Venturing through the GCI proxy $LVNTA

Note: I wrote this LVNTA / GNCMA (disclosure: I'm long both) update in late September; however, I didn’t want to post it till the shareholder votes went through. As we inch towards the deal closing / as hordes of investors post the idea on Sumzero (and I’m sure posts on VIC, Seekingalpha, etc. are coming soon), I figured now was as good a time as any to #releasethepost. I’ve mainly left the original post unchanged (except for updating some stock prices) and have included an update insert when I’m adding something I think is new / relevant. I believe everything in the post should be fully up to date but there is a chance a stale number or two slipped through.

Liberty Ventures (LVNTA, disclosure: long) remains among my favorite situations. Most of that bullishness comes from my continued bullishness on Charter (disclosure: long through the Liberty structure), which Liberty Ventures is effectively a levered play on. But with the preliminary GCI proxy filed, I wanted to take a few seconds to throw around some updated thoughts on Ventures.

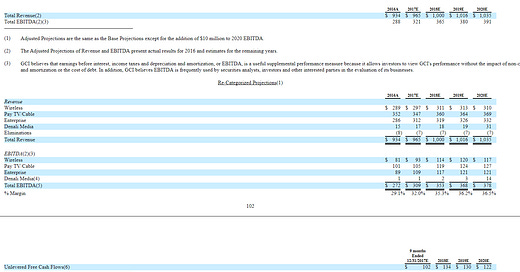

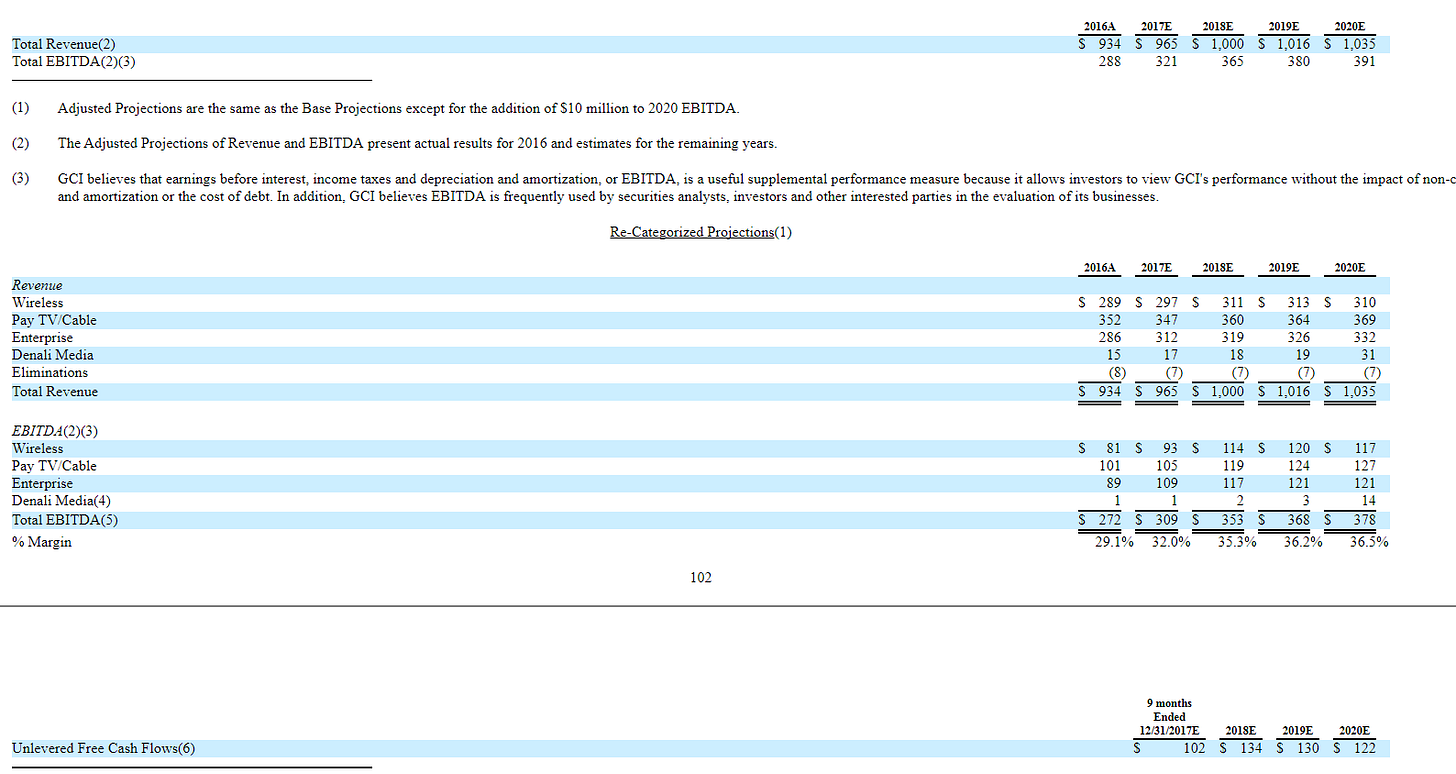

Let’s start with the most obvious new information since my last post: GCI’s projections for their core business on p. 102.

Remember, Liberty is buying GCI for a headline EV of ~$2.7B, of which ~$1.12B is equity split between $950m in LVNTA stock (at the time of the deal) and $170m in preferreds. I saw a bunch of people who looked at the projections above and compared them to the GCI $2.7B EV and said “wow, if GCI really hits those projections, Liberty is getting a great deal!” And that’s certainly true: it’s tough to find an example of any other cable company that trades for <7.5x forward EBITDA (which is where Liberty will have effectively bought GCI when the deal closes). Now, GCI is a quad play cable company and a larger percentage of their earnings are coming from government subsidies and network transport / backhaul type revenue than someone like Charter, so it might not be 100% accurate to compare GCI’s multiple to other U.S. cable companies, but even if we took the analysis much broader (to the EU quad-play cable companies, which face much more competition and regulation, or just generally to mission critical + economical resistant infrastructure type plays), it would be hard to find a comparable company trading close to this low of a multiple.

