If you’re following the stock market, the story of the year so far has been anything that touches crypto and particularly AI flying.

But under that absolutely dominating storyline are a few other trends that, to be honest, I find a lot more interesting. One is the difficulty a lot of firms seem to have with their accounting right now, but (to be fair) that is kind of niche.

Another trend that I think has the most widespread implications has been the huge run up in stocks that are “GARP-y” (Growth At A Reasonable Price). In fact, many of these stocks have run up so much that I’m no longer sure if they qualify for the “at a reasonable price” part of GARP. Without the “reasonable price” piece, I’ve started to internally think of these companies and their run ups as a potential “quality bubble.”

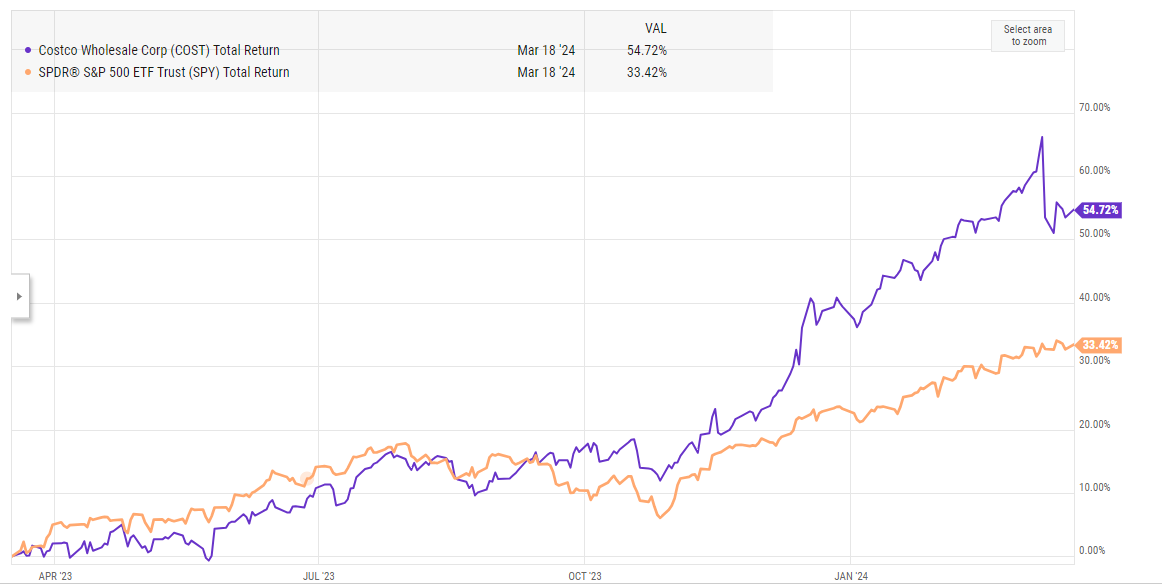

A perfect example of this (potential) bubble is Costco. No one doubts Costco is a fantastic company, but my god does it trade richly. Charlie Munger famously called Costco a “perfect damn company” except for the fact its stock traded at 40x earnings…. and Costco’s stock has only continued to run since that quip. Today, the stock trades for ~50x earnings!

Again, no one is doubting Costco is a great company. It’s got a great moat and the model is hugely defensible….. but it’s not a huge growth company. They grow their store base by 3-5%/year (and that’ll probably shrink a bit as the store base is pretty penetrated in the U.S.) and their membership a bit more than that. Earnings have been growing ~10%/year and seem set to continue to do that for several more years (after that, their existing store base is going to be large enough that growth will have to come down simply because new units don’t budge the needle as much).

So yes, great business…. but it’s tough to see how you generate a great return (or even an above average return) when you pay 50x for a company that’s best case is growing earnings by 10%/year for a few years and then maybe slightly above GDP after that.

My favorite example of the “quality” bubble is in restaurants. Companies like CMG (Burritos), WING (chicken wings), and KRUS (sushi) are all at different points of their growth cycles, but all have proven to have strong unit economics and be best in class in their categories. The market has rewarded them with huge share price appreciation:

So these have all been mammoth winners…. but I think it’d be near impossible to look at their current prices and think they’re priced for anything other than perfection. For example, WING is trading for >100x next year’s EBITDA and ~100x next year’s EPS. Yes, they’re growing quickly (20%/year)….. but they’d be trading at ~20x earnings 10 years from now if they continued to grow at their current pace! CMG is trading for >50x this years earnings; again, they’re growing quickly (>10% revenue growth and ~20% EPS growth as they get some operating leverage), but CMG is ~$10B revenue company sporting a ~$75B market cap. How much longer can they keep up that growth rate; don’t the law of large numbers start to drag it down eventually?

I’ve mentioned this a few times in the past, but when interest rates were really low (i.e. when the ten year was trading <2%), I was always surprised by the multiple “safer” large cap companies traded at. I could understand buying a company like COST for 50x P/E (or a 2% earnings yield) when the ten year traded under 2% because you could look at COST at 50x and say “I’m getting near certain growth and inflation protection at a larger yield than treasuries (plus the tax advantages of long term compounding versus interest rates!); sure I think it’s rich but the opportunity cost makes sense.”

But we didn’t really see that type of behavior / multiple when rates were low. For example, in late 2021, COST was trading for a ~33x EPS multiple. Not crazy cheap in an absolute sense, but the relative value / yield versus treasuries (which were yield well below 2%) was actually pretty good! Today, COST is trading ~50x with 10 years yielding ~4.3%. So in the span of ~3 years, COST’s earnings yield has gone from trading ~150 bps wide of the ten year treasury to ~200 bps inside of the ten year.

Strange / interesting!

