The weirdest corporate action I've ever seen $SCLX $SRNE

Can a company orchestrate its own short squeeze?

Upfront note: this article is talking about two risky / small / strange stocks in SCLX and SRNE. I’ll disclose I bought a few SCLX warrants on a lark, so I do have a position here but it is an incredibly small one. On top of mentioning risky/small/strange stocks, this post is going to discuss shorting. I just can’t overemphasize how much risk and uncertainty is involved here; this isn’t investing advice and you should absolutely do your own research. Also, a quick hat tip to this article / author from a few weeks back, which is where I first heard about the situation.

I’ll jump right to the point: the situation at SCLX / SRNE might be the strangest I’ve ever seen. It involves perhaps the strangest corporate action I’ve ever seen (a dividend from SRNE of another company’s restricted shares with the restricted shares not saleable or transferable for ~5 months), some of the strangest press releases I’ve ever seen (several include the contact information for basically every major broker in America), and perhaps the most aggressive attempt I’ve ever seen from a company attempting to initiate a short squeeze.

Given the size, strangeness, and illiquidity here, I was tempted not to write the situation up, but it’s so weird and was taking up so much of my headspace I couldn’t help but put some thoughts to paper. So I’ll reiterate again that nothing on here is investing advice, these two companies are small, illiquid, and quite risky, and you should really do your own work / consult a financial advisor / do all sorts of stuff other than read this blog (might I recommend trying a board game? My wife and I got into Lost Cities last week and it’s just a great two player game).

Anyway, there’s a lot of history here, but for our purposes the story begins in March 2022. SRNE announces a deal with a SPAC to take their Scilex subsidiary public at a valuation of ~$1.64B. Assuming no redemptions, SRNE would own ~88% of the new company, implying their stake is worth roughly $1.5B.

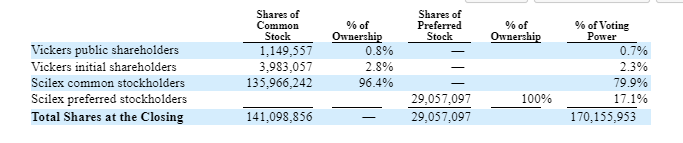

That SPAC deal closed in November 2022. As is typical with SPACs, there was a wave of redemptions. The SPAC SCLX was merging with originally had >13m publicly traded shares out (see p.7 of their 10-Q); by the time all of the redemptions are finished, the SPAC’s public shareholders own just ~1.1m shares, the SPAC sponsors own ~4m restricted shares, and SRNE owns ~136m shares, or over 96% of SCLX (table below from this 8k).

