The future of telecom- expert interview with former FCC Chair Tom Wheeler (part 3 of 3: broadcasters)

TL;DR: AlphaSense was kind enough to sponsor an expert call with me and Tom Wheeler, the former head of the FCC. It’s a fascinating time for the telecom industry, and we discussed a whole range of issues, including fiber overbuilding, satellite internet (starlink), spectrum issues, the broadcaster cap, M&A potential, and a bunch more. If you’re interested in watching the interview (or reading the transcript), you can find it here.

Part 1 of this series (see here) discussed a few different bull cases (namely quantitive cheapness and spectrum upside) while part 2 (see here) discussed some competing bull and bear cases as well as the potential for M&A in the sector. Today I want to conclude the series by talking about broadcasters like NXST, GTN, SBGI, TGNA, etc. Why? Because I think broadcasters hit on almost every single point we’ve discussed so far: they’re insanely cheap and they have upside optionality from both M&A and spectrum…. but they also have a very obvious bear case as the world continues to evolve.

So it’s a fascinating sector… and broadcasters are particularly relevant to my AlphaSense expert call Tom Wheeler (remember, this whole series of posts was to get you excited to read that call!) because the FCC is the main regulator of the broadcasters (seriously, go look at NXST’s 10-K; the FCC is mentioned 79 times by my count, and the “federal regulation” section of their 10-K lists only the FCC and discusses them for almost three full pages (an eternity in 10-K land!)).

A broadcaster is the company who owns the local big 4 channel (i.e. Fox, ABC, NBC, CSO). For those who don’t know, the government established the Broadcast Ownership Limit decades ago to prevent one company from having too much reach / influence with consumers. So while a big company like Disney (who owns ABC) might own the local ABC broadcaster in big markets like NYC or LA, they can’t own all of the markets nationwide, so they’ll partner with a local broadcaster like Nexstar tends to own their affiliate in smaller markets (for example, Nexstar owns the ABC affiliates in Nashville, Salt Lake City, and Grand Rapids).

This is such an interesting time for broadcasters because they are at the absolute center of so many different currents. On the bull side, you have the possibility for monetizing their spectrum, M&A possibilities from the ownership caps getting lifted, and monetization of the continued heated nature of our political system. On the bear side, broadcasters are facing huge headwinds from cord cutting, the fracturing of our media ecosystem, and the ultimate question of “should these companies even exist?” Wrap it all up in a wrapper that’s incredibly cheap, and you have a recipe for an entire industry that could generate massive alpha on the long or short side.

I’m going to try to walk through all these points. Let’s hop into it: (editor’s note: I wrote almost all of this ~Feb. 22; broadcasters have started reporting earnings this week, so while nothing in here should change materially some of the data points may be slightly stale)

Bull point: Broadcasters are cheap overall…. but they are REALLY cheap on a levered basis

Let’s start with the simplest fact: broadcasters are cheap. Given all of the (real) worries about cord cutting and other headwinds the market has, the broadcasters trade for low EBITDA multiples. So broadcasters trade cheap on an EV / EBITDA basis…. but it’s probably better than that when it comes to the equity. Historically, the market was very comfortable letting these businesses run with a decent leverage profile. Why? Because broadcasters are steady free cash flow machines; they have basically no capex needs and a major piece of their earnings come from carriage fees that have been largely economically resistant (recession or not, people are still going to want to watch the NFL). The combination of a historically nice leverage profile and current long term fears has traded the broadcasters down to low EV / EBITDA levels…. but on a free cash flow basis the companies are insanely cheap.

