TL;DR: AlphaSense was kind enough to sponsor an expert call with me and Tom Wheeler, the former head of the FCC. It’s a fascinating time for the telecom industry, and we discussed a whole range of issues, including fiber overbuilding, satellite internet (starlink), spectrum issues, the broadcaster cap, M&A potential, and a bunch more. If you’re interested in watching the interview (or reading the transcript), you can find it here.

In part 1 of this series, I laid out why I thought the telecom sector was so interesting and went through four specific examples that I thought could present potential alpha; I highly encourage you to read that post as today’s post will build on a lot of the background / foundation set there. Today, I want to dive into another four areas of change that I think are interesting / could generate alpha. Those are:

Cable eating wireless (cable bull / wireless bear case)

Fixed Wireless (wireless bull case / cable bear case)

Cable M&A

Fiber M&A

Tomorrow, I’ll wrap this series up by diving into the broadcasters and maybe answering a few reader questions.

Let’s dive in.

Cable eating wireless (cable bull / wireless bear case)

In 2024, the fastest growing wireless company was T-Mobile; TMUS added just shy of 5m wireless customers (I’m taking out their FWA sub additions; we’ll discuss FWA later).

The second fastest growing wireless company? Charter (CHTR; disclosure: long), who added >2m lines.

Behind them came AT&T (~added 1.7m net wireless subs), then Comcast (>1m lines), and finally Verizon (<400k).1

So Charter and Comcast are already taking quite a bit of share in the wireless market…. however, it gets even worse for big wireless when you think about where cable is taking share. Cable companies only sell wireless in markets where they offer broadband, and each sells broadband in less than half the country, while the big telecos sell wireless nationwide. We’re effectively comparing cable’s regional adds to wireless’s national adds, and the cable companies are keeping up with the wireless players…. meaning that the cable companies are taking enormous share of the wireless markets in their regions. To put it in perspective, the U.S. consists of just shy of 130m households. Charter’s broadband passes ~57m. If you extrapolated Charter’s adds to a nationwide footprint, they’d be adding wireless subs at the same pace (or faster than) T-Mobile while absolutely lapping the rest of the telecom field.

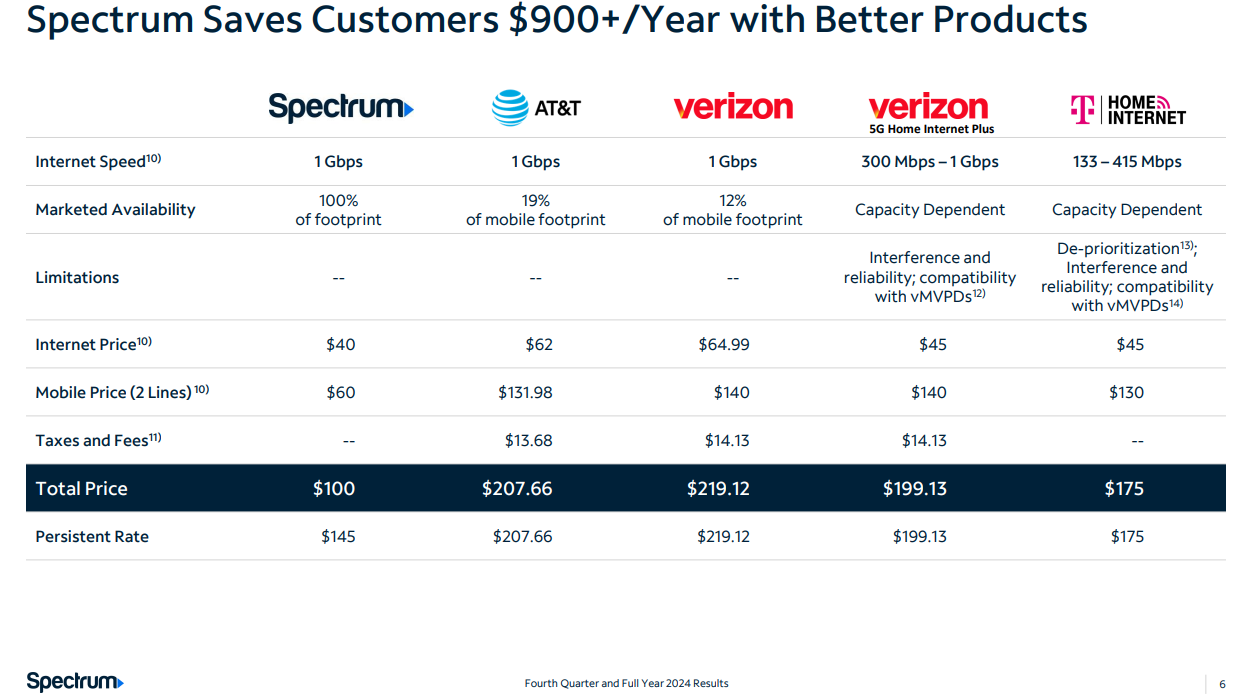

Why are cable companies taking so much wireless share? The answer is simple: their wireless product is at least equivalent to their competitors (their wireless runs on Verizon’s network; cable would argue their product is better given they can use their network to offload so much traffic and improve speeds) and they can offer it a lot cheaper than their competitors given cable’s fixed infrastructure advantage. The chart below is from Charter’s Q4 earnings; yes, it’s probably biased given they are making the chart, but I’ve yet to talk to anyone who has made a switch to cable wireless and hasn’t saved several hundred dollars per year on their mobile plans.

