Tucows "right" in eNom deal $TCX $NAME

Quick Summary

Tucows is buying Rightside’s eNom division for $84m

The deal appears to be a win/win for both companies

I may have only written this article to indulge my fascination with the one day stock chart and/or to quickly break my plans for the blog. You decide.

One of my plans for this blog was to publish articles in groups of four or five that would fit some overarching theme. So, for example, yesterday’s post on Shoretel (SHOR; disclosure long) would lead into a post on its peer Vonage (VG). Vonage has a fantastic management team but it’s not obviously cheap, so the VG post would lead into a post on the struggles of holding fairly or even slightly overvalued stocks on quantitative metrics when they were helmed by fantastic management teams. That article would center on two companies: Vonage and Tucows (TCX). I also had decided that I was going to start the blog off by analyzing a few companies relatively in depth before just posting random streams of thoughts on companies and corporate transactions.

But then I went on a run and I just couldn’t get the deal Tucows announced on Friday out of my head. So here I am, putting up my second post on this blog and already breaking both my “overarching theme” plan and my plan to kick off by analyzing a couple of companies instead of random deals.

Anyway, Tucows has been written up pretty extensively all over the web, so I’m not going to spend a ton of time talking about them (here’s a decent write up on them over on VIC). I used to hold a big position in them but sold out a few months ago. I (obviously) kick myself all the time over that decision, but that’s neither here nor there for this article (it is both here and there for the article on fantastic management teams though, so expect a good deal of self-mutilation there).

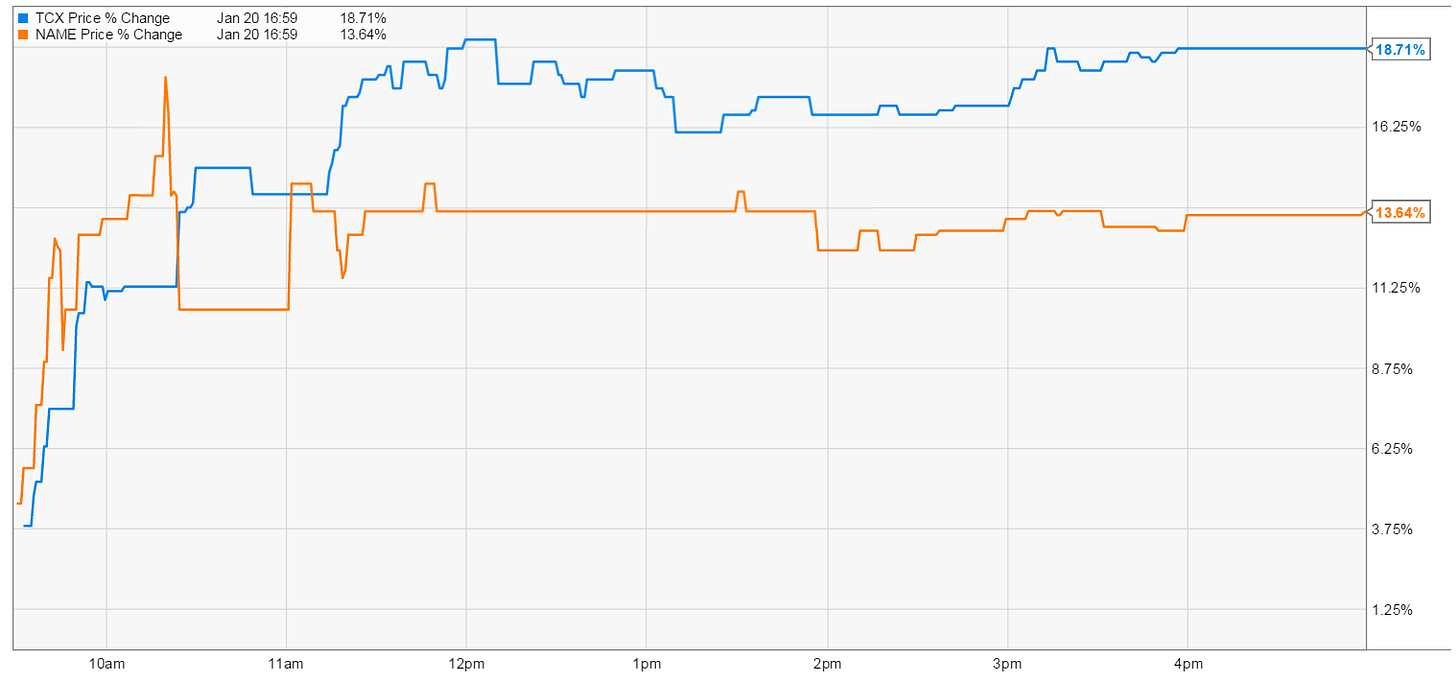

Instead, I just wanted to quickly highlight the deal that Tucows announced on Friday: buying eNom from Rightside (NAME) for $83.5m. Both stocks responded extremely positively to the deal: NAME was up ~14% while TCX was up ~19%.