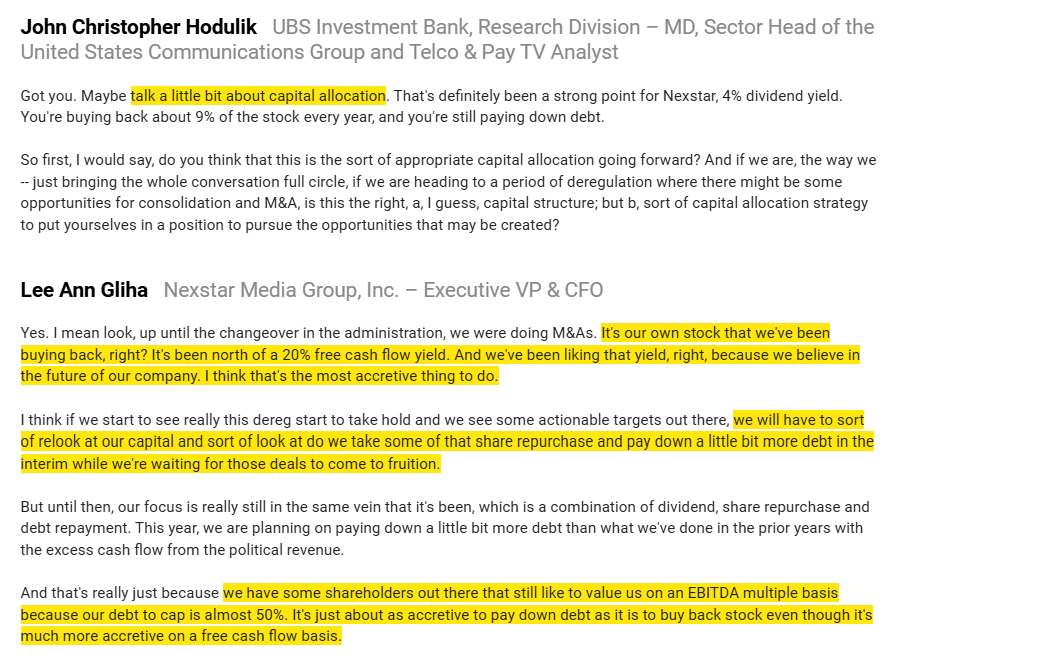

Don’t take my word for it; NXST has been talking about needing to weight potential M&A against buying back their stock at a 20% free cash flow yield but also noting that given their leverage profile repaying debt can be equally accrettive on an EV basis (though no where close to as accrettive on a levered FCF basis!):

Incredibly, NXST is the best run company (with the best management) in the sector, so despite trading for a >20% FCFE yield it probably trades for a premium to peers. That’s right: NXST has a >20% FCFE yield and is more expensive than peers.

