All of the sudden, everyone wants to talk about AI plays.

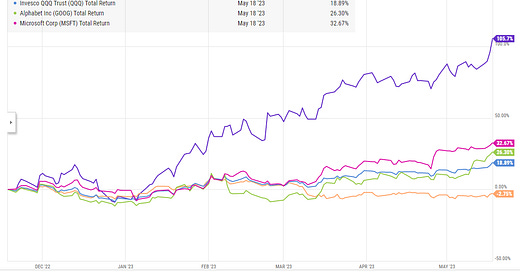

Well, not everyone…. but I can assure you that there’s not a single investor who’s watching NVDA rip higher every day (and drag the NASDAQ with it) in the face of a down market (NVDA has more than doubled over the past six months with the Russell dropping a small amount) without thinking “I wouldn’t mind finding something that gets the ‘AI’ treatment.”

PS- buying ahead of a bubble certainly isn’t my game, but I do kick myself a little bit for missing this one. In early Feb, Jerry Cap tweeted that Soros would obviously be buying NVDA in front of AI hype; NVDA is up a casual ~42% since that tweet with the IWM down ~10%. And I haven’t stopped thinking about The Diff’s line from early January that the smartest people will be buying Nvidia calls right before AI hits its true dominance. I thought about both those tweets/lines a lot at the time (so much so that I can remember them 3-4 months later!)…. and did nothing about it. ARGGGG

Anyway, today’s post is not about secondary ways to play AI (I may do a post on that at some point; if you have any thoughts, I’d love to hear them!).

Instead, I wanted to throw a thought bubble out there: how are you using AI to improve as an investor?

AI and learned models is nothing new in investing. Renaissance has built the greatest track record in history by building out cutting edge quant funds that are effectively machine learning, and I understand every major pod shop is running some type of quant / machine learning overlay on their entire portfolio at all times.

But I’m more interested in how small, reasonably concentrated event / value investors (so, basically, me or people like me!) are using AI to improve.

I’ve only asked a few people about AI in investing (I’ve thought about just making it a closing question on every podcast, but have avoided that so far!), but I don’t think I’ve heard of an investor who is using AI for anything more than an improved google (basically, using ChatGPT to summarize articles or to get more in-depth answers than google would provide). And that’s fine! Time is our most valuable resource, and if ChatGPT can save you a little time by summarizing an article or getting you sharper on a space that’s quite valuable.

But I can’t help but think there’s more.

Are there ways to use AI to improve portfolio management? To screen stocks? To enter your historical portfolio / trades and make trading and research improvements?

For example, pretend you have a stock that just reported earnings and is down 20%, and you’re tempted to buy more. I could imagine an AI program could look at your historical portfolio / trades and say, “hey, when you buy a stock down 20% after earnings, that tends to be a losing trade for you as the average buy underperforms the market by 20% over the next three months.” That would be an insanely interesting output! Not only would it help you avoid a bad trade, but it could help reveal some bias the you have as an investor (in this case, you’re not incorporating negative news from earnings into your analysis quickly enough).

You could imagine all sorts of pings like the one above that would help you improve your portfolio’s performance in the short term and help you improve as an investor / uncover some biases in the long term. The pings I’ve though of so far are simple (maybe when a stock you own doubles over three years, it tends to do really well over the next five years as you’ve got a talent for uncovering really interesting growth-y compounders….. but you never take advantage of “averaging up”) but powerful

I don’t know. Maybe I’m living under a rock and there’s a giant group of investors that have already found ways to make AI work for them? But I personally haven’t heard of anyone doing anything super edgy / interesting, and it seems hard for me to believe these tools are this powerful / rapidly infecting so many industries and they wouldn’t have massive implications for stock picking / portfolio management.

Have you found one? Feel free to hit me up in the comments (or my DMs); I’m going to try to spend some time researching / talking to other investors about it over the next few weeks, and I might post a follow up article if I learn anything / find any new tips!

I’m about as biased as possible here, but I had the same thought a few years ago while I was at a large hedge fund and recently founded a company building this.

Our goal is to create an “AI Brain” that is customized to each investor to help generate ideas, ramp up to speed, and make portfolio allocation decisions. The example you provided around buying down 20% is squarely on our roadmap.

Would love to chat sometime and hear more of your thoughts of how you’d like to use an AI in your process.

portrait-analytics.com

You're exactly right. I've mainly used ChatGPT to expand my circle of competence. I was researching the horse racing industry in Alberta for one of the stocks I'm researching, CNTY. I got on the learning curve quickly when it came to learning about the different breeds, lingo, and life spans of different horses, the ages at which each horse reaches its peak performance, and using this info to infer whether the incentive programs for breeders would have an immediate effect on the Alberta horse racing industry. I could imagine that using Google to find the same answers would take 3-4 times as long.

I think what you're talking about is probably quickly approaching us.

Just like how Mohnish Pabrai has an extensive investment checklist. We could feed our checklist into an AI, and whenever we make an investment decision, the AI could be our personal assistant and keep us accountable to our checklist. It's definitely not a stretch for AI to analyze our winning and losing trades and try to find patterns that we aren't aware of. i.e. doubling down on losers too often and winners less often