In June, I put up “Why does Big Tech Seem to get so cheap all of the sudden.” I got lots of really interesting responses and answers to the question, and there was some kernel of truth to all of them.

But my answer to the cheap question was “the risk to big tech is that their moats get eroded, and big tech gets cheap when their moats seem most at risk.” I continue to really like that answer, and I’ve been thinking more about it and expanding on it.

An investment into a large tech company could be simplified into two return streams: you get a market like return plus the return for bearing the idiosyncratic risk of their moat suddenly breaking and the company crashing in value. Every year that the moat doesn’t break, you generate alpha. Some years, the tech moats seem completely unassailable; when you buy them in those years, you’ll generate only a little alpha going forward for holding the tech stocks because the prices are pretty high / they’re not pricing in much risk (I think of big tech stock prices in late 2021 as exemplifying this “low risk” pricing). Some years, the tech moats seem to be hanging on by a thread; in those years, the stock prices will be low and you generate a heck of a lot of alpha for buying and holding the tech stocks (big tech stocks in late 2022 had a lot of this priced in). Of course, I do think you could question if that’s real alpha or just return for bearing that idiosyncratic risk (everything dies eventually; one day a big tech moat will break and the stock will drop 20% as people worry it’s breaking and then another ~75% over the next three years as it becomes clear the business is imploding).

Obviously that framing is a little oversimplification, but I’ve come to really like that way of thinking about investments. A lot of investments can be boiled down to one or two major risks, and I like thinking about investments as trying to boil it down to one or two risks and deciding if I want to “clip the returns” for underwriting those risks (I’ve coined it “risk riding” in my head, because you’re kind of riding a wave and, as long as the wave doesn’t crash on you, you’ll move forward / generate alpha).

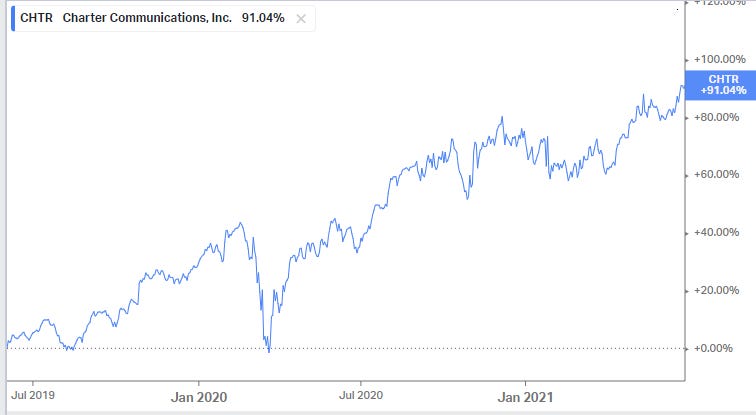

Ok, maybe that sentence is a little too trippy / theoretical, so let me try to give a recent example. Consider the cable companies like Charter. At its core, an investment in a cable company is underwriting one big risk: in most markets, cable and fiber have a monopoly or duopoly position for delivering broadband. Buying a cable stock is underwriting the risk that monopoly / duopoly position will get broken.

So, from ~mid-2019 to ~mid-2021, broadband demand is exploding thanks to the pandemic, and fiber and fixed wireless roll outs (that bring competition to cable’s markets) still haven’t started on huge scale. In that world, cable stocks rip higher because the market is assigning little to no risk of the monopoly / duopoly breaking.

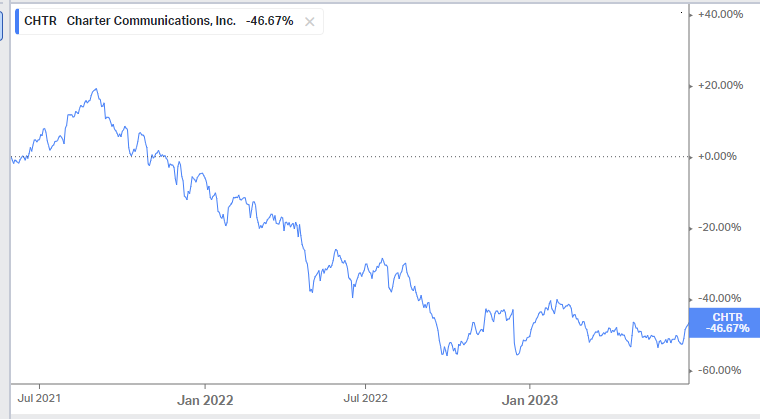

Then from mid-2021 to mid-2023, we get waves of fiber upgrade announcements from legacy telecom players, and T-Mobile and Verizon both roll out fixed wireless broadband products that take more share than most observers expected. Suddenly the risk of the monopoly breaking looks higher, and shares respond by adding a bigger risk factor (i.e. they drop hard).