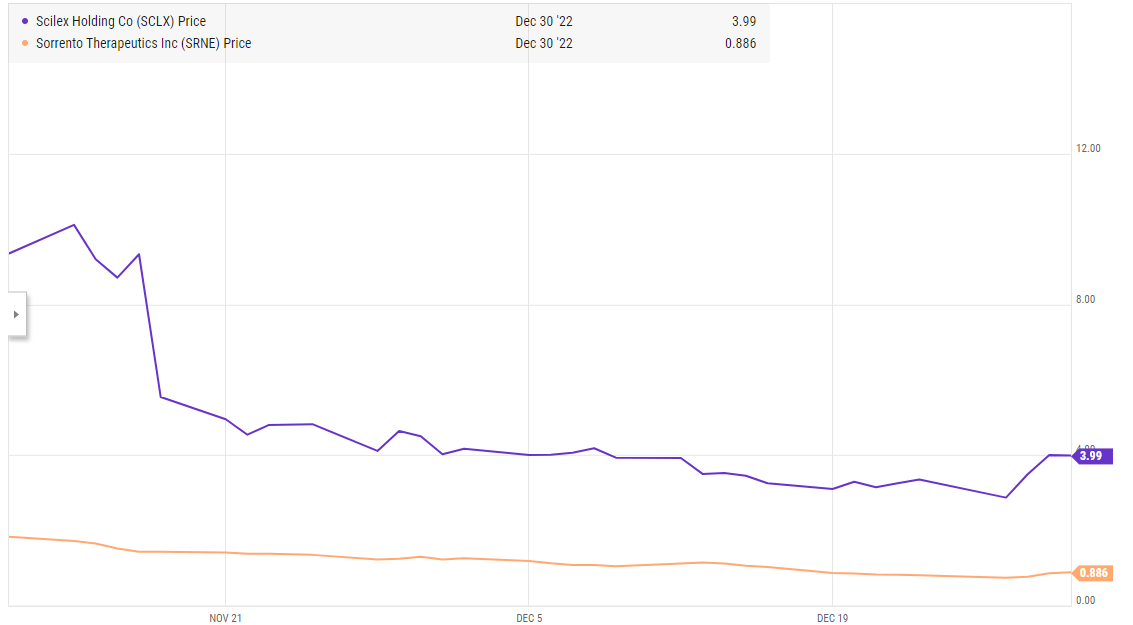

With the SPAC merger finishing, SCLX’s stock quickly sells off into the year end.

That’s all pretty standard stuff for deSPACs. Here’s where we jump in / where things start to get interesting. There are three curious things happening in December 2022 with SRNE / SCLX:

Like most SPACs, SCLX has some publicly traded warrants that give the warrant holder the right to buy stock at $11.50/share. SRNE goes and buys ~1.4m of SCLX’s warrants on the open market (see here and here). That is not a small amount of warrants; SCLX only has ~6.9m publicly traded warrants (that’s per their last 10-Q). SRNE buying warrants on the open market is a very interesting move; SCLX is trading well below $10, and SRNE already owns 96% of them. It’s curious to see SRNE buying something that bets on pretty strong SCLX price appreciation since SRNE already has so much exposure!

SRNE has suddenly become a sum of the parts (SOTP) play. Even with SCLX’s stock crashing post de-SPAC, the implied value of SRNE’s SCLX’s shares are worth much more than SRNE’s stock price. SRNE has ~472m shares outstanding (per their November 10-Q) and (per the table above) owns ~136m shares of SCLX. That’s ~0.288 shares of SCLX / SRNE share. To pick a random day, on December 20 SCLX closes at $3.29/share, so each SRNE share owns ~$0.95 of SCLX ($3.29 closing price * ~0.288 SCLX shares/SRNE). SRNE close that day for <$0.86/share, so at market prices SRNE investors are theoretically getting SRNE’s stake in SCLX for a discount and getting the rest of SRNE for free.

Here’s where things get really interesting: in late December, SRNE quietly announces a move to unlock their SOTP by dividending out 76m shares of SCLX (just over half of SRNE’s SCLX shares) to SRNE shareholders (and I do mean quietly! I don’t believe they even put out a PR; they just file a simple 8-k).

So let’s just pause here. Heading to the end of December, you could paint the picture of SRNE being an SOTP play. They own 135m shares of SCLX, and the value of their SCLX shares are worth more than SRNE’s market cap. Of course, there are only ~1m shares of free float of SCLX versus the >135m shares SRNE owns, so that’s not really an “actionable” SOTP trade.

Turning back to point #3, in late December SRNE announces the dividend of 76m SCLX shares. There are three interesting things about that dividend. In order of least to most interesting:

It unlocks a lot of the value of SRNE’s SOTP from their SCLX shares (not all, as SRNE will retain ~60m SCLX shares post dividend).

It is the absolutely strangest dividend I have ever seen. SRNE’s SCLX shares are restricted shares that cannot be sold or transferred until May 11, 2023. Because of that restriction, SRNE plans (and does) distribute to their shareholders a non-transferable SCLX share that will become unrestricted in May (I’ll link to this PR later, but the dividend is so confusing that SRNE had to publish an FAQ about the dividend which confirms that the dividend shares are nontransferable).

