Two interesting closed end funds at a discount ($CET, $PSH)

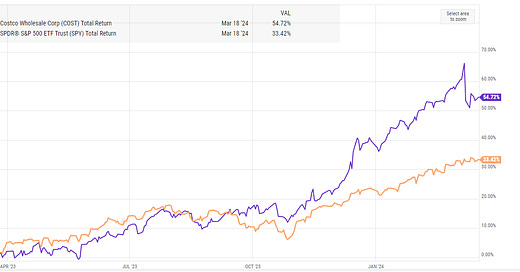

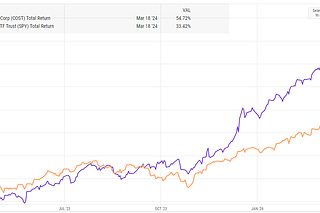

Last week I tweeted out about Pershing Holdings (PSH; disclosure: long) NAV (Net Asset Value) discount widening out, and it got me thinking about closed end funds. A simple fact about closed end funds is they generally trade at a discount to their NAV. Of course, tons of companies trade at a discount to their NAV; however, calculating NAV generally requires some assumptions. For example, I've long argued that MSG (disclosure: long) trades at to wide a discount to its NAV. However, MSG's main assets (the Knicks and the Rangers) are not individually publicly traded / haven't been bought or sold recently, so calculating MSG's NAV requires an investor to make an assumption on what the Knicks and Rangers (MSG's two owned sports teams) are worth. Is that a herculean task? Absolutely not.... between other recent basketball / hockey team sales and the annual Forbes valuation, it's pretty easy to get in the right ballpark of what those teams are worth. As far as NAV stories go, that makes MSG a relatively simple story but it still requires assumptions from the investor / appraiser; more complex stories (like Berkshire-Hathaway) require the investor to value multiple different operating units, so while an investor may pitch the company as a "discount to NAV story" it's very possible that the investor is just being too aggressive in their valuation (i.e. giving one division a 10x multiple when it really deserves an 8x). So what makes closed funds so interesting is not just the simple fact that they trade at a discount to NAV.... it's that they trade at a discount to NAV and their NAV (which generally consists of liquid, publicly-traded stocks) is so easy to pinpoint / rely on. When PSH tells you their NAV is $22/share, management isn't making any assumptions that one unit is worth 9x earnings instead of 8x or 10x; instead, they're simply giving you the mark to market value of their liquid holdings. Given the combo of a discount plus a very reliable NAV, closed end funds have long fascinated me. In particular, closed end funds have appealed to both the "value" investor in me and the "activist" in me. From the value investor's point of view, every day the company does some quick math and tells you what it would be worth if it liquidated all of its holdings and returned the proceeds to you. What could be more interesting than buying the company for a discount to what it could immediately liquidate for? From an activist point of view, the company is trading at a discount to what its telling investors it could liquidate for. Shouldn't running a campaign against a closed end fund by arguing "this company is trading for less than it's worth; let's all just vote to liquidate it, invest the proceeds in an index fund, and all be richer?" be the easiest activist campaign in history? Of course, real life is more complex than the "simple" value / activist investor presented above can see. Sure, closed end funds trade at a discount to NAV, but in general that discount is deserved: closed end funds generally are "closet indexers", and given their perpetual management fee is much higher than an index funds and thus will cause the closed end fund to perpetually under-perform the index, some discount to NAV is generally deserved. And yes, it seems like it should be an easy activist campaign to liquidate a company / closed end fund trading at a discount to its readily realizable liquidation value... but in general the discount to NAV isn't crazy wide, so the upside from realizing liquidation value generally isn't enough to make up for the time / brain drain / expense of running an activist campaign. Anyway, that's my high level overview of closed end funds trading at a discount: in general, they're interesting because of the discount, but with higher expense ratios and no path to narrowing the discount, the discount is probably deserved and there's simply better places to put money to work. Of course, there are a few possible exceptions to that rule of thumb. Today, I wanted to present two closed end funds that I've found myself thinking about a lot recently / currently find interesting Closed end fund 1: Pershing Square Holdings (PSH)

