One of the strangest corporate events / squeezes I’ve ever seen is happening over at Children’s Place (PLCE). I’m just a curious onlooker with no dog in this race (well, not quite true: I did think about buying some on the initial dip earlier this week and have a literal rounding error position, but largely passed because retail messes have a way of snowballing quickly, so I do have a “shucks, I missed it” dog in this race), but it’s such a strange and interesting story I figured I’d do a quick piece on it (particularly in case it turn into Gamestop 2.0!).

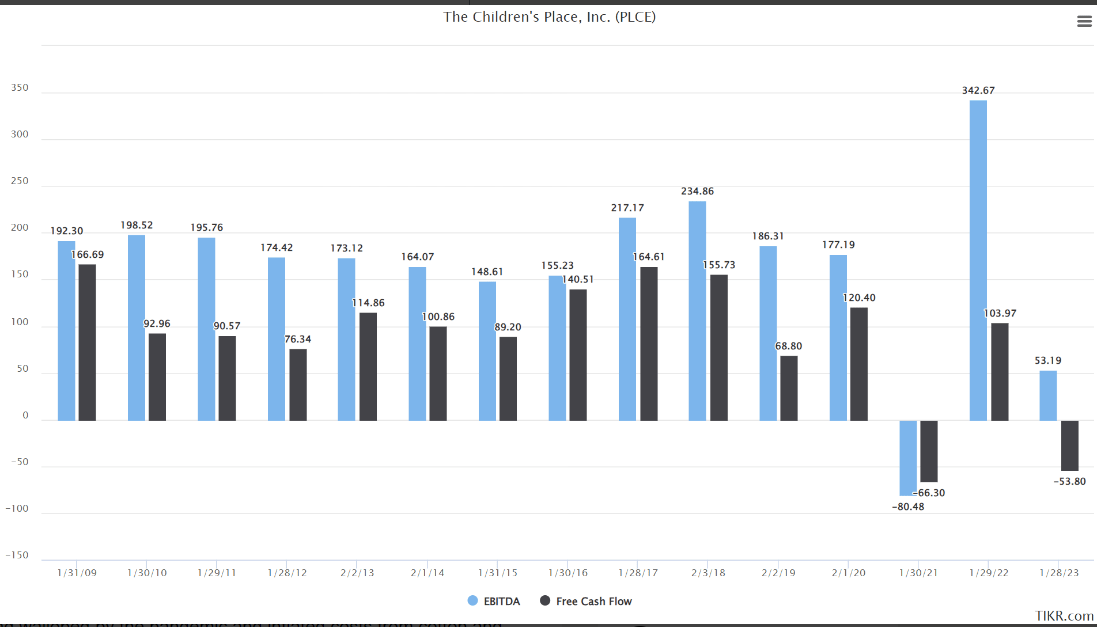

Some quick background: Children’s Place is a specialty retailer of (surprise!) children’s clothing. They’ve long been a favorite of value investors because they traded at a cheap multiple, had a history of solid free cash flow generation (pre-COVID), and returned a lot of cash to shareholders through repurchases. The chart below (ruthlessly taken from this article) shows the company’s history of FCF; the bull hope was that as we exited the COVID / supply chain issue world and things normalized PLCE’s free cash flow would normalize around historical levels and the stock would prove cheap.

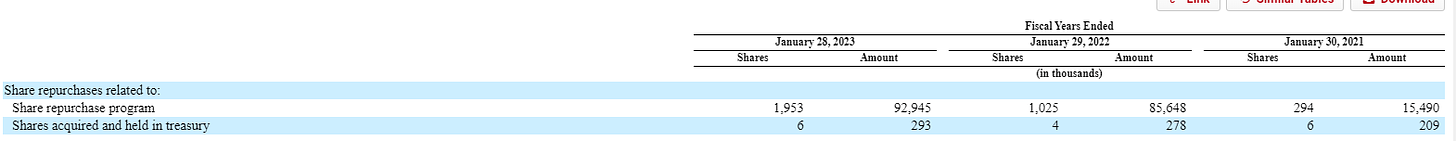

How cheap? PLCE had ~12.5m shares outstanding at the end of Q3; the stock traded just a hair over $20 for most of this year, so you were talking about a ~$300m market cap. You can see why that was an attractive proposition; if you thought PLCE could normalize at ~$100m in annual FCF, you were buying the company for ~3x annualized / normalized free cash flow, and the company had a history of returning cash flow to shareholders (in both FY22 and FY21, PLCE bought back just shy of $100m of stock per their 10-k).

