Like a lot of the rest of the world, I’ve been thinking about banks a lot recently.

Many of the investors I’ve talked to have said “banks are off limits for me.” Perhaps that’s the right approach; banks are somewhat black box-y. They are basically confidence games that take short term money and magically use it to fund long term investments, and right now it appears confidence can disappear from any bank at any time. It really doesn’t matter how good your balance sheet is; if 50% of your deposits pull over night, you’re going to have to fire sale some assets, and when you’re ~10:1 levered (as most banks are), even a small haircut (which you’ll have to take in a fire sale) will lead to the equity being a zero.

And, as if the looming “will we just see a cascade of deposit flight from all banks?” risk wasn’t enough, there are other risks! In the near term, expenses are going up as the FDIC tries to refill its coffers post SIVB bail out, and banks will likely need to pay more for deposits now that depositors have had the difference between a zero cost deposit and fully backed (and interest paying) money market fund so clearly illustrated to them (that increase in deposit costs will crimp margins). In the medium to longer term, you’ve got worries about commercial real estate loans and probably an added cost/regulatory burden as regulators look to make sure no banks can get SIVB’d going forward.

So yeah, there’s plenty of risk…. but it’s hard for me to think there’s not opportunity here.

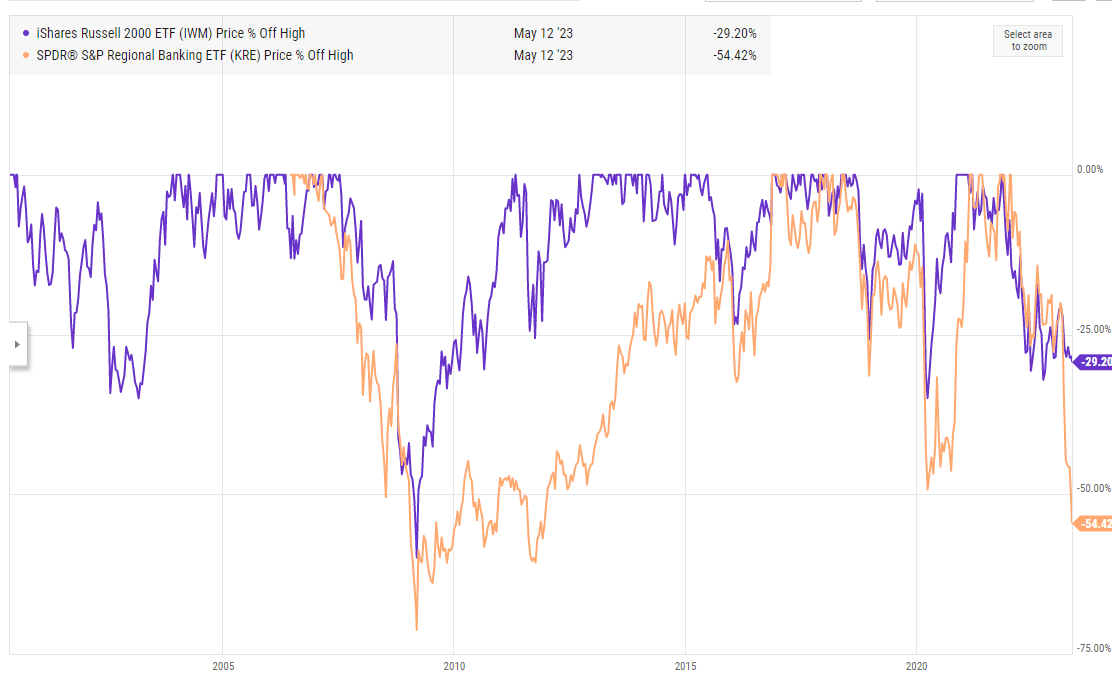

Consider the chart below: it’s the regional bank ETF versus the Russell 2000 over the past year. The regional bank ETF is down 40% while the Russell is ~flat.

Ok, now consider this chart: it’s the regional bank ETF versus the Russell 2000 from March 2008 to March 2009 (the regional bank ETF drops ~50% while the market drops ~45%_.

That’s pretty wild! In the past year, the regional bank ETF is down almost as much as it was in the financial crisis, and it’s gone down that much despite the index being roughly flat.

In fact, as far as I can tell, this is by far the worst underperformance versus the index the regional bank ETF has ever had (excuse how messy the chart below is; it’s % off high for the Russell 2000 and banking ETF over time. I don’t do tons of charts; I’m sure there’s a better chart to show what I’m trying to show but this one should get the job done!).

On the heels of the current crisis, there are absolutely long term worries about banks earnings, regulatory burden, funding and capital structure, etc….. but I actually don’t think any of those are particularly relevant versus today’s stock prices. Most of the regional bank stocks I see are trading under tangible book value and for a mid-single digit multiple of trailing earnings; they’ve fallen so fast and hard that I think the market is starting to price a lot of them as having solvency and distress concerns. Maybe we have one or two more banks fail (PACW and WAL certainly seem to be tottering….), but my guess is that if you and I are talking a month or three from now and we’ve moved on from talking about “which bank is next to fail” to “how low will banking ROE be going forward”, the majority of the bank stocks are going to be significantly higher.