Again, not perfect / there is certainly simplification in there, but it’s an interesting way of simplifying stocks and set ups.

In general, you want to buy stocks when the market is terrified of the one “big” risk and you can correctly identify that the market is wrongly terrified or too scared of it (I think cable earlier this year counted, and it likely is still roughly there; if you look at the current cash flows versus the stock prices, it seems pretty obvious the market is forecasting cable losing some market share / having some type of deflationary price war as new entrants continue to come in).

Anyway, I’ve been thinking about this framework a lot recently because of the recent Charter / Disney dispute and its potential knock-on effects for network affiliates like Nexstar (NXST).

For those who don’t know what a network affiliate is, I did a long write up on network affiliates back in 2019 that holds up pretty well, so I’ll refer you to that…. but, if you want a refresher, a network affiliate is a company that owns an affiliate of a big four network (ABC, FOX, CBS, NBC) in a variety of market. They do this because legacy broadcast rules placed limits on how much of the nation a single company could own the broadcast rights to. Because of those rules, the network would enter into “affiliate” agreements with a third party who would carry the networks programming in areas where the network couldn’t own the station. So, for example, Nexstar owns the ABC affiliate in my home market of New Orleans.

Historically, being a network affiliate is an incredible business; the networks were at the core of the legacy cable bundle, so they had great pricing power as cable grew. Without the internet, the local news was the prime way many people got their news, so the network affiliates combined a capital light business model (they had basically no capex, the local news cost almost nothing to produce, and the networks provided all of the expensive sports and primetime programming) that was reasonably economically resilient (the affiliates did get a lot of advertising revenue, which is economically sensitive, but they also got an increasing amount of revenue from retrans fees just for being on the cable system, which was very resilient! Plus, every two years, the networks would land a gold mine from political advertising).

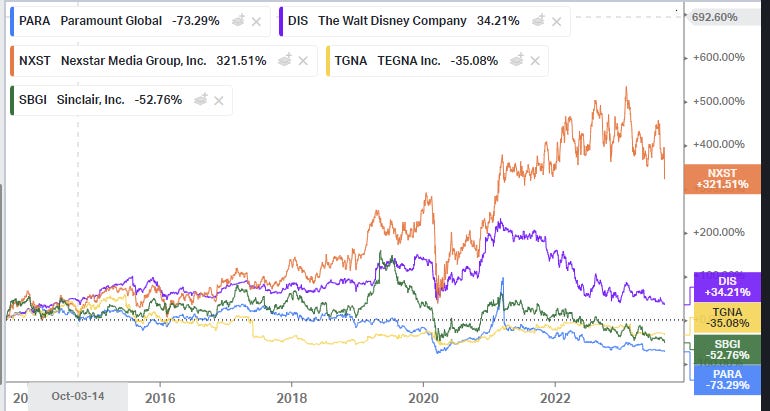

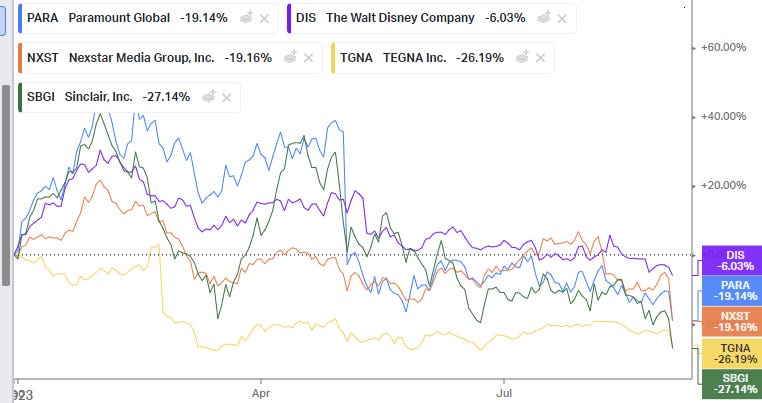

However, Nexstar didn’t just luck into a great business; the management team is perhaps the best in media, and they’ve deftly employed financial engineering and massively accretive acquisitions to create tremendous value. I believe NXST is, by far, the best performing of the legacy media stocks over the past ten years, and they’ve dramatically outperformed direct peers like SBGI and TGNA. That outperformance is not an accident; this management team is spectacular.