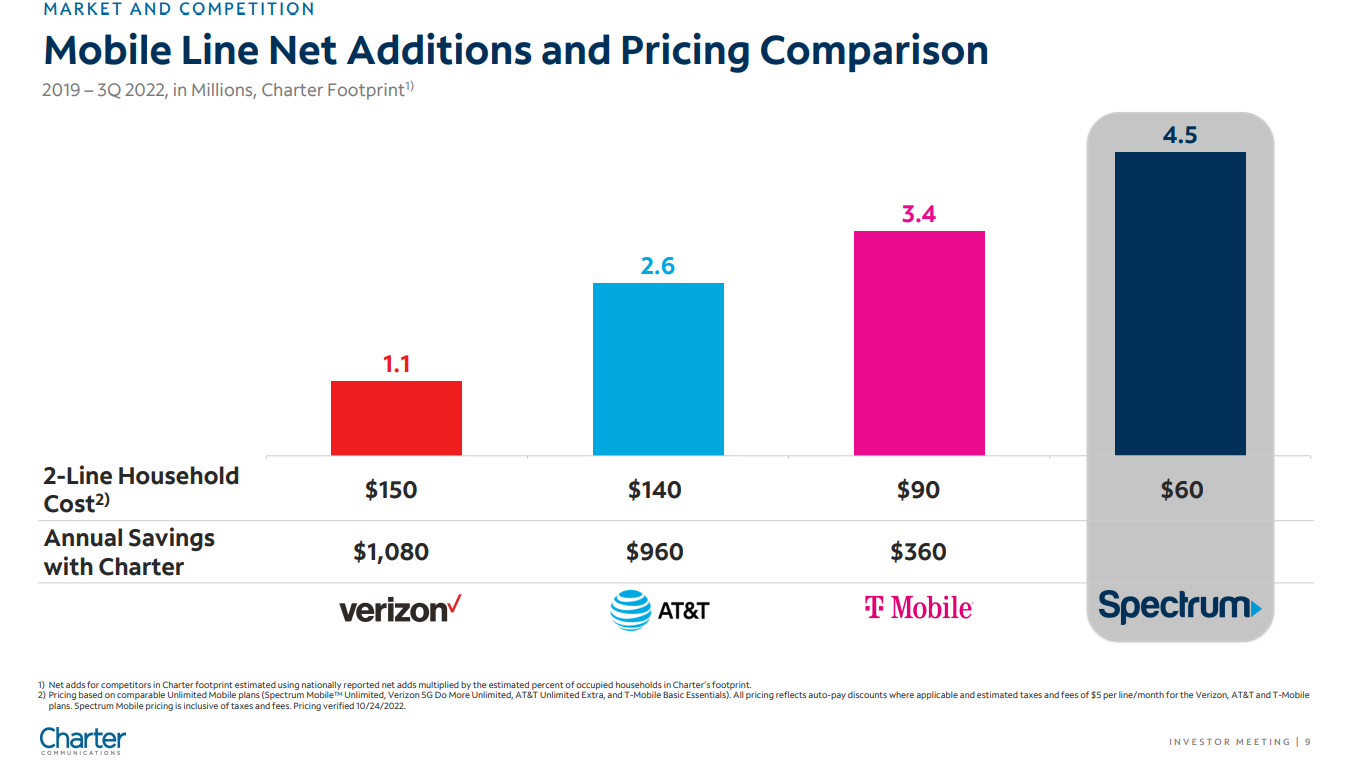

This chart is a bit more dated (it’s from December 2022), but I like how it shows both potential annual savings and line growth in one image:

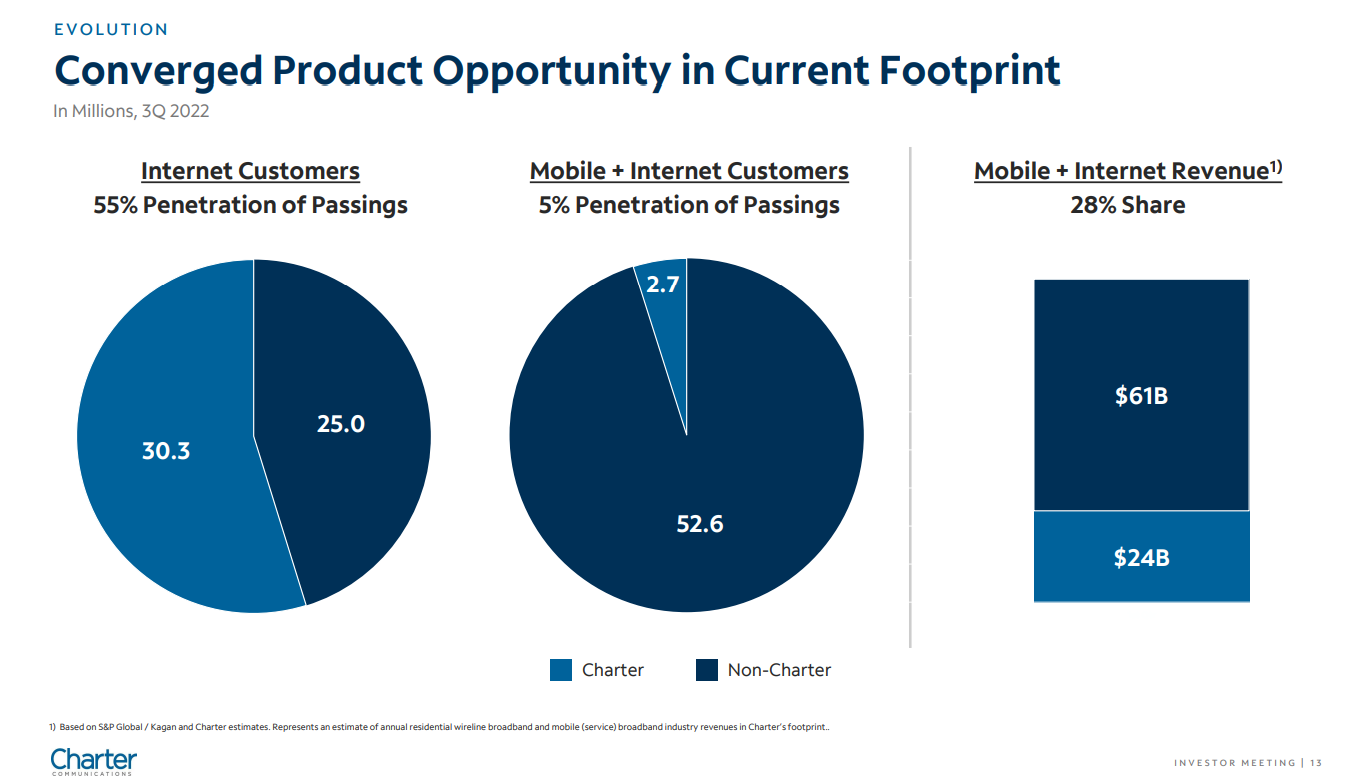

The cable companies are starting from a very small base, so so far their growth hasn’t really impacted the wireless companies. But cable’s subscriber base is starting to get meaningful, and given the pricing dynamics above they should continue to grow rapidly / take share. And they are clearly planning to do just that; CMCSA’s Q4 earnings call notes: “with 7.8 million total wireless lines, which is 12% penetration of our residential broadband customer base or around 6% of our total passings, we have a long runway ahead.” Again, this chart from Charter is a bit dated (it’s from December 2022), but I think it nicely shows the opportunity if customers increasingly take the savings from bundling wireless with broadband.

Which begs the question: what happens in a year or three if cable continues to grow at a similar pace? Comcast mentioned having ~6% wireless penetration in their passings at the end of 2024…. what happens when that number gets into the double digits?

Remember, wireless is a huge fixed cost game; you need enormous investments into infrastructure, spectrum, etc. to run a wireless business. How are wireless players going to respond if cable continues to take share in their core markets and they start to see fixed cost deleveraging?

Fixed Wireless (wireless bull case / cable bear case)

In 2024, T-Mobile added ~1.7m high speed internet (fixed wireless, or FWA) customers. That was down from 2.1m in 2023. Verizon added just shy of 850k FWA subscribers in 2024, down from just under 1m in 2023.

In contrast, Comcast lost ~400k broadband customers in 2024, while Charter lost ~500k.

Now, there was plenty of noise for cable adds in 2024; in particular, the death of the ACP. But I would argue the biggest reason cable companies have dramatically underperformed over the past ~3 years is the rise of fixed wireless. Cable bulls like me (yes, I’m throwing myself under the bus) far, far under estimated the impact fixed wireless would have on the market.

Today, it seems pretty clear fixed wireless is here to stay. But the key question for cable companies going forward is if the drop in FWA growth from 2023 to 2024 is a sign a sign of things to come (i.e. fixed wireless is hitting its capacity limits), or if FWA can reaccelerate from here.