But the multiples we’re talking about are based on GCI’s proxy estimates, and it’s my guess that those estimates (particularly the out years) are somewhere between conservative and wildly conservative. To show one example of why I think numbers are conservative, take their unlevered free cash flow (FCF) number: GCI is basically forecasting unlevered FCF declining each year from 2017 – 2020 (I’ve annualized the 2017 number) despite EBITDA growing by >20% over that time period. I believe GCI’s FCF situation can be a little wonky because of taxes (they have a bunch of NOLs but some issues with a warrant that was doing strange things to their historical taxes; for example, their 2016 10-K notes they were projecting a 60-65% tax rate for 2017), though I think a lot of that gets simplified in the merger (as the warrant is paid off and the tax geniuses at Liberty take over). But, tax wonkiness aside, how does it make sense that GCI’s FCF would decline every year in the projection while EBITDA is increasing? There are only three ways to explain that continual free cash flow decline:

They are making massive investments into their network.

Why this can’t be the case: GCI is forecasting <2% annual growth in 2019/2020, so either they are not forecasting massive investments in the networks or they are forecasting them and just not providing themselves with any payoff for the investment. And remember- they are just coming off a really big capex cycle (per the Q4’16 conference call: “I would just note that we continue to spend an awful lot of money on Terra, and we are going to continue to spend that this year in 2017….. we are not going to parse out the financials there other than to note… there is some growth there”), so in this scenario GCI is basically forecasting continued elevated capex with no payback. Investing in big capex projects with no returns is not very Liberty like, to say the least.