Anyway, we’re in the midst of a panic and my thoughts are rambling, but there are four things I wanted to talk about here:

As we move on, each successive bank failure is more likely to be the last

Lots of the fears that I’ve seen thrown around with banks aren’t exactly new / unknown.

I’m impressed by the variety of ways to bet on a “banking bounce back”

Banking upside on the back end

And, before I dive into those, I’ll note one thing: I’m definitely not a banking expert. One of the great things about having a public platform is the variety of thoughts and notes I get form people. The future is uncertain and hazy, but if you think I’m just flat wrong on something (and you have some basis for thinking your view is correct; I’ll never get over how many people like to respond to something “you’re wrong” and then when pressed have done exactly zero thinking and have no expertise on the subject), please feel free to correct me in the comments!

Anyway, on to point #1.

Point #1) As we move on, each successive bank failure is more likely to be the last

There are two things at play here.

First, for the most part, the banks that had significantly negative tangible mark to market equity have already gone under.

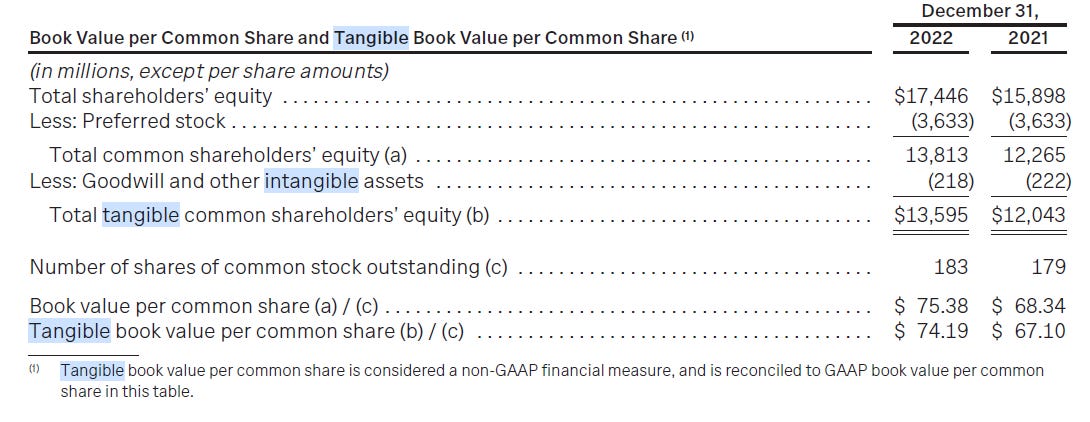

First Republic (FRC) is a great example of this. They reported ~$13.6B (~$74/share) of tangible book value (all FRC screenshots I’m about to share are from their 2022 10-K; you can find it on the FDIC website).

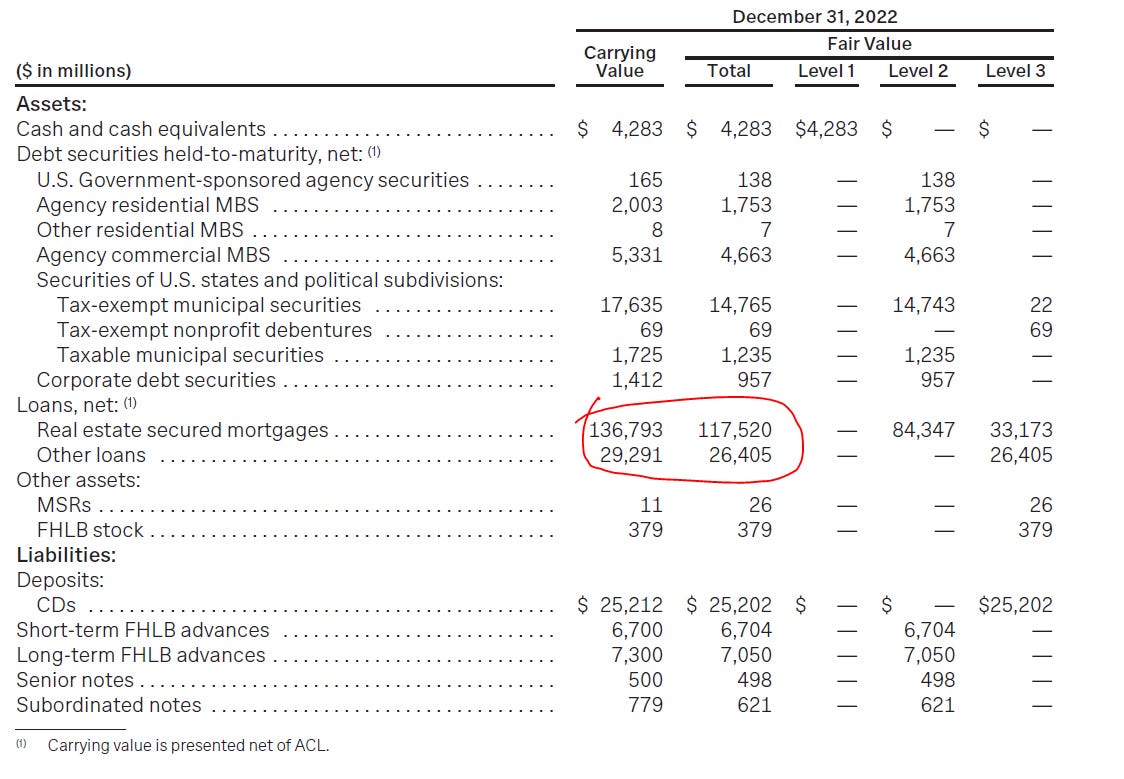

However, they were ~$5B (~$25/share) underwater on their held to maturity debt securities:

And they were another ~$22.5B (~$118/share) underwater on their loan book:

One of the best podcasts I’ve done was with John Maxfield on banks a few months ago. I asked him why a bank shouldn’t mark to market a loan book, and he told me the banks didn’t have to because they only would do so during irrational fear that caused them to panic sell their loans in a desperate rush for liquidity. Well, rightly or wrongly, FRC got hit with fear and a run, and their loan book proved a huge problem.

But here’s why I think step one of the crisis is over: the banks that had these deeply negative HTM securities or loan books have already been hammered (well, except for BOH, but that bank is literally protected by an ocean!).

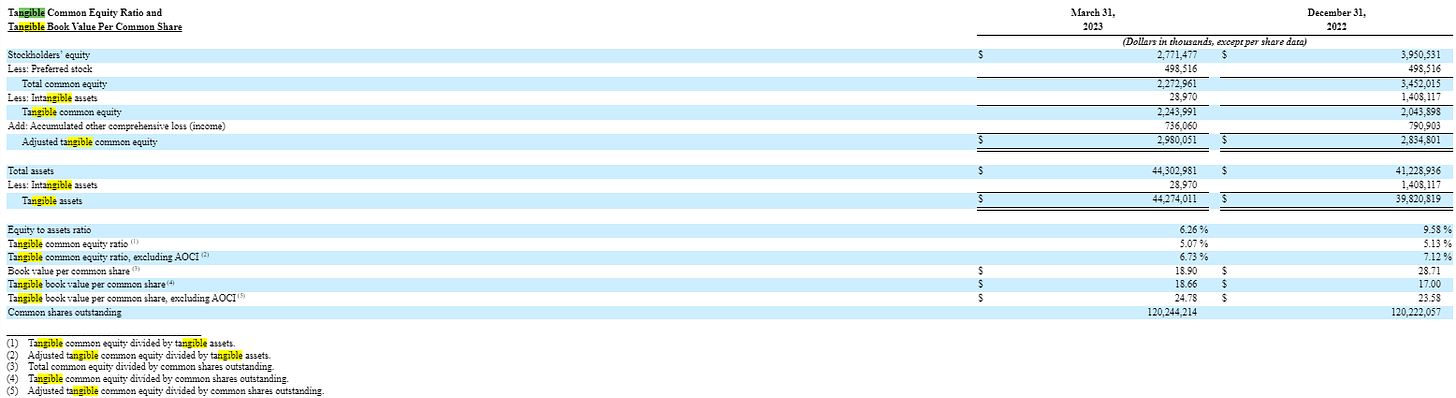

The current bank failure worry de jure is PACW; it reports $18.66/share in tangible book.

Their 10-Q is here; I’m not going to screen shot the whole thing but they fair value both their HTM securities (see p. 17) and their loan book (see p. 51). If you took their fair value marks, the HTM securities would mark ~$1/share off their book value, and the loans would hit them for another ~$11/share, leaving them with ~$6/share in tangible book value.

That’s not much… but it is something!

I’m not saying PACW is going to survive. Loans are illiquid; if you need to fire sale them to stay alive, you’re probably going to have to sell them at a discount, and given a thin equity cushion and the leverage inherent in a bank, that discount can easily kill you.

But I highlight it to show that PACW has a much bigger cushion than FRC did (FRC had literally negative equity, so you could argue PACW has infinity more cushion). And, if depositors go for a different bank after PACW, that bank will almost certainly be one with an even bigger equity cushion than PACW.

So that’s on the asset side; the other side to consider is the deposit / funding side.

I guess I’ll make a quick diversion before diving in here. A lot of the people I talk to say something like “the regulators are completely discombobulated here; their response has been awful and they don’t appear to know how to stop this crisis.”

Cool, no disagreement here!

And while it would have been great to get a better regulatory response and stop this crisis before it really got rolling, I think the simple passing of time is an even more effective cure, and at this point we appear to have gotten that.

What can kill a bank is just a sudden rush of deposits leaving the door. Most banks could handle losing 25% of their deposits over a two year span. It wouldn’t be pretty; there would be cost cuts and heads to roll and such, but if they knew deposits were going to leave like that the bank could ensure they had enough liquidity, let loans roll off without replacing them, and do all sorts of other things to ensure they could meet that type of deposit pull.

Where banks struggle is when 25% of their deposits try to leave in two hours. Then you’re talking about fire selling loans, desperately calling up the fed to see what they’ll take for collateral for emergency funding, etc.

