Tl;dr: I did a (free) expert panel with Tegus talking about the future of sports media rights that is launching today. The experts included people who’ve been involved with sports media rights deals at the NBA, Amazon, and ESPN. The call is free to check out (you can sign up here).

So the purpose of this post is really to highlight that panel as it’s a really interesting and informative one…. but I also wanted to provide a bit of background on why I wanted to do that panel and what I was hoping to take away.

If you’ve followed media even tangentially, you know that the value of sports media deals are exploding. And that explosion has all sorts of ripple effects throughout the sports landscape. In particular, the sports rights explosion has caused an enormous bump in player salaries. Today’s players salaries make yesteryears look tiny. Here’s one of my favorite examples: Magic Johnson (one of the five best basketball players of all time) made ~$40m in his entire career… Paul George will be making more than that every season on his new deal.

That’s a simple / silly example, but the explosion in sports rights is driving player contracts to huge levels and altering every aspect of the sports landscape (John Wall famously complained about how he, as an all star, was making the same as a role player simply because of when their deals were up / the salary cap explosion driven by the last NBA deal). And it will have huge impacts on the sports world going forward: because these rights explosions are driving franchise valuations and player contracts ever higher, if the rights train ever slowed down or reversed for some reason, we could be looking at pandemonium in the sports world (lockouts and work stoppages; teams entering financial distress, etc.).

The sports rights “train” slowing down or reversing might seem crazy to imagine…. but we’re seeing the explosion in sports rights value come while sports leagues’ traditional partners (ESPN, CBS, FOX) are under huge financial pressure as the legacy cable bundle unwinds. It’s fair to wonder if the legacy media players will be able to afford another round of sports rights increases giving their stressed financials (in fact, it may be fair to wonder if they’ll be able to afford the later years of their current rights contracts!). Five years ago, the legacy media companies being stretched would have spelled disaster for sports leagues and their rights renewals….. but recently we’ve seen a string of tech companies (Apple, Amazon, Netflix) get serious about bidding on streaming rights.

So I wanted to break down the sports rights landscape from two perspectives: what’s happening with legacy media partners and what their outlook was, and then I wanted to use those views to inform why tech players are getting involved in sports rights. And, ultimately, all of these bidders are “for profit” players, so I wanted to understand how they looked at and justified these huge investments and what type of returns they thought they’d be getting.

Let’s start by talking about the state of the traditional broadcast / cable partners. To put it bluntly, traditional partners are undergoing huge pressure. I’ll quantify that pressure in a second, but consider this: CBS pays the NFL ~$2.1B/year for their carriage rights. As I write this article, Paramount Global (CBS’s parent company) has a market cap of ~$8B despite being the subject of a bidding war. Obviously you can’t flat compare a fixed contract amount (like the NFL rights) to an equity market cap, and there are a lot of other things that go into Paramount’s market cap…. but just the size of those numbers is staggering and probably indicates that the NFL contract is, by far, the most important asset at CBS.

Or consider Warner Brothers; their stock dropped ~7% when it came out they were going to lose the NBA rights. Again, a lot of other stuff going on, but WBD was a ~$20B company, so they lost >$1B of value when it came out they wouldn’t pay the NBA >$2B/year.

So, for the legacy partners, their sports rights are increasingly their only reason for existing / a huge piece of how the market values and thinks about the companies as the rest of their business fades into irrelevance.

And I think the companies know it too. I’d cite two interesting examples of “losers’ remorse” that I think informs a lot about how the companies look at sports rights. The first is Warner Brothers losing the NBA earlier this year. Remember that Warner had an exclusive negotiating window with the NBA earlier this year; Warner backed out when the bidding exceeded $2B, but when it became clear that they would lose the NBA entirely they sued to try to match. If Warner had really wanted those rights, they could have just stayed in the bidding originally or bid a price that would have taken the NBA off the market in the exclusive marketing window…. instead, I think Warner got sticker shock at the price tag of the NBA and it was only when they were staring the cold reality of how empty their business would look without the NBA did they take the desperate step of suing the NBA to try to retain those rights.