The taxes are still really wonky

Why this can’t be the case- It certainly could, but, in general, a company is probably underselling themselves if they are using a temporary super high near term tax rate to guide their projections they are using to sell themselves on. Generally a seller would try to show projections that normalize the tax rate to give them negotiating leverage. And if wonky taxes are the reason FCF is so low in the near to medium term, then shareholders are probably going to be pretty happy when the tax rate normalizes and cash flow shoots up in ~2021. Update- I wrote this before tax reform passed, which should further boost after tax FCF.

Management undersold the forecast

Why this can’t be the case- No management team has ever given a conservative assumption in order to sell their company on the cheap simply so they could go work for an owner they liked (GCI’s management team has a decades long relationship with Malone as they were part of TCI until 1986 and had glowing quotes for Liberty in the deal announcement) and receive an attractive employment agreement (Liberty is well known for providing their CEO’s with aggressive comp structures that can really reward them for performing well; Charter’s CEO has the potential to be a billionaire in the next few years thanks to his employment agreement). Remember, management teams exist solely to maximize shareholder value in all cases (see point #15).

There are plenty of other questions with GCI’s projections (like why margins barely expand after a jump in 2018 despite all the different LT cost cutting initiatives they’ve mentioned), but they’re all pretty connected so let’s move on.

So if I think management is lowballing estimates, the obvious question is why management would do that? I think the answer can be found in the background section of the proxy. If you look at p. 81 of the proxy, Liberty and GCI’s management discuss a 5 year employment contract, including an aircraft agreement for the CEO, on February 7th. This discussion is while GCI and LVNTA are still negotiating the price for the whole company and ~two months before the final acquisition agreement is actually struck. Now, I’ve never been on the inside of a public M&A transaction, but I would guess having a management team lock up executive agreements for the use of a private jet before an official deal is struck isn’t considered a best practice. But that’s just a guess, who knows?

Also worth considering: GCI wasn’t shopped. So you have a management team that had already locked up a long term employment agreement and a company that wasn’t shopped getting acquired by the best cable investors / allocators of our generation. I feel like that’s pretty fertile grounds for a bit of undervaluation. The headline acquisition price for GCI in the merger is $2.7B and that’s what most people seem to use for their NAV; can you fault me for taking the over there?

There’s another clue in the background section that Liberty thinks GCI’s value is well above the price they struck for it. Page 80 of the proxy notes that LVNTA’s first approach to the GCI board was for $27.50 in LVNTA stock while highlighting that the NAV of LVNTA stock suggested GCI was actually getting $38/share in value. GCI counters by just asking for $38/share in LVNTA market value. Liberty rejects the $38 proposal but agrees that, going forward, they will base negotiations on the market value of LVNTA, not LVNTA’s NAV. Liberty then goes on to strike a deal that includes the same $27.50 market value of LVNTA stock (which is actually even less dilutive due to an increase in LVNTA price since negotiations started) but adds in some preferred stock to increase the consideration to GCI. Add that background to the quote below from Greg Maffei on the GCI merger call, and I think it’s pretty clear that Liberty knew exactly how much value they were paying to get GCI and thought GCI was worth significantly more.

“Now, some of you may question the issuance of Liberty Ventures shares at this price with the perception that there's a discount. But we can tell you that we spent a long time thinking about the long-term value of this deal. And, driven by the tax efficient growth of GCI and the opportunities opened up, we are very bullish that this will more than offset any value through the dilution of the issuance of these Liberty Ventures shares. As I said, one of the biggest drivers of this is the tax efficient separation of Liberty Ventures including its stakes in Liberty Broadband and Charter. But I want to note, we are also very bullish on GCI. We're very excited to have Ron and his team join. There are significant cost and growth initiatives that GCI had, and we remain very optimistic on their business.”

I’m generally pretty wary of trusting management teams with rosy projections for a merger. And it’s certainly possible that Liberty could be wrong on GCI’s core value for a variety of reasons, or perhaps I’m underestimating just how valuable Liberty found the tax efficient split of LVNTA to be (after all, the Charter and Broadband stakes do have a lot of deferred capital gains on them!). But I do think when you consider Liberty’s history of M&A and add it to the awful negotiation process from GCI, it’s pretty reasonable to think that Liberty thinks they are getting significantly more value in GCI than they were giving up in LVNTA stock at the time of the merger (and, given Liberty’s background, they are probably correct).