In mid-March, I wasn’t really interested in buying banks. It was just impossible to know where the deposit flight stopped. It seemed possible that any bank could lose 20% of their deposits overnight and basically not open their doors the next day.

But that time has passed. I’ve probably read 50 banks earnings calls or conference presentations over the past few weeks. And, near to a man, all of them tell a story that sounds something like this: “In the week where SIVB went under, we saw a lot of outflows. After that week, things stabilized, and as time as passed our deposits have held steady or we’ve even seen some deposits return or deposits grow.” Basically, they all sound something like this chart from a recent CFG presentation.

Again, not saying we don’t see deposit flight again… but I think a natural question is if you’re a depositor and you didn’t panic flee in March, what’s going to make you panic out now? I would guess that most of the large / chunky uninsured deposit accounts have left regional banks at this point; the remaining deposit accounts that are over the insurance limits are probably operating accounts tied to a business in some way. That seems to jive with the stats I see; most of the regional banks I’ve seen are reporting 60%+ of their deposit base is now made up of deposits that are insured or collateralized (and thus should be much lower panic flight risk because they’ll be made whole even if the bank goes under).

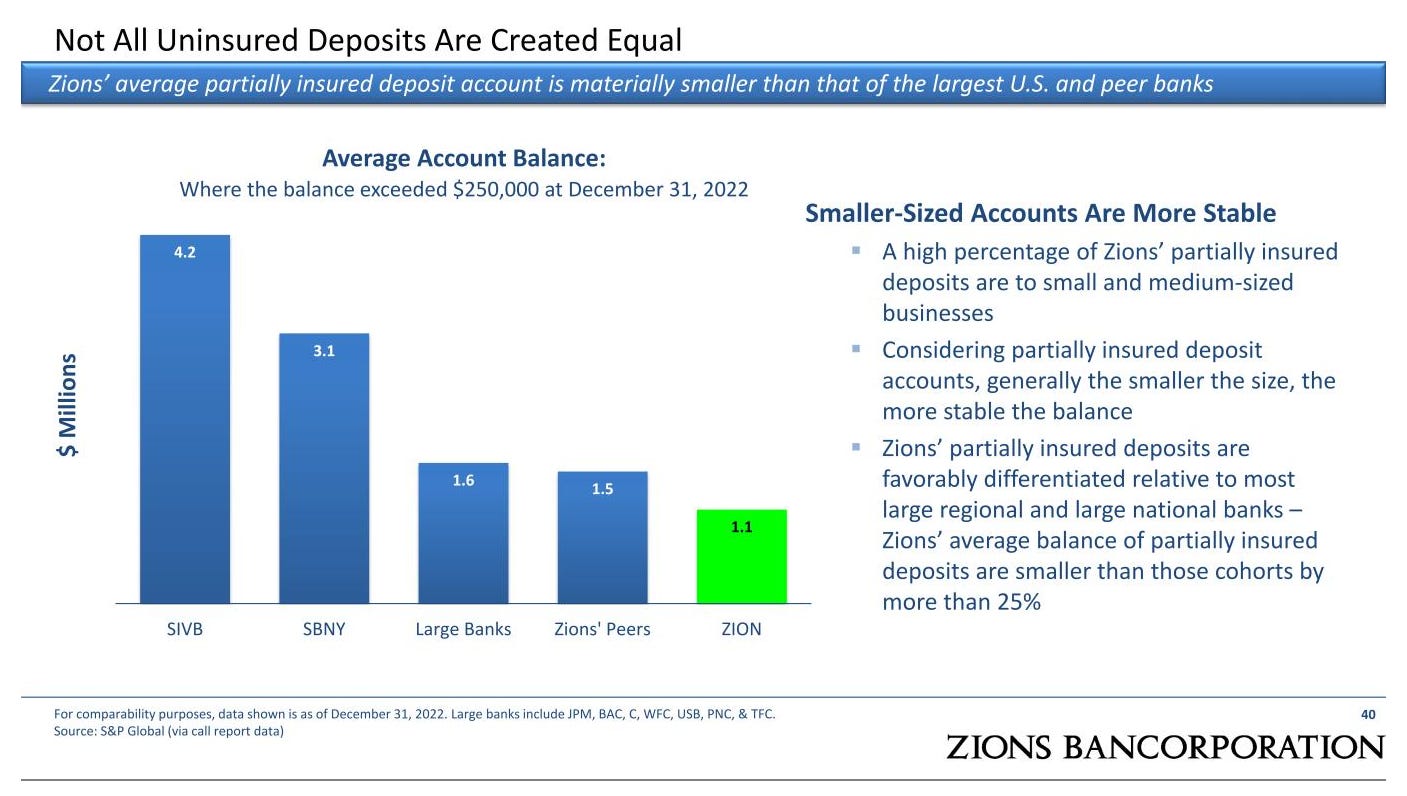

Also worth noting that the deposit flights happened at banks that had particularly large uninsured accounts; Circle had $3.3B in uninsured deposits at SIVB (and that’s just at the end; I think it was $5B before they started trying to pull) and Roku had almost $500m. Obviously everything is scale related (a $50m account at a community bank could be bigger as a % of deposits than a $5B account was at SIVB!), but accounts that large and chunky are going to be particularly prone to flight and I’m not seeing any other banks with that much concentration / if a bank did have that type of chunky exposure, it’s probably pulled out already. Note too that SIVB / SBNY had larger than average uninsured deposit account balances:

Even if we do see more panic deposit pulls, banks have been granted precious time. They’ve had time (more than two months!) to raise liquidity and prepare for deposit flights so that they’re not panic selling or desperately calling around to meet a liquidity need. They’ve had two more months of earnings, and for banks with underwater HTM and loan books they’ve had two more months for that discount to accrete (i.e. we’re two months closer to the loan/bond paying off, which means fair value is closer to face value!).

One more point while we’re here: we’ve had ~five banks fail so far this year, and that’s naturally giving investors flashbacks to the GFC. But I don’t think the two could be more different. In the GFC, there was a real asset quality problem: a bank had something marked on their books at 100 and it turned out to be worth zero. What you have right now is a strange mismatch of a funding problem and an undercapitalization problem; these banks are going under because they have fundamentally good assets that have just dropped in value a ton because interest rates went up. Rather than raising equity, they pretended there wasn’t an issue, and when depositors got nervous they forced the issue on the banks.

So to me the challenge is kind of: if you can find a well capitalized bank that’s been panic sold but isn’t going under, there’s almost certainly upside here. And I think there are several of those out there.

Moving on the point #2:

Point #2: Lots of the fears that I’ve seen thrown around with banks aren’t exactly new / unknown.

If I start discussing banks with people, a lot of times the conversation will steer to “why won’t everyone take all of their deposits and stick them in money market funds or Apple’s bank account,” or “aren’t these guys loan books going to get crushed in a recession?”

Both are reasonable fears…. but I think there are multiple rebuttals.

First, I’d just reiterate that I don’t think these are super relevant concerns versus today’s share prices. Many of these banks are trading well below tangible book value; they’re trading as if there’s some chance of imminent distress. If non-performing loans tick up in Q2 but all of the “will bank XYZ get seized over the weekend” talk is behind us, it’s hard for me to believe share prices aren’t going up.

Moving on from that, the “alternative place to park your money” issue is real. SIVB failing beat into depositors heads “hey, your bank account is at risk and yields nothing; why not look into switching to money mark funds and getting some interest while being safe?” The Apple bank account is highly visible and streamlined.

But none of these concerns are new. Money markets paying more than bank accounts has been around for over a year. The fact is bank accounts are quite sticky. Once you’ve attached two credit cards and some bill pays to your bank account, it becomes more hassle than it’s worth to try to move back and forth from a money market account. I understand this risk is top of mind now, and maybe deposit beta goes up a little bit over time because the internet makes it easier to move money and the current crisis has hit people over the head with the risks of bank accounts…. but it was just as easy to move your money in December 2019 or December 2022 as it is today. I’m willing to bet on decades of history that suggest deposits are relatively sticky.

Just to use one example to show this visibly: consider ZION. Deposit pricing went from 0.20% in Q4’22 to 0.47% in Q1’23. At the end of March it was 0.90%. It’s probably going a bit higher in Q2 given interest rates are up and depositors are still jumpy…. but their loan yields went from 3.52% in Q1’22 to 5.3% in Q1’23. Their deposit cost could jump up to 2% (more than doubling their real time end of March number!) and they’d be in roughly the same place as they were at the start 2022!

It’s probably worth noting one other thing here. Right now the interest curve is in pretty extreme backwardation: the fed funds rate is 5.25%, and a 10 year treasury yields <3.5%. My guess is that a lot of the deposit fears relate to that backwardation (depositors looking at money markets and saying “dang it yields more than bonds”); I think the deposit beta stuff I mentioned above is real so this doesn’t really matter, but if and when we move out of backwardation I think these fears go away fast.