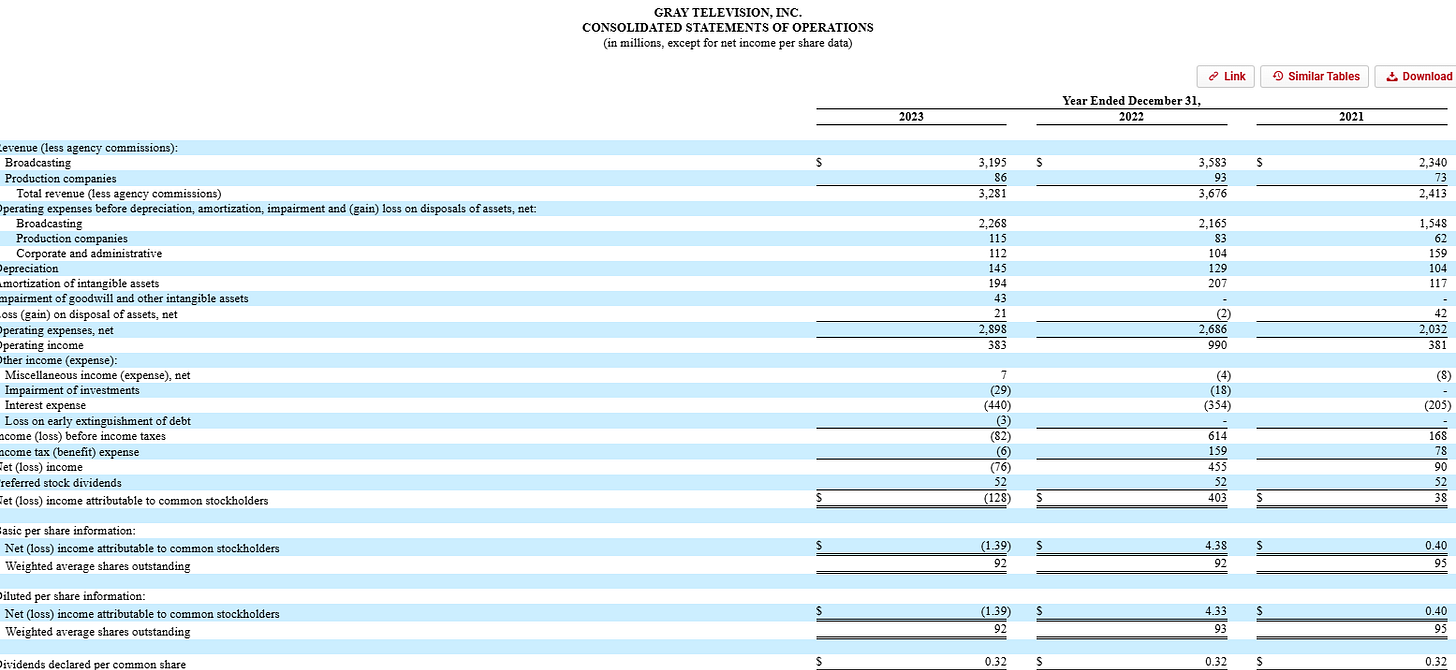

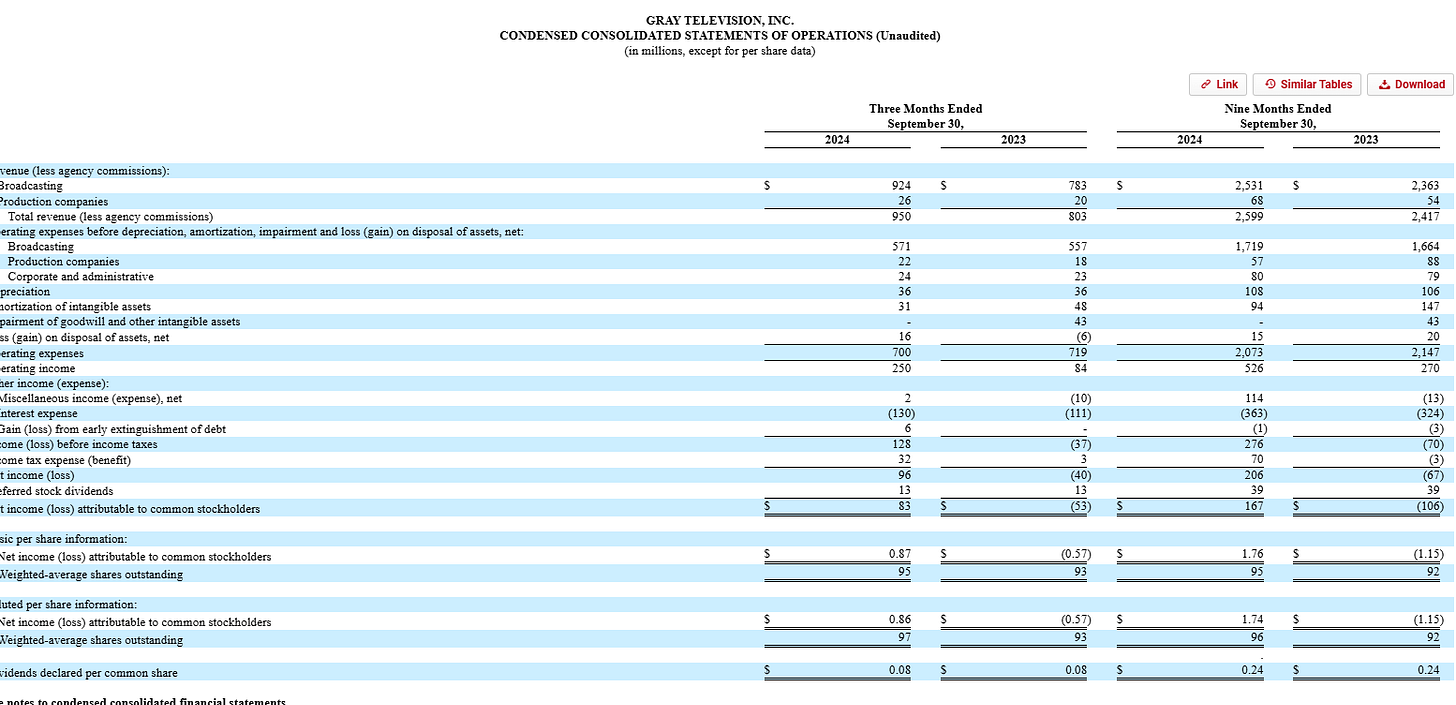

Consider, for example, GTN. GTN’s trailing EBITDA is just over $1B1. They have a market cap of ~$400m and an Enterprise Value of just under $7B, so the company is levered. On an EV / EBITDA basis, they trade for just under 7x EBITDA (roughly inline with NXST)…. but I calculate on their current cap structure fully taxed free cash flow to equity is around $300m/year. So if GTN can survive you’re buying them for just over 1x free cash flow to equity.