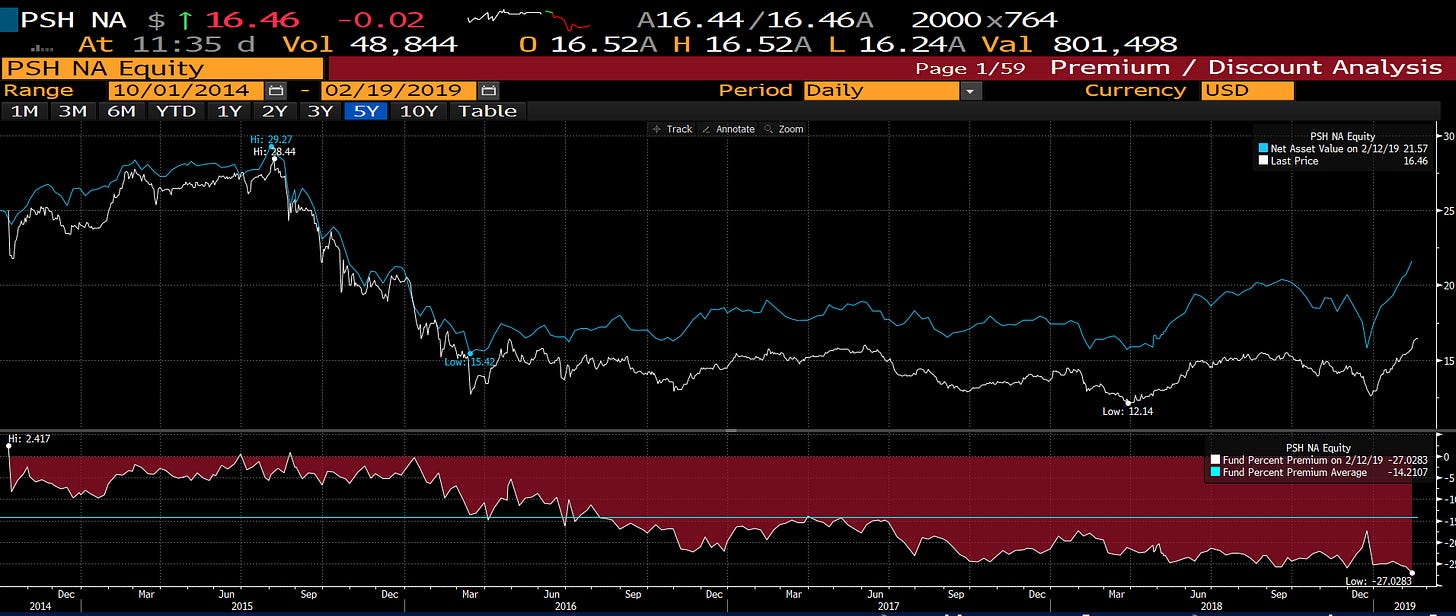

Why is it interesting? Pershing's discount to NAV has widened out to its widest levels since its IPO, and I'm not sure why. I heard several theories when I tweeted the question out; popular answers included people worried about lack of trust in Ackman / the possibility he invests in another Valeant, PSH's status as a PFIC, PSH's leverage, and PSH's high fees. All of those reasons make sense in a vacuum..... but it's not like any of those didn't exist to an equal (or even great extent) a year or two ago, when the discount was narrower than it is today.

Other things of note

Ackman's reputation has certainly taken a hit.... but it's definitely recovered from its "lows" over the past few years. One of the things that got me to look again at PSH was a string of articles like this one in the wake of his solid start to 2018; my guess was that PSH's NAV discount would have tightened substantially given that positive press. For it to widen out was perplexing.

I can't emphasize enough how much it surprises me that the discount is a ballooning given Ackman's recovering reputaton. ~Two years ago Pershing was coming off the Valeant disaster and still had exposure to the Herbalife short, so the book was much riskier (a concentrated short position carries a lot of risk of a short squeeze) and people were much more skeptical of Ackman, yet somehow the discount was 10 points inside of today's?

Some reasons people gave me for the discount existing that I think make some sense:

PSH doesn't give exact portfolio sizing for their positions, which makes hedging the portfolio difficult, particularly in a rapidly rising market. That makes some sense, but you can get directionally in the right ballpark for each position's size with a bit of work, and it's not like this is a new thing, so I don't think it can explain just how far the discount has blown out.