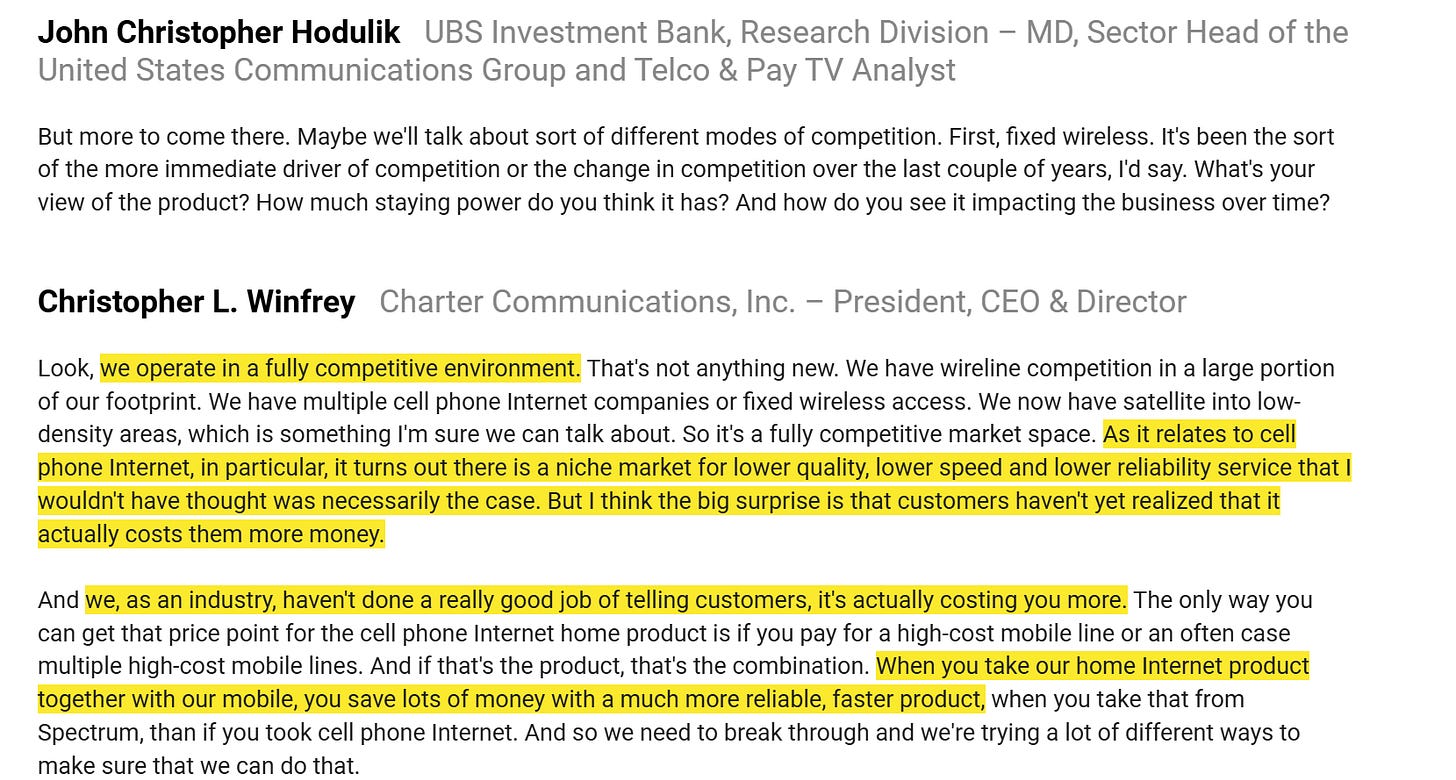

Cable bulls would argue that it’s a sign of things to come; I’ll just use the quote from CHTR’s CEO (who dismissively calls FWA “cell phone internet”) to highlight what cable bulls feel:

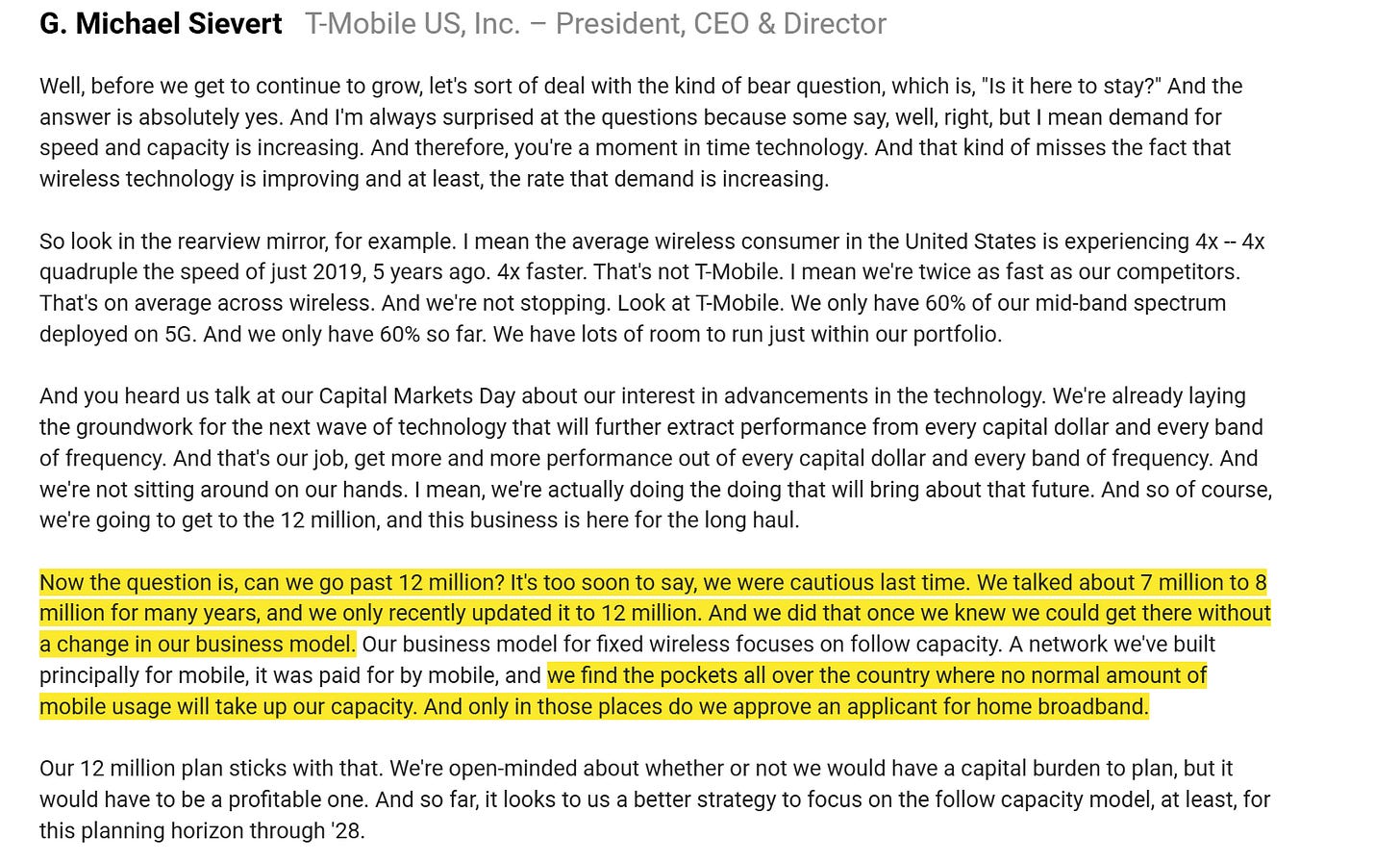

Big telecom would argue differently. The argument would shift depending on which specific telecom company you asked, but I’ll include a response from T-Mobile that I think highlights it best. They’d probably say “as our tech gets better and better, we’ve been able to custom segment the market and only cherry pick places to offer FWA where we know we’ll have excess spectrum. Doing that, we’ve already been able to grow our ultimate FWA plans, and, if we ever wanted to, we could start building up additional capacity to really attack and grow the market.”

So the question is who do you believe? The cable companies when they say FWA is tapping out, or the mobile companies when they say FWA has a long runway to go? Does that belief change if more spectrum becomes available in the near future? How does telecoms recent foray into buying fiber assets match up with their stance on FWA? Does it show they’re actually bearish, or could it allow them to accelerate FWA?

I want to pause here and note that the last two bullets (Cable eating wireless and Fixed Wireless) showed how cable and telecom / mobile companies are increasingly competing with each other. I think that sets the stage nicely for the next two bullets; when two industries begin to clash (as is increasingly happening with wireless / cable / fiber), some type of M&A is almost inevitable, and I expect that to be the case in cable / telecom. The only question is what type of deals it leads to: does a telecom company buy a cable company? Or does cable merge with each other while telecom companies gobble up fiber companies?

Cable M&A

If you’re a sellside analyst, earnings season is your busy season. There are a lot of things you do during earnings season, but one of the most important is asking questions on the earnings call. As a sellside analyst, you get to ask a question and have management put their answer into the public domain. That’s an opportunity that’s not afforded to buyside analysts, and the right question can really help shape the narrative around a company (or at least a quarter) or uncover some interesting trends going on an industry. So the question is important for that “uncovering info reason”…. but sellside research basically doubles as corporate access these days, and having your questions taken on a call is also an effective signal that you have good corporate access!

The etiquette around sellside earnings call questions are pretty standard: each analyst is limited to two questions (sometimes its one question and one follow up; sometimes its just two questions upfront). And there’s a reason for that rule: you don’t want one analyst to ask 50 questions and monopolize the entire Q&A. If you as a sellside analyst break that rule by asking three or four questions, you can expect some light ribbing on the earnings call (the CEO will say something along the lines of “wow, that’s a lot of questions; I’ll try to make sure I can answer them all” and the IR team will pause the conference after your questions and say “a reminder to please limit yourself to two questions); if you keep breaking that rule, you might not be allowed back on the earnings call, which would be a disaster as a sell sider!