I’ll show this to you simply off GTN’s income statement2: they did $4.33/share in EPS in 2022, and they did $0.40/share in 2021 (they would have reported a similar number in 2023 if not for elevated write-offs / amortization / one time items)… average those together and the company does ~$2.40/share in EPS/year. However, those numbers include ~$1.40/share in intangible amortization (adjusted for taxes!), which is pretty non-economic. Put that back in, and GTN would average ~$3.80/share in EPS…. roughly in line with their current stock price of ~$4/share.

Now, you might be thinking, “that’s historical earnings; this business is a melting ice cube!” And there is some truth to that…. but it’s still not really popping into GTN’s earnings statement. Here’s what they’ve reported for the first nine months of the year; in the first three quarters, they’ve reported $1.76/share in EPS (that number includes a large one time gain, but the gain just largely offsets their amortization). GTN doesn’t report Q4 earnings till next week, but it will certainly be huge given the tsunami of political advertising. It’s entirely they did $2/share in EPS in Q4 (that’s about what they did in 2022, and given the Presidential race the advertising cycle in 24 was probably a bit better than 22!)… so, again, you could be looking at GTN at a very levered 1x free cash flow to equity.

And GTN is using their cash flow to buy back their debt at a discount to face value; if they can make it to the other side, those debt repurchases will prove very accrettive to equity holders.

Bull case: M&A is coming

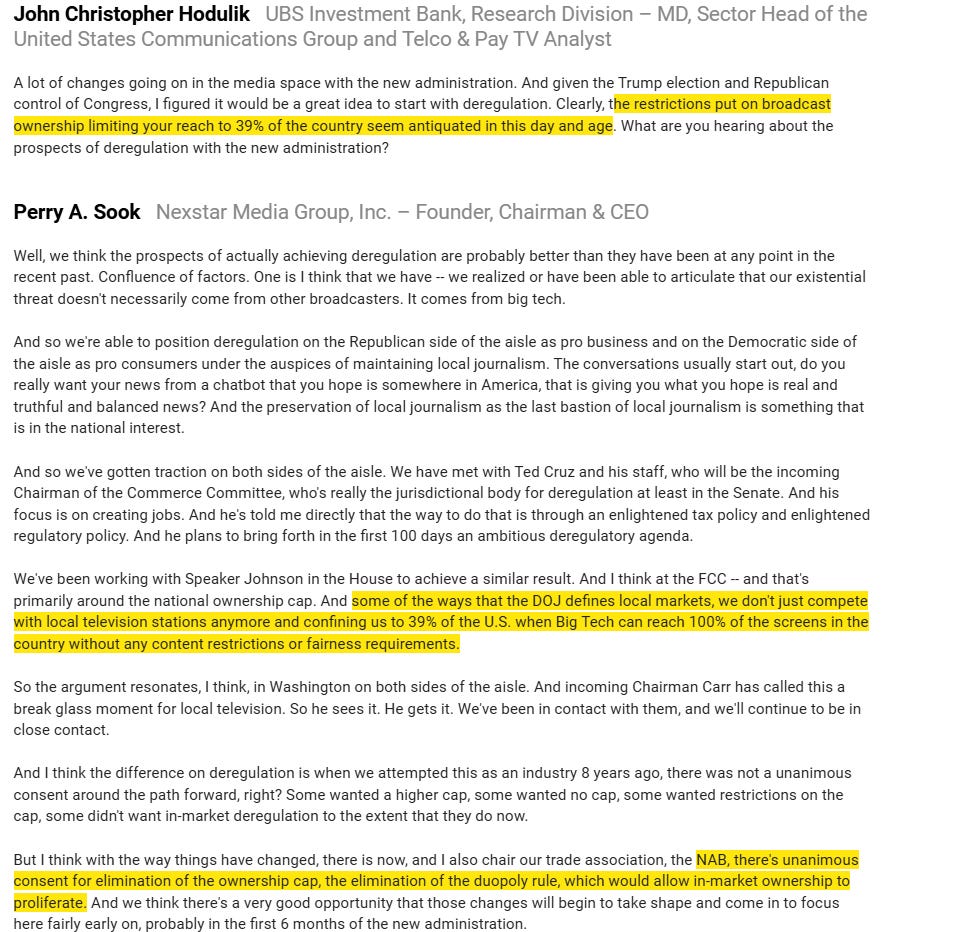

In today’s day and age, it’s pretty clear that having an ownership cap on broadcast networks is outdated. To steal a line from NXST’s CEO: why should networks only be allowed to control reach to 39% of the country when Big Tech can reach 100% without an restrictions?

