TL;DR: AlphaSense was kind enough to sponsor a free expert call with me and Tom Wheeler, the former head of the FCC. It’s a fascinating time for the telecom industry, and we discussed a whole range of issues, including fiber overbuilding, satellite internet (starlink), spectrum issues, the broadcaster cap, M&A potential, and a bunch more. If you’re interested in watching the interview (or reading the transcript), you can find it here (and again, it’s available for free).

Long time readers know that I follow the telecom space very closely. I think it’s a fascinating industry undergoing a ton of changes with a lot of potential call (and put!) options that investors frequently ignore. So when AlphaSense asked me if I wanted to do a free/public expert call, I pretty quickly settled on telecom as the industry at the perfect intersection of “really interesting for a bunch of different reasons” and “I am the right person who can ask a bunch of really insightful questions here.” And I think AlphaSense sourced an incredible expert to discuss the field with: Tom Wheeler, who was the head of the FCC under Obama. From that post, Tom had broad regulatory authority over a host of interesting decisions that are really relevant to today’s telecom backdrop. For example:

Interested in the future of satellite internet? That falls under the FCC, and Wheeler was instrumental in laying out the vision for the satellite industry and broadband.

Interested in spectrum plays? Spectrum plays are actually one of the most popular plays for enterprising value / event investors. Why? Getting a spectrum play correct results in a multi-multi-bagger that can make your career; getting one wrong can quickly turn into a donut. I know of several very popular spectrum plays right now, and getting a spectrum play correct requires getting the regulatory process correct (as Intelsat investors learned the hard way). Tom led the FCC when they did the broadcast spectrum auction back in 2016, so there are few people better equipped to give insight into spectrum dynamics.

Interested in telecom M&A? Tom’s FCC worked with the DOJ in opposing the Comcast / Time Warner merger as well as approving the Charter / Time Warner merger, so he’s certainly well equipped to comment on the M&A outlook (and potential regulatory hurdles!).

Interested in broadcasters? The FCC regulates broadcasters (and oversees the local station cap!), so there’s probably not a single regulator better equipped to discuss broadcasters than the (former) head of the FCC.

Interested in big tech? Wheeler’s FCC proposed net neutrality rules back in 2015, so he’s certainly well aware of the interplay between telecom and big tech.

I could go on and on on how the FCC interacts with a variety of spaces that are interesting for investors, but you probably get the point…. and it also probably comes as no surprise that the head of a major regulatory agency interacts / has knowledge on a lot of things that are relevant to an investor!

So that’s why Tom Wheeler was a perfect person to discuss the current telecom / regulatory landscape with…. but that doesn’t tell you anything about why I’m so interested in telecom or, perhaps more importantly, why you should be so interested in telecom (and, by extension, the expert call with Tom Wheeler).

As investors, we’re ultimately all just trying to make money by finding mispriced companies / events. With that in mind, rather than tell you why I think you should be interested in telecom and the Wheeler interview, I thought I’d show you a a bunch of potential bull cases for some different pieces of the telecom / media world that we touched on during the Wheeler interview. Note that I’m not saying any of these bull thesis are likely to pass or that I believe in them; I’m just saying there’s a reasonable world where any or all of these bull cases play out and generate significant alpha, and I hope that me highlighting them juices your interest in the telecom world (and, by extension, the expert call with Tom!). In particular, I wanted to highlight the following stories (while remembering that all of these are right up Tom’s wheelhouse / we touch on all of them in some way, shape, or form in our interview).

Verizon’s capital return story

CHTR: A non-cyclical quasi-monopoly at <5x free cash flow?

Spectrum YOLOs?

Satellite disruption (bear case)

Cable eating wireless (cable bull / wireless bear case)

Fixed Wireless (wireless bull case / cable bear case)

Cable M&A

Fiber M&A

Roll it all together in broadcasters: cheap, capital return, M&A, and spectrum! (GTN, NXST)

Because this post was running long, I’m going to split it into three parts. Today’s post will cover cases #1-4; tomorrow will cover cases 5-8 (editor’s note: part 2 is now live here), and then we’ll wrap it all up on Thursday (or maybe Friday if I get lazy) by diving into the broadcasters and maybe answering a few follow up questions (editor’s note: part 3 is now live here)!

