The "bonus for everyone" culture is killing shareholders

Roughly 15% of the posts I see on Facebook complain about “kids these days” (Before the election, it was probably 25%. Now my Facebook feed is probably 15% “kids these days”, 65% political rants, 15% baby photos or engagement announcements, and 10% cute puppy videos. Related note: I only like 10% of my Facebook feed). One of the most common complaints about “kids these days” has to do with the “trophy for everyone” culture ruining them and making them feel entitled. Maybe they’re wrong, maybe they’re right. Who knows?

I think we’re experiencing a similar thing with management team bonuses today. It feels increasingly like we have a “bonus for everyone” culture at companies. Almost no matter what management teams do, they get a bonus that treats them like they’re top notch value creators who are irreplaceable and creating hundreds of millions in shareholder value. I realize I’m (by far) not the first or only person to point this out, but it feels like the process of handing out bonuses no matter what a company does is getting worse by the day. And while the "trophy for everyone" culture may or may not ruin "kids these days", I know that the bonus of everyone culture is really hurting investors when it comes to incentivizing management to create long term value.

Now, a lot of value investors decry the size of management team bonuses across the board. I certainly don’t fall into that camp. When companies were confined by their asset size, the difference between the best performer and the second best performer wasn’t really a huge deal of value- if you think the best CEOs can create 10% more than the next best, then the best steel plant CEO can make 10% more steel than the next best. That small of a difference isn’t really worth paying up for. But in a winner take all tech world, that 10% improvement from a quality CEO could be the difference between being the next Facebook and being the next myspace. It’s worth paying up a bit when the top brass can swing billions in value like that. So I don’t mind if Snap thinks Evan Spiegel deserves an extra 3% of the company for taking it public. A ton of people thought he was crazy for turning down a $3b offer from Facebook in 2013; now, they’re going to IPO for $25B+. In my mind, that’s $20B or so of value creation over the past 4 years; why shouldn’t he get a piece of that (ok, that’s a bit simplified as it doesn’t risk adjust or anything, but general point holds)? Similarly, why shouldn’t we as a country give Rex Tillerson a $10m tax deferral to become the secretary of state- we live in wild times, and giving Tillerson a $10m personal windfall is well worth it if having him as secretary boosts our economy by even a fraction of a percent or reduces the chance for some type of WW3 tail risk by a basis point. Either of those creates overall gains of hundreds of billions of dollars for the world; why shouldn’t Tillerson get a $10m windfall in return?

But those are (hopefully) cases of significant value creation. Those bonuses are deserved. Across the board, I’m seeing evidence of management teams that are weakening their company through some combo of incompetence or ignorance that are getting paid like they have rejected a $3B takeout and grown the company to $25b+.

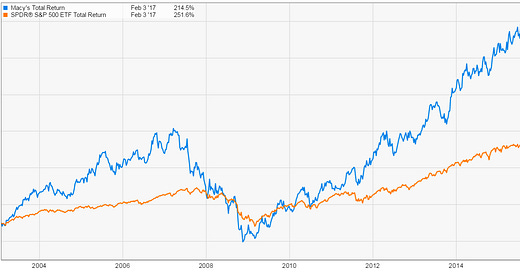

Let’s start with a high profile, topical example; for that, let’s take a look at Macy’s (M) CEO Terry Lundgren. Is he retiring this year and leaving Macy’s a bumbling mess with no plans for the shift to online retail despite the fact it’s been obvious where retail was going for five years? Did the company underperform the S&P 500 under his year ~14 year tenure? The answer to both questions would be yes. No worries; he’s still getting an $80m bonus on his way out if he can pull off a change of control.