Multiple people in the top levels of government have expressed support for eliminating this cap, and it’s really hard to see any reason why it shouldn’t go away. Once it does, we could be in for a boom time in M&A. Again, NXST is the best run of all the broadcasters and likely the best acquirer, and you can hear how eager they are to do acquisitions when they talk about the cap going away. And they should be eager; they’ve historically proved that there are huge operating synergies when they buy another station (though, like any truly shareholder focused management team, they judge a good acquisition against the opportunity cost of buying back their own incredibly cheap stock)!

Bear case: is there any reason for local broadcasters to exist?

This is a point I’ve made a few times over the years, so if you’re a regular reader then bear with me…. but I think I need to make it again because it is the critical question an investor in broadcaster needs to answer: is there a reason for the broadcasters to exist going forward? Remember, to simplify, a broadcast network basically provides three types of content: sports, primetime programming, and local news. A local broadcaster generally licenses everything from their network except for their local news (i.e. your local ABC channel pays ABC for ABC’s primetime programming and sports but produces the news themselves).

Historically, that has been a very powerful spot for the local broadcaster. Let’s rewind the clock to the 70s. The TV landscape looked something like this: there were three main channels (ABC, NBC, and CBS). You tuned into them to get your local news, your nighttime news, sports, and prime time programming; there wasn’t really an alternative. Cable was just starting up, and there weren’t even cable networks yet (HBO wouldn’t start up till 1972)…. so maybe you had cable infrastructure to get TV, but most likely you got your TV using an antenna (“bunny ears) that captured the air waves. If you wanted any video entertainment or real time news, TV was really the only option.

Local broadcasters had a lot of power in that world. They controlled the spectrum the networks ran on, and the big networks were regulatorily precluded from owning networks across the country. Plus, the local news was (alongside the newspaper) the dominant way to learn about what was happening in the world and particularly your town, and the only way to do so in real time. That was a great moat.

Fast forward to the 90s, and local broadcasters still have a lot of power. Yes, people can get cable and all of the channels that come with it, but local broadcasters have by far the most draw on cable because they have the best programming, the best positions (local broadcasters tend to take up all of the lower / easiest to access / most popular cable channels), and remain the best source for local and national news. And there’s still a reason for them to exist: again, networks are regulatorily precluded from owning all of the nation’s local networks. And their local news remains of critical importance; the internet is still nascent, so there’s really no better way to get up to the minute news, particularly locally, than the local network.

Now fast forward to today. The cable bundle is rapidly unwinding. There are plenty of alternatives to cable to get entertainment (Netflix, video games, etc.). If you want to watch sports, you can get access to much of a network’s sports programming without the cable bundle (for example, I subscribe to Paramount+, and I can watch football games with that subscription, though given my local AFC team in the Jets I’m not sure why I’d really want to watch!). There are plenty of ways to get the news; you don’t need to wait for the evening to watch the primetime news on ABC when you can just go to cnn.com or a thousand other sites, and while local news is a bit more fragmented you can still get access to local news without a cable channel.

What I’m trying to drive at is this: outside of a regulatory restriction that says the networks are limited in how much of the country they can own local stations in, what reason is there for local networks to exist?

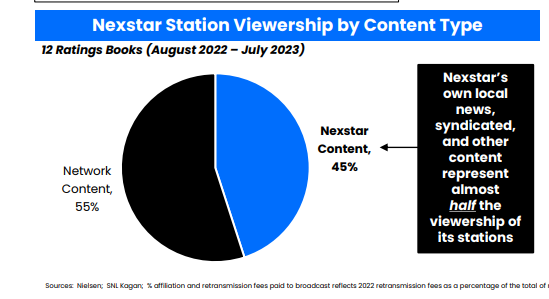

A broadcaster would probably say, “of course there’s a reason for us to be there! almost half of our viewing comes from non-network content like local news and syndicated content.”