Here’s a little fun with math: LVNTA’s NAV was ~$61.50 at the time of the merger (per p. 110 of the proxy) versus a market price of $44.48 (~38% higher). If you think Liberty believes LVNTA should be worth NAV (and, based on both management statements and Liberty’s corporate history of value realization, I have no reason to believe it shouldn’t or that management believes otherwise), then Liberty knew that they were giving up ~38% more value than the headline LVNTA market price to get GCI. Liberty paid $1.12B in equity (of which ~$950m was LVNTA stock) to get GCI; adjusting that $950m for the 38% discounted NAV suggests Liberty was valuing GCI’s equity for at least ~$1.5B ($950 * 1.38 + $170m in prefs) and the overall EV at ~$3.1B versus the $2.7B headline EV. That $400m difference would add ~$3.70 to LVNTA’s NAV; a not insignificant amount given today’s share price of ~$55 and NAV of ~$65. And again, I would guess that if Liberty thought they were effectively paying $3.1B for GCI, they thought they were getting even more in value.

The bottom line with LVNTA is that it remains, at its core, a bet on Charter. But their GCI ownership will play a significant role in LVNTA’s overall returns, both because it represents 25-30% of LVNTA’s asset base and because GCI’s cash flow will fuel share repurchases going forward. And, given the merger background and Liberty’s history with cable assets, I’m happy to bet that the GCI story will play out well.

A few last, random thoughts on the LVNTA

One thing that I haven’t seen discussed a ton on LVNTA (if at all) is their ownership of Lendingtree (TREE). LVNTA owns 20-25% of TREE (depending on how you account for the shares that LVNTA has effectively sold calls against that are now in the money) with a pretty low tax basis. I would not be shocked to see those shares eventually spun out into a somewhat levered tracker (similar to LTRPA) at some point, though I’m happy to hear from more experienced Liberty watchers if they think there’s a different endgame.

Update- Tree’s stock has been an absolute rocket ship recently, which I think increases the chances of a TREE spinoff in the near to medium term.

It seems pretty clear / near certain the end game for LVNTA and LBRDA is the two of them merging together and then eventually merging with Charter (or perhaps just merging all three of them together at the same time). The synergies between GCI and Charter would certainly be pretty high. GCI is projecting their cable division to do ~34% in EBITDA margins in 2020; Charter will likely be doing well over 40% by that time (with an eye towards 45%) and will have huge synergies just from putting GCI on to their video and equipment purchasing contracts. Just assuming synergies in the cable division would get GCI’s cable up to 40% EBITDA margins would add $22m to GCI’s 2020E EBITDA, or a ~6% increase to the whole company’s EBITDA. I don’t have enough to get super granular here, but between CHTR / GCI synergies and continued growth I don’t think it’s crazy to think Charter could get GCI’s EBITDA to ~$500m by 2022 (assuming a deal in 2019/2020). Could they (Charter) value GCI at $4B and still have the deal be crazy accretive to Charter? Absolutely. And that EBITDA number might end up looking conservative- on top of being the largest cable company in Alaska, GCI is also the second largest wireless company so they have a true quad-play offering. GCI’s data penetration is 51% of homes passed versus mid-40s for Charter, and the competitive intensity for Alaska should be much lower given it seems like GCI is generally competing with inferior DSL or satellite type competition (I don’t think there will be a fiber to the home product like Fios getting built out in Alaska, so cable should have a continued strong advantage in speed in Alaska). Given higher data penetration, lower competitive intensity, and the ability to quad-play bundle, why couldn’t GCI’s EBITDA margins be higher than Charter’s in the long run / in a merger, particularly once you factor in the synergies Charter’s size / scale would bring in a merger?

