I’ve been spending lots of time looking at retailers recently. Yes, retail is challenged, and historically it’s a tough sector to invest in…. but right now many of them are posting incredible results thanks to a variety of factors (lots of competition closed, consumers are flush with money and eager to spend, etc.) Despite those record results, the stock’s are trading at very low multiples, and many management teams are taking the cash from those record results and plowing it into aggressively reducing their floats.

For example, I mentioned Bed Bath and Beyond (BBBY) last month. They currently trade for <5x trailing EBITDA and ~2x their 2023E EBITDA (if you believe their targets), and management is directing all of their cash flow to retiring shares while the stock is cheap. It seems asymmetric to me; ignore the 2023 targets; if current results are roughly sustainable, the stock is way too cheap and the combination of cash flow and repurchases are going to send shares screaming higher. If current results aren’t sustainable, then the stock is probably too expensive…. but you could probably cut EBITDA in ~half and make an argument that the stock is still ~reasonably valued around these levels.

A few other retailers have caught my eye; I’m still doing work on them, but I may write something on them in the near future. But I wanted to highlight one in particular because it’s an interesting situation that I think is ripe for mispricing and I’m trying to rapidly get up to speed.

The company is Sportsman’s Warehouse (SPWH). SPWH entered an agreement to get bought by Bass Pro Shops for $18/share last December. That deal fell part Thursday night, as the companies agreed the FTC would not clear the merger.

So SPWH will need to go it as a standalone business. As I write this, the stock is trading for <$14/share. As I’ll discuss, that appears way too cheap…. but there is a catch. SPWH (and all sports focused retailers) are going through a mini-boom currently, and there’s a the question of how long that boom will last and what sustainable earnings look like once the boom is over. So I’m still doing work / ramping up here; if you’ve done work and see something I’m missing, I’d love it if you pinged me so we can swap thoughts!

Anyway, SPWH is interesting to me for a bunch of reasons, including:

It’s cheap on an absolute and relative basis.

Smaller cap stocks have been absolutely hammered over the past month; there are worse markets for a deal to break into (height of the financial crisis; March 2020), but this is about as bad a market as it gets for a deal to break. I think the combo of deal breaking + small caps getting crushed + no one having done a ton of work on this has created a lot of motivated and price insensitive selling.

A lot of SPWH’s sales come from hunting and shooting, which is mainly firearms and ammo. Firearms and ammo are a classic “can’t be amazon’d” category; online retailers (particularly the larger ones) don’t want the hassle and liability that come with selling guns online. Heck, lots of physical retailers don’t want the liability that comes with selling guns and ammo. So I like the little niche aspect that SPWH’s business has.

We know the price a sophisticated buyer (Bass, which is Private Equity owned) offered to pay for SPWH, and today SPWH is trading significantly underneath that price.

Peers have raced higher while the merger was waiting to close.

SPWH’s management has already tried to sell the company once, so we know they’re open to M&A / selling themselves. In my experience, if you’ve got a management team that’s tried to sell themselves before, they’re open to doing so again in the near future if that’s what’s right for shareholders. I would not be surprised to so SPWH pursue some shareholder friendly maneuvers, including possibly shopping themselves again, in the near future.

Let’s build on all of that a little, starting with valuation. As I write this, SPWH is trading for ~$14/share. SPWH has basically no net debt (they had $20m drawn on their revolver in Q2’21) and they’ll receive $55m in break fee from the Bass deal falling through (their tax rate is ~27%, so net of taxes this is ~$40m). With ~45m shares outstanding, SPWH’s EV and market cap are both around $600m.

EBITDA for fiscal 2020 was ~$163m and EPS was $2.73, so we’re talking low to mid single digit EBITDA and P/E multiples (H1’21 is basically flat over H1’20, so LTM multiples and 2020 multiples are basically equal). That’s obviously very cheap…. but again, the current environment is a banner year for retailers like SPWH. EBITDA in 2019 was ~$60m, and EPS was ~$0.47, so if you think 2019 was a normal year than SPWH’s normalized multiples look much more reasonable or maybe even expensive (~10x 2019 EBITDA, ~30x 2019 P/E).

