I’ve been trying to reduce my mindless scrolling of the Twitter timeline. So far, my attempts have been reasonably unsuccessful (Twitter is a very addictive product!), and one recent tweet caught my eye:

Another investor mentioned MSFT around the same 2011/2012 timeframe fit a similar profile, and that got me thinking about both the dynamics that set MSFT / NVDA for such epic runs and what we can learn from them to find companies today with a similar profile.

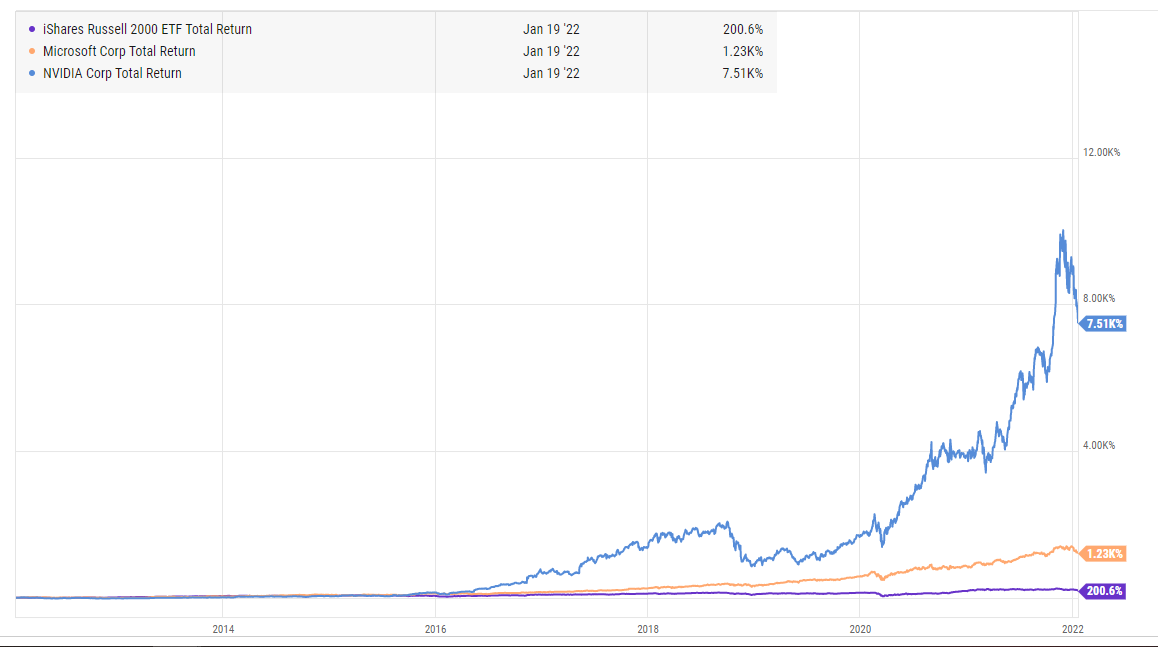

Let’s start with the dynamics: these were enormous companies (MSFT ~$250B; NVDA was ~$10B market cap but remember $10B 10 years ago was much, much bigger than $10B today) that were basically household names set to go on absolutely parabolic runs that demolished the market return. That combination meant any investor could have taken a bet in size on these companies and just crushed the market (sometimes people will point to microcaps that go on epic runs and say “find the next one”, which we’d all love to do. But what makes NVDA and MSFT so unique is they were already big, so literally anyone could have “found” them and taken a big shot).

Anyway, that tweet got my wheels turning a little bit: what are some things that we could learn from MSFT / NVDA ~10 years ago that we could apply to find similar stories today?

Well, to start, I think the most important point is that even large companies can outperform. Microsoft was one of the 10 largest companies in the world 10 years ago, yet you still could have smashed the indices by buying / holding the stock. I’d suggest that’s a relatively new phenomena; in the pre-internet world, you almost certainly couldn’t have smashed the indices over a significant period of time by buying their largest components simply because large companies started running into scale issues (growth required some type of physical investment, and managing a sprawling corporation had huge negative returns to scale in the pre-internet / computer age). So the temptation is to say “O, you can’t demolish the indices by buying a massive company”, but the Microsoft example suggests otherwise and I think the returns to scale in the internet age argument says that Microsoft might be just the beginning of large companies outperforming indices over a lengthy run. (Note that I’m not saying all large companies will perennially outperform; it’s inevitable one of the mega-tech companies that seems unstoppable today will stumble at some point and I’ve thought so for years. Nor am I saying mega-cap companies will perform quite like MSFT; while I think a lot of the FANGs look reasonably priced, I’d be shocked if they >10x in 10 years given how huge they already are (plus much more reasonable starting valuations)).

