession, and with the halving happening today, I wanted to throw up a post with a few random thoughts on bitcoin, the miners, the halving, etc. I will admit that I’ve been a long-time crypto skeptic, so feel free to take this post with as many grains of salt as you want! But there are four things I wanted to touch on:

“Bitcoin goes up in the halving” assumptions

Bitcoin miners and the gold rush / marginal capacity

Multiple discrepancies in miners

Can miners be repurposed for AI (high-performance computing / HPC).

Before getting there, I will just caveat all this with one thing: I have spent a lot of time looking at Bitcoin and miners recently…. but I am by no means an expert, and I’m still learning. All of my opinions are rambling and subject to change; in fact, I’m more than open to changing any of my thoughts, and if you think there’s an area I’m obviously wrong on this I’d love to hear it (comment section or twitter DM probably best, but it’s not hard to reach me!)! Let’s dig in:

#1: “Bitcoin goes up in the halving” assumptions

One of the things that constantly causes my brain to short circuit is that *most* (not all, but most) of the Bitcoin people I talk treat it as a given that the halving will serve as a catalyst to send Bitcoin up a ton. Here’s how the CNN article I linked to earlier put it:

It’s not rare for a conversation about bitcoin with a BTC believer to sound something like this: “I conservatively assume Bitcoin goes to $90k post halving, but based on past cycles $125k-$150k or higher is more likely.” It’s just a wild assumption; BTC is more than a trillion dollar asset class at this point, and people are throwing around “conservative” calls for a 33-100% gain inside of a year. Just a casual trillion here and trillion there!

The “Bitcoin goes up post halving” assumption is based on four (somewhat connected) things

Bitcoin has gone up materially in post halving cycles

The halving will result in a drop in new supply, causing the price to go up (Saylor makes this argument in a very creative way in this tweet).

The halving brings a bunch of new eyeballs / attention to BTC. New eyeballs = new potential demand, so you get the virtuous combo of supply going down as demand goes up.

There’s a believe in crypto that crypto goes through ~4 year cycles; ~two down years followed by two up years where things explode to new highs. 2022 + 2023 were down years, so under this logic follows that 2024/2025 are up years that will take BTC (and other crypto) to new records.

Those assumptions make my brain break for a variety of reasons, but a major one is that it assumes a shocking level of market inefficiency. We’ve known the fourth halving would occur this year basically since Bitcoin was founded, and Bitcoin is no longer a small, thinly traded project; again, it sports a trillion dollar market cap! For a trillion dollar currency / commodity (or whatever you want to consider Bitcoin) to trade in predictable 4 year cycles or go up materially on an event that’s been known about for years implies an unbelievable level of market efficiency.

So that’s the logical side of me speaking… but, to be fair, I thought/said the same thing about Bitcoin ETFs getting approved (that approval wouldn’t move BTC price; it was so widely publicized that it had to be “baked in”), and Bitcoin has been a rocket ship since then!

But here’s another reason why I suspect the “post-halving go up” effect while be much more muted this cycle that I never hear discussed: the change in supply is no where close to as big as prior cycles.