So Nexstar has been a massive winner for years…. but the whole time the stock has traded for a pretty consistently reasonable multiple. If you adjust for their political advertising, I don’t think the company every traded for more than ~8.5x EV/EBITDA. Again, this is a business that employs financial leverage and generates an enormous amount of FCF, so I don’t think it’s crazy to say that NXST has consistently offered investors ~15% potential free cash flow to equity yields (or better; it’s often been 20%+) over the past ~ten years. It’s been the gift that’s kept on giving for many value investors; when you buy a stock at a 15% FCF yield, the company returns most of that cash flow to shareholders, and the business doesn’t collapse / earnings keep growing, you generally get a ~15% return every year you hold the stock.

However, there’s always been one huge risk for NXST (and the other affiliates): for better or worse, NXST is tethered to the legacy cable bundle. If the bundle ever fully unwound, NXST would face a very questionable future (I’ll discuss this a bit later). Given that risk, I’ve always wondered: were investors in NXST generating alpha, or were they just clipping the “network affiliates don’t get replaced” risk fee?

To some extent, this is a silly question. Look at the 10 year stock chart I posted earlier; NXST has dramatically outperformed TGNA and SBGI (and every other media peer), and they’ve done that because management has made some deft moves. So there’s no question: NXST investors have generated industry alpha over TGNA and SBGI!

But it’s been clear for the past ten years that the cable bundle is starting to unwind, and I think a large part of NXST’s low multiple can be explained by fear of what happens to NXST (and all network affiliates) in a post-bundle world.

The question is this: as the legacy bundle unwinds, what is the reason for a network affiliate to exist? If we go to a fully streaming world, why should a network provide an affiliate a cut of their revenue?

If you think about what an affiliate to a network actually creates (aside from a loophole around media ownership requirements), it’s one thing: local news. Yes, lots of people watch the local news, but it’s not exactly hard to produce. Why should a network pay a huge cut of their fees to NXST just to produce the local news? Shouldn’t ABC simply say “hey, you’re a great local news producer…. but we’ll let people sign up for ABC on their own, and you can go and try to sign people up for the local news on your own?”

In that world, I think things get really nasty for affiliates. It seems to me much of their historical earnings come from a weird regulatory loophole that required networks to work with them, not from really providing any huge amount of value.

Of course, I’ve been expressing these concerns for years, and, to date, NXST investors have (rightly) bet that the broadcast affiliate was such a lynchpin of the cable bundle that they would survive the bundle unwinding. Again, when you buy a business at a 15%+ free cash flow multiple, and the biz doesn’t collapse, you just keep clipping 15%+ equity returns.