It’s worth noting the company has ~$400m in debt (mostly on their revolver); obviously that’s a meaningful amount, but if you believed PLCE could return to normalized earnings then that leverage would actually prove helpful as it’d turn the stock into a bit of a rocket ship.

So that’s the background… but things changed last Friday (Feb. 9). The company put out a press release on their Q4 results. The Q4 results were, to put it lightly, an abject disaster. Sales came in below the company’s expectations, but the real killer is operating margins were coming in at negative 8-9% versus the company’s prior expectations of positive 2-3%.

The combination sent PLCE into a liquidity crunch, and the press release noted,

The Company has been working to improve its liquidity position and strengthen its balance sheet to best position the Company for the future. The Company is working with its advisors (including Centerview Partners), lenders and potential lenders to obtain new financing necessary to support ongoing operations, and is considering strategic alternatives in the event that the Company is unable to consummate new financing.

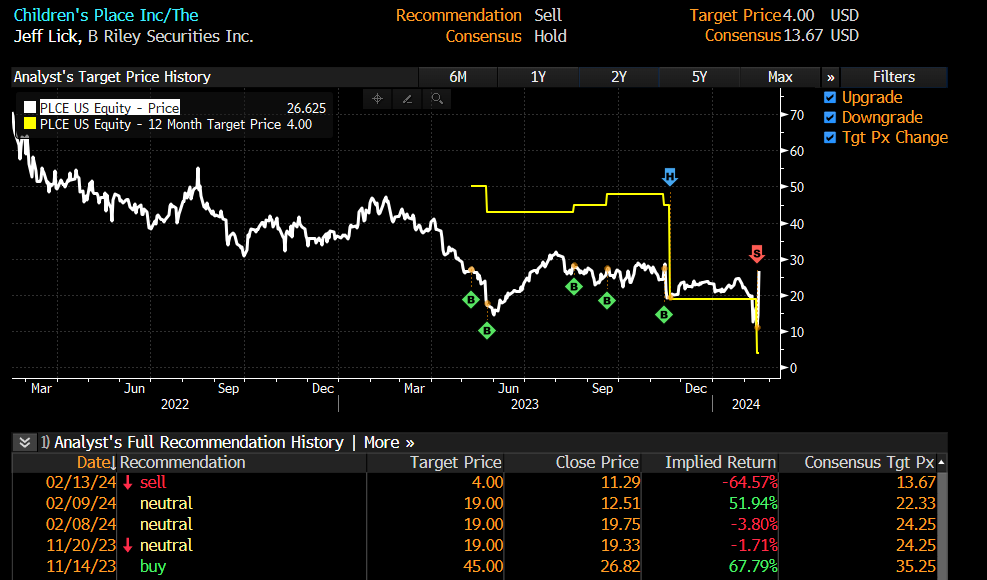

Again, these results were an abject disaster. One of the few analysts who covered the company instantly took their rating from neutral to sell and their PT from $19 to $4 while noting a real chance the company couldn’t make it through the current liquidity crunch.

That’s a huge ratings change…. and it’s made even larger when you consider the analyst had a buy rating with a $45 price target on PLCE as recently as November!