That out the way, let’s dive in:

Verizon’s capital return story

I figured I’d start with the simplest one because it’s so easy. As I write this, Verizon trades for ~$41/share. They did ~$4.14/share in EPS in 2024, and they’re guiding to grow that in 2025, so they trade for under 10 P/E. In addition, they pay a >6.5% dividend yield at current prices, they’ve increased their dividend 18 years in a row, and their balance sheet is right on the verge of the level where they’ll consider share buybacks (per their Q4’24 call: “We have increased our dividend for 18 consecutive years. We have paid down our debt and our team has done a great job. We're on 2.3x right now on the leverage, which is very close to the 2.25x when we're going to consider repurchasing shares. So that will put me and the Board in a very different situation when it comes to the optionality of doing repurchases when that happens.).

Can you find a sexier story than Verizon in the stock market? Yes, absolutely….. but Verizon is a non-cyclical business (cell phones and fiber internet are about as recession resistant as it gets) that’s growing and trading at a very cheap price; it’s kind of hard to see how you don’t make money over the medium to long term at Verizon just given the combination of the quantitive cheapness / capital return story. And I thought the VZ idea might be a nice little amuse-bouche to whet your appetite for the telecom space, because we’re about to start diving into a some stuff that is quite a bit sexier (IMO)…..

CHTR: A non-cyclical quasi-monopoly at <5x free cash flow?

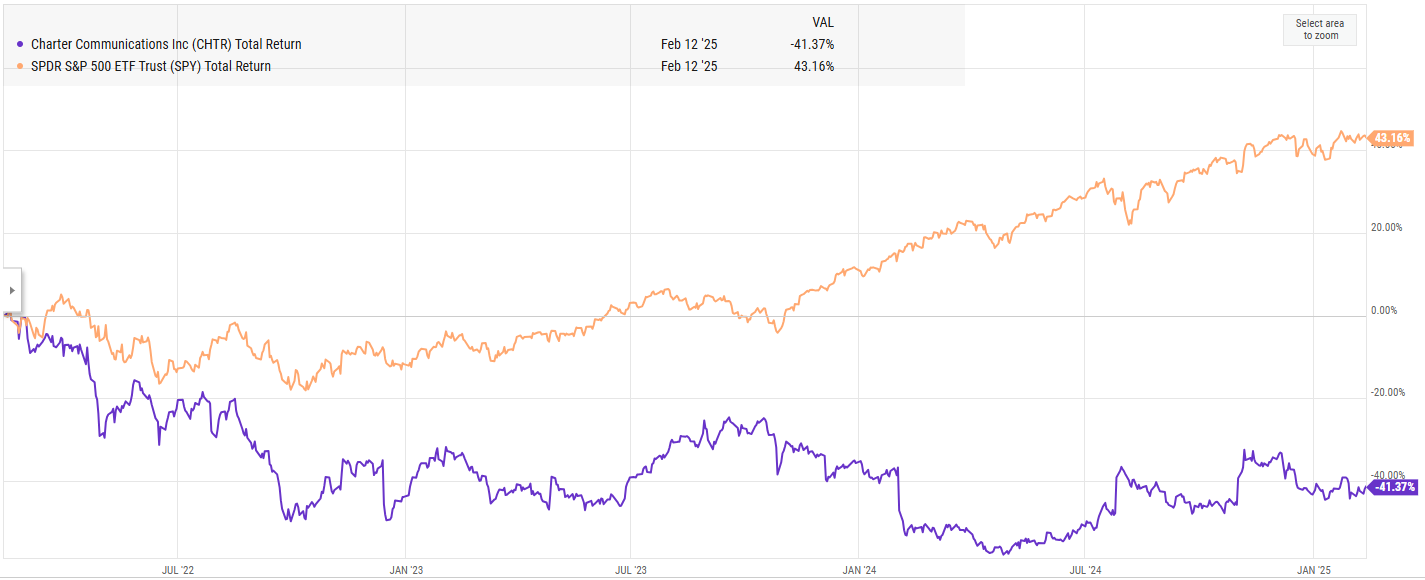

Let’s move from a simple, unsexy story (Verizon) to a hairier (but maybe sexier!) story. Long time readers will know about my fascination with Charter (disclosure: I remain long). It has been a huge drag on returns over the past few years.

So why do I remain so interested in the stock? Because it’s insanely cheap.