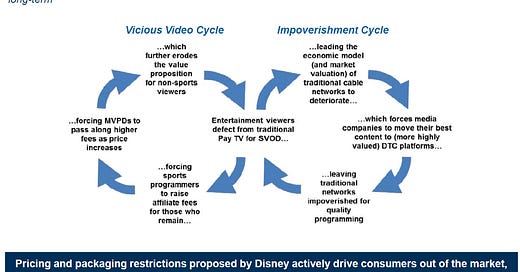

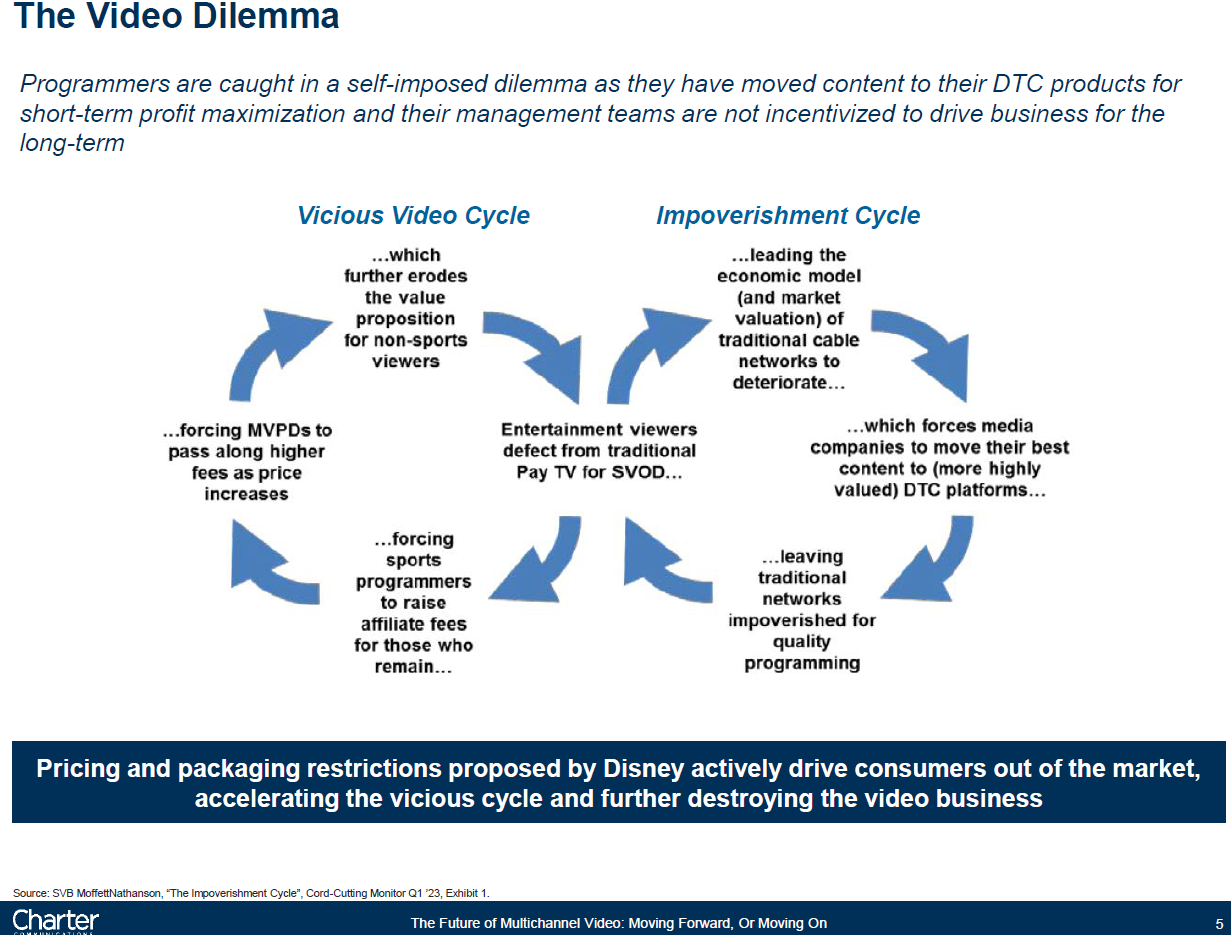

I wonder if that’s changing now. On Friday, Charter announced that they were blacking out Disney and basically threatened that if Disney didn’t come back to the table in the next two weeks, Charter would move on without them. The whole call was fascinating, and I’d certainly encourage you to check out the full call deck. This was kind of the money slide that showed the vicious cycle destroying the cable bundle…

but if you’re long NXST this line in particular has to jump out at you.

We didn't take any of the decisions that got us here likely. We think the opportunity for customers and all of us as market participants, including shareholders, is too big, too important and too timely to pass up. I am optimistic we can find a path forward with Disney. We have tremendous respect for their products, brand and management team, but we need to move quickly forward together or move on.

If we move on, as Jessica mentioned, some of our video customers will go elsewhere. But for the majority of our video customers who aren't actively engaged with Disney and ESPN product, we believe that subscription revenue will be lost for Disney. And at that point, you have to wonder why we would ever pay an ABC broadcast station a retransmission fee again. With the most expensive case of content and its time requirements removed, that would create new flexibility, interesting linear packaging and pricing capabilities for nonsports customers, alternative video combinations through a-la-carte and potentially other partnerships, which can add value to our connectivity bundles based on fewer interest and budget.

That world is an absolute disaster for affiliates. If the cable companies are going to work with companies to just sell their D2C apps, I’m not sure that’s a world the affiliates have a place in. If ABC is going to provide all of their primetime and sports programming D2C, what is Nexstar or any affiliate really selling? A local news channel? How many people are going to sign up to pay for a local news channel? How many people are going to sign up for more than one? That world gets brutal for affiliates really quickly. And, even if you don’t want to go that nuclear, Charter just paved the road for the cable bundle to kick ESPN off…. how many people keep subscribing to the legacy bundle if ESPN isn’t in it? If this blackout holds, I’d guess we see huge churn for the cable bundle in the very near future; that can’t be great for any affiliate.