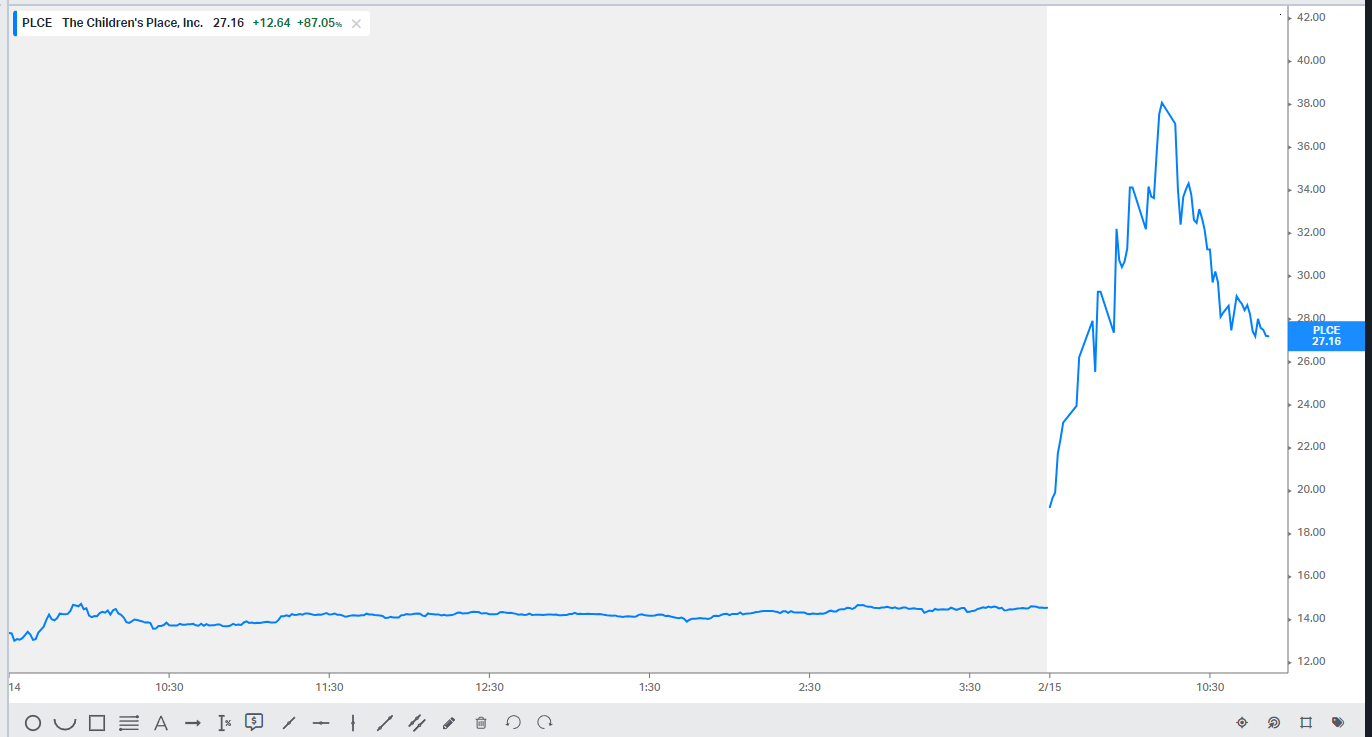

The stock responded about how you’d expect: it had closed the prior day at just under $20/share, and it opened up the next day at <$10/share. Surprisingly, the stock inched up to close that day at ~$12.50/share… still down a lot on the day, but in my experience retailers facing liquidity crunches see much more dramatic stock drops, so I was kind of surprised by how well the stock held up!