But I really don’t think that’s the right way to look at it. Yes, syndicated content and local news get a lot of viewing…. but not all viewing is created equally. Syndicated content is really low value; if you lost access to day time TV shows the networks offer, you could find a replacement pretty easily (a different syndicated show, just binging Netflix, etc.). In contrast, an NFL game or two can drive ~1m subs to even an already huge platform like Netflix. And while local news is certainly important and people do like their local teams / develop relationships with them…. it’s another area where it’s hard for me to believe that subscribers would actively cancel / pay monthly prices for one specific team. Nexstar is earnings hundreds of millions per year; if local news was a real driver of that, I think we’d have seen a ton of competitive products have sprung up to try to capture some of that.

There is one other more interesting pushback a local broadcaster might have. Local broadcasters would note that they get the same subscriber dollar figures from vMVPDs (like YouTube) as they do from the legacy cable network. If that isn’t proof that their content is value added, what is?

It’s an interesting argument… but I’m a little suspicious that this status quo can last. Again, the networks are cutting in the local affiliates on a huge slice of revenue by given them a share of the vMVPD revene, and that might make sense for the networks when there are regulatory reasons you can’t control local across the country. But I continue to believe the scant assets the local broadcasters provide would command a pittance versus the fortune in retrans fees they are getting under the current structure.

To me, it’s clear the broadcasters are undoubtedly coasting on their historical position to earn way outsized profits. I worry that, as time goes on, both the distributors and networks look at the local broadcasters and say “why are we paying them anything?” and the broadcasters ultimately go away.

Bull case: focusing on the core?

Cord cutting has obviously been vicious for broadcasters and anything that touches legacy media. But here’s an interesting thought: Comcast is trying to spin off their cable networks, not their whole legacy media operations (i.e. comcast is trying to keep their broadcaster). What if we’ve hit a point in cord cutting where the long tail (the random cable channels that play replays of Friends all day) are worthless and set to go away, but the reach and ubiquity of broadcast networks actually has staying power / can start to stabilize the bundle? Is that the world Comcast is playing for? I’m a little skeptical, but NXST paints an interesting picture….

Bull case: M&A, part 2

This builds a little bit off the prior three points. Say that the broadcast cap is lifted, and we get set for a world of M&A. Maybe the networks say “hey, we can cut out the local affiliate and keep all of their millions in profits for ourselves.” That’s certainly a possibility, and it’s my worry…. but maybe the networks look at that and say “hey, we’re going to piss off a lot of people if we do that, and we’re probably looking at years of lawsuits if we try it.” Maybe the networks take a page from the Comcast book above and look to double down on their core by buying out their local affiliates?

Bull case: spectrum!

The broadcast spectrum auction in the mid-2010s was one of the most successful spectrum auctions of all time….. and the broadcasters still own a heck of a lot of spectrum. Eventually, you have to think that spectrum gets monetized in some way, shape, or form, and I’m pretty sure the best monetization is not using that spectrum as a dedicated way to air programming for free that you can easily get in other forms (i.e. why should NBC have dedicated spectrum when you can just go to peacock and stream it? Doesn’t that spectrum have higher alternative uses?).

The broadcasters have formed their own JV to try to take advantage of this opportunity. If you listen to the broadcasters, the opportunity here is huge, and it’s important to note that this spectrum currently isn’t really earning anything for them. So if the broadcasters turn out to be right, the upside for them is enormous (particularly given their low valuations)….. but I will have to admit I’m a bit skeptical that this spectrum could be better monetized by their JV versus in the hands of a telecom player (quotes below from NXST discussing why they’ve held on to their spectrum and the potential upside).

Conclusion

Ok, that wraps it up for my media series. As always, I’m happy to swap thoughts on anything media related (and, again, I’d encourage you to read my interview with Tom Wheeler; it hit on all of these topics and was really fascinating!).

This is actually their L8QA EBITDA; broadcasters experience mini-booms in advertising during even years thanks to political cycles, so they generally present their trailing earnings as an average of the trailing two years to adjust for this mini boom.

I wrote most of this article weekend of Feb. 22; GTN will report Q4 earnings at the end of Feb, so the numbers I’m using will be slightly stale but still largely accurate in the near future!