So the big question is how much of the current results is some type of pull forward of sales versus how much of the boom is sustainable / perhaps driven by peers and competitors closing or focusing less on SPWH’s target markets.

I don’t know the answer to that question. But I do know that the current boom has been far stronger than anyone expected (including management and SPWH’s failed buyer), and that there’s a chance the boom has improved the business longer term.

Let me start with the first claim: SPWH’s boom has been far stronger than anyone expected.

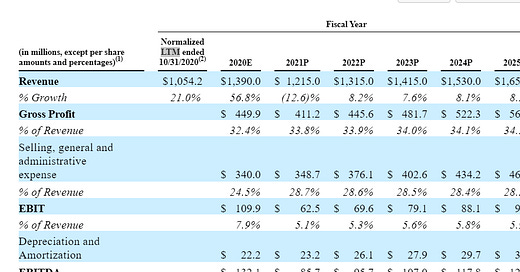

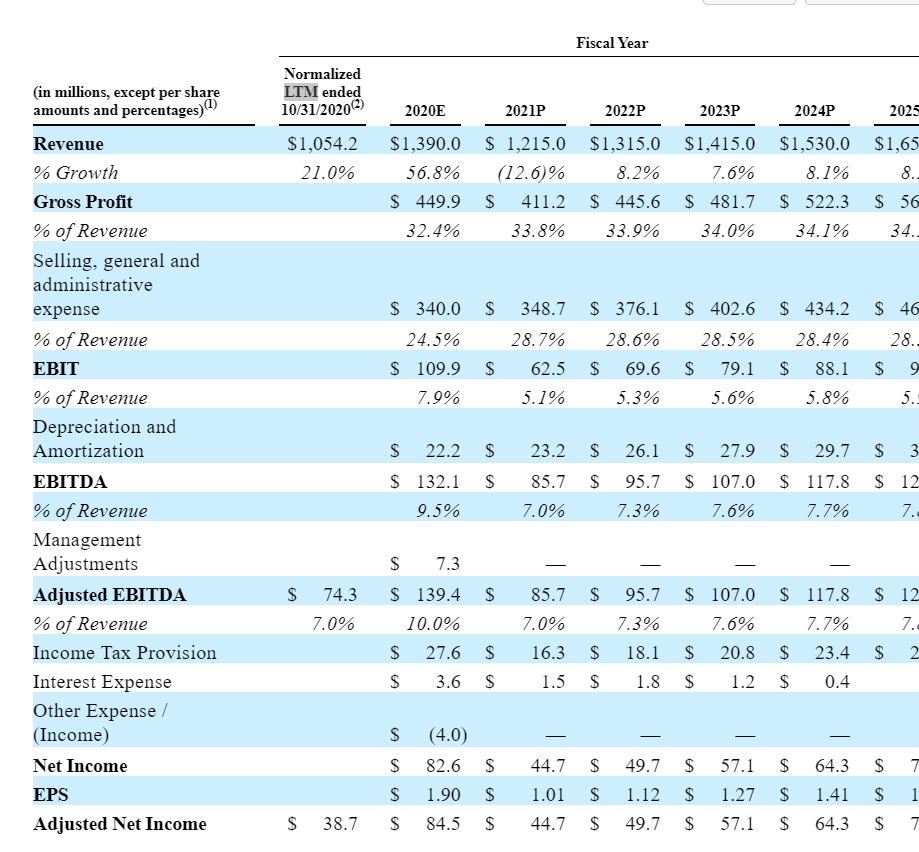

Why do I believe that? Well, go check out the projections from SPWH’s deal proxy back in February (they’re on p. 47). I’ve included a screenshot of them below.

For 2020, management was projecting $140m in EBITDA, and for 2021 (this year), they were projecting $86m.