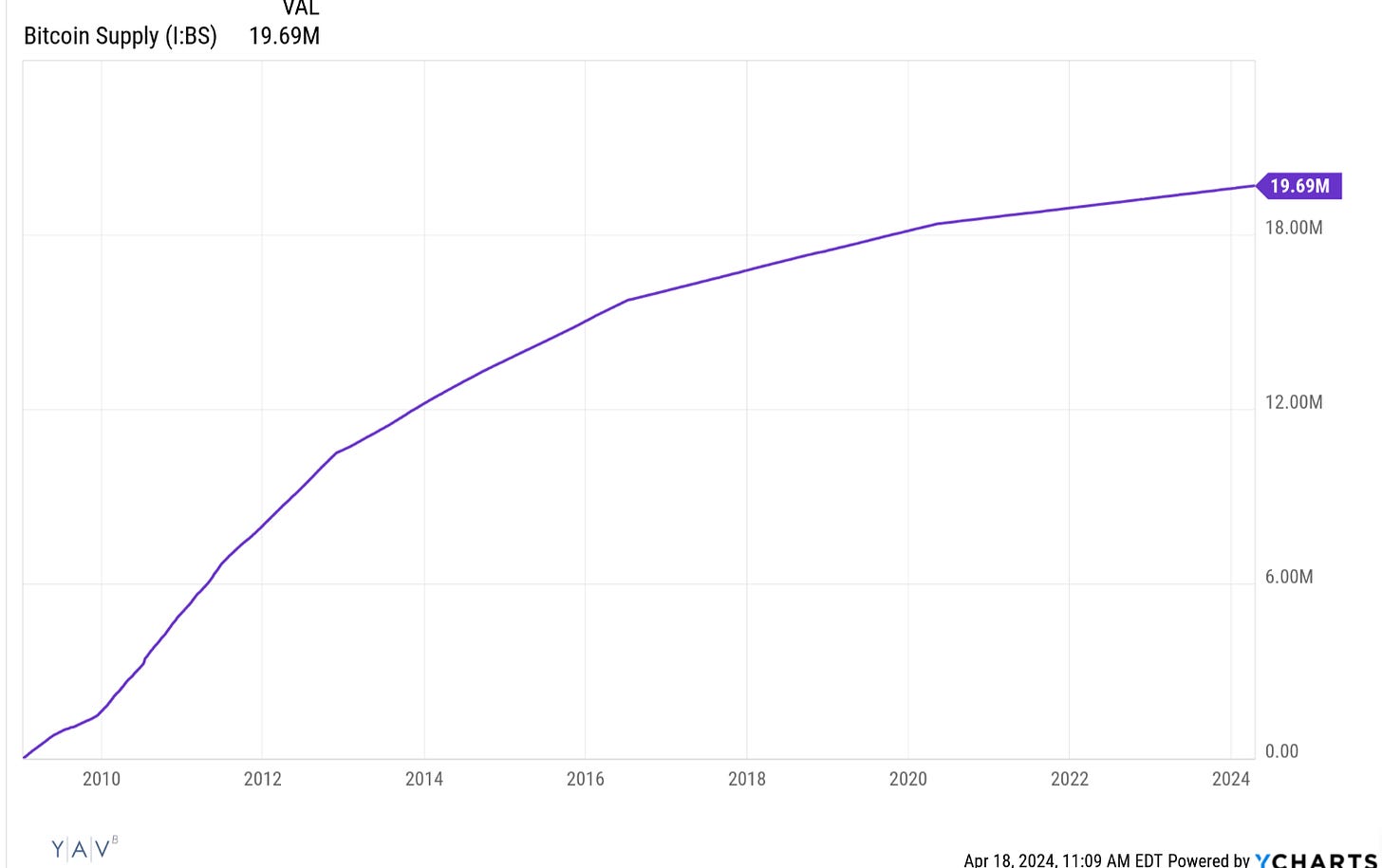

As I write this, there’s just shy of 19.7m bitcoin outstanding. We’re currently making ~900 BTC/day; post halving, that goes to ~450. If you went back to 2020, there were just over 18m BTC outstanding, and the halving took new BTC from 1.8k/day to 900/day.

You can probably see where I’m going with this: not only is the “stock” of BTC ~10% larger today than the last halving, the cut today results in less supply reduction (i.e. in the prior halfing, we lost 900 new coins/day; this cut will see 450 new coins/day disappear). A bigger stock and smaller supply reduction (on top of a much higher price) seems a combination for a more muted halving.

Anyways, that’s just a little rant. Perhaps BTC touches $100k next week and I’m quickly proven wrong, but I’m just shocked by how many (very smart) people I talk to in the BTC space take it as gospel that BTC goes up post halving / we are at the beginning of a bull cycle that comes every few years like clockwork and there’s no stopping BTC from going up in the next 18 months.

Let’s move on from that rant to point #2:

#2: Bitcoin miners and the gold rush / marginal capacity

The basics of bitcoin mining are pretty simple: there’s a huge network of miners, who effectively solve math problems to keep the network secure. In return for solving math problems, the network rewards miners a set amount of bitcoin (they also get a cut of transaction fees, which is a small amount of the award now but will become increasingly important in subsequent halvings). The number of bitcoin is fixed, so as miners come on / off the network the network makes the math problems more difficult / easy.