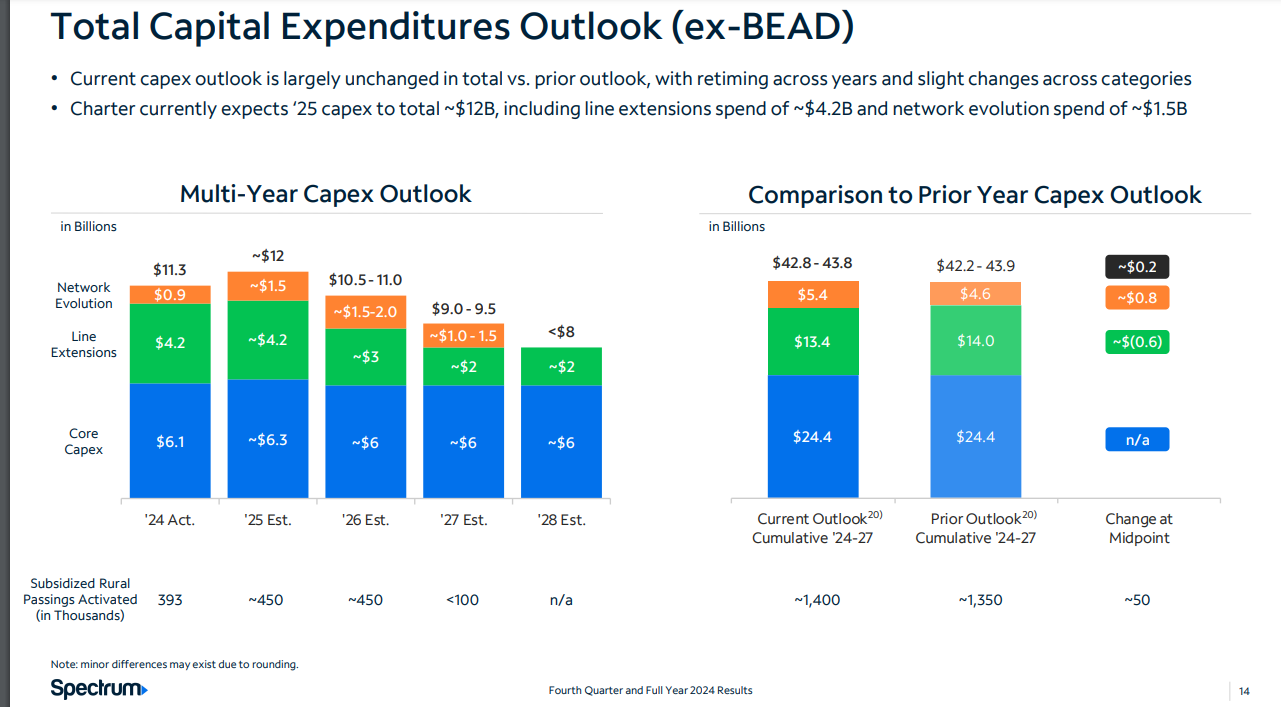

Consider: EBITDA in 2024 came in at $22.6B, up ~3% YoY. The company also provided a multi-year outlook on capex:

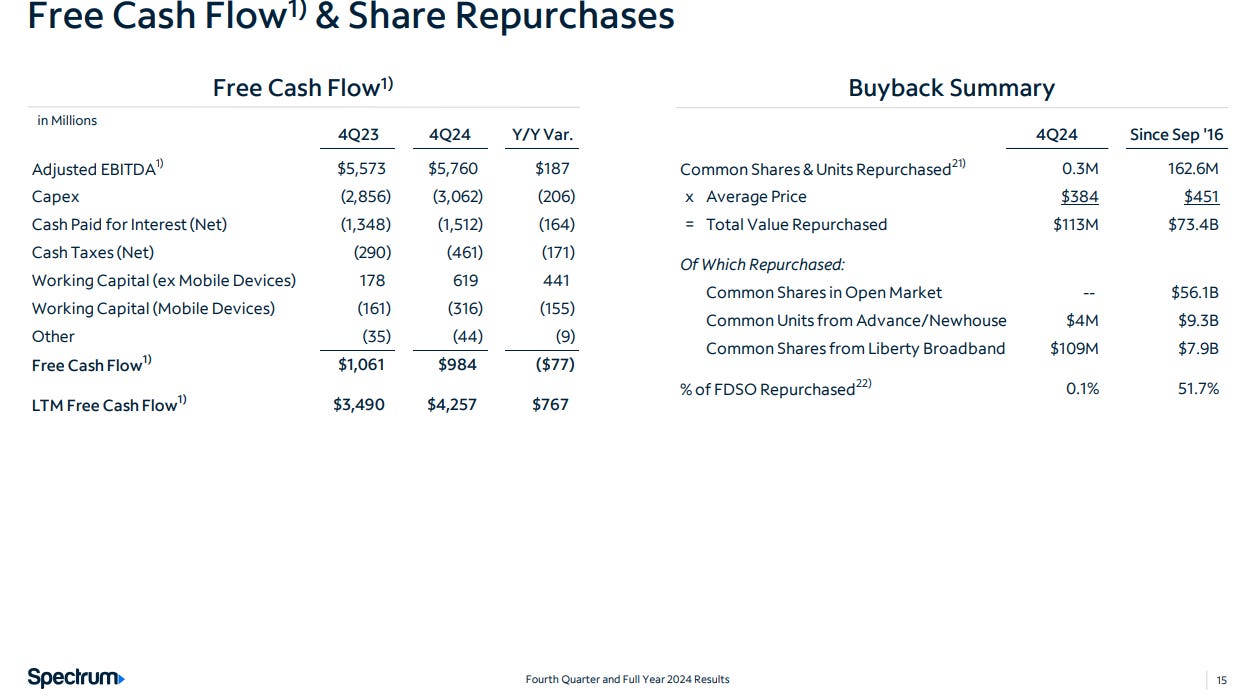

Humor me for a second, and let’s assume EBITDA continues to grow at a low single digit pace. That’d put them on track for $25B in EBITDA in 2028, when capex will come in at $8B. Charter has ~$93b in net debt that is very well termed out and carries a ~5% interest rate, so annual interest expense is ~$4.7B. Longer term, their tax rate should trend to ~21%.

So let’s do some math on what the company looks like in 2028. $25B in EBITDA less $8B of capex and $4.7B of interest expense gets you to ~$12.3B in pretax cash flow. A 21% tax rate would take after tax cash flow down to ~$10B.

Charter currently has ~161m shares outstanding. If you believe the numbers I just put down above, they’d be doing ~$60/share in free cash flow in 2028. The stock is currently trading at ~$350/share, so you’d be buying it for <6x free cash flow. <6x free cash flow is obviously cheap, but I think Charter will ultimately prove cheaper than that because all of my numbers will be conservative. Consider:

EBITDA: my “low single digit” EBITDA growth rate could prove conservative… Charter has historically talked about mid-single digit or better EBITDA growth rates, and it’s reasonable to think they get back to those numbers as they fully lap some of the headwinds they faced in 2024 (ACP expiration, continued investment into wireless, perhaps some competitive intensity comes down as fixed wireless matures).

Free cash flow: Charter will generate ~$20B in free cash flow over the next 3-4 years. The analysis above effectively assumes they just light that cash flow on fire…. but Charter will certainly do something with it. The most likely thing they’ll do is deploy it into share repurchases; Charter’s market cap as we speak is <$60B, so theoretically they could shrink their share count by ~1/3 with their free cash flow between now and 2028.

Leverage: Charter is currently ~4.2x levered, and they’ve historically run leverage closer to 4.5x. If EBITDA grows by ~$2b over the next few years, they’d need to deploy ~$8.4B in capital in order to maintain a constant leverage ratio of 4.2x, and that’d be closer to $15B if they decided to take leverage back to 4.5x. Again, the most likely thing they do to maintain their leverage ratio (or get back to 4.5x) is a whole bunch of share buybacks; with Charter’s market cap at ~$60B, they’d need to buy back ~15-25% of their stock just to keep leverage constant.

I mentioned on both the leverage and free cash flow bit that the most likely thing Charter does is buy back shares. Why do I believe that? It’s simply based on Charter’s history; over the past ~9 years, they’ve bought back 50% of their stock.

If Charter’s stock stays where it is an the leverage / cash flow story plays out as I discussed above, Charter could easily buy back another 50% of their shares over the next few years. That would send their share count below 100m shares, and send their free cash flow per share over $100/share on the numbers I just ran. Not bad for a $350 stock!