Speaking of endgame- CHTR currently isn’t paying taxes due to NOLs. They’ll burn through those at some point in the next few years. If they were to eventually merge with LBRDA / LVNTA, I wonder if it could be structured in such a way that Liberty is the buyer for tax purposes, which would allow them to step up their basis in Charter and create a huge tax shield. I’m not a tax expert and there would be tons of complications in doing so, but just a thought.

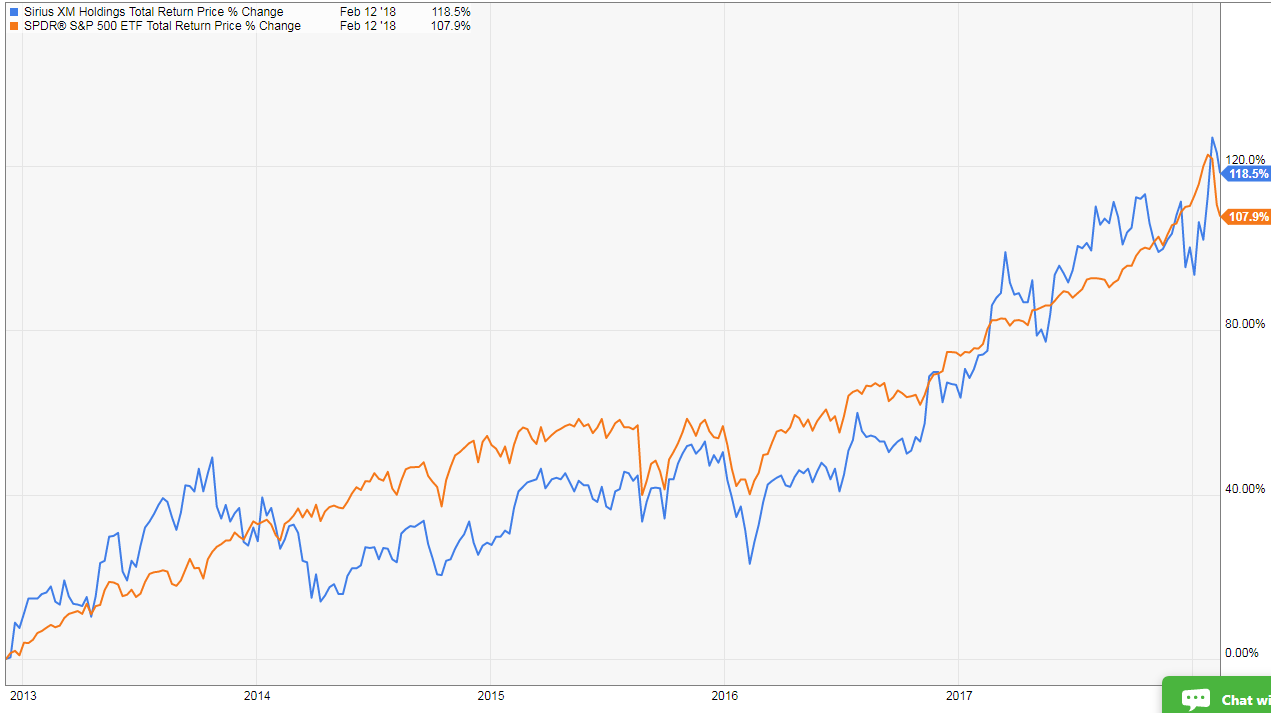

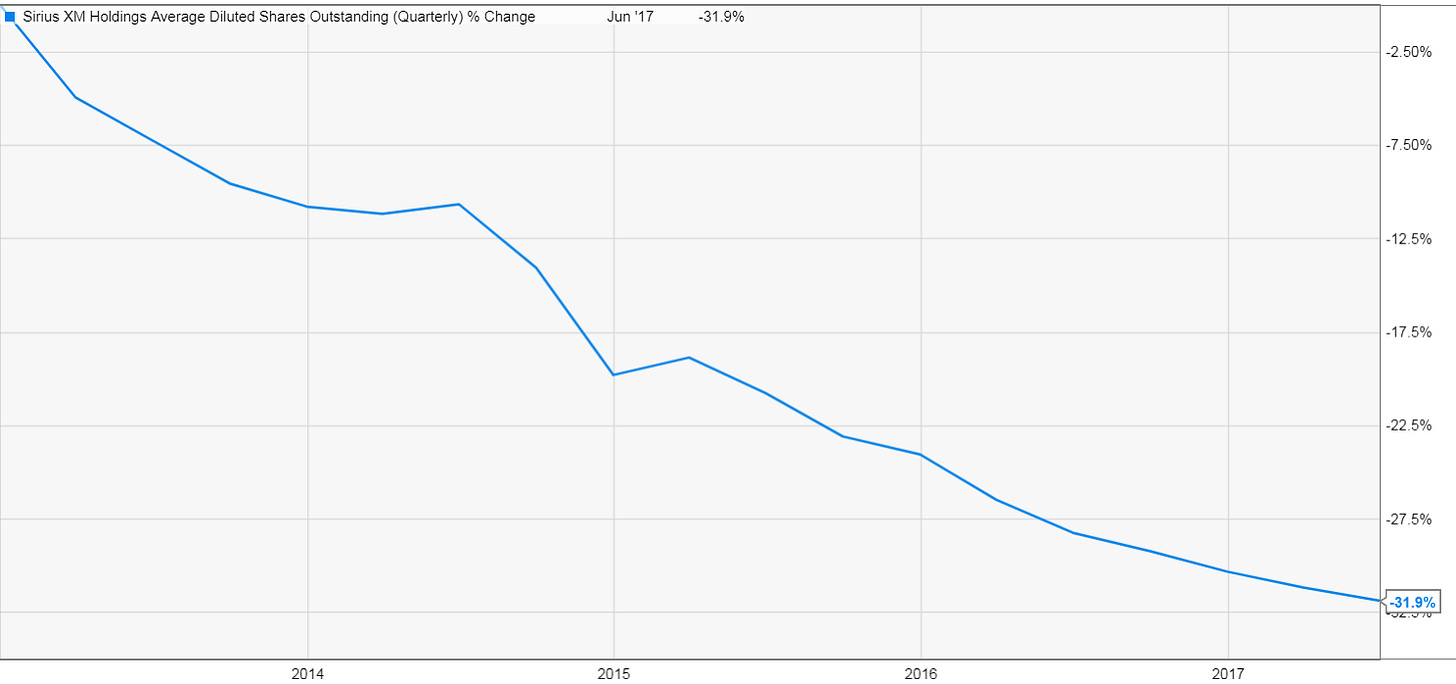

I know some people who disagree with me that a LVNTA / LBRDA collapse into Charter is the near to midterm endgame (it’s almost certainly the endgame in the super long term, either because an acquirer takes them all out or Charter simply runs out of shares to repurchase). In LBRDA / CHTR, they see parallels to LSXMK / SIRI- a holding company that holds a significant stake in a public company that has that stake increase significantly over time as the public company directs the majority of its cash flows to share repurchases. While that may not be the ideal scenario for LBRDA as LSXMK (which I am long) currently trades at ~75% of NAV (which consists solely of its majority ownership in SIRI), CHTR’s stock would probably perform really well in this scenario and drive share appreciation across the entire holding company complex.

Since Sirius announced their first share repurchase in late 2012, shares have outperformed the S&P 500 while diluted shares have dropped by >30%. CHTR shareholders could do a lot worse than a chart that looks something like the two below!

The one thing to note here is that, regardless of what happens with Charter and Liberty, LBRDA / LVNTA will almost certainly collapse / merge with each other eventually, and GCI’s cash flow would allow LVNTA to continue to repurchase shares after the collapse. That’s something LSXMK doesn’t have (really their only holding is Sirius stock) and which should serve as a bit of a floor on how much of a discount to NAV LBRDA / LVNTA shares can trade at over the long term.