I mentioned in my monthly links earlier this week that I was getting bombarded with inbounds about Credit Suisse potentially blowing up / causing a Lehman moment last weekend.

Everyone in finance is familiar with the concept of a “bank run.” Because banks are built on borrowing short term and lending long term, questions about their finances can become a self-fulfilling prophecy. Even if there was no issue to begin with, if enough people pull their assets / deposits out of fear that there is some issue, then the bank can quickly become insolvent because they can’t quickly realize liquidity on their longer term assets!

So after rumors started spreading that CS was in trouble, CS spent the weekend calling up clients and reassuring them everything was ok to head off a potential bank run.

Why am I recapping this?

Well, the rise in CDS cost that precipitated these rumors wasn’t particularly large in the grand scheme of things. And, just based on my Twitter feed, I don’t think a lot of the accounts that were spreading fear were doing real analysis. Most (not all, but most) of the fear seemed to be coming from day trading accounts or accounts with large followings that I wouldn’t say are known for the depth of their fundamental work (the WSJ had a recap that showed how popular the theory was on Reddit). I’d guess many of these accounts were tweeting scary headlines like “CS on verge of Lehman like default” knowing that the tweet would get a ton of engagement, not because they actually believed it (or, if they did believe it, they probably aren’t accounts that should be getting as much engagement as they are!).

That got me wondering: in a social media age, are financial institutions more prone to bank runs than they were in the pre-internet age?

Maybe that question sounds crazy…. but before the meme squeeze in early 2021, I doubt anyone believed that a bunch of retail day traders on a message board could bring down a multi-billion dollar hedge fund and prop a dying video game retailer up to a multi-billion dollar market cap for almost two full years (alongside saving a dying movie theater company!).

So we’re living in an age where anything can happen and there’s some small portion of investors that are willign to burn huge sums of money trying to create gamma squeezes and the like. For most companies, that doesn’t matter. In fact, for most companies, that optionality is a boon. If your stock becomes a meme and goes way above its intrinsic value, you can use that spike to raise cheap capital. If your stock becomes hated for some reason (I could certainly imagine a future where day trading boards start loading up on deep out of the money puts in a company to express displeasure in something they’ve done), you can take advantage of that by buying your stock back cheaply.

But banks don’t have that luxury. If their stock drops 20%+ on no news, people are going to panic. They’re going to wonder who knows something that they don’t; counter parties are likely to shoot first (pulling loans, demanding extra collateral, etc.) and ask questions later. Honestly, it’s just good business; if you’re lending money to someone at market interest rates and there’s a 1% chance that a huge stock drop signals something is wrong and a 99% chance that it’s nothing…. well, the risk/reward of a loan is so skewed that it makes sense to reduce exposure just in case the 1% is right! And every one doing the economically rational “right” thing and reducing exposure at the same time can create a self-fulfilling bank rank.

Maybe that concern is misplaced. I’ll say a lot of banks look pretty attractive right now. Just to chose one, Goldman (GS) is trading for ~$300/share. Tangible book is ~$290/share and actual book is ~$313/share, so you’re buying it for roughly book. Return on equity for the first half of the year is in the low teens despite a pretty crappy market; if they can earn low teens ROE (which is well above their cost of capital) in this market despite a pretty overcapitalized balance sheet, I’d suggest results should be much better in more normalized markets (ROE was well over 20% in 2021, though that’s almost certainly an above average market!). Buying a bank with the brand of GS that consistently does an ROE in excess of their cost of capital for book value is generally a winning proposition, but I can’t shake that there’s been a big increase in tail risks for these companies.

Anyway, just at a high level that all looks pretty attractive…. but the tail “bank run” risk is out there. And there are plenty of attractively priced stocks elsewhere that don’t have that same risk.

No firm conclusions here, but just something that’s been on my mind.