Of course, if any of this plays out, Charter’s stock will almost have to go up over the next few years. The repurchases will simply prove to accretive for it not to. So the right answer is probably somewhere in the middle….

Bottom line: I don’t think it’s crazy to think Charter could do $100/share in free cash flow in 2028 or 2029. The stock is at ~$350 today…. if it comes clsoe to any of the numbers I just laid out, the stock is going way, way higher.

Spectrum YOLOs?

Adjusted for market cap / number of opportunities there are, I’m not sure there’s a single space that has made or lost investors as much money as what I call “spectrum Yolos”. These are companies that have some type of spectrum ownership, and investors buy them in the hopes the companies will eventually turn the spectrum into a profitable asset (generally by clearing the spectrum and selling it to a telecom company, though there are other ways to win!).

It’s impossible to mention spectrum yolos without mentioning the Straight Path / Verizon / AT&T bidding war that made a thousand event / small cap value fund’s decades in the mid-2010s, because that is the absolute best case scenario that you’re dreaming of when you buy a spectrum play, and there is at least some universe where in the next decade or three we see “Straight Path 2.0” emerge from a smaller spectrum play.

I’m aware of several spectrum plays where I have had credible friends do huge amount of work and think the upside is enormous. To list just a few:

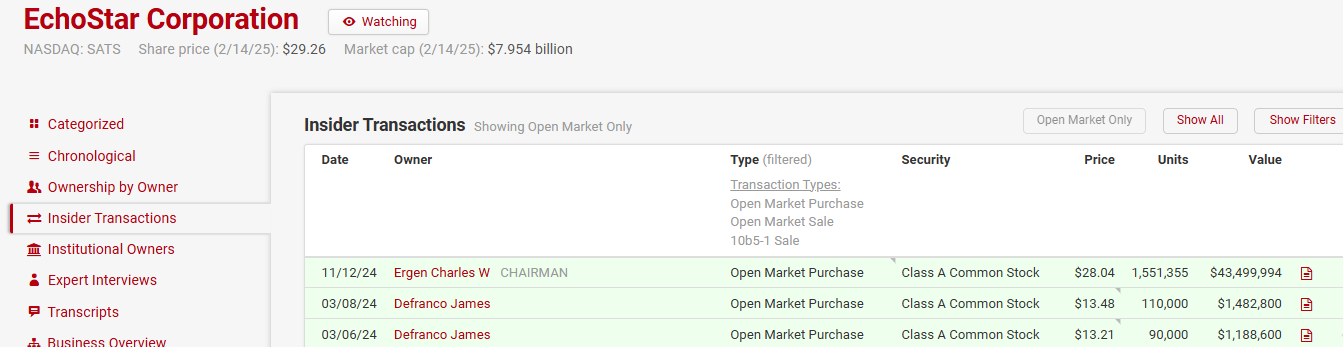

Echostar (SATS) has to be mentioned in any spectrum discussion. SATS is the combination of Echostar + Dish; Charlie Ergen spent years buying billions and billions of dollars worth of spectrum at Dish, but Dish eventually found themselves overlevered and needed to merge with Charlie’s other company (SATS) to get more liquidity. With the near term liquidity concerns settled by the merger, the upside is enormous if SATS / Ergen can figure out a way to successfully monetize the spectrum. That is an enormous IF, but there is a reason that almost every telecom regulator / executive says “don’t bet against Charlie” when someone mentions him… and Charlie is certainly betting on himself given he bought ~$50m of stock late last year:

NextNav (NN) has been written up extensively by Laughing Water; the stock trades at ~$12/share, and Laughing Water thinks their spectrum is worth >$40/share. I’ll defer you to that write up for more since it pretty much speaks for itself!

Anterix (ATEX) has been a popular play on spectrum, and just last week they announced a strategic review after “receiving inbound interest in the Company”. I know several investors who think NAV is over $100/share versus today’s price around $40/share.

AST Space Mobile (ASTS) isn’t really a spectrum play… but they did just announce a strategic deal to get access to spectrum, and the upside if the story plays out as the bulls would have you believe is certainly just as big / explosive as some of these spectrum plays (though there is a very vocal bear case as well!), so I figured I’d mention it here

I’ll pause here to note: ASTS is a very controversial stock. There is a very detailed bull and bear case out there on it… not for the faint of heart!