The other place I’d point for “loser’s remorse” is the SEC on CBS. CBS had the SEC on a long term deal for ~$55m/year; ESPN “stole” the SEC from CBS for ~$300m/year a few years ago. CBS turned around and bought the rights to the Big Ten for ~$350m/year. So CBS paid more money to get the rights to a worse conference? Why? I suspect it was similar thinking to Warner with the NBA; CBS had sticker shock at the huge inflation in the price tag for the SEC, but they panicked once they saw the hole in their fall schedule where the SEC had been and how devastating that hole was on the whole of their business (pun intended)…. so when the reality of losing the rights hit them, they panicked and paid up for an inferior product1.

Let’s put the legacy media players to the side for now and talk the second way the sports media landscape is at a cross roads: tech and streaming giants are increasingly stepping in to compete with and/or fill the void left behind by legacy media players. Amazon grabbed Thursday night football and swooped in for an NBA package; Netflix has grabbed the WWE plus NFL christmas games; Apple has the MLS plus the Yankees (for some reason).

So that’s the evolving competitive landscape…. but what I really wanted to understand was how these companies looked at bids this large and thought that they could or would be profitable.

Consider ESPN’s most recent deal with the NBA. It will see ESPN pay the NBA $2.6B/season, up from $1.4B during their last deal. However, not only is ESPN paying a huge increase in fees…. they’re also getting a pretty significant drop in inventory. Remember, the NBA’s prior deal only had two partners (ESPN and Warner). The new deal has three partners (ESPN, NBC / Peacock, and Amazon). The third package includes a bunch of games (including playoff games!) that would have been part of the old package.

So ESPN is paying almost double the price for less games and less exclusivity. That is an enormous step up!!!

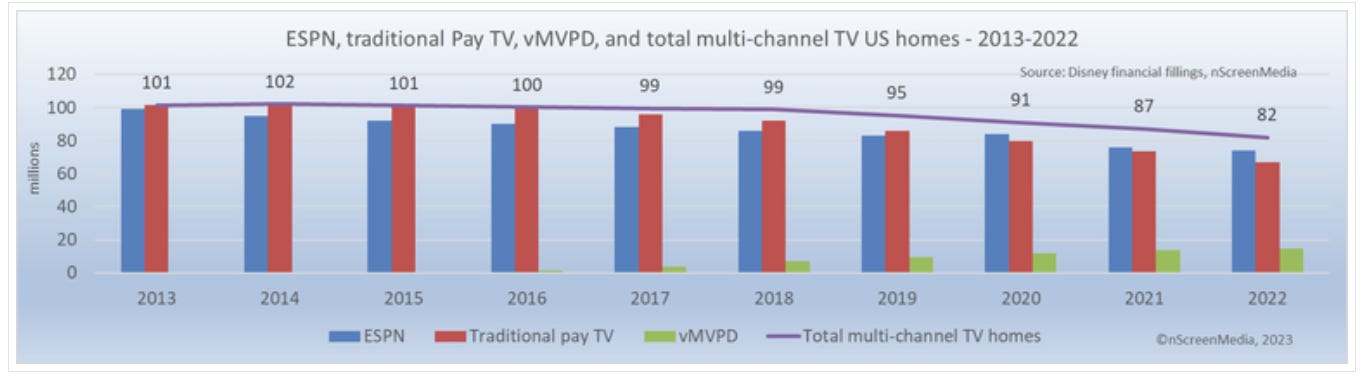

But it gets even worse. When ESPN struck their prior package, they had ~100m subscribers. Their last 10-k had them at 71m subscribers as of September 2023, and I wouldn’t be surprised if their next 10-k is approaching 65m.

So, on a per sub basis, ESPN’s prior deal started out at ~$14/year/sub ($1.4B/year spread over ~100m subs). The current deal starts out at ~$37/sub/year ($2.6B/year over ~70m subs)… that’s closing in on a 3x increase in per sub price for a worse / less exclusive package!

But things might be even worse than they appear. For years, there’s been a worry that the cable bundle would “doom loop.” It had gotten so expensive that the most marginal subscribers would churn… which would lead the networks to raise their prices to make up for those losses (i.e. when the network goes from 100m subs to 90m subs, they could maintain revenue neutrality by raising prices by ~10%)…. but that increase in prices would cause the next most marginal subs to churn, which would cause more price increases, and the cycle would continue into perpetuity until the entire cable bundle unraveled.