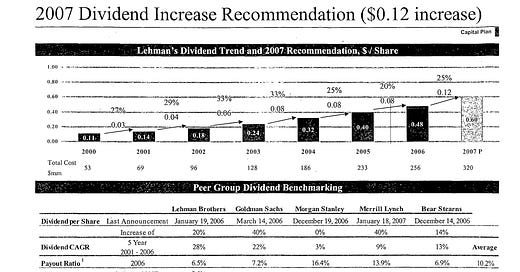

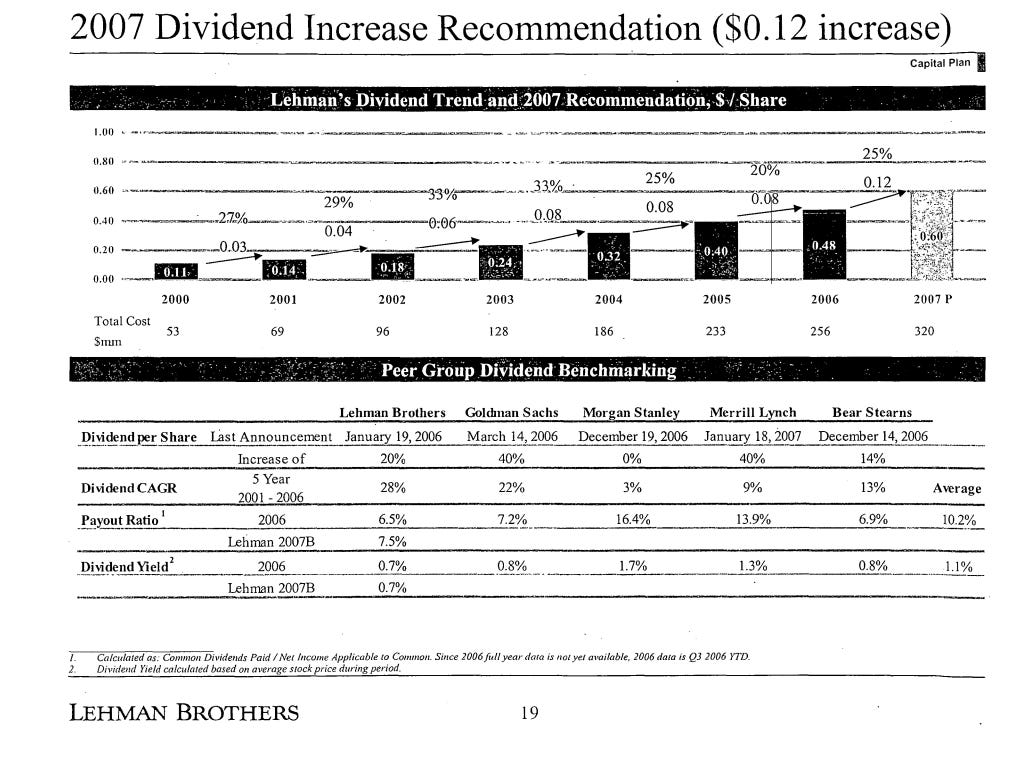

PS- I was googling around to think about this article and found Lehman’s financial plan for 2007 that their board discussed. It’s really interesting to flip through that with the benefit of hindsight. Lehman looked like the perfect compounder stock; ROE consistently over 20%, dividends and share buybacks increasing, etc. Within two years, the equity would be wiped out and the company would cease to exist. Crazy.

I think people/the market don’t realize how big the consumer business has gotten at Goldman. That gives the balance sheet more stability than a LEH.

But I also don’t think people realize how reckless they’ve been building that consumer business. I’d need to see them perform in a downturn before I gave it any value at all. From a risk/reward basis I’d rather own a well-managed consumer finance business like SYF than whatever GS has been building.

The thing that was frustrating with the "CS as Lehman" meme is just that a really big cause of the Lehman collapse/all of the GFC was immense, complex, unregulated counterparty risk that was marbled throughout the entire financial system. Nobody knew who owed what to whom, and it was suddenly deeply plausible that many large, cornerstone institutions could be truly insolvent.

Many of the regulatory changes after the GFC can be characterized in any number of ways, but the "big scary opaque counterparty risk" thing really has gone away post-Basel III et al. Nobody should be (or needs to be!) relying on rumors and Twitter accounts or even equity prices to signal on this stuff in the way that we had to pre-GFC.