So, as a sell sider, you’re going to spend a decent bit of time figuring out exactly what questions to ask the management team. You’ve only got two, and you want to make sure the two you ask are really relevant to the thesis / what most of your clients are asking you about the company / industry.

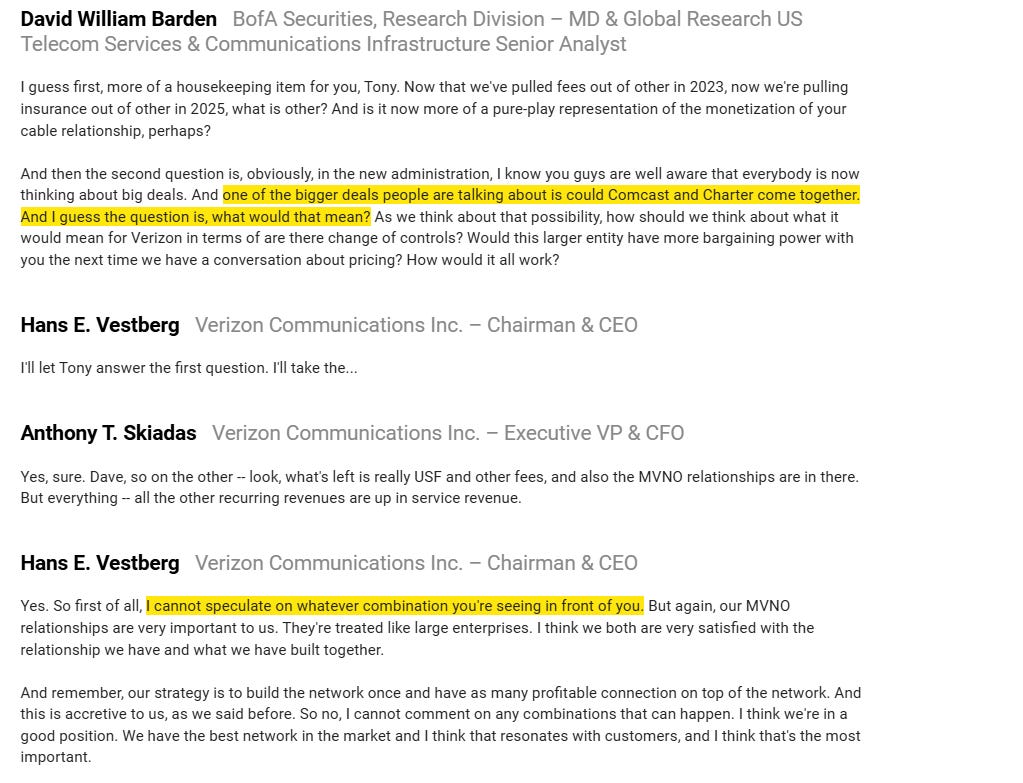

Why do I mention all of this “day in a life of a sell sider”? Because one sell sider was so curious about a potential Comcast / Charter merger that he used his precious question slot to ask about that merger on Verizon’s earnings call:

Imagine how loud the buzz about a merger has to be from your clients for you to say, “you know what, I better ask this third company about a potential merger even though there’s been no deal, nothing from the companies to indicate a merger is in the works, etc.”

Why is the buzz around a Charter / Comcast merger so loud?

Well, I suspect one reason is that investors think that the Trump administration is going to be much more lenient when it comes to merger regulations / oversight than the Biden administration was. Of course, that’s not saying much; the Biden admin was probably the most aggressive merger regulator in history, so saying someone will be more lenient than them is kind of like saying a random dude on the street is much worse at basketball than Lebron James.

Still, the Trump admin is almost certainly going to be very forgiving when it comes to merger regulations. Remember, the first Trump admin approved the T-Mobile / Sprint deal (which I personally think was much more anticompetitive than a Charter / Comcast potential) merger would be, and I’d imagine the second admin will be even more lenient given their “regulations should be default gone” attitude.

So I think if you’re a buyer, you look at the board right now and say you’ve got ~4 years where the world is open to all sorts of M&A that may never be available to you again. Charter seems to be the key chess piece here: John Malone is a big / influential shareholder and seems to be a willing seller as he winds up his empire, so they’re probably the easiest and largest domino to fall. Charter’s potential openness to a deal is not lost on anyone given there are industry pieces debating if Comcast or T-Mobile will ultimately be the buyer.

