I was chatting with a friend Friday, and we were talking about a stock that was a darling of the 2021 growth / meme trade but has fallen on harder times recently. I mentioned something off hand along the lines of “they’re getting back on track, and it seems like every former growth darling that gets back on track has caught a huge bid.” He responded, “Yeah, it seems like once a company has gotten a ‘compounder / growth’ darling bid once, it doesn’t take much for them to catch that bid again.”

And that got me thinking: are there certain companies that are just more likely to catch a bubble / get a growth multiple?

My friend and I were discussing this in terms of the 2021 growth / despac class. I think we had something like Carvana (CVNA) in our head; the stock peaked >$300/share in 2021 before falling off a cliff in 2022. By the end of 2022, there were reasonable questions if the company was going to survive; however, they righted the ship in 2023, and the stock rocketed (it was up ~10x in 2023 and another ~60% so far this year).

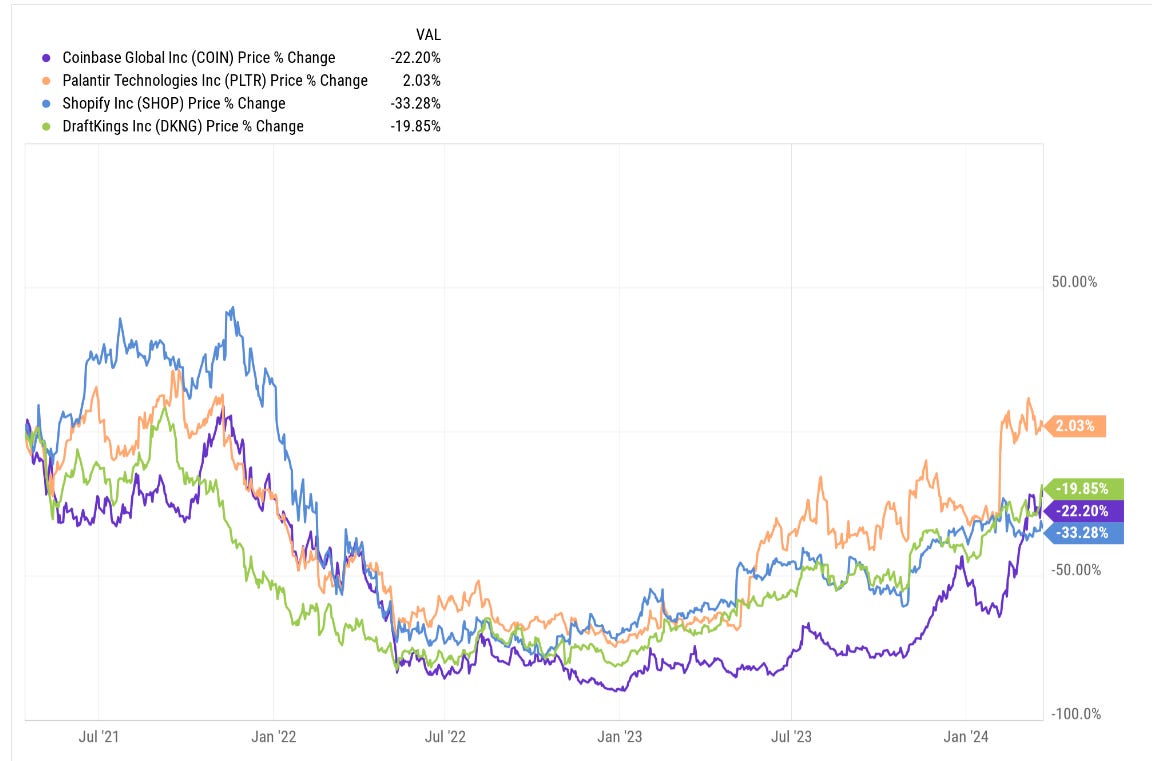

There are plenty of other similar examples. For example, if I just look at some of ARKK’s largest holdings, PLTR, COIN, SHOP, and DKNG all enjoyed lofty multiples in 2021. They all cratered in 2022, and have enjoyed multi-bagger runs off the bottom in 2023 and so far this year.