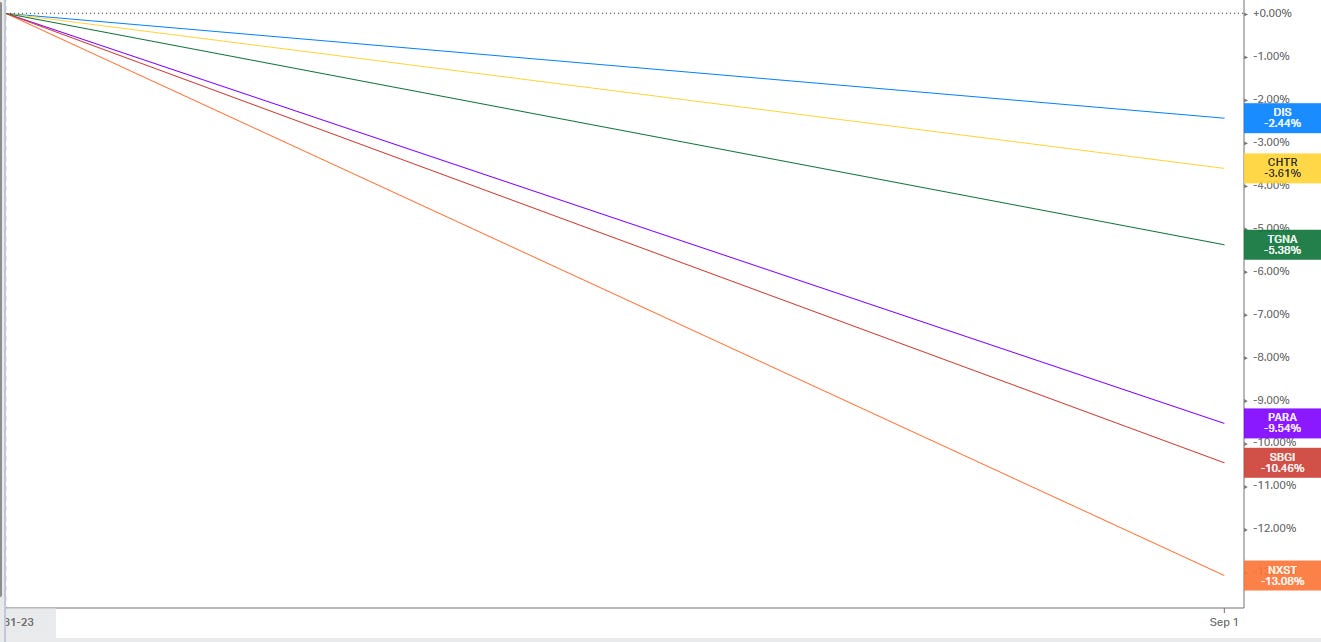

The stock market saw that line of thinking from the Charter call and shot quickly; it’s really notable that TGNA, SBGI, and NXST (all affiliates!) were down significantly more than DIS or CHTR were on the day the dispute came out.

Anyway, I’m not writing this to prognosticate on what the future holds for media (though I’m sure you can see I think there’s real firm risk for the affiliates here); I’m writing because it’s an interesting set up.

In large tech, you generate alpha taking on “moat crumbling” risk every year….. but you generate the most alpha when that crumbling risk is at its highest.

For the past decade, investors in NXST have been generating some “cable bundle unwind” alpha every year for the past decade; every year the bundle hasn’t unwound / NXST hasn’t been displaced, the investors have earned alpha.

Today, the risk of NXST getting displaced seems higher than ever. It doesn’t take much imagination to draw a line from CHTR blacking out DIS/ESPN to a bunch of distributors blacking out affiliates or forcing them to take huge price decreases to stay in the (diminished) cable bundle. And the market has certainly priced that into their stocks; even before Friday’s sell-off, its been a rough year for most media stocks.

But with that added risk comes added potential return. Buying when the obvious risk is at its highest is when the most alpha can be generated, and if you can (rightly) determine that “this too shall pass”, NXST could present a significant bargain (or, alternatively, if you can rightly determine that an unbundled world isn’t close to as bad for NXST and the affiliates as I think it’s going to be).

Am I skeptical? Yes, absolutely.

But I also wouldn’t be surprised if three years from now we looked back and said, “once again, the market sold NXST down to a >20% free cash flow yield…. and, once again, NXST investors generated >20% IRR multi-year holds from ignoring the market and betting on the best team in the business.”

TBD.

PS- if you know of a good investor in the media stocks who’d be interested in doing a podcast appearance, I’d certainly love to discuss it on the podcast at some point!

Mario Gabelli is the best media etc brainshare around.

Another great write-up, Andrew. I remember you being a longtime cable buff, which I am not. So your perspective in this sector is always appreciated. I’ve recently made a significant investment into another “dying” industry: coal. Most, and perhaps all, of your logic applies to this too although the alpha could be two to three times as great if market sentiment has prematurely abandoned the future of coal - particularly outside the USA. Einhorn is to be commended for his early-ish identification and massive investments in this possibility. Pabrai is piling in now too. At the core of their theses is massive share buy-backs. It’s super interesting to ponder the final outcome. Can you apply your bright mind to this next question? What would be the various impacts of a regular, massive buy-back that reduces the float without diminishing free cash flow?