I like to use this hugely dumbed down example to show how this works: post halving, 3.125 BTC/block will be awarded. Let’s just dumb things down and pretend the network had 3 miners on it and each was roughly equal in terms of mining power. In that world, each miner would get just over 1 BTC/block.

If you and I looked at that and said, “hey, I think it’d be profitable to bring a new miner online” and then did exactly that, now there’d be 4 miners on the network, and we’d each get ~0.78 BTC/block in rewards. If two other people did, suddenly there are 6 miners on the network and everyone is getting ~0.52 BTC/block as a reward.

Again, that’s a huge simplification, but it’s a good one for imagining the network: as more capacity comes online, every miner will get less BTC/day. If capacity comes off, miners will generate more BTC/day.

Because a fixed amount of BTC gets generated, a simple rule of thumb is that when BTC goes up, it gets more profitable to mine… which incentivizes more miners to come on to the network (there’s nothing unique to BTC about that; it’s how commodities work! i.e. when oil prices go up, you’d expect more wells to get drilled).

And we’ve seen just that correlation play out: as Bitcoin has roughly doubled over the past year, the network hashrate (the amount of compute on the network) has gone from ~350 exahash to ~650 exahash.

So, despite bitcoin doubling over the past years, the profitability of miners has not doubled due to the increase in hashrate. You can see this in the hashprice. Hashprice combines all of the different variables (network difficult, bitcoin price, transaction fees, etc.) into one number that estimates roughly how profitable it is to be a bitcoin miner; you can see below that hashprice is up a bit over the past year but not substantially so:

With the halving upon us, the returns for mining bitcoin are about to get cut roughly in half. And, despite the halving coming (and thus lowering returns), we’re seeing miners plow ahead with huge expansion projects. For example, RIOT has plans to bring their capacity to ~31 EH/S by the end of 2024 (from ~12.4 EH/S at the end of March), MARA is planning to get to ~35 EH/S by the end of this year and 50 EH/S by the end of 2025 (from ~28 currently), and CLSK is planning to go from ~16.4 EH/S currently to 50 EH/S over the next few years. So just those three companies have plans to bring on >70 EH/S of capacity over the next few years, or more than 10% of current capacity.

I worry that you’re seeing a mad race to add mining capacity now, and that race is getting fueled by a temporary super normal profit cycle sparked by a huge rise in BTC right before the halving. Eventually that supply comes online…. and it seems to me that a bunch of new supply coming online post-halving is a recipe for disaster if BTC doesn’t keep skyrocketing.

So what happens if BTC stalls or, lord forbid, drops post halving as all of this new mining capacity is coming online?

What’s supposed to happen is the network adjusts and older/more expensive miners shut down so the network shrinks. But I worry that with all of this capacity coming online it gets more difficult for miners to take down their new toys, and instead miners run at zero or negative margins for a while as everyone hopes and prays for a BTC rebound.

We’ve seen similar supply gluts into price collapses happen in cyclical industries before. Think about fiber during the dotcom bubble or the shale industry in the early 2010s. Neither is a perfect correlation because of some of the unique property of bitcoin, but basically both fiber and shale built out huge capacity in expectations of mammoth demand or continued high prices…. and then when all of that supply came online prices collapsed and almost everyone in the industry went bankrupt.

I worry something similar could happen here…. but perhaps with a twist.

If you and I were adding bitcoin mining capacity, what we’d need to do is estimate how much network capacity will be online in ~6 months. We’d then look at our capital and power costs and determine if it would be profitable to bring a new miner on. That becomes a little bit of a game theory issue because we have to look at all the capacity peers are bringing on, estimate their costs, etc.

But there is a shortcut: if you and I think bitcoin is going to the moon, then we could justify bringing on miners at almost any cost. It takes a few months to bring meaningful amounts of mining supply online, so if bitcoin really spikes there will be a period of supernormal mining profits (similar to what we’ve seen so far this year), and any supply that you and I ordered in advance will mint a fortune.