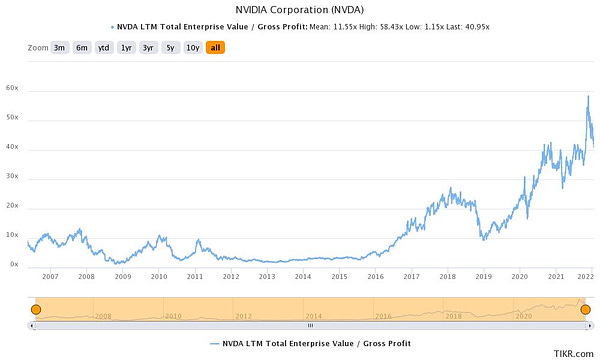

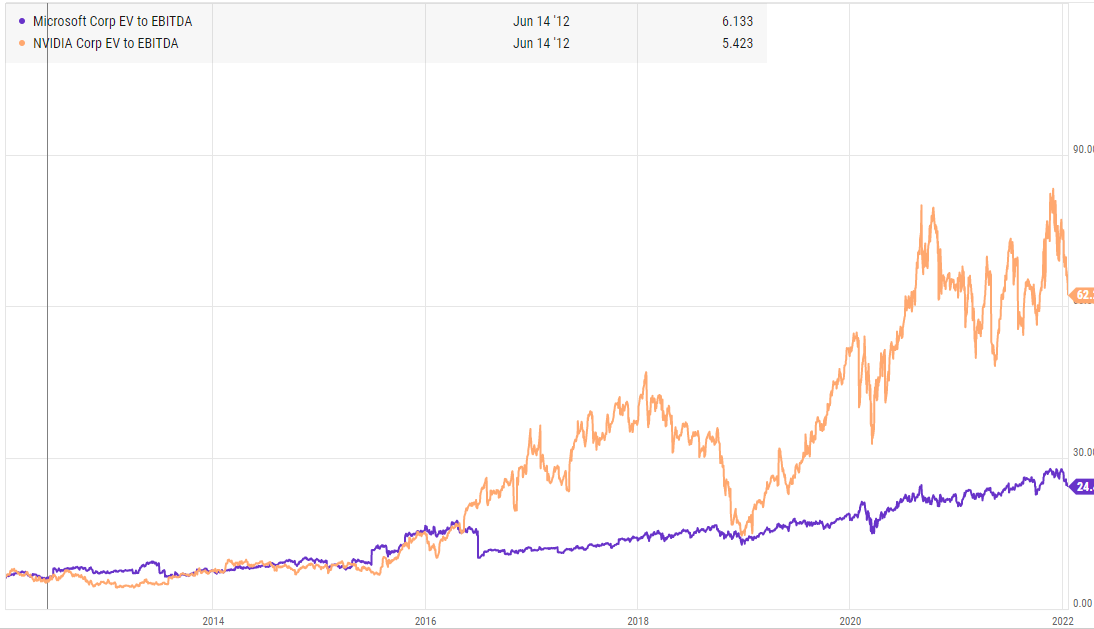

The second thing we can learn from MSFT / NVDA is that multiples matter. That sounds trite, but I think we’re learning with the recent growth correction that investors may have gotten just a little too generous in slapping 50x sales on any SaaS company with a pulse and some type of growth. MSFT and NVDA’s stocks did well because the companies performed insanely well and the stocks were priced as low/no growth starts at the start of the period. Seriously, check out the charts below. MSFT was at ~10x earnings in the early 2010s; NVDA was approaching 5x EV / EBITDA.

With the benefit of hindsight, those multiples clearly look insane…. but it’s easy to forget that at the time people thought these businesses had all sorts of challenges. I know lots of “pod shop” style hedge funds who were short NVDA for years because of secular challenges and “overvaluation”, and in the early 2010s we all worried Windows was going to zero as everyone stopped buying computers and that Steve Balmer (MSFT’s CEO at the time) would light all of Microsoft’s cash pile on fire pursuing stupid deals.