At least Lundgren didn’t manage to bankrupt Macy’s. Surely management teams who bankrupt companies can’t get bonuses, right? Wrong. I’ve been looking at a ton of post reorg bankrupt stocks recently, and it’s flat out shocking to me how many times the same management team that took a company into bankruptcy is rewarded with bonuses during the bankruptcy and equity in the new company when they emerge. Most of post reorg stocks I’ve been looking at are too small / illiquid to dive into here, but Breitburn is as good an example as any of the ones I’ve followed closely. The company filed for bankruptcy last year. Humorously, because the company was structured as a partnership, investors who owned shares that were eventually worthless could be hit with taxes on debt forgiveness. Not management though: they were smart enough to dump all of their shares on the open market before they could get hit with that tax bill (below is a screen shot of the CEO dumping the last of his shares, but you can find all of the management team and boards filing dumping their shares in all the form 4s in June 2016).

I mean, that’s amazing stuff. I’ve invested with some pretty awful management teams, but most of them could only find a way to lose all of the money I had put into their stock. Breitburn’s management somehow caused shareholders to lose all of their money + hit them with a tax bill on top of it while dodging that bullet themselves. An amazing display of personal greed and incompetence. Kudos to them, but surely this management team doesn’t get a bonus, right? Wrong. The company is now seeking to pay the same top executives who bankrupted them $10m in bonuses (you can find the source info here; it’s docket 992)! Humorously, the filing notes that without paying the big bonuses, “total direct compensation for the KEIP Executives will only consist of base salary, resulting in their compensation being substantially less than the market.”

I get sometimes boards are loathe to take a risk and change CEOs, even if the current CEO might not be the best in the world. A subpar known quantity is safer than the unknown, particularly if you’re a director with limited share ownership and a comfy director job paying you tens of thousands a year to meet once a month and rubber stamp approvals for the management team. But Breitburn’s management bankrupted them; are oil and gas firms really so desperate for experienced executives that a management team that generated letters from broke retired police officers with cancer would be swiped away in a second if not given a bonus? It’s similar to Ophthotech’s retention bonuses I highlighted earlier this week- are firms so desperate to hire away the management team that spent hundreds of millions researching sugar water that you need to give them more money? If these management teams are that in demand, clearly I’m in the wrong field.

The issue with the bonus for everyone isn't just the patent unfairness of CEO's who have cost their shareholders millions getting paid life altering fortunes. It's also that a bonus for everyone encourages perverse CEO incentives. If you know you are getting paid no matter what, you're incentivized to do literally nothing to rock the boat. Think about Macy's: it was probably pretty obvious the internet would eventually not be great for Macy's physical retail presence. But Lundgren knows he gets paid no matter what- why make substantial investments in figuring online out now when it will create huge costs that hurt your ability to get even larger bonuses from hitting short term profitability metrics and generate negative headlines as the investment cause accounting profits to decline, even if they investments are necessary and create long term value? Lundgren's actions are rational actions for someone who is getting paid no matter what and doesn't have a major equity stake- don't rock the boat, make sure accounting profits remain high, and let shareholders worry about fighting for longer term survival after you've retired to your own private island.

What’s the solution to the “bonus for everyone” culture? Honestly, there probably isn’t one. Once the system has been trained to expect rewards for everyone, it’s increasingly difficult to change it. How do you convince a top notch CEO to take a pay for performance type package when everyone else is offering a pay no matter what package? You probably can’t. As investors, the only thing you can do is either hold your nose and invest despite the awful structures, or go looking for those rare Berkshire / Amazon type systems where the CEO has chosen to get all of his reward from holding a major equity stake and watching it appreciate, not from big bonuses. Quite honestly, in those rare cases, the CEO is probably subsidizing shareholders; if Buffett in the 80s had decided the only way he’d stay at Berkshire is if they gave him a 10% cut of profits every year, shareholders would have been massively better off if they had taken that deal versus losing him. The fact he’s worked for shareholders effectively for free for 40+ years has been an incredible wealth transfer of tens of billions of potential wealth from Buffett to his shareholders. The fact Buffett managed to accrue one of the world’s great fortune despite a compensation structure that almost certainly never paid him his true worth is just another example in the long list of things that show just how unique Buffett is.