Actual EBITDA for 2020 came in at $163m. That’s an insane beat versus their 2020 projection; remember the projection was prepared in ~November, so basically they had every quarter but Q4 in the bag. The company was projecting ~$30m in EBITDA for Q4 and did ~$52m. Bonkers.

2021 is looking similarly strong. For the first half of the year, SPWH has done $59m in EBITDA. Their target for 2021 in their deal shop was $86m, so they’re about 70% to their target in just half the year. SPWH is a retail business, so earnings are generally weighted towards the second half of the year. It seems near guaranteed that SPWH is going to blow away their 2021 projection again.

Of course, SPWH blowing away earnings now does raise some “are they pulling forward future earnings” questions. Basically, the worry is that people who would have bought, say, one gun a year every year have decided to buy five guns this year and will hold off on buying guns for the next four years.

Again, I don’t know the answer to that…. but personally I’d rather pull forward earnings every time. It’s better from a time value of money perspective, and I tend to think that a lot of people who think they’re stockpiling now actually love the products and will be back for more visits regardless.

So SPWH is absolutely blowing away their earnings presented in their projections. That means they have more cash to play with now, and that they might be on a higher earnings projection than they initially thought. Bottom line: to me that’s all good news. SPWH had an offer to get bought out for $18/share, and their results while they were waiting for the deal to close blew away their projections. Despite that, the stock is currently trading way under deal price; in fact, it’s trading at close to the price it was trading before it entered a merger agreement. That seems off (I’ll circle back to that later).

One last thing on the earnings pull forward: SPWH has obviously been quiet while they were waiting on the merger to finish (No calls, conference appearances, etc). But we can look at what peer retailers are saying. For example, Dick’s (DKS) reported results on November 23 and then went to a Morgan Stanley conference on November 30. I pulled out some some key quotes from the MS conference below(emphasis mine):

So last week, we announced a 12.2% comp on top of a 23.2% comp the year prior, and a 6% comp the year prior to that. And from a profitability standpoint, we were up $3.19 -- EPS was $3.19, which was up 59% to last year and 513% to 2 years ago. So I say that just to say just how meaningfully different our business is, just if you look at the numbers.

But if you look at every aspect of our business, I'll be honest with you, I think we are a completely different company than we were back in 2017 when we started on this transformational journey. And that's everything from the merchandise that we carry is highly differentiated now. We've been working on that partnership with our strategic vendors, so that we are carrying sort of higher heat product and product that is more differentiated.

We've completely focused on service in the stores as well as experience in the store. So even back in 2017, we were bringing in HitTrax batting cages, and we had our golf simulators. We've been focusing on technology, and that -- bringing that all in-house enabled us to spin up curbside during the pandemic so that we could seize all that momentum. (MS conference)

I know we're not going to guide to '22, but I think you can hopefully tell, we feel really, really bullish about the business at a whole compared to where it was pre-pandemic. It is meaningfully higher. (MS conference)

Question: So we're going to move on to margin. I used for sales, I called it the $60,000-question, the reversion or compounding. I'll call this the mid-teens multiple questions, and we'll talk about gross margin because your gross margin has rerated, almost as profoundly as any company in our coverage, among the highest. And I think this is what the seesaw is sitting on of the market, the decision of how to revalue or not DICK'S Sporting Goods. So we -- the margin's up, call it, 600 to 1,000 basis points, 600 to 1,000 depending on the quarter. How do we think about it? What do we retain versus not? I'll just leave it open ended.

Answer: I think this is the -- in some ways, the easiest one to explain and understand because some of it's just math. So -- but where it's more science. So the -- or I should say, the product that we have that we've been talking about that is more differentiated is not product that typically gets caught up in a promotional cycle. So certainly, we believe that our margin is permanently improved, and the majority of that margin gain will continue. At the same time, we have moved to totally digital advertising where we used to have 16 pages of newspaper circulars. So we can be much more, much more focused on real-time data science-driven promotion and pricing.