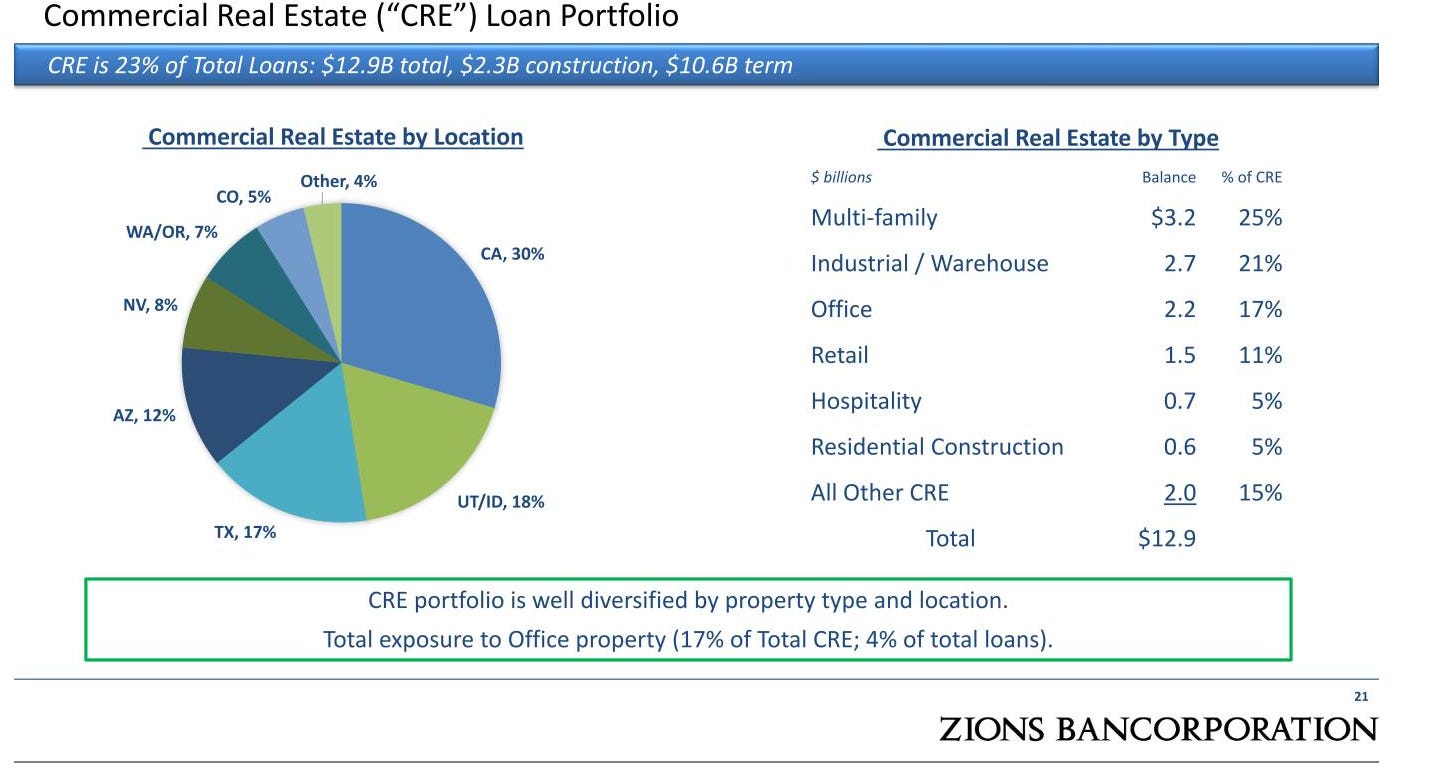

On the loan book side, it’s worth remembering that banking executives read the same stuff you and I do. Yes, recessions aren’t good for their loan book….. but any recession now is going to be the most telegraphed and anticipated recession in U.S. history. My guess is that most investors think bank loan books look like 2007, when they were stuffed with speculative real estate loans and such. Or most investors think bank loan books are heavily overweight downtown office buildings that are effectively empty and completely underwater. That’s just not the case.

Again, consider Zion. Only 23 % of their loan book is commercial real estate….

And their credit quality is exceptional, with only 0.30% NPAs

ZION is also extremely well capitalized and can absorb significant losses.

So, yes, I’m sure NPAs will go up if we enter a recession…. but the general vibe I get from a lot of investors is that these banks will crumble instantly the moment we hit a recession. I’m sure there are some banks like that out there, but I’m just not seeing that in the majority of the banks. The scars from the GFC are real, and these banks have had over a year to prep for a looming slow down. Their balance sheets are generally strong, and their loan books are pretty high quality stuff.

On to point #3

Point #3: I’m impressed by the variety of ways to bet on a “banking bounce back”

So far, I’ve just addressed the bear cases around regional bank stocks and tried to dispel some of fear. I haven’t talked about specific “plays” or investments to take advantage of the environment.

That’s very intentional for a few reasons.

First, because it’s always worth reminding that nothing on this blog is investing advice.

Second, it’s because I didn’t really want to talk specifics in this post. I’m happy to talk specifics offline, but this is a sector wide panic, and while you can probably add alpha picking the right stocks, I think the most important part here is likely to be getting the general “we don’t see 50 more bank failures” call right and individual security selection, while helpful, is probably less important.

Just to chose three banks randomly, WTFC, OZK, and CFG are all multi-bullion dollar banks. They’re all trading for under their reported tangible book value (though do have some HTM marks to account for, but nothing wild!), and they all do mid-teens returns on tangible equity. Put the two together and you’re buying them at mid to high single digit P/E multiples. You can pretty easily find another 20 banks of similar size / valuation / return profile. Could any one of them run into trouble? Sure…. but I’d guess if you buy a basket of banks at these levels it’s pretty hard to not do well from here provided we don’t have real contagion from the current crisis.

So you could just go with a basket approach…. but beyond that I am impressed with the variety of ways you can make a bet that banks aren’t going to fail. There are a whole host of different themes you can bet on.

For example, you can bet on different types of bank:

Bet the jockey: Northeast Bank made an all in / Beal bank style move in late 2022; you could bet the jockey and buy that stock at around 2x last quarter’s annualized EPS (I think it’s a really interesting story and I bought a tracking position, but that is a truly unique bet amongst banks).