So if you’re a normal shareholder of SRNE, you get some non-transferable shares of SCLX in your account…. but what happens if you’re short SRNE? Per Bloomberg, there are ~60m shares of SRNE short. The SCLX dividend ends up being ~0.141 shares of SCLX/SRNE share, so the shorts are now short ~8.5m restricted shares of SCLX (~0.141 SCLX/SRNE * 60m SRNE shares short). (Note that I came up with that number using Bloomberg; SRNE publishes a PR in early Feb. with similar short share numbers).

Now you may have noticed something from that last bullet point: post dividend, SRNE shorts are short ~8.5m shares of SCLX restricted stock. Per the 8-k / table earlier, there’s only ~1.2m shares of SCLX in the free float.

So you could be looking at ~7x SCLX’s current free float short. That’s a recipe for some fire works.

Of course, the SRNE/SCLX shorts are short restricted stock, not actual stock. They won’t be short SCLX “normal” stock until the dividend is paid out, at which point the free float will be higher. Maybe there’s nothing to see here.

But maybe there is! The SCLX restricted stock is a really funky security; the OCC has needed to publish basically weekly memos to explain how to adjust legacy SRNE options for the SCLX position (I’ve included a sample one below; you can find them all on the OCC site by looking up SRNE. Side note: I’m confused why the OCC decided to adjust the SRNE options for SCLX normal common when the dividend was of restricted common, but whatever).

SRNE / SCLX have also made clear they think the confusing dividend could be effecting how the shares are getting marked in people’s accounts. We’re getting close to the punchline of this article, but basically because the dividend shares are so strange and not currently tradable, a lot of brokers may not properly be reflecting the value of the SCLX dividend shares in people’s accounts. For example, say you owned 100 shares of SRNE; you’d receive ~14.1 shares of SCLX as a result. However, because the shares are restricted, a lot of brokers might have had those shares valued at 0. I’ve also heard a lot of brokers might have valued those SCLX shares at SCLX’s trading price as of the dividend (~$5/share), not at its current price (~$8/share).

That value mismatch probably doesn’t make a big difference for people who were long SRNE… but if you were short SRNE, it could make a big difference for margin. Consider: if you were short 100 shares of SRNE at the start of the month, those shares were worth $100 in total. If you still hold that short, it could be worth anywhere from $100 to $213 depending on if your broker is marking the SCLX restricted shares at $0 (i.e. not valuing them), $5/share (valuing them at dividend price), or $8/share (valuing them at market). That’s a mammoth swing!

So that’s kind of the situation overview. On the one hand, you could look at this all as a very normal corporate process designed to unlock SRNE’s sum of the parts.

But I think there’s a strong argument to be made that the whole thing was a very sophisticated, very long term plan from SRNE to “squeeze” their shorts. It’s quite impressive; the whole thing took almost a year of planning, they had to execute a SPAC merger with a low float, quietly do a dividend announcement of the SCLX shares before anyone had time to cover the SRNE shorts, time the SCLX dividend perfectly so that the dividend shares would be restricted, etc.

But where things get really interesting is I think SRNE isn’t just trying to squeeze the shorts, but they’re planning on profiting from it. Remember, SRNE bought up host of SCLX warrants in late November / early December. They then pulled this dividend transaction off…. and I think they’re now clearly trying to force a short squeeze to happen.

In the past ~week, SRNE has published two different PRs trying to “clarify” the issues around the SCLX dividend (they also pushed out the rarely seen late Saturday night PR with their annual meeting announcement!). The focus of the PRs seems pretty clear: SRNE is trying to scare anyone who is short the SCLX dividend shares in any way. Perhaps more importantly, SRNE might be trying to scare any brokers who have customers that are short the SCLX dividend that the short might be a problem and they should require their customers to cover the shares instantly. Consider the first PR: more than half the PR is devoted to how bad the SCLX dividend is for SRNE shorts and naked shorts (including multiple bolded lines noting naked short positions in SRNE or SCLX could be an SEC violation). There’s also this line

According to recent reports from various brokerage firms lending shares of Scilex common stock for “short” sales, the current borrowing interest rate is estimated to be over 400% per year. If your Scilex common stock is held through a brokerage firm, bank, dealer or other similar organization and you have a “short” position, please consult with your financial advisor, broker or other agent immediately to determine your borrowing interest rate for your “short” position(s) of Scilex common stock.

