If you talked to someone who was decently plugged into the market and asked them about Nike, they’d probably tell you the company was struggling. Why? Nike’s last quarter and recent guide were terrible, and their stock dropped ~20% on the results. And you don’t need to be a full earnings junky / CNBC addict to know that: Nike’s guide down has been a hot topic for any company (and thus investor) that touches the consumer in a variety of ways (so if you’re looking at any retail or consumer goods company, a common question would be “is there any near term worry about the Nike read through” or something along those lines).

Ask the same person about Tesla, and they’d probably say that Tesla is starting to hit its stride again. They might say something like “Tesla and Elon were really distracted by the pay battle, but that’s behind them and now they’re focused on winning the AI / self driving / whatever else war…. and, judging by the stock, they’ve got a shot!”

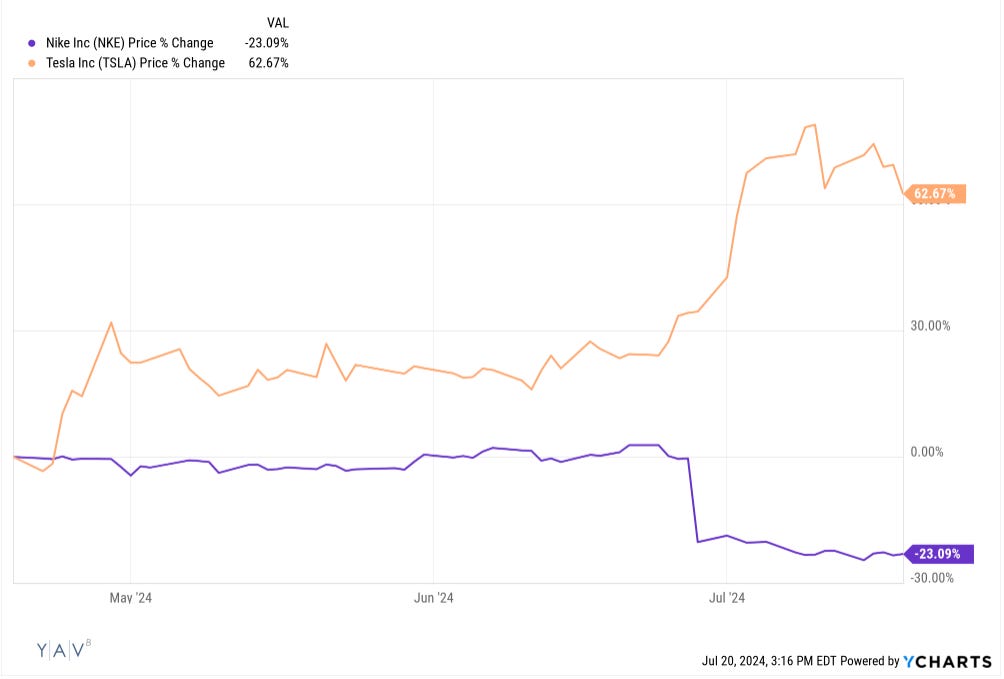

And you can see that narrative in the stock charts: Tesla is up a whopping >60% over the past few months, while Nike is down ~20%.

But it’s honestly not clear to me that either story is true. Yes, Nike isn’t a growth darling right now…. but their “business falling off a cliff” performance has them projecting ~flat growth. And the stock is trading for ~20x P/E…. not exactly a business in decline.

And, while Tesla’s stock has been racing, it’s not clear to me that anything at the business has really changed. I know that a lot more than near / medium term earnings estimates drive fundamental value (particularly when you’re talking about a company like Tesla that has some type of claim / chance of succeeding as a winner take all self-driving / AI play), but whether you’re looking at the very short term (this quarter’s results), the short term (this year’s earnings estimates), or the medium term (2026 earnings estimates), analysts have actually been pretty consistently cutting estimates for Tesla.

