Weekend musings: $MUDS / TOPPS fall out

I’m not sure how many times I’ve said “I swear I’m going to talk / write about something other than SPACs” in the past few months (most recently here)….. but here I am, writing about SPACs again. Whoops!

Regular readers may recognize that paragraph…. because it’s literally the same paragraph I opened my last post on SPAC sponsors not caring about their reputation with. But the recent fall out of the MUDS / TOPP deal collapsing has tickled me so much that I wanted to dip into the SPAC well one more time.

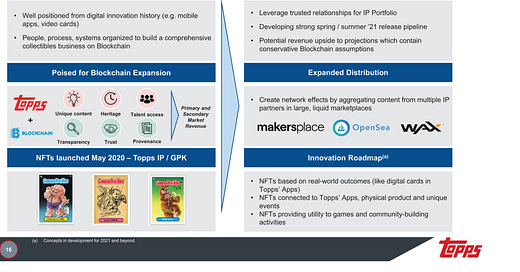

Some background: MUDS announced a deal to merge with Topps, the trading card company, back in April. Now, the wheels had already largely fallen off the SPAC market by April, but the Topps deal proved very popular despite the general cooling of the SPAC markets. Investors instantly saw the potential for Topps to use their iconic IP and rights to take advantage of the booming NFT space, and as the NFT space grew hotter and investors came to understand the TOPPS merger more, the stock continued to rise. At its peak, MUDS was trading for ~$17.50/share, a 75% premium to trust value.

And honestly, it’s tough to blame investors for getting so excited about the MUDS / TOPPS deal. This was a capital light business with a good moat that was coming public at ~12x EBITDA despite putting up double digit growth and having a potential NFT play on top of that. That’s a really attractive combo!

And, to top it all off, this was a business that was experiencing some real operating momentum. The company announced Q2’21 earnings just this Wednesday (August 18), and as part of it they did a serious guidance raise. Adjusted EBITDA guide for 2021 was taken from ~$135m to $160m, while revenue guide went from ~$750m to ~$840m. Both numbers implied 50%+ growth from 2020 numbers.

Put it all together and you had a literal dream SPAC merger. An iconic company coming public at a reasonable valuation that was growing quickly with great operating momentum and a “free” call option that could be potentially insanely valuable in their NFT play. Plus serious institutional investors were in the PIPE (Gamco and Wells), and Mudrick (the SPAC sponsor) would write a $100m check into the PIPE as well.

So this seemed like a SPAC set for success when they announced the deal in April and particularly when they raised guidance on their earnings on Wednesday. By Thursday, the deal was effectively dead when the company was blindsided by the loss of their MLB deal, and on Friday the deal was officially cancelled.

The reporting around losing the MLB deal indicates the Topps was shocked by losing the deal and had basically no indication that this was coming. And I do believe them; heck, as recently as June Topps put out a press release with quotes from MLB reaffirming “their licensing relations” and their commitment to NFTs.

Still, it’s legit crazy to me that they could get this blindsided by losing the MLB deal. That deal was the company’s most important asset, and it was expiring in the reasonably near future. No one thought to check in with MLB once a month or so to make sure everything was good? No one thought to renew the MLB license, even at a nice premium, as part of announcing this buzzy SPAC? The quote below from the WSJ article summed it up well:

The idea that Topps could seek to go public through a SPAC without further locking up its primary revenue stream shocked deal-makers and people in the private-equity world. These people said that ensuring the MLB contract could be renewed would typically be among the first steps in the due diligence process for a business like Topps.

Again, insane. More than half of their revenue (and growing) comes from the physical cards business. I love Stars Wars and WWE as much as the next guy (who doesn’t love strong men running around in their underwear!), and I’m sure F1 and UEFA are nice contracts to have, but it doesn’t take much knowledge of the sports / card landscape to look at the chart below and realize that the vast majority of their physical revenue (which, again, is more than half their revenue and growing, and certainly more than half their value) comes from the baseball contract. I’m just not sure how any reasonable party could commit to a >billion dollar merger without a little more assurance that the target’s key asset was locked up than “they’ve renewed for a long time, and we’ll reach out to them a few months before our deal is set to expire!”