Satellite disruption (bear case)

So far, this article has tended to a bunch of bull cases….. so let’s pause for a moment and discuss a big bear case: satellite competition.

For most of the ~past decade, when it came to competition from satellite internet, cable was Don Draper:

Why do I say that? Just look at any cable company and search their transcripts for “satellite.” You’ll find that, for the most part, the only time satellite comes up is when an analysts announces themselves as the “telecom, cable and satellite space” analyst, not in any real discussion of the business.

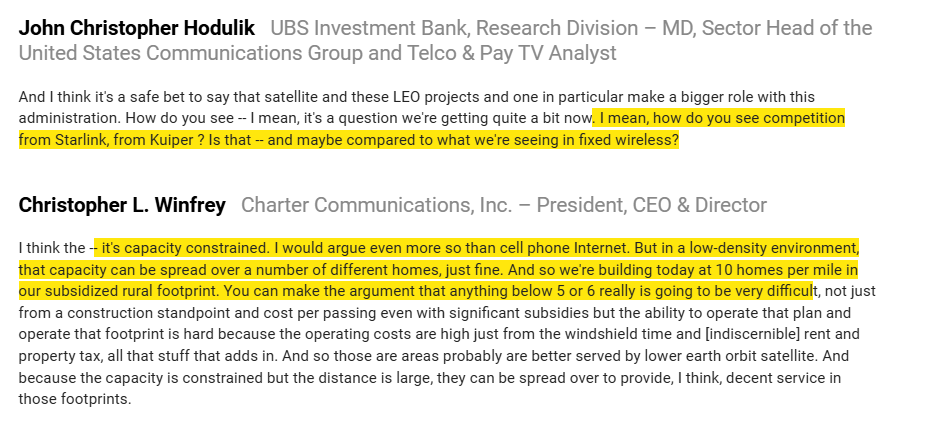

On the rare times when cable companies would talk about competition from satellites, it would generally be along the lines of “yeah, it might work in some really rural applications that are too far from a network to build a fiber/cable line to, but it can’t compete against fixed infrastructure…. it’s just too capacity constrained.” Don’t take my word for it; the below (from Charter’s CEO back in December) is probably the most generous you’d hear a cable executive talk about satellite internet.

That’s why Comcast raised so many eyebrows inside the industry when they said this during their Q4 earnings call:

In addition, there will be opportunistic, capacity-constrained competitors carving out a permanent part of the market in the form of fixed wireless and likely satellite as well. That shouldn't be a surprise to anybody. That is and has for quite a while now been our view of the long-term structural and competitive characteristics of the broadband market.

To my knowledge, that’s the first time a cable had ever talked about satellite as a long term broadband competitor.

Now, obviously I’ve focused on cable with this quote, but the risk to telecom from satellite is wide spread. Starlink / SpaceX are massive companies with near unlimited funding, and if the returns are enormous if they can crack mobility in some way. And they’re at least clearly thinking about it; SpaceX has made multiple filings that suggest they are at least considering ways to use spectrum to deliver mobile in the medium to long term.

I will admit: I am skeptical satellite can truly make a dent in all but the most rural and/or nichiest of broadband / mobility cases. The physics and economics just don’t make much sense to me. In fact, I suspect that satellite could play an interesting role in providing back up coverage or upside sales to broadband / mobility plays; T-Mobile is using their partnership with Starlink to launch “sassy” offers to woo Verizon / AT&T customers, and Verizon and AT&T are backing ASTS in a program that could create a lot of extra revenue if it takes off.

But Elon has made a career of proving skeptics wrong…. there’s certainly a non-zero chance that 20 years from now all of our mobility is provided by Starlink and every legacy telecom / cable is a zero with a ton of stranded assets, right?

That wraps it up for past 1; I’ll see you for part 2 tmr (and remember, part 3 will likely include some mailbag questions, so feel free to lob in any thoughts / questions if you have them!).

Totally agree with the CHTR bull case fwiw. Have you taken a look at LBRDK? Basically CHTR but cheaper, less liquid, and with some event driven angles. I wrote it up on my substack if you want to dig in.

Did you pick up the wrong share count for CHTR? I think it should be ~145 fully diluted as of 12/31/24, not ~161.