We might be at that “doom loop” point today as cable sub losses are currently accelerating, and those losses / that acceleration seems set to continue. It’s entirely possible that in a few years ESPN could have 50m subs and still dropping… the NBA rights at that level would come out to >$50/sub for ESPN! That’s absolute insanity; ESPN currently charges cable companies just under $10/month/sub; if that future came to pass (and ESPN didn’t materially raise their prices), then the NBA rights alone would eat ~50% of ESPN’s revenue every year! And that’s before considering all of ESPN’s other expenses (on air talent, the $300m/year for the SEC rights I mentioned earlier, etc.)

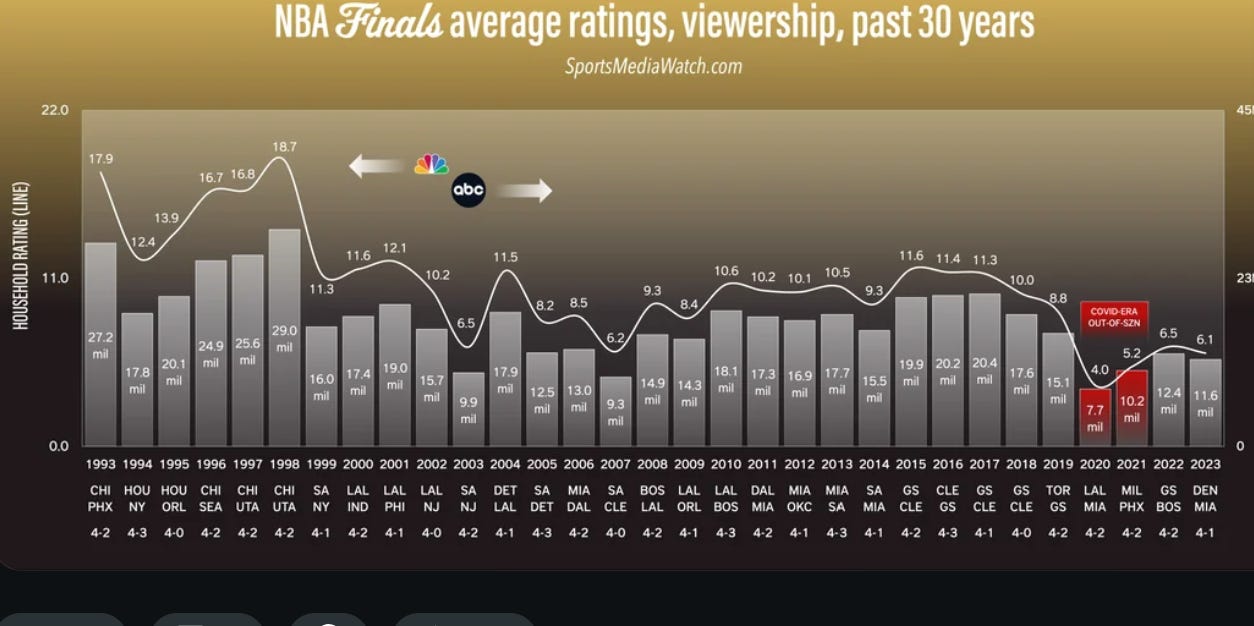

And all of this cost increase has to be considered in another context… the NBA ratings have been dropping consistently for the past 30 years!

So I wanted to (and did!) ask all of those questions in the panel. How were legacy networks considering the risk locking themselves into these long term contracts in the face of ever declining sub numbers? How did they justify the huge numbers they were paying? What did they think about the need / potential to have to shift models midstream if the bundle continued to unravel?

But the other side of the coin is interesting as well.

Legacy media companies had perhaps the greatest monetization engine of all time. In the legacy cable bundle, ESPN would charge cable companies $5-10/month/sub, and they’d get that revenue no matter what their ratings were. And cable bundle subscribers didn’t really have a choice; they couldn’t say “O, I don’t watch football but I do watch basketball, so let I don’t want to pay for ESPN during football months but I will during basketball months.”

In contrast, people subscribe to streaming companies (like Netflix) and tech bundles (like Amazon Prime) by choice. Churn is a real thing (to use a personal anecdote, I’ll sign up for Max when they have a Game of Thrones series airing and then instantly cancel when that’s over)…. and these sports rights are enormous investments! Squid Games apparently cost just over $20m to make and became Neflix’s most watched show ever; Netflix is apparently paying the NFL ~$75m/game for the Christmas games. So for the price of one NFL game (which lasts maybe three hours and whose value basically instantly expires when the game ends), Netflix could make ~4 squid game type shows (with ~6 hours of run time and which will have value weeks or months or even years after its released as people can watch for the first time when it suits them, rewatch a series to prep for the second season, etc.).