Buy the “bailout winners”: First Citizens (FCNCA) bought the remains of SIVB in a wildly accrettive deal; even after a massive move, the stock is trading at roughly tangible book value.

Buy the “almost bailout winners”: FCNCA wasn’t the only company bidding on SIVB. Several others have confirmed they lost out on the SIVB bid, and you can find the full list of bidders on the FDIC website. My guess is that the FDIC wasn’t letting banks bid on SIVB unless the FDIC knew the bank could handle the integration / had a strong enough balance sheet to survive; maybe you buy the “losing bidders” on the theory they’re survivors and might get a crack at an SIVB style deal if another bank or three fail?

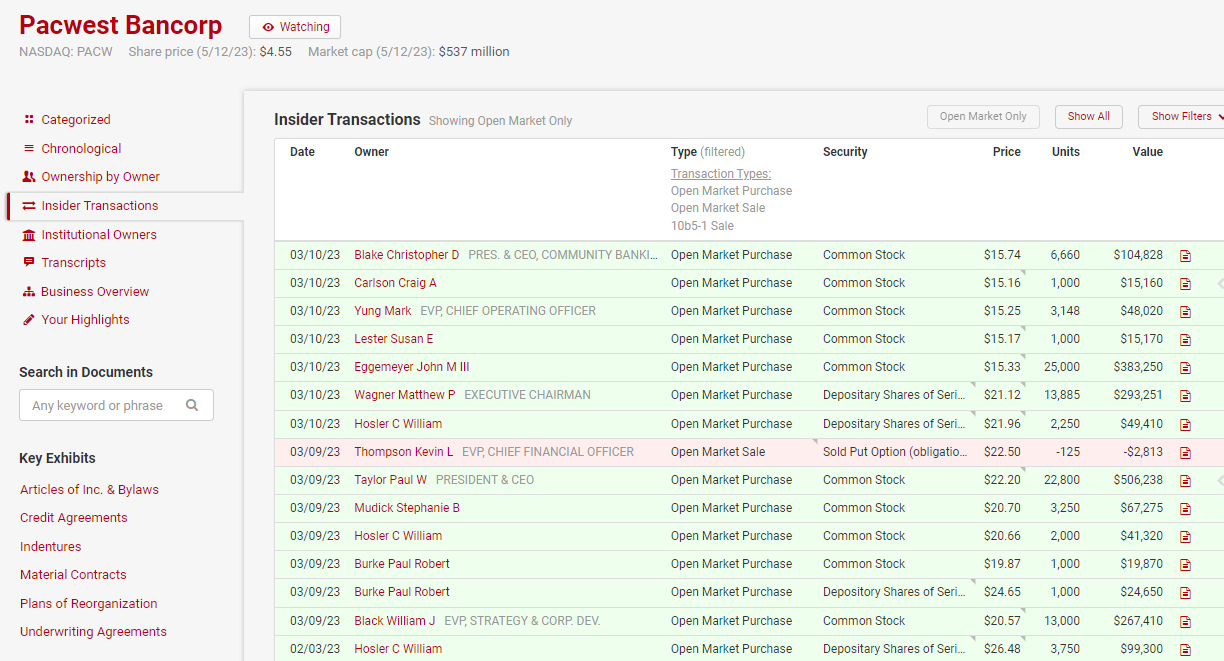

Buy a bank with insider buying: One of the things that interests me about banks right now is that I’m not sure I’ve ever seen a sector that has so much insider buying. Now, banking’s a confidence game, so maybe you could argue the insiders are making token buys to shore up confidence in their bank (it’s not lost on me that PACW was buying stock in March at prices ~300% above current share prices!), but given the valuations and what I’m seeing I tend to think the insiders are buying because they see a lot of value, so you could find a bank with a lot of insider buying and join them.

Or you could go a completely different route. A lot of banks have perpetual preferred stock outstanding. These preferreds are often non-cumulative, so if they skip a dividend it is lost forever. That’s a negative….. but banks are creatures of capital market confidence; if a bank skips a preferred dividend, it’s because they’re going under. Look at PACW; it’s currently fighting for it’s survival and it declared full pref divs plus a token common dividend this quarter. A lot of these prefs are trading for pretty distressed levels (60-70% of face value). Some of that is because the prefs are often fixed rate perpetuals that were issued in a lower rate environment, but a most of it is because the market is distressed (I see tons of prefs that were trading for ~85% of face two months ago that are trading for ~65% of face today). So you could go find some bank prefs and buy them and effectively bet that the bank is not going under. I think this is a really interesting trade in particular because if things got kind of rocky I kind see banks agreeing to issuing tons of equity at 50% of tangible book, which would destroy the returns for common but give huge upside to pref shareholders.

Anyway, I’ve been looking at a few interesting ones here, and this idea really intrigues me. They tend to be a little illiquid so I won’t call any specific out, but I’m happy to engage one on one if anyone sees an interesting one or a different angle and wants another set of eyes on them.

This post is running long… but there is one last thing I want to discuss before wrapping up.

Point #4: banking upside on the back end.