It’s also crazy to me that Topps found out about losing the MLB on Thursday (August 19th). The shareholder’s vote for the SPAC merger was set for August 25, and the deal would have closed soon after. What would have happened if Topps had been “blindsided” by this news next week (right after the shareholder vote)? The merger would have already closed. I’d bet the stock would have been down >50%, and lawsuits would have flow. I wonder if there was some game theory from Fanatics (who won the MLB deal) on “blindsiding” Topps with the news now instead of after the SPAC deal closed; if the news had broke a week from now, Topps would have had a bigger war chest to play with to try to tempt MLB to stick with them (the deal would have put $50m in cash on Topps balance sheet; on top of that, Topps would have had a pretty highly priced public equity they could use to try to convince MLB to stick with them). By breaking the news now, Topps is blindsided with the news, loses out on their SPAC deal, and is stuck with a big private equity owner who doesn’t want to be there (the majority of the MUDS deal proceeds were going to cashing out the majority Topps’ private equity shareholder’s stake).

So this is just a crazy situation to me. But there are two other points I wanted to highlight here.

The first is: why did MUDS cancel the Topps deal? Yes, the MLB news was absolutely awful and decimated Topps value…. but we’ve seen plenty of other companies that had awful news or awful performance where the sponsors / companies buried the news, pushed the SPAC deal through, and then told shareholders about the awful news after the deal had gone through and subsequently saw their share prices crater (I mentioned a ton here). Burying bad news and pushing a deal through can often be in a company’s and the SPAC sponsor’s best interest; the company gets capital on terms no one in their right minds would give them given the bad news, while the SPAC sponsor gets to vest their founder’s shares, which basically cost them nothing so as long as the company doesn’t go to zero the sponsor will make money.

If Muds / Topps had really wanted to, I think they could have pushed this merger through. The special meeting was set for August 25, but the record date for shareholders to vote on the deal was long passed. This is a little technical, but the deadline to redeem shares was August 23 (see the def proxy); because shares generally need to be settled in order to redeem, that means the last day to buy shares with redemption rights was August 19th (depending on your broker and how good their systems are, it may have been earlier! remember nothing on here is investing advice, and I’m certainly not a market structure / technicals expert). Because the Topps news broke late on August 19th, I think you could have had a situation where the news broke just late enough where a bunch of shareholders who were buying didn’t have redemption rights, and MUDS / Topps could have pushed the deal through with a shockingly low number of redemptions given the company had seen their valuation effectively kneecapped by the MLB news. And, even if redemptions ran high, I bet Topps would have happily waived the minimum cash condition to get this deal through and still get all of that sweet, sweet PIPE cash at a premium valuation.

I’m sure there would have been plenty of lawsuits and stuff if they had pushed the deal through, and yeah it would have been unethical…. but I’m just saying it could have happened. I’ve definitely seen SPACs do worse (like hiding DOJ investigations!). So why didn’t they push through? I suspect a big reason is Mudrick, the SPAC sponsor, had a $100m commitment into this deal at trust value. They had real money on the line, and if they let this deal go through that money would be getting cut in half (at least) instantly. Because they were in the PIPE, Mudrick had the incentive to cancel the deal when things got bad even though they probably could have got out.

Speaking of sponsors, that brings me to the other point I wanted to make. I had lots of people reach out to me about MUDS / Topps when it was announced and over the next few months, asking what I thought about the deal. Pre-MLB news, the Topps deal is generally something I would have gotten excited about to. I mean, low double digit EBITDA multiple for a super cash flow generative, nicely growing company with a good moat, a long track record, and an NFT play? That’s a dream! But there was one thing always in the back of my heads with MUDS / Topps. The quote below is from the SPAC sponsor discussing Topps on the merger call,

Also this is not our first SPAC, this is our second SPAC. As many of you know SPAC’s have taken the street by storm and being able to navigate through this universe in these processes I think it's been very helpful. 2 SPACs doesn't sound like a lot but I don't think there's a lot of firms that have done 3. So, it's a new innovation and I think we're fairly familiar with it and finally, we don't unlike hedge funds can have longer holding periods and shorter holding period I just wanted to point out to the folks that are listening that are typical holding period exceeds 5 years and our largest position in the firm we've owned for 12 years it was first investment we ever made so we tend to take a very long term view of businesses and that's the approach we're taking to our investment in Topps.