I don’t want to get into deal specifics too much. Tucows is paying $83.5m (though based on Rightside’s disclosure it seems a working capital adjustment will make the price a bit lower) and is forecasting the deal will add ~$20m in annualized EBITDA (see transcript). It’s obviously a fantastic deal for them, and the market clearly agreed (the stock gained ~$70m in market cap on the 20% move, which is like an 85% return on their $83m investment). Instead, I want to spend all my time talking about how funny I find the random note to investors buried at the end of their deal press release (“NOTE TO INVESTORS: We know that releasing this transaction on a Friday morning, especially this particular Friday morning, is not ideal. We apologize for that. These things sometimes cannot be helped”).

Just kidding, though I am mystified by how funny I find that line. Instead, I wanted to quickly dive into some random thoughts on M&A.

I feel like M&A gets a pretty bad rap among investors, particularly smaller investors. Buffett maybe spearheaded the charge by stating that M&A is driven by bankers looking to spur activity and create fees. Combine Buffett’s warnings with the poor return for average M&A transaction and a couple of spectacular “roll up” blows ups (I’m looking at you, Valeant), and it feels like most investors instinctively associate M&A with value destruction.

But I feel like that’s a pretty poor generalization. For every Time Warner / AOL, there’s an eBay / Paypal or a Disney / Marvel. Yes, you might say that Time Warner / AOL was a random merger while the other two were strategic / in the same field and thus more likely to create value, but then how do you explain Valeant? Every deal Valeant made was within the same field (pharma). Ok, maybe Valeant was a roll up / used a bunch of leverage, but if you’re going to explain that away then what are you going to do with Kraft-Heinz? Or (almost) literally all of the John Malone companies (Charter, Lionsgate, etc.)? All of them use both debt and a ton of mergers to create fantastic value, and I don't see tons of investors screaming "house of cards" or "crazy roll up destined to fail" at them. It’s funny how when a stock / merger strategy works, it’s a “compounder” or a “platform company” (though Valeant has killed that term for now), but when it doesn’t work it’s a “roll up” destined to die. Hindsight's always 20/20.

Anyway, back to Tucows / Rightside. I only wanted to highlight it because it’s such a clear and simple example of how M&A deals can create value on all sides. Tucows is buying a company in a strategic deal that will let them cut a ton of cost and create significant value. It’s pretty clear eNom was non-core for rightside, so selling eNom lets them get rid of a non-core business that I would guess was basically breakeven under their watch (Tucows is going to cut a ton of costs to get it up to $20m in EBITDA) and get almost half of their market cap in cash while they do so.

And, in a desperate attempt to tie this back to yesterday’s Shoretel post so that I’m not already defeating my “overarching theme” rule, I think a problem a lot of investors might have with the company is buying it on the expectation that it selling for a big premium could create value for someone else. I think the Tucows / Rightside deal is a perfect example of how strategic M&A can create a ton of value for all sides when done correctly.

Or consider the case of Alimentation Couche-Tard / CST Brands (CST) last year. Couche-Tard (among the funniest company names in the public markets) reached a deal to buy CST for $48.53 last summer, roughly a 35% premium to CST’s price the day before they announced they were trying to sell themselves. That’s a pretty nice return for CST… but I think the real winners were Couche-Tard’s shareholders. Their stock gained somewhere between 5-10% on the news (depending if you measure from deal announcement or when serious rumors a deal was in the works started floating a week before)… which doesn’t sound like a ton till you remember CST’s market cap is under $5B and Couche-Tard’s is over $25B. Paying a ~$1B or so premium for CST created an additional $2B or so in value for Couche-Tard’s shareholders. That’s the type of value I could see in a Mitel (or Vonage. Or some other strategic) deal with Shoretel. Pay a 30% premium and see your stock go up by a similar amount as the market digests the massive synergies.

Maybe I’m a bit crazy to think that. Or maybe this post was just me indulging myself because I couldn’t get that Tucows / Rightside chart out of my head earlier today. Or maybe I just wanted to prep you, the reader, for how much self-mutilation there will be later in the week when I discuss TCX’s management. Who knows? But the bottom line is M&A has a bad rep among a lot of investors, and I think it causes a lot of investors (myself included) to miss some opportunities by underestimating the strategic value of companies, either as buyers or sellers.

PS- Rightside is hosting a call on the deal tomorrow (Jan 23) after market close, so it's possible everything I mentioned here will be somewhat off with the benefit of more information. I doubt anything major will change but just being upfront about that in case you're reading on Tuesday and thinking "man, what is this guy talking about? Both stocks were down a kajillion percent today."