We have -- what am I forgetting? What's our third one? Oh yes, sorry, I forgot, of course, eCommerce profitability. And then also the reason I was saying it was all math is that the operating leverage that we have from those higher sales that we just talked about, the rebaselining of the sales, have made the eCommerce business incredibly profitable and all the operating leverage that we get out of the rent expense. So overall, I agree with you. I mean, I think we are -- it's clear to see that the operating margin is higher than it was pre-pandemic, and there are structural reasons for that.

Obviously, SPWH is not Dick’s. Dick’s is about 10x SPWH’s size and has a much better brand. But SPWH and Dick’s are broadly similar, and Dicks is emphasizing that their Q3 was great and while they don’t believe the long term can be quite as good as it currently is, that they think a lot of the business improvement is here to say. I don’t see why that isn’t the case at SPWH as well, and the market certainly isn’t pricing that in. (PS- it’s not just Dick’s that is seeing good results; BGFV has a broadly similar merchandise profile and is around the same size as SPWH, and their Q3 call included lots of positive commentary on the business and long term trends as well).

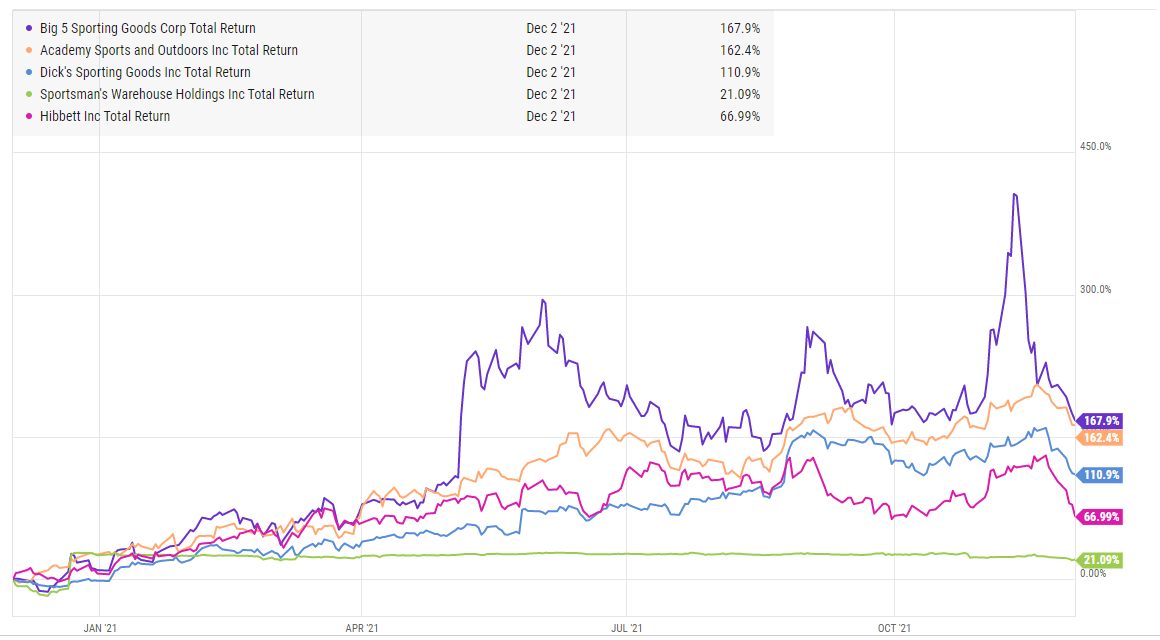

Speaking of peers, one thing event drivn people love is when a stock has entered a merger agreement and all of its peers race higher while the merger is happening. Why? Because it reduces fundamental downside. If all of your peers are trading for 5x and you get a buyout offer at 7x, if the offer fails you’ll trade back down to 5x (all else equal). But if all of your peers have traded up to 10x while the deal was outstanding…. well, you could make the argument that you should trade up on the deal breaking.