Speaking of Balmer, the management piece is interesting. Initially, I was going to look for value large caps with managers who I thought were awful, but NVIDIA has been led by it’s co-founder since inception. So literally the same company and management team that the market was giving a value multiple to 10 years ago is getting a growth / compounder multiple today. With Microsoft, a big piece of the change from ten years ago is the CEO switch, which got them from a manager who brought a lot of enthusiasm but maybe not a lot of the skills you need to lead a tech company to a manager who seems to be just firing on all cylinders. Anyway, the interesting thing here to me is that management matters (obviously), but it doesn’t necessarily take a management change for the market to unlock / recognize value.

Obviously, all of this is small sample size, and there’s a lot of survivorship bias here (I picked NVDA and MSFT, which did awesome, but didn’t include IBM)….. but I still think it’s an instructive exercise (and you could probably widen the sample size out by adding Apple a few years ago when it was at like 10x P/E and Buffett was buying, or any one of a number of other techs that have traded at value multiples recently).

I’ve been trying to come up with a list of companies that fit the MSFT / NVDA example; I’ve got a few below, but if you have any thoughts I’d love to hear them (I mean, obviously! NVDA went up freaking 75x in 10 years. If you have any 10 year / 75 baggers, I’m always all ears!):

TRIP: TRIP’s current EV is approaching $4B. In 2019 (pre-COVID), they did ~$460m in EBITDA, so they’re cheap if you believe they can get back to pre-COVID. They play in an enormous market, and their CEO (who I believe has really bungled a lot of growth initiatives) will be replaced this year. Shades of Ballmer leaving Microsoft: a good asset that has been mismanaged for years trading at a cheap valuation (normalized for COVID effects!).

Sporting goods retailers: I mentioned them recently, but these all trade for deep value multiples while putting up the best results in their history. The market fears that their COVID tailwind will vanish, but I wonder if competitive closures (mom and pops shutting down, death of department stores, Nike cutting down distributors, etc.) leaves a big white space opportunity that’s going to surprise the markets. Could these double their profits while tripling their multiple plus retiring a bunch of shares along the way over the next 10 years? I think it’s possible, and that combo would lead to a >10x.

DBX: Founder led company with a huge recurring monthly revenue base and hundreds of millions of users. Trading for <15x free cash flow. It’s probably too cheap as is, but it’s pretty easy to paint a story where we look back 10 years from now and the chart looks like NVDA: they hit it out the park with a new product that ignites growth / leverages their user base, revenue explodes higher, and earnings quadruple (or more) while the multiple triples.

My friends at Daloopa have a free Dropbox model if you’re interested in brushing up on them; I’ll disclose I’m friendly with the team but worth checking out if you build out lots of models!

TWTR: I’m cheating a little here because it’s not cheap statistically, but they just changed out management and there’s no doubt that the company has been mismanaged. Revenue and earnings could explode upwards if the company finally finds the right product / market fit (some good thoughts here).

SFIX: It’s not cheap on a P/E basis, but at current prices the EV is <$2B, so it’s <1x sales and <2x GP. I know that there’s a lot of costs below the gross profit line, but this is a business that’s “playing on hard mode” and attacking a massive market. The upside if they get this right is enormous, and if and when they do it’ll probably look as obvious in hindsight as NVDA 10 years ago does today (PS I mentioned SFIX in my 2022 predictions as a potential winner, so you could accuse me of some preexisting bull bias!).

Those are just some preliminary thoughts; obviously I’m not out here guaranteeing a 10x over 10 years for any of these! If you have any additional potential candidates, I’d love to hear them!

This is a good thought provoking post. I'm going to take some more time to think about it, especially in the context of my current portfolios. Valuation does matter but it's worth considering their different circumstances. MSFT has a quasi-monopoly on a segment of enterprise software that needed a non-idiot CEO to evolve it with technology (cloud, mobile, gaming) and that's been successful enough to get a re-rating. NVDA developed a leadership position in a technology that was going to take over a big portion of mainstream computing thanks to gaming, crypto and other demanding applications. The wave just got bigger and they were right there. Maybe TRIP is like MSFT. Questions remain on the others for me because I wonder about switching costs and their ability to compete longer term. So far DBX has failed to come up with anything new that matters. They have all been duds. I think they might be better off figuring out an M&A strategy and executing that. I'm going to try and figure out a "lens" using your ideas here that I can use to view stocks in the portfolio and those being considered. Here's to wealth building once this market rout ends.

What about semicap ;)))