I'll discuss activism again in a bit, but Pershing is an activist fund. Given their lower asset size and Ackman's hurt reputation, it's possible he's trying to apply the same "activist toolkit" but it'll be increasingly ineffective going forward.

A few years ago, Pershing had a ton of outside money. Today, PSH represents the majority of Pershing's capital, so Pershing is reliant on PSH to continue / exist. That reliance makes Pershing substantially less likely to pursue value creation opportunities at PSH that threaten its fee stream (I don't think this is an entirely fair criticism; this will be discussed later, but over the past year PSH has actually repurchased shares / been relatively friendly to outside shareholders, so even with their diminished capital levels PSH seems like they're still treating minority shareholders decently well).

Related to outside money- some people suggested Pershing's onerous restriction terms for LPs meant some LPs used PSH to hedge out their Pershing exposure while they waited to redeem. That's an interesting angle, but at this point given the size of outside money versus PSH I don't think hedging can be pointed to as a reason for the discount to constantly get wider.

One of the things I like about Pershing is that it's the rare closed end fund that provides you access to two things you really can't get on your own or from investing in an index: non-recourse leverage and activism.

Leverage: PSH has bonds outstanding that lets them go ~125% long. Could you go net long 125% in your portfolio? For sure.... but that leverage is recourse to you, which means you may be forced to sell in down months / you may have some sleepless nights in really bad months. Obviously going long PSH is not the same as going levered long an index, but it is interesting to think about it as a comparison. If you could find 10 levered closed end funds similar to PSH that were 125% long and went long all of them, you would effectively have created a diversified levered long portfolio with no recourse / margin call potential.

Activism: Most closed end funds are simply closet indexers. Ackman / Pershing Square is an activist fund, so you have the chance for them to do something unique that other funds can't do / don't have access to (something like his controversial Allergan / Valeant trade, which generated mammoth profits that were only available because he was plugged in and willing to go activist).

Sure, Pershing's fee stream is high (1.5% of NAV as a management fee plus 16% of gains as an incentive fee), but again, the fee structure has been high the whole time this structure has existed so I don't think you can point to it as the sole reason for the discount existing. In addition, the fund's below its high water mark ($26.37/share); given there's no return hurdle for the high water mark at some point these fees will almost certainly be paid so you certainly need to adjust for that when thinking about the fees and discount long term, but with NAV currently <$22/share you've got a bit of a cushion before you need to start paying.

The management fee is paid on net assets, not total assets. As mentioned above, Pershing is leveraged and that leverage is non-recourse to you. Given the combo on non-recourse leverage plus management fees not being paid on any assets that are leveraged, some leverage is absolutely ideal for minority shareholders.