Again, I realize that there’s a lot more driving Tesla’s valuation that just near and medium term earnings estimates. But it does strike me that most people would probably look at Tesla’s stock chart and say the business was accelerating (if not booming), and the earnings estimates just aren’t saying that.

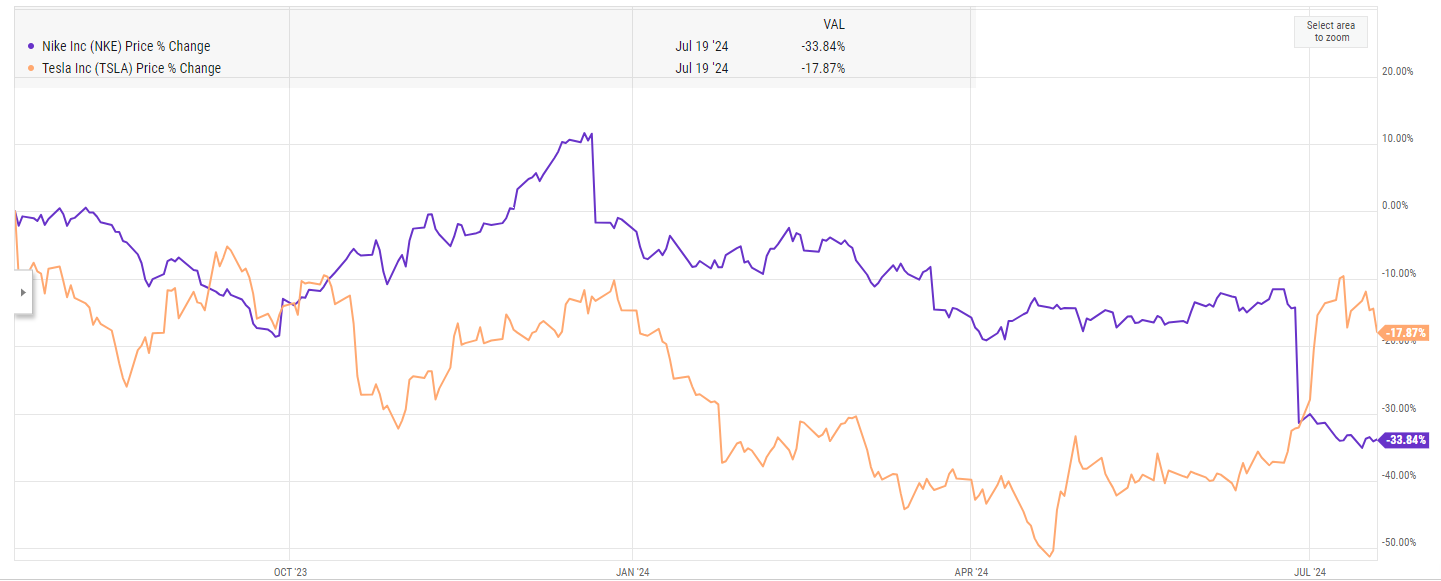

To drive this back to the earlier story, most people would probably nod their head and agree that Tesla’s business was accelerating while Nike’s business was flailing. But I chose the two companies for a specific reason: both saw their stocks take off in completely different directions around the same time (~a month ago), but both are still down pretty substantially over the past twelve months.

I’m not exactly breaking any new ground by saying “stock price can drive company narrative.” But it did just jump out to me on these two companies in particular, and it’s one thing I’ve been spending a lot of time thinking about: a lot of times, the real money is made when you buy into a story where the narrative (i.e. the business is collapsing) differs from the fundamentals (maybe it’s the business has just hit a growth stall, or maybe the business is just fine!).

How often is the stock price driving the wrong narrative?

And how much work does it take / how often can you correctly identify a stock price that’s driving the wrong narrative?

I can tell you in Europe Adida’s is kicking NKE ass, they are now prominent above NKE , I’m with 2 teenage boys and have been to 100 sneaker stores and spoke with salespeople, for what it’s worth