Right now, things seem pretty bleak for banks. Deposit flight, competition for funding with money market funds, a looming recession, rising FDIC fees to cover the SIVB bail out, a bumbling regulatory response (IMO), and likely increased regulatory scrutiny and compliance costs as we put the immediate crisis behind us.

So yes, things seem scary…. but I wonder if people are being a little short sighted and we’re all going to be surprised by just how profitable banks come out on the other side of this turmoil.

We just had four of the largest banks in America disappear almost over night. Not only that, but two of them (SIVB and FRC) were well known for giving super prime customers way below market loans (effectively pricing everyone else out). Plus, every bank is currently building liquidity and preparing for a recession.

Combine all of that…. and I’d have to guess that the business of banking is going to be more profitable a year from now than it was last year?

It just makes sense. Yes, banking is in part online…. but a lot of banking is a local game. We just had four-five huge competitors go away over night; I’d guess that most markets have lost at least one major or medium sized competitor after all those BKs. On top of that, most banks seem to be raising liquidity / retrenching in some way. You’d have to imagine lending spreads are going up in that environment.

I could easily see a scenario where ~two years from now all of the banks that had been consistently reporting mid-teens ROE are reporting high-teens or even 20%+ ROEs, and mentioning how the removal of a key competitor in one of their markets has resulted in more rational competition and their spreads and margins are at all time records.

Maybe I’m crazy…. but generally the survivors of a panic do pretty well on the other side, and right now you can buy all of these companies with a history of mid-teens ROEs for under book value. That seems pretty attractive, and if we get a mini-boom on the heels of this it’ll be a real cherry on top.

A lot of M&A on the back end of this crisis also wouldn’t be crazy. Since the GFC, the increased regulatory on banks has turned it into a scale game, and online banking and such have certainly increased the fixed cost of banking. With more regulation (and thus more regulatory cost) likely coming down the pipe on the heels of this crisis, I’d guess the fixed costs are going to continue to go up, and that likely leads to some M&A. I’d also note that FRC and SIVB seemed to go down in large part because the tech sector had a more concentrated deposit base with them; going forward, I think banks will pay extra attention to their “sector exposure”, which I think could also lead to a little bit more M&A (i.e. a bank with a lot of industrial exposure might consider buying a bank with a lot of healthcare exposure to get some diversity; this obviously is not a new thing but SIVB/FRC might bring it even more to the forefront and encourage some extra deal making).

Wrapping it up

Anyway, this post is long and winding. If I had to tl;dr it, it would be this: my guess is we’re closer to the end of the crisis than the beginning, and I see lots of opportunities to buy good banks that should be survivors for below tangible book value (and that’s adjusted for any held to maturity securities). These banks of a history of mid-teens ROEs; yeah the next few months might be rocky, but I could see them having a period of inflated profits as everything normalizes given the vaporizing of a lot of their competition, and historically if you can buy good banks for at or below tangible book value the returns are quite attractive. I’m willing to bet this time isn’t different (but I’m not an expert so please feel free to tell me where I’m wrong!).

One random thought on my mind: if you’re talking to someone about the upside for a bank with an underwater HTM book or something, a lot of times the conversation will steer towards something like “all of that mark will accrete back to the book over time!” Heck, I did something like that in that article. And while that is true, that return is basically just time value of money; it’s probably unfair to give more credit to that bank “earning” that discount back versus a bank that has nothing underwater and just earns a normal return on their loan or securities book. The only difference is the bank with the HTM issues gets a little extra leverage since, for regulatory reasons, they were allowed to overinvest a little bit by holding those securities at cost instead of fair value.

Another random thought: maybe it’s too early to be buying? I discussed above how I think mid-March was actually the point of most risk (at least IMO), and time has cured a lot of the worries, but it is a little strange that we’ve got a full out banking panic and, once you adjust for HTM securities, most of the sector (excluding the obviously quite distressed ones) is trading just under tangible book. It does feel like a real panic should see these trade at like 60% of book or something; maybe it’s too early / these aren’t quite as juicy as I think? Maybe I’m too focused on pre-crisis stock price and the earnings / returns these were putting up before the crisis (mid-teens or better ROEs, so buying them at tangible means you’re buying them for mid to high single digit P/E). Completely possible…. but I do believe the earnings / deposit beta / better loan book stories are real, so I think today’s price can easily get you multi-year mid-teens IRRs (or better with multiple expansion, which I think is likely).

what do you think of buffett and munger’s comments? they are kind of the banking experts and expressed a lot of concern that this isn’t close to being over.

In regards to PACW, "Deposit balances further grew ~$700M as of April 24. Total insured deposits, including accounts eligible for pass-through insurance, represented ~73% of total deposits as of April 24, up from 48% at December 31, 2022. Immediately-available liquidity stood at $12.4B,

which exceeded uninsured deposits of $8.1B, with a coverage ratio of 153% at March 31."

I'm also not a bank expert, but that seems solid to me. (I'm long 1500 shares PACWP) Also I was hoping to pick up some bonds in PNC, but decided not to since most of them are trading above par. So clearly the bond market is comfortable with PNC's prospects.