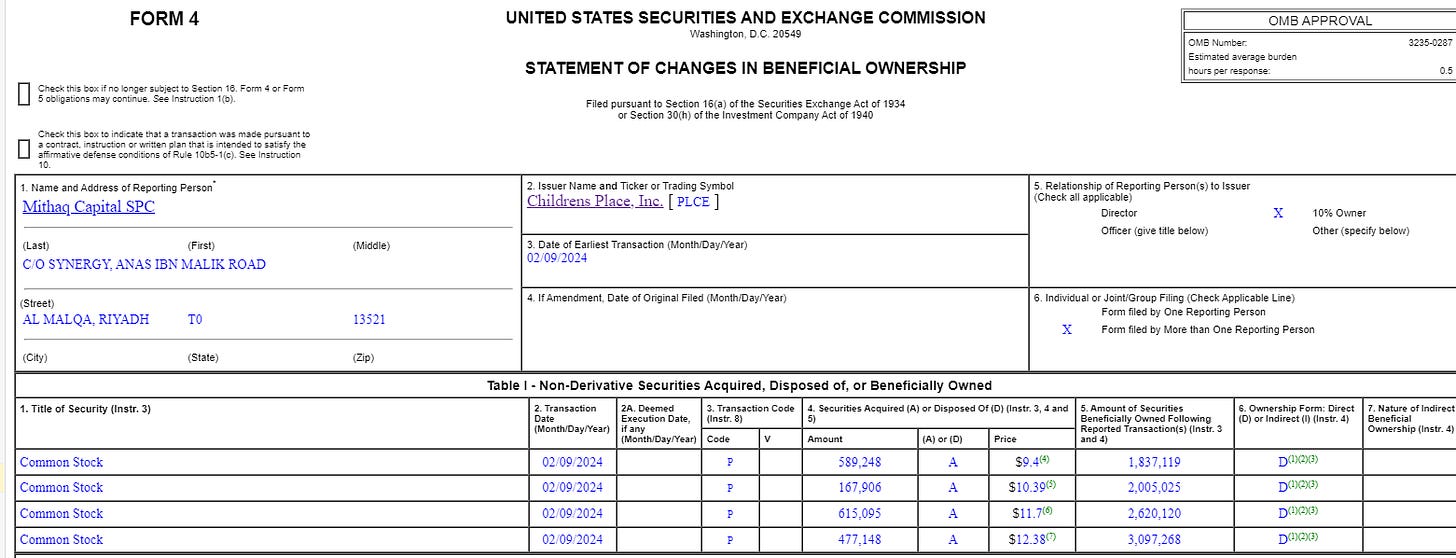

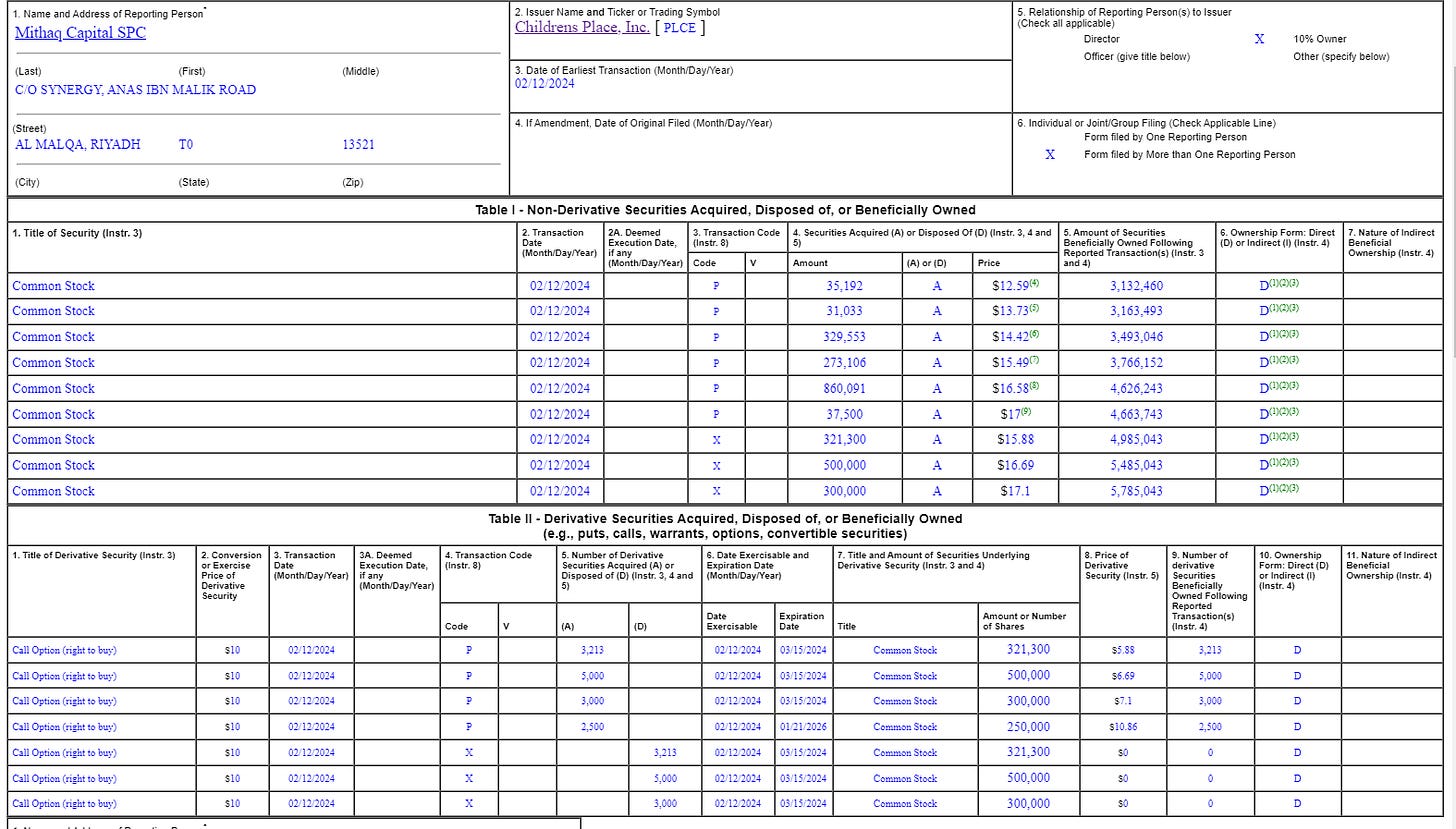

Here’s where things get spicy: Mithaq used the swoon in PLCE to snap up shares. On Feb. 13, they filed their first form 4, which showed they’d bought ~1.8m shares of PLCE during the dip on Feb. 9. Remember, PLCE has just 12.5m shares out, so this was a huge amount of PLCE’s float (~15%). The purchases bought Mithaq up to >20% ownership of PLCE.

But Mithaq was just getting started. Mithaq wanted to show PLCE just how much they loved them by sending a Valentine’s Day form 4 that showed continued, aggressive buying.

That aggressive buying did two really interesting things. First, it’s created a little bit of a meme squeeze in PLCE today (I’m writing this mid-day Feb. 15; the stock has ~doubled as I write this and it’s been paused multiple times for volatility halts).

But, perhaps more interestingly, it’s created some really weird dynamics. Today (or perhaps last night), Mithaq delivered PLCE notice that they own ~54% of PLCE and plan on nominating and replacing the full board; in addition, Mithaq wants to talk to PLCE about providing financing.

I’m just fascinated / impressed by Mithaq’s strategy here.

Mithaq aggressively bought >50% in PLCE in the open market inside of a week. Perhaps I have a short memory or am forgetting something, but I’ve never seen an investor blitz their way to this much ownership this quickly before. Mithaq was able to do that because other shareholders were absolutely panicking (perhaps rightly so!) about the liquidity issues; Mithaq saw value there and was able to pounce in a big way.

When most investors try to buy up this big of an ownership stake, they run into volume limits, the stock starts spiking on them, and they have to file a 13-D or something announcing their ownership before they’re able to come close to a controlling position (generally they can get to 10-15% of the company before they need to file a 13-D, and their aggressive buying generally pushes the stock up 10-20% and alerts everyone that something is coming). The company in question then generally responds by putting in place a poison rights plan to prevent the investors from effectively acquiring control of the company (or even buying more shares). PLCE didn’t have any of those protections in place, they were dealing with a crisis, the volume in the stock was off the charts, and Mithaq used the combo to effectively acquired control of PLCE before anyone was the wiser.