Let me be clear: I’m not making a call on any of these companies’ business models, valuations, etc. All of these are pretty controversial companies with highly vocal bulls and bears. I don’t have a position in any of them; I’m simply discussing the fact that they enjoyed lofty multiples in 2021, cratered in 2022, and today are enjoying lofty multiples again (for example, as I write this, SHOP trades for around 100x EBITDA. It’s a great company and could easily grow into that multiple, but I don’t think anyone would look at that multiple and argue for deep value!).

I wonder if there’s something to these names that lends themselves to inflating / big multiples when things are going right. Maybe it’s that they’re attacking huge markets, so when things are going well bulls can point to massive TAMs and almost any valuation. Maybe once something’s caught a big bid it’s easier for investors to convince themselves there’s value (i.e. yeah it’s had a big run…. but 3 years ago people were paying $300/share and 1000x P/E and today I’m paying $100/share and 100x P/E, so I’m still buying cheaper than them and there’s a long way to go!).

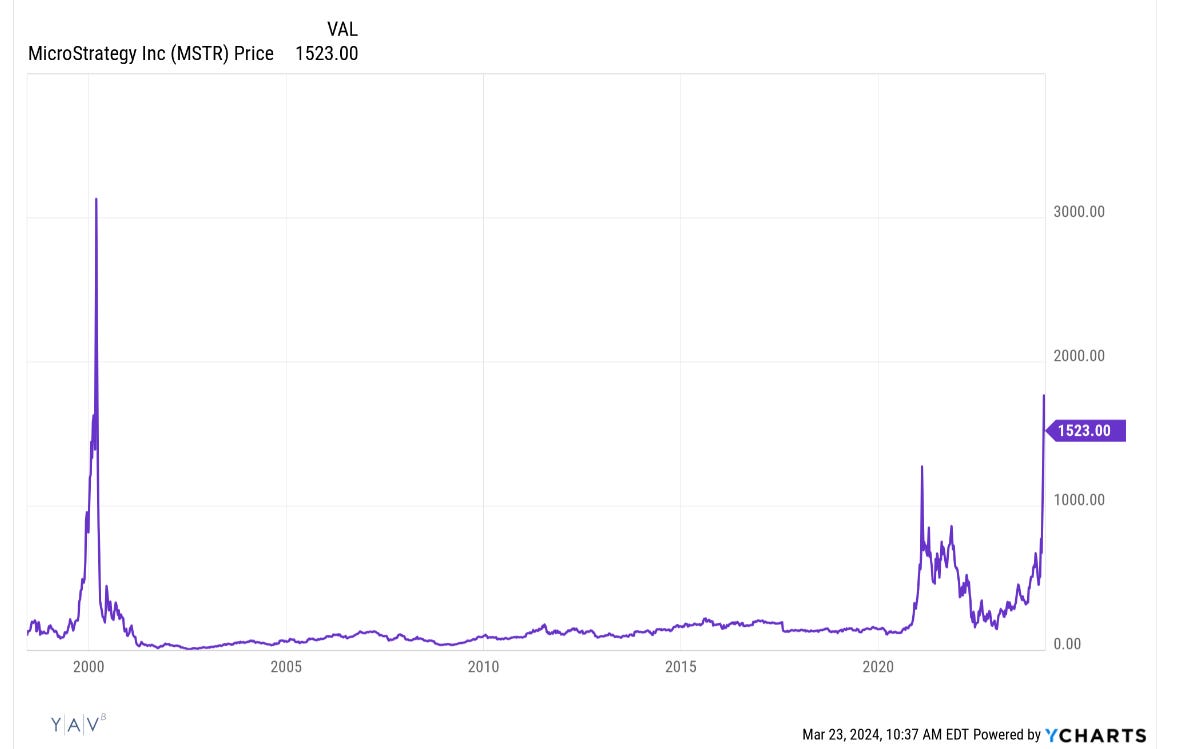

But that got me thinking: many of the current growth darlings weren’t around during the dotcom bubble…. but some were, and they enjoyed huge valuations back then too. For example, consider MicroStrategy (MSTR). In 2021, MSTR managed to turn themselves into the best publicly traded play on crypto / bitcoin, and they’ve managed to maintain that hold today despite the introduction of BTC ETFs as an alternative….. but this is not MSTR’s first run in with being a growth stock darling. MSTR was part of the original dotcom bubble; the stock today still hasn’t hit the highs it enjoyed in early 2000!