Anyway, I realize saying we’re in a “quality bubble” is provocative. Bubbles invite images of popping and speculators crying when they’re wiped out. I don’t think that’s what’s going on with these business; I just think they’re really good businesses that are priced to absolute perfection. My guess is that shareholders from today’s prices generate uninspiring returns over the long run as it’s just really hard to outrun multiples as rich as today’s.

But I’ve been thinking about the “quality bubble” for three reasons

I’ve been wondering what’s these prices / valuations. It’s easy to point at something like Costco and say “index flows,” but it’s hard to point to a smaller company like CMG or WING and say that some type of index flow is causing the valuation inflation. Is there something else going on?

Markets are really competitive places; these stocks seem quite richly priced, but I have been wondering: what’s the other side of the argument? You only buy a stock because you think you can generate long term alpha; what’s the argument for generating alpha buying any of these stocks at the current prices?

Again, the point of investing is to generate alpha. I don’t really see a way to generate alpha in these types of stocks from current prices, so I won’t be buying them…. but I do think one interesting thing to think about when looking at stocks is “could it catch a quality multiple expansion?” Let me give an example: BJ’s trades for <20x current EPS. It’s not as good a business as COST, but obviously it’s a similar model and it’s still a pretty high quality business. I think ~20x EPS seems fair-ish….. but I think you could look at that multiple and say “I’m paying a fair price plus grabbing a free upside option that it joins the quality club” and trades for 30-50x earnings at some point. Looking for that set up is a pretty interesting way to grab optionality in the current market (IMO).

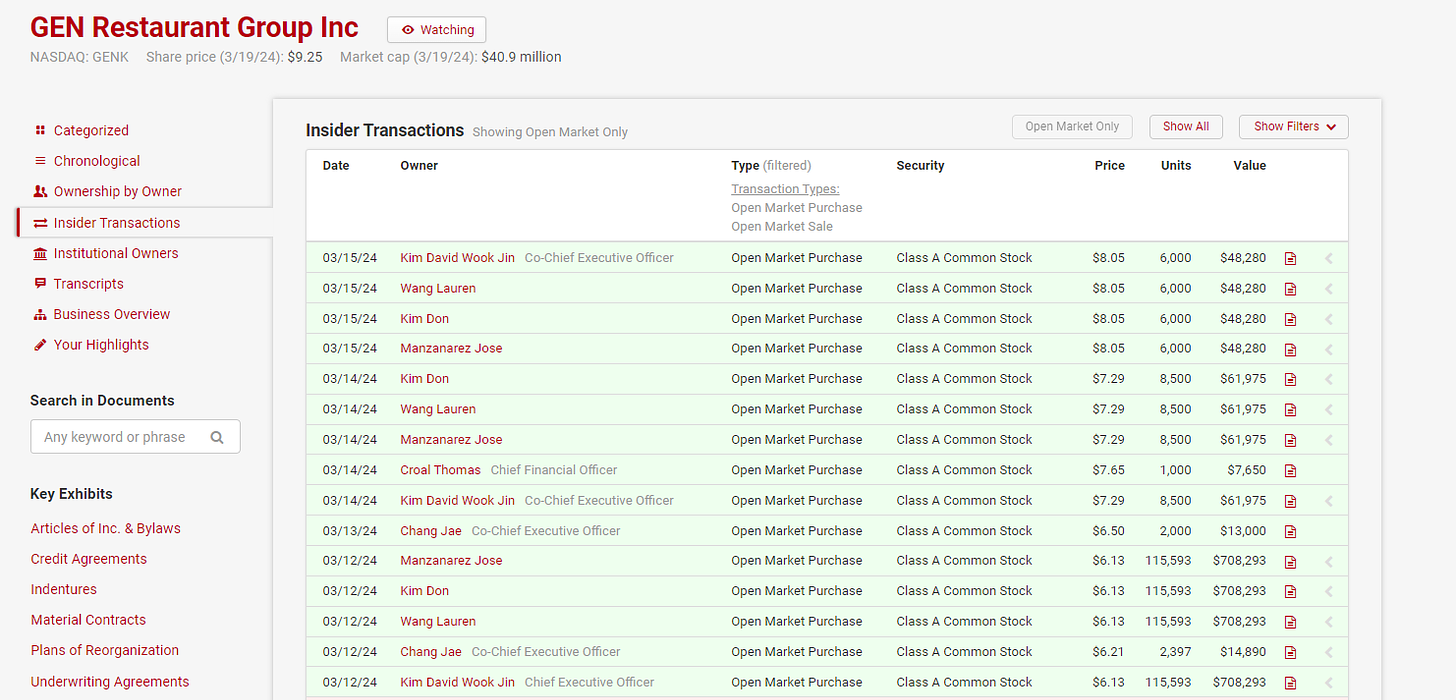

Another example? I’ve seen a lot of investors interested in GEN Restaurant (GENK) recently. I need to do work on it, but the thesis here would be pretty simple. We’ve seen what can happen when you get a category killer right (again, just look at the charts of WING or KRUS); GENK could be the dominant Korean BBQ restaurant, and if it hits there’s a huge runway for growth and a lot of multiple expansion in front of them (and it doesn’t hurt that you’ll get head to some of them for due diligence; I love Korean BBQ!). Plus, they’ve recently had a wave of insider buying

I think some of these name have been picked up in momentum/trend following baskets that are chasing AI stories. For example, COST is a 2.9% weight in MTUM ($9 billion AUM) vs. 75 bps weight in SP500.

I see some of these names as excellent funding shorts right now (COST, WING, WDFC), likely to get caught up in any momentum/AI drawdown, but without the upside explosion risk of something with true AI exposure.

The market is pricing in future rate cuts. Woth short term rates at 2.5% the earnings yield on Costco of 2% doesn't seem that crazy. We will see if the cuts materialize.