But it’s not just Charter that could serve as a M&A prize. Over the past few years, cable has faced competition on a scale that, to be frank, it has never seen before due to a combination of fiber overbuilding and FWA roll outs. The best way for cable to fight back against that competitive onslaught is buy leaning into convergence (i.e. offering both wireless and broadband, and then using their broadband network to offload / support their wireless business and undercut telecoms on price, as shown in the Cable eating wireless (cable bull / wireless bear case) section), as I believe cable is the best positioned to offer a bundled, converged offering. However, you can’t launch a mobile offering if you’re a subscale player; the start up costs are simply too high, which means the industrial logic for smaller cable players to sell to large players is enormous. I would not be surprised if we saw any or all of the other publicly traded cable players (ATUS, CABO, WOW (disclosure: long)) put into play in some way, shape, or form in the next year or three. Again, the industrial logic is just too strong, and you’ll likely never have an administration more open to sales than the current one.

Fiber M&A

2024 saw a wave of fiber M&A.

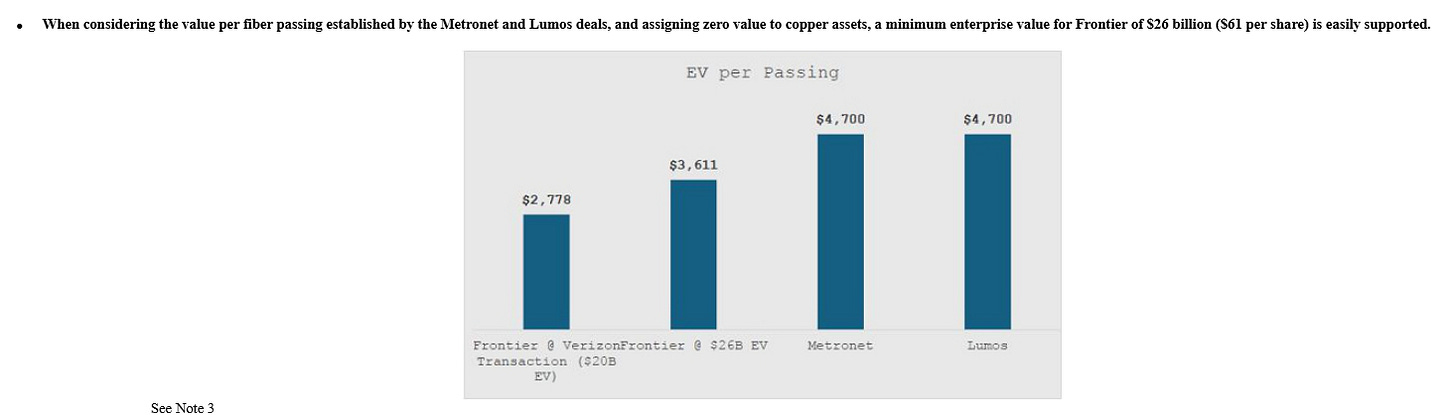

The headliner would obviously be Verizon’s ~$20B deal to buy Frontier…. a deal which multiple shareholders protested was too cheap!

T-Mobile announced multiple multi-billion dollar fiber JVs.

It is important to note that all of these deals were done at eye popping multiples; Glendon highlighted some of the multiples in their presentation against the FYBR / VZ deal. Now, FYBR / VZ would push back that there are a lot of other things that go into those multiples (in particular, Metronet and Lumos were set up for a lot of growth), but I just wanted to highlight the multiples because no one in the small cap publicly traded fiber world trades close to those multiples!

There are a slew of smaller fiber players out there. Some of them are private / private equity backed; some of them are public players. I think all of them control valuable strategic assets but also face difficulties when it comes to finding more growth / markets to build and accessing capital markets (I like how Ting described the environment on their earnings call: “In fiber and in enterprise software we see a continued lack of common equity checks being written and we see lots of companies with private equity sponsors coming to the end of their last rounds without a clear path forward in sight.”). Given that combination plus the large multiples we saw in last year’s strategic deals, I would expect to see a lot of fiber M&A in the coming year. Just to list a few potential (public) targets:

TCX had to stop new build fiber due to their rising capital cost; it would seem a natural move for them to sell off their remaining fiber assets. The company basically admitted that on their earnings call (“we continue to expect 2025 to be a year with a lot of change in the fiber space. And change can create opportunities.”)

WOW (again, I am long2) has spent >$200m in largely fiber growth capex over the past two years, and has seen their stock go straight down. They have a decent bit of leverage, but at this point their market cap (<$400m) is barely larger than what they have spent in growth capex over the past few years. Selling a chunk of those growth assets to prove the multiple and delever the company could make a lot of sense (assuming they don’t sell the whole company first), particularly if you think they get anything close to the multiple other fiber assets have traded hands at.

BOC is a popular name among (very) small cap investors and has a small collection of fiber assets; they seem to be in fiber for the longer term, but the top brass their also has a financial background, and it seems clear to me the risk/reward of going standalone versus hitting a potential strategic bid tilts far, far to the strategic bid….