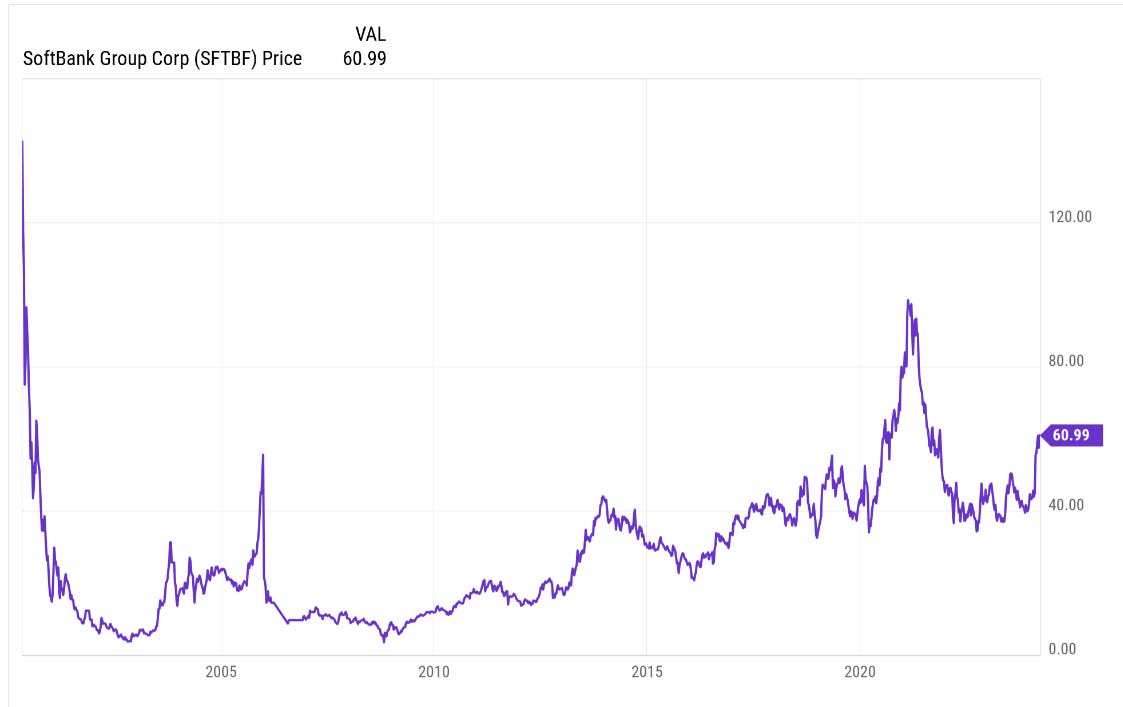

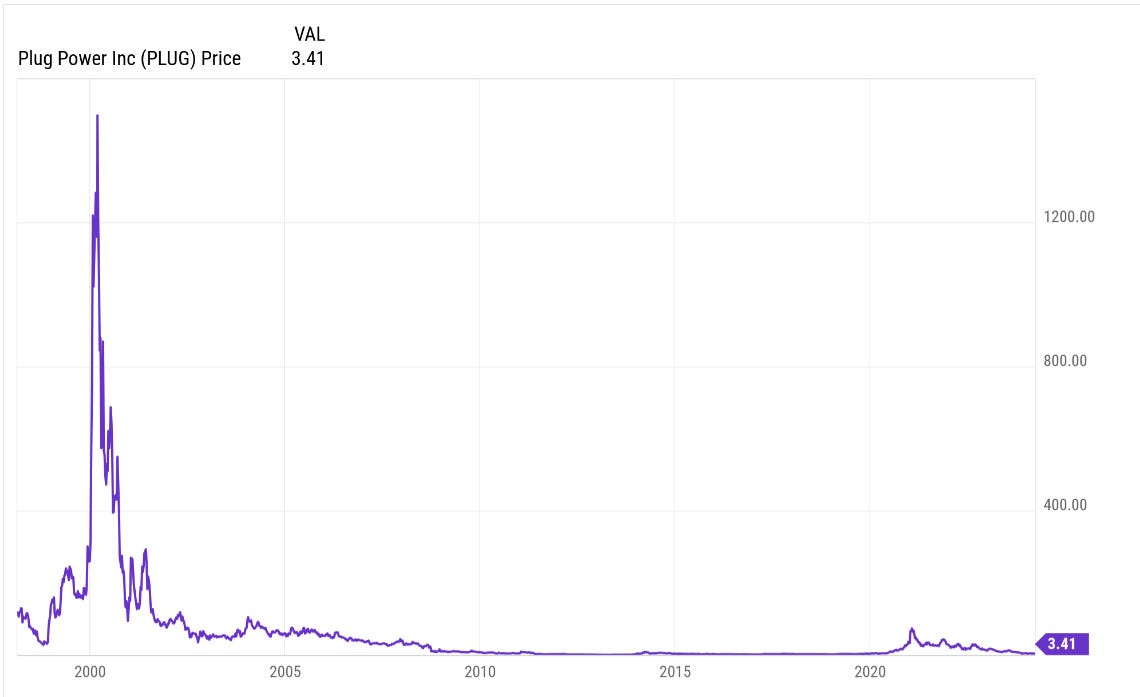

MSTR is not the only dotcom darling that’s enjoying a run today; to chose two more examples off the top of my head, both Softbank and PLUG enjoyed huge runs in the dotcom bubble that they’ve yet to recover, but they did manage to bubble up back in 2021.

Ok, PLUG’s chart makes it a little hard to see the 2021 run because they spiked so hard in the dotcom bubble; here’s a zoom in to show how wild the stock got during the post-COVID run in 2021:

Again, I’m not making any commentary on these businesses, their valuation in 1999, 2021, or today (ok, I’ll comment on their 1999 valuation: it was pretty crazy!), or anything. I’m just pointing out that all of these businesses enjoyed wild runs into the dotcom bubble, they reinflated in the growth / meme mania in 2021, and they are catching bids again today.

So it got me wondering: is a history of getting a “bubble bid” something investors should consider when looking at potential investments?

I will be honest: if you had asked me that question a few years ago, I would have scoffed. Value is value; what does it matter if a company has gotten involved in a mania before?

But today I’m a little older / wiser / more flexible. While I wouldn’t actively look for a company that’s been involved in a bubble before, if you offered me two companies that were exactly the same, except one had gotten “bubbled” before and the other had not, I would take the former in a second.

Now, in that scenario, I said exactly the same, so I’m effectively buying a free “bubble” option. Which begs the question: what’s the price you would pay for the option? Obviously, free is nice, but if the “no bubble” company traded for 10x EBITDA and the “bubble possible” company traded for 11x, would it be worth paying up for that bubble option?