The interesting thing here is that MUDS wasn’t Murdick’s first SPAC; it was their second. Their first SPAC went public in early 2018, announced a deal to merge with Hycroft in early 2020, and completed that deal in June 2020. That deal…. hasn’t exactly lit the world on fire.

I’ve said for a while SPAC sponsors don’t give a fudge about their reputations. They only want to make money. But I do care about SPAC sponsors reputation as a signal. And, personally, I saw lots of red flags with this one. Mudrick’s first SPAC was a disaster, and Mudrick is mainly known as a distressed investor (almost every interview on the heels of the Topps deal asked why a distressed investor was buying this type of company). It always seemed strange to me that a distressed investor would get involved with buying a solid, cash flow generative, growth company that didn’t really need capital (again, all that SPAC cash was going to cashing a private equity player out). I always figured there was a risk that a “traditional” growth investor would have flagged in diligence that Mudrick was willing to overlook (or didn’t know to look for) that let them win a deal that traditionally would have gone to someone else. In this case, it seems that was right, as I think a growth investor would have really dinged Topps for the risk of losing MLB. (Just to stay humble, I’ll admit I never really traded MUDS, and that I make plenty of bad calls. For example, Altice is down ~20% and underperforming Charter by ~30% since I called Altice the “best” large cap stock).

Odds and ends

Another thing that tested management credibility? There’s no chance in heck Baby Bottle Pop outsells Skittles, right?

Interesting article on Michael Eisner’s would be Topps payday

I thought the Topps Now initiative was pretty interesting; the way this plays on exclusivity and limited timing could result in some really interesting economics. Imagine your team just won a big playoff game on some exciting moment (a walk off home run, buzzer beating three pointer, goal line stand, etc.). I’d imagine instantly presenting someone with an offer “hey, buy this commertative collectable card now and relive that moment forever; this offer will be gone in 24 hours” could sell a lot of items at a pretty big premium. We’ve seen lots of that with limited edition shoe / fashion drops and plenty of other things (quote below from their merger call)

Sticking with the e-commerce trend and moving to the, or the e-commerce theme. You can see here how we've built our e-commerce business. Our idea was while it's great that you can buy product on opening day or it's great that you can go back into the store sometime in the summer or some point in the future and buy additional product. We wanted to reimagine how consumers could interact with our brands and when you think about how important immediacy is to consumers. We had an opportunity to meet that need with technological advancements through our e-commerce business. We started really building this about 5 years ago. We created a brand called Topps Now and this program is depicted in the infantry at top. Let's say you're a fan of baseball watching baseball on the left hand side here and there are several games on a Saturday afternoon. What Topps will do is curate what we believe are the best moments from those games, one moment, two moments, five moments and in the middle image you see that the next day those cards will be available online and they're available on Topps.com for 24 hours. You as a fan have an opportunity to purchase those cards for up to 24 hours after which we shut down the ordering. We produce the cards and they arrive at your door in three to five days. Again, reimagining how products are transmitted to fans and how fans can get engaged in purchasing. That’s evolved all the way to something as recently as project 2020 which was programmed we executed last year with great success it was the year 2020 and we selected some of the best cards that we felt we had delivered over the decades and we turned over the creative licensing- the creative reins to various artists to reimagine and redesign those cards. So whether it's a Cal Ripken card or Tony Gwynn card we entrusted various artists with the opportunity to recreate these cards giving them an opportunity to tap into their social networks their audiences and really expand our audiences and beyond that what's represented in the boxes below are various offerings. I won't go into all of them but it's really just a demonstration of how unique some of these products are and how we bring products beyond our everyday products to consumers via e-commerce.