Something similar might be happening to SPWH. I’ve pasted the one year total return for them and some peers below.

That’s right: over the past year, 3 of the four best comps for SPWH have more than doubled, and the fourth is up a cool 67%. SPWH is the huge laggard here; you could argue that they were undervalued at the old deal price given how aggressively peers had run up. And none of their peers are getting ~$1/share in after tax money from a deal break fee!

Anyway, I think I’m going to wrap it up here. I’ve got lots of other thoughts on SPWH, but I’m still doing work and researching. Again, the deal just broke, so I’m trying to ramp up quickly. I’m sure there are quirks in SPWH’s strategy, store footprint, margins, etc. that someone more knowledgeable than me can point out; if that’s you, I’d love to hear it.

PS- SPWH releases earnings Wednesday (December 8) after market close; the PR says they aren’t doing a call, but they might change that now that the merger has dropped? Famous last words, but given the results peers have reported so far (DKS and BGFV), I’d expect SPWH’s earnings to be good and their outlook to be solid (if they give one). If they do give commentary, I’ll be most interested in what they say around their go alone plans (again, I think this is a natural M&A candidate in the near term), what trends they’re seeing, and what they’re doing with capital allocation (they are cash rich thanks to the break fee and the pandemic sales boom; most of their peers have gotten reasonably aggressive with share repurchases and dividends, I think SPWH should do the same though they don’t have a real history of capital returns in the recent past).

PPS- one push back to the “peers are doing great” piece above is that SPWH is much heavier focused on guns. Smith and Wesson (SWBI) reported last week, and they noted demand levels “easing” from historical highs, which could be a sign SPWH’s results are going to soften faster than peers.

Thanks for writing this up! I briefly looked at SPWH after the deal fell apart but got scared off by the same SWBI headline you noted. I wonder if retailer economics are different, though—do gun sales get pulled forward more than ammunition? And wonder if there’s a good attach rate on buying ammunition.

(Negative version of this is that the Covid pull-forward was more about fears of unrest rather than the usual fear of gun bans, so may have skewed more towards ammunition than guns. I’ll have to check some transcripts for that, but if so the trade is probably shorting SPWH’s comps.)

Thanks for posting. I was looking at this also. Here are some industry/user observations from me and my friend (an avid gun guy).

1. When my wife & I visited a local store, we saw most of the folks in the gun section of the store. About 50% of the store is focused on hunting & guns but also apparel & fishing are there too. This is basically a “big box” duopoly for hunting with Cabella’s and Bass Pro Shops (BPS) as the other players Dick’s (via Field & Stream) & Gander Mountain (via bankruptcy & purchase by Camping World) have closed-down stores. In the Buffalo-Rochester-Syracuse market, you only have 3 stores to choose from (1 – SPWH & 1 each Cabella’s/BPS) in DMA of over 3 million folks with many hunters. The Rochester Gander Mountain used to sell the most guns & ammo of any store in NYS. Some Walmarts have some hunting guns & ammo but the selection is limited. The smaller shops have specialized into other areas as SPWH/Cabella’s/BPS have larger scale. Also, the reason for the merger falling apart was FTC rejection due to the potential monopoly described above.

2. It would be interesting to find what the situation is in other parts of the country. Also, as guns become more regulated it will favor large incumbents that have infrastructure to deal with the regulation. This may become a profitable niche like tobacco for convenience stores.

3. SPWH is a value targeted guns/hunting store vs. higher end Cabella’s & BPS. SPWH only has 100 stores & is located West of the Great Plains. It opened 10 stores last year. IMO it can open at least 100 more in the Midwest, East & South. They have been able to achieve 20% RoIC from new/existing stores as they are smaller than Cabella’s/BPS & focus on guns/hunting.

4. One downside is California is allowing folks to sue to gun companies & I am assuming the retailers (but they may have some protection as they follow/implement state law).