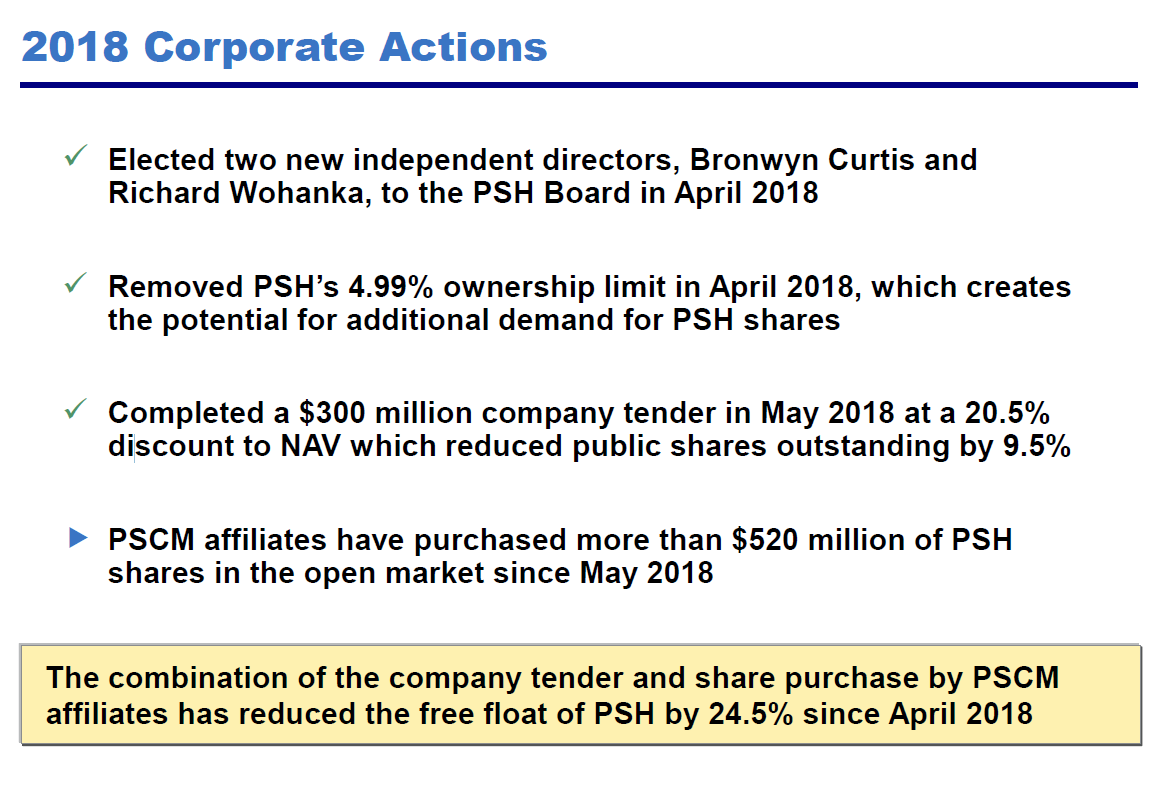

Another reason I'm surprised the discount has widened over the past year: Pershing has shown itself to be pretty friendly to minority shareholders. That was not a given; Pershing could have just kept cashing those checks and told minority shareholders to take their complaints and shove it. Instead, they've done a tender and insiders have bought a bunch of shares.

Somewhat countering this: Pershing recently initiated a small quarterly dividend. The reason they gave for that dividend was to open themselves up to a wider investor base. Pershing is supposed to be financially sophisticated; returning capital through a dividend when shares trade at a huge discount to easily accessible NAV is absolutely awful capital allocation. If a company Ackman was invested in that traded at this wide a discount chose to start a dividend instead of repurchasing shares, Ackman would be using that as an example of why his team was needed on the company's board.

Closed end fund 2: Central Securities (CET; disclosure: long)

Why is it interesting? Central Securities is a closed end fund with a long history of out performance; despite that history (I recommend reading this VIC write up for some background), the company trades at a substantial discount to NAV (as I write this, it trades for a >18% discount to NAV). However, CET is reasonably concentrated, with ~22% of its NAV made up of a private holding (Plymouth Rock, an insurance company which I will intermittently refer to as PR). I suspect that Plymouth is held for a substantial discount to its fair value on CET's books.

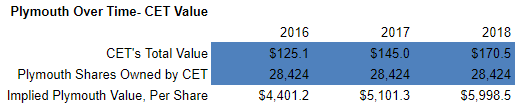

Below is how Central Securities has valued Plymouth in their annual reports over the past three years.

Why do I mention how CET values Plymouth? Well, CET's annual report notes that because the Plymouth stake is illiquid, they chose to apply a discount to its fair value, and the board chooses to apply "a discount for lack of marketability in the higher end" of the possible ranges. That's interesting: if CET's Plymouth stake were to become liquid for some reason (Plymouth got bought out or went public), that means CET would see an immediate boost to their NAV as that illiquidity discount started to vanish.

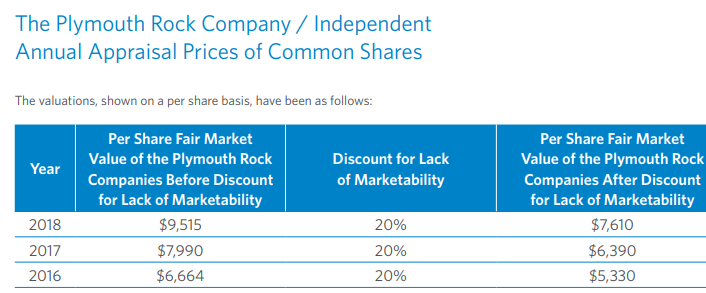

How large is CET's discount on the Plymouth stake? Well, each year (I believe in April, though I haven't confirmed), Plymouth publishes their appraised value for their stock.