And let’s examine that bubble option…. what is it? Is it something about that business that creates bubble optionality (it’s not lost on me that all of these companies are growth-ier / tech-ier companies)? Or is it the management team (Softbank and MicroStrategy are still run / controlled by the same CEOs from their dotcom glory) that’s most important; are there some managers who are just better at sensing when something is going to turn into a mania / capturing the zeitgeist and bottling it up for themselves and their shareholders?

I don’t have firm answers to any of those. However, here are my leanings:

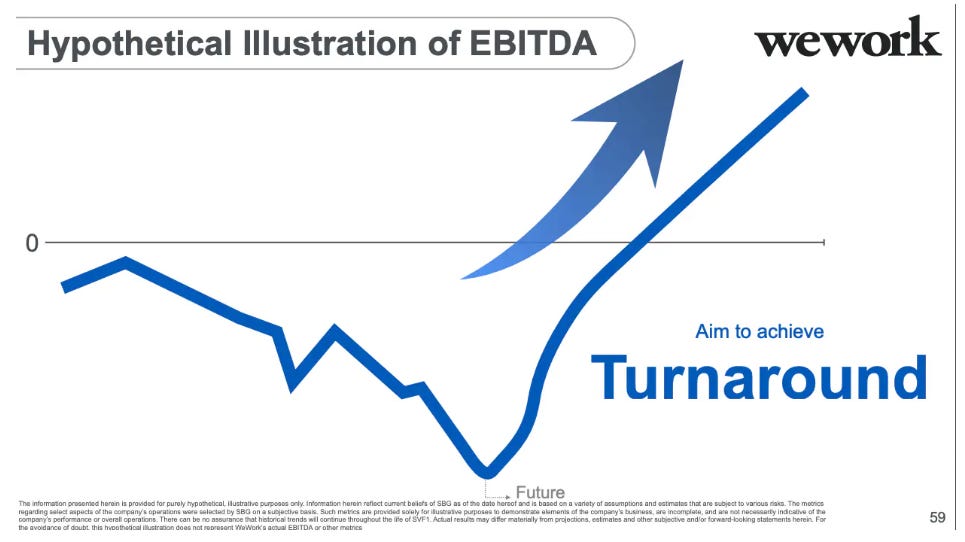

Management teams are a big driver of capturing bubble options; every management team has skill (well, allegedly every management team has skills; I’ve owned a few stinkers where I wonder if the management teams had skills other than paying themselves and lighting money on fire). Some just have skills that lend them more to seeing growthier things that could capture the zeitgeist and having the charisma to go out and spread the word / attract investors. So that is something you could look for…. however, capturing a bubble multiple for a company often takes some type of fanatical belief from the management team, and that fanatical belief can lead to some pretty crazy proclamations / actions from management (like the infamous Softbank slide decks, a few of which I’ve posted below). Honestly, once I see that type of fanaticism / craziness, I’m just too skeptical to seriously consider those companies / teams as I’ll never be able to trust them, so for me personally those types of bubble options probably aren’t in my wheelhouse.

On the company side, I do think there is something to buying something with a view that it could get overvalued if things broke right. Again, I’m not saying to actively look for overvaluation, but an example might show this best. A lot of value investors (myself included) have been frustrated buying stable, low growth companies for a 12x multiple that we think are worth 15-20x. Consider this: say you’re looking at a bank trading for 1.2x book that you think is worth 1.8x book…. that’s a really big value gap (50% upside). The issue is the market is almost certainly never going to trade that bank for 3x book. Maybe the better play is to look for a company trading for 12x P/E that you think is worth 18x….. but that the market traded for 200x P/E a few years ago and could maybe catch a huge bid if things broke right.

I mentioned this in “the quality bubble”, but a similar line of thinking would be to buy a restaurant company with a long runway at a value price on the thesis that if things go right it could get get a real growth bid as it expands.

So this is something I’m still thinking about / toying with. Nothing revolutionary here, but I thought some of the examples looked really interesting once you put them on paper / really thought about them.

I’ll wrap this post