And this line

Approximately 2.5 million shares of Scilex common stock were unrestricted and freely tradable as of the Payment Date. This public float may be increased if some or all of the unrestricted and freely tradable “public” warrants to purchase shares of Scilex common stock are exercised. The exercise price of the Scilex “public” warrants is $11.50 per share (subject to adjustment for recapitalizations, stock splits and similar transactions and as provided in the warrants).

Finally, SRNE’s most recent FAQ includes a note that they’ve been working with the DTC to make sure the SCLX dividend shares are marked properly in accounts. It also provides the line (in bold) “Several major brokers have confirmed to Sorrento and Scilex that they are adding the Scilex share positions to the individual brokerage accounts of Sorrento shareholders receiving the Dividend Stock” and proceeds to give the contact information for basically every major broker in America.

Anyway, put it all together and it seems clear to me the SRNE is trying to orchestrate some type of short squeeze in the SCLX shares. They spent almost a year positioning themselves to pull one off, and honestly at this point it seems like they might be successful. Their PR and FAQs seem to be making clear: there are way more shares short SCLX than there are free float of SCLX, and they’re trying to make brokers / shorts aware of how much trouble the mismatch could get them in. And remember: the SCLX dividend is non-transferable, so in order to “cover” it a short would need to buy a share of SCLX and then hold it through to the SCLX dividend getting delivered in May, then use their SCLX share to cover the dividend.

I think a good tell of what SRNE is trying to pull is in the FAQ when they talk about the warrants. SRNE notes that SCLX has less publicly traded free float shares plus warrants outstanding than they do shares short from the SRNE dividend of SCLX.

So it seems like SRNE/SCLX have positioned themselves to orchestrate a short squeeze and benefit from one if it does happen. SRNE has all of the warrants they recently bought that they can benefit from, as well as another ~60m shares of SCLX that they still own / didn’t dividend out. SCLX also has two different ATM programs (one with B. Riley; one with Yorkville) for a combined $1B that they can start tapping if their shares get squeezed.

Will a squeeze happen? Who knows! I’m always skeptical of squeezes, but when you’ve got things like Bed Bath & Beyond shooting up ~50% every day despite being (seemingly) days away from filing for bankruptcy, you start to think anything can happen in this market. And SRNE / SCLX clearly seem willing to do whatever it takes to orchestrate a squeeze. Again, I’m skeptical…. but the planning from SRNE seem absolutely masterful, and if a company that has planned something this carefully is this committed to seeing a short squeeze happen, it seems like there is some chance of it happening. So, yes, skeptical… but I’ll disclose I have a very small position in the SCLX warrants and stock in case my skepticism is misguided!

Again, this is one of the strangest corporate actions and situations I’ve ever seen, so I’ll reemphasize that you should do your own work and be very aware of all the risks here.

"the implied value of SRNE’s SCLX’s shares are worth much more than SCLX’s stock price" -- I think you mean SRNE's stock price here.

I'm long SCLX, which I think is the best vehicle for exploiting this situation.

You omit discussing the fundamentals of SRNE and SCLX, no doubt for brevity, but as you are no doubt aware, SCLX has been executing well in terms of getting coverage for and selling ZTlido® and in progressing their pipeline, including SP-102, which is in P3 trials for sciatica pain.

I think SCLX is the preferred vehicle since:

1. It's the subject of the orchestrated short squeeze (duh ... most professional investors are too smart for their own good, so KISS and embrace your squeeze)

2. If you're playing the squeeze rather than fundamentals, by definition you don't care about SOTP, so forget about SRNE

3. While SCLXW theoretically offers more leverage, you likewise shouldn't expect SCLXW to reflect the squeezed value of SCLX (as evidenced by today's price action, where at the time of ranting, SCLX is up more than SCLXW)

4. SCLX is also more liquid than SCLXW, and since it trades 4.5x higher, you can put more capital to work.

I'm looking forward to the sequel where you discus the endgame for SRNE.