NNI is another popular name among value investors. They own 45% of ALLO fiber in addition to a ~$200m preferred investment. ALLO is a large and rapidly growing fiber company, and as they grow they are consuming an enormous amount of capital (debt at ALLO has gone from ~$340m at year end FY23 to ~$1.1B by Q3’24). There aren’t many fiber companies of scale left out there; ALLO is a nice bit size for a large strategic and given ALLO’s capital consumption a sale to a strategic could make sense…..

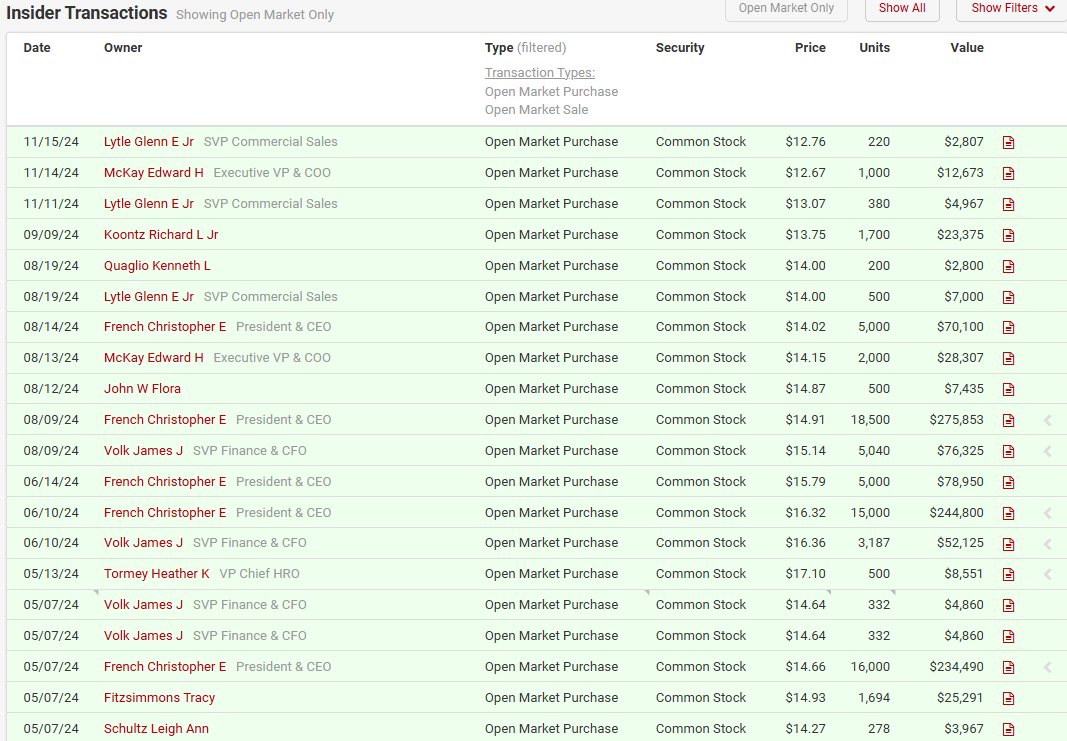

SHEN has really reshaped their portfolio over the past few years; they paid out a huge dividend after they sold a bunch of wireless assets to T-Mobile, and they sold their towers for a huge multiple and effectively reinvested the proceeds into a fiber business. To say the market hasn’t rewarded those moves would be a understatement; even adjusted for the dividend shares have been ~cut in half over the past three years. They’re currently wrapping up the integration of their fiber purchase, and management has been a consistent buyer of the stock. With the company still pretty subscale and the market yawning at them, perhaps now is the time to sell?

Fiber overbuilders face an increasingly difficult task: the easy overbuilds have generally been done, so what’s left to overbuild is increasingly rural / less dense (much less appealing for an overbuild! Simple math says that a mile of fiber will generate a higher return if it passes 10 homes versus 5 or 2!). As TCX mentioned, the funding is getting more difficult, and smaller players don’t have a full bundle to offer like their larger competitors do. The economics of those recent sales and the changing landscape suggest fiber overbuilders should take a strategic deal while a strategic deal is there…. otherwise, they face a lot of questions in the future!

Alright, I’m going to wrap part 2 up here. Stay tuned for part 3 later this week, where I’ll discuss the broadcasters and how they fit into almost every trend that I’ve touched on so far, and please remember to check out part 1 here if you haven’t already (as well as signing up for Tom Wheeler expert call here!).

Note: all of the companies report slightly differently, so you can’t easily pure apples to apples anyone, but this is all directionally correct

Disclosure: on top of being long, I have sent several public letters to the board

if the mobile+cable bundle by charter is working, then the cable business offered by an overbuilder like wow would face further subscription losses. does that worry you?

another question, $CCI seems to have their fibre assets priced at less than the cost, any thoughts on how this may apply to wow's fiber asset?

thanks!

Is it possible that big part of cable mobile customers are just their voice customers converted to mobile? So not really taken from wireless cos?

Similar to Frontier boasting their fiber adds, while perhaps most of them are their dsl customers converted to fiber?