So I’d say I wanted to know how tech companies are looking at bidding on media rights…. but we already know the answer to that question: Tech companies love sports streaming rights. It seems like every tech company that touches streaming rights can’t get enough.

Consider Thursday Night Football. Thursday night football originated on Fox, and it ended up being an unprofitable contract for them. Amazon decided to dip their toe into the NFL by getting Thursday Night Football, and it would have gone exclusive to them in 2023…. but, in 2022, Amazon and Fox agreed Amazon could take it exclusive a year early. The reporting said that Amazon couldn’t wait to get the contract exclusive, and Fox couldn’t wait to get the contract off their hands.

What was Amazon seeing in the Thursday Night Football results that made them so excited to take the contract exclusive and eager to take on more contracts, and why were they seeing the contract so differently than Fox (who was airing over legacy cable)?

And it’s not just Amazon who saw the results from a sports package and got eager to buy more. Peacock saw the results from the wild card NFL game they hosted and used that to justify their big NBA bid. You could paint similar pictures for how Netflix came to bid on Christmas NFL games or Apple’s foray into sports.

So I wanted to know what data these streamers were seeing that made them so eager to buy more rights.

Were they looking at sports rights more as customer acquisition vehicles for new subscribers or churn reducers for existing subscribers?

How did improved ability to target advertisements in a stream versus legacy cable’s dumber / more mass advertising impact bids?

Is there a preference for big single events versus months long content? I.e. if the Super Bowl would deliver 100m viewers in one night, but you could get 1m viewers over 100 nights with an NBA package… that comes out to the same number of viewers. Which would be more valuable?

That’s a lot of questions… and, honestly, those were just the beginnings of my questions! Some others included:

How do leagues weigh distribution when evaluating bids? Do they just take the largest check? Or do other things matter?

When the NFL’s deal was up a few years ago, you’d frequently hear that they didn’t want to switch a big package off of broadcast for fear of losing viewers. With Amazon and Netflix taking games (plus Peacock going streaming only for some playoff games), they’ve clearly gotten over those fears… but I wonder if the stigma lingers. Or I wonder if there’s something else: can streaming players point to increased engagement and better data to argue that league’s should actually prefer their bids over possibly richer legacy deals?

Or consider hockey; there were a lot of factors behind its decline, but I think one major one is they left ESPN when ESPN was the dominant factor in sports. How do leagues consider a partner’s ability to boost or decrease popularity (i.e. if I was a small league, I might pay Netflix to carry my games / do a documentary on me after seeing what Drive to Survive did for F1)?

How does shoulder programming (like pre and post game shows) factor into the overall value of bids?

How has gambling impacted sports rights? Have we already felt the majority of impact from gambling or can it continue to increase?

So all of those were the questions top of mind for me going into the interview; obviously we couldn’t come close to diving into all of them in just an hour long panel, but I think the panelists did a great job in the limited amount of time we had helping me get inside the board room and understand how every party (league, broadcaster, etc.) is thinking about sports rights when they make these huge bids.

I really enjoyed the panel, and, if any of those questions are interesting to you, I think you will too. Sign up here if you’re interested (again, it’s free!).

PS- just to make something explicit that I was implicitly stating throughout the article: I suspect part of the reason for the sports rights explosion is that sports rights have been traditionally dramatically undervalued, and their growth was somewhat slowed by sticker shock of the bidders. So that’s why Warner stops bidding at $2B, or why CBS let’s the SEC go for $300m only to buy the Big Ten for $350m. The emergence of deep pocketed big tech players who are willing to bid with fresh eyes and deep pockets (plus other monetization abilities) has escalated the rights closer to their fair value…. but, based on what I was hearing from the panel and what we’ve seen from the big tech players spending (i.e. their eagerness to renew and/or buy rights), I suspect that sports rights remain undervalued and will continue to go up as big tech discovers more ways to monetize and gets more comfortable with integrating the assets.

One key question I was / am interested in…. perhaps how does the sports leagues impact on the rest of the network affect a bid. I.e. maybe the network losses money on the games themselves, but networks are airing nonstop ads for themselves during the game. Things like “check out our new comedy show on Thursday night” or “stay tuned after the game for a special news report.” How does a network think about the boost from those shows / ads?