Last month, AMC finally completed their “APE conversion.” They converted the APEs into AMC stock, did a reverse split, and set themselves up to raise a boatload of equity by aggressively issuing shares (which they almost immediately executed on to the tune of ~$325m in ATM issuance in ~a week).

I’d been following the conversion closely; I wrote it up when it was first announced, and I did a really interesting pod with “Chance” after the initial settlement was delayed.

Originally, I was following the conversion for “profit” reasons: after the announcement, I went long APEs and had bought puts on AMC, looking to profit from the arb. That trade went really poorly (worth a reminder that nothing on this site is financial advice / I am a complete dummy); I thought the exchange would most likely be done by April and almost certainly be done by July, so I had bought most of my puts with that timing view in mind. As the exchange lingered on, those puts eventually expired mostly worthless and the APEs didn’t move up, creating an extremely frustrating loss. ARGG.

After that miss, I was largely out of the APE / AMC game (I had a very small remaining position that has effectively been closed by the exchange finally going through and options expiring last week), but I was still following because it was so interesting.

Anyway, I mention this because I’ve found the post closing action in AMC / APE so fascinating.

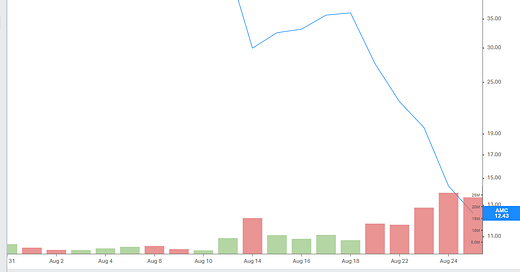

AMC’s stock was absolutely hammered as the exchange closed, with the stock trading down ~80% through the exchange….

And that decline has only gotten worse, with the stock dropping another ~33% as the company successfully (and aggressively) executed their ATM.

Most people expected that AMC’s stock would be down when the collapse happened; for most of this year, AMC’s stock had hovered around $5/share, and APE’s had hovered around $1.50. The general consensus seemed to be that AMC would trade towards APE, but they’d meet somewhere in the rough middle. At like $2/share or something (that’s pre-split prices; post split, $2/share is the equivalent of ~$20/share today). Note that I’m not underwriting that as AMC’s fair value or anything (this is clearly a company in extreme distress; even with that constant equity issuance, it’s going to be difficult for them to avoid some type of restructuring IMO). I’m just suggesting that when you have an arbitrage between two securities and the two securities “collapse”, the resulting price is generally somewhere between where the two traded.

Instead, AMC has just screamed lower. Aside from some very brief periods in early January, APE never traded below ~$1.00/share. At AMC’s closing price Friday of ~$8.50/share (remember, they did a 1 for 10 reverse split, so $12.50 is equivalent to $1.25 pre split), AMC is currently trading below where APE traded for basically all of this year. In fact, AMC’s currently trading below where APE traded for almost all its existence.

I know AMC is a meme stock and weird things happen with meme stocks. I’ve had a joke with a friend who asks me every now and then about shorting meme stocks, and I just tell him to get a tattoo of “we do not short meme stocks” on his forehead. I always tell him to get that tattoo because meme stocks are unexplainable; they can rise higher or fall farther than you can imagine.

But I’ll be honest: something about AMC (well) trading below even where APE traded has me a little unsettled. People talk all the time about “broken markets” and I generally discount those complaints. When people say “markets are broken,” I’ve generally found they mean “my stocks don’t go up” or “my stocks go up less than NVDA.”

But AMC seems a little broken to me. It just makes me sad. AMC had ~520m common shares out before the collapse. At $5/share (the pre-split price at the start of the month and for most of this year), that’s a market cap of >$2.5B. AMC sustained that share price (or better) for most of the year. That $2.5B is worth ~$500m at current prices (and factoring in the small settlement share payout).

It’s pretty clear that all the money in AMC was just hoping for a squeeze. Post pandemic, I thought AMC was clearly overvalued (again, I doubt there’s any equity value there), but, even after the craziness of Gamestonk in 2021, I would have been pretty skeptical that a meme stock could maintain a valuation that elevated for literally years simply betting on a short squeeze. I didn’t think there was enough “meme” money to sustain a >$2B valuation out of thin air for literally years; it just seems like eventually people would get bored and try to sneak out the exits before everyone else did (creating a self-fulfilling cycle of rushing for the exits).

The AMC / APE conversion proved that belief very wrong. AMC was maintaining a market cap billions too high for years just because people were betting on a short squeeze, and now they’re collectively ~$2B poorer for it. And not just them; APE had a ~$2B market cap of its own, and it’s now clear its market cap was getting supported purely by the AMC squeeze support. Wild.

I know it sounds silly saying “a meme stock brought on a bunch of new supply and the stock collapsed”, but the new supply was so obviously coming for the past year that I just wouldn’t have believed the stock could collapse this hard. I can’t believe “meme” money could sustain something for this long at a valuation this high when it was clear so much new supply was coming on.

Perhaps I shouldn’t be shocked given how many people continue to “invest” in new crypto projects after so many of them proved to be ponzis or squeezes that “rug pull” became common lingo.

So, yeah, I guess I’m naïve, but I didn’t think a public market squeeze could last this long with such obvious liquidity coming on. The whole thing just makes me a little more skeptical of markets / a little more inclined to listen when someone says “the markets are broken.”

Because you could lend out AMC to receive gargantuan lending fees most of that period of high price, you could look at AMC as a low value stock with a huge coupon of indeterminate duration attached. Once the coupon expired (ie borrow cost went back to normal-ish) the underlying (lack of) value was all that remained.

The go-to trade on the meme stocks IME is the long-dated put spread. If it keeps memeing the short leg can close out and you end up with a long put the whole time that pays off if it stops memeing.

I had BBBY and AMC put spreads last year where I closed out both legs at a profit.