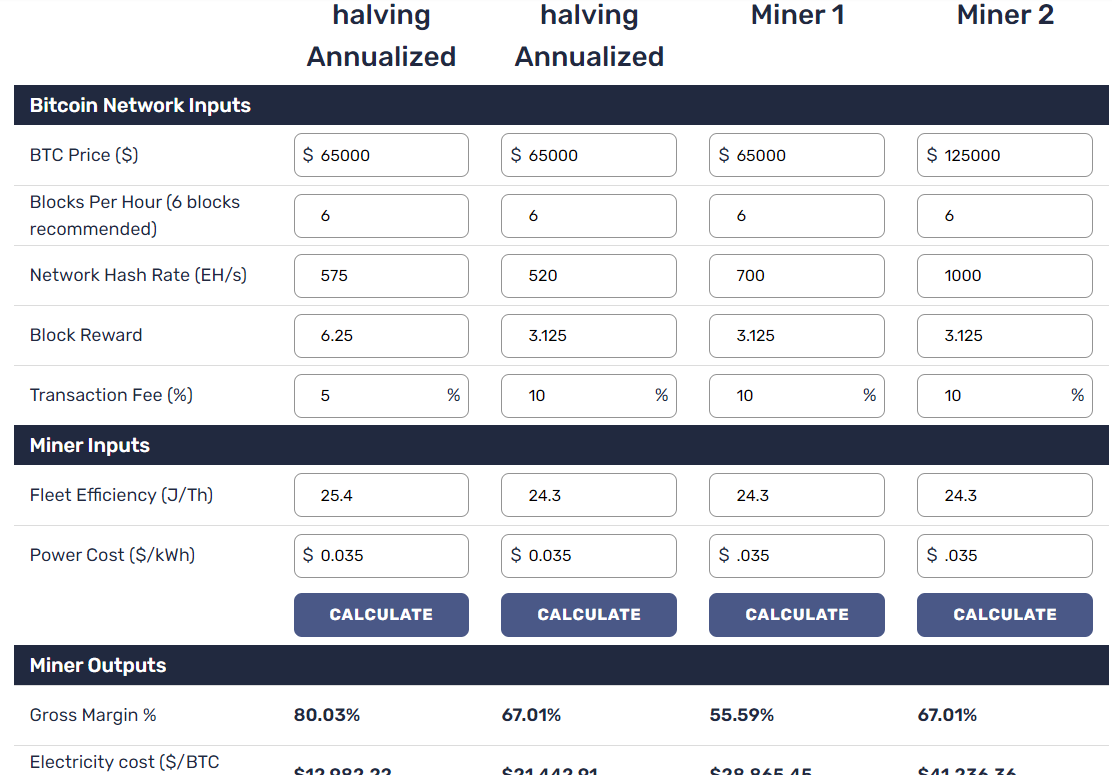

Terrawulf’s IR site has a really interesting function where you can plug in different assumptions (network hash rate, BTC price, etc) and see how profitable mining is under different scenarios. I made an example below; miner 1 is what would happen if the hash rate stalls post halving…. but miner 2 is the way more interesting one. It assumes BTC screams higher, and compute just pours on to the network in response (the network adds another 300 EH/S, roughly what it’s added over the past year). Despite the huge increase in network power (and the halving), BTC remains insanely profitable to mine because of the huge increase in BTC cost.

What I’m trying to drive at is this: it might be uneconomical to bring new network capacity on now if you believe BTC stalls out…. but if you really believe BTC is going to the moon, bringing new mining capacity on is a high octane way to play that belief.

So my larger worry for bitcoin miners is not just that all of this supply is going to get delivered and destroy industry profitability…. I worry that marginal supply decisions are getting set by people who think Bitcoin is going to $200k, so the oversupply is going to be even worse than a typical supply glut, and that oversupply might last a little longer than a purely rational economic point of view would think because people keep doubling down on a looming BTC price spike.

Alright, this post is running long, and I want to get it out on halving day. I’ll be back with a post covering points #3 + #4 early next week (as well as any takeaways / feedback I get on this post).

Till then…. happy halving (is that a greeting? I feel like it should be).

People make a lot of assumptions about the true BTC "float" to impute market cap. But no one really knows what that is. BTC Treasuries can account for like 12% of the float. But, I think you can safely assume maybe another 10% is lost + Satosthi holds about 1 million BTC.

To me, that would be an interesting calculation, maybe the float is closer to like 15 million or so. Just a guess.

sound piece !