But that control comes with some new issues! It represents a change of control under PLCE’s credit agreement, which triggers an event of default. But even that’s interesting! Mithaq is in discussions to provide PLCE financing, so perhaps they view PLCE’s event of default as a catalyst to help get more liquidity (or more ownership for Mithaq) into PLCE!

Here’s another interesting question: PLCE’s proxy pretty clearly defines a change of control for their executive comp packages, and it includes 50% of the stock turning over. Generally, when a company runs into liquidity and sales issues as bad as PLCE is facing, their management would get replaced at some point. I wonder if Mithaq’s buying spree puts management in position to receive a change of control payout if they leave in the next year or two…..

Anyway, I have no take aways currently. It’s possible PLCE is GME 2.0. It’s possible that Mithaq injects liquidity into the company, turns them around (proving out the “$100m normalized free cash flow” thesis), and a few years from now everyone looks back on this as a case study of doing work ahead of time and buying control of a company during a crisis on the cheap. Or it’s possible the issues at PLCE run much deeper than expected, and Mithaq is acquiring control of a basket case!

I have no idea. Again, I don’t have a dog in this fight, but I’ve never seen buying this aggressive, and I’ve certainly never seen public market investors trigger change of controls and events of default like this before. And I find it completely fascinating; one way or another, Mithaq will have served as their own catalyst at PLCE in a way I don’t think anyone’s ever done before.

Got long first thing this morning and traded it on the squeeze. I would be very careful playing it on either side. Nice note Andrew

Who is Mithaq? And please tell me it’s pronounced mythic.