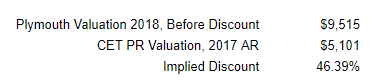

Why does that matter? Well, remember that these "Plymouth Appraisals" are published towards the middle of the year (i.e. the 2018 value is published in April 2018). By comparing those appraisals to CET's value the year prior (i.e. by comparing Plymouth's 2018 appraised number to CET's valuation of Plymouth in CET's 2017 annual report), we can see how big a discount CET is putting on their Plymouth stake. And the discount appears to be really wide; here's the math for CET's 2017 number:

Valuing CET's Plymouth Stake at fair market value without any liquidity discount would add ~$4/share to CET's NAV (ignoring taxes, which are a real problem and I'll talk about in a second), blowing out the NAV discount from ~18% today to ~26%. There's reason to think there could be more upside to that number: Plymouth has been absolutely crushing it, and it appears the company values themselves at ~1.5x book value. If you look at recent transactions in the space and Plymouth's history of value creation, it's likely that valuation is substantially below where Plymouth would be valued if there was ever a real value realization event (i.e. a merger).

Other things of note

The biggest downside to CET is tax related. CET tends to hold stocks / companies for years, and they have some huge unrealized gains in their portfolio. The Plymouth Rock piece takes the cake (they have a cost basis of $0.7m versus a fair market value approaching $200m), but some other positions have big unrealized gains in them too (for example, they have an Intel (INTC) position that's up more than 5x). As a closed end fund, CET doesn't pay taxes, but if it ever sold those positions it would dividend out those gains and shareholders would need to pay taxes on them. This tax position can be pointed to to explain much of CET's current discount: assuming a 22.5% tax rate, CET's deferred taxes represent an NAV drag of ~$2.70/share and CET would be trading for ~90% of NAV on a tax adjusted basis.

Despite the tax drag, I think CET's interesting. There's still plenty of upside from marking Plymouth to fair value, and CET would be particularly interesting for non-taxable investors who wouldn't need to pay taxes on distributed gains (I'm not a tax advisor and that's not tax advice; just an observation!).

Outside of taxes, the big risk to CET is if the Plymouth stake is simply overvalued. I don't think that's the case; you can look through Plymouth's annual reports and see that their appraisal generally values them at ~1.5-2.0x book value and 15-20x trailing EPS; both marks seem reasonable to conservative for a well run, growing insurer.

There is a history that suggests when CET sells Plymouth shares, it is at a premium to CET's mark. In their 2012 annual report, CET valued Plymouth at $2,350/share; in July 2013, CET sold ~half their shares back to Plymouth for ~$2,650/share (a 12-13% premium to last mark). I'd guess that in an IPO or merger, CET would get an even bigger premium on their PR shares.

CET's CEO (William Kidd) has a great, multi-decade track record, and insider ownership (between him and a foundation his wife controls) at CET is really high. Kidd is also 77 years old, and while his son is on the board he doesn't appear to be involved in the business. At some point, I'd guess succession becomes a topic, and I wouldn't be surprised to see the company look for a tax efficient way to rationalize their PR stake at that point. Just spit balling though.

PR appears to be performing really well. I'd recommend reading their annual reports (2018 should come out in April). CET took a huge increase to their valuation of PR in 2018; based on prior years, I would guess CET only takes that increase if PR knocked it out of the park in 2018, so I'd suspect we see some really good numbers and a big bump in PR's appraised value when their annual report comes out. I would not be surprised if PR was a target M&A at a big premium at some point (I've seen some compare PR favorable to other specialty insurers that were taken out at big multiples; I don't think the comparison quite fits but at these prices you certainly are not paying up for the comparison).

Capital allocation is rational here (CET repurchases their shares when they trade for a large discount; in 2018, the only time they repurchased shares was when markets were melting down in Q4 (see item 9). Well done!), fees are low (~75 bps of net assets), the company's track record is really good, and investing in CET gives you access to an insurer with a great track record (Plymouth) that you can't get access to through any other investment. The combo of all of that suggests CET should trade for a pretty tight NAV discount; even if you tax adjust CET's stakes and give them no credit for upside in their PR valuation, CET trades for ~10% discount to NAV. That still seems to wide to me. I guess it makes sense given the market is scared of an illiquid stake without an easy way to value it, but it seems to me like the NAV CET presents is extremely conservative and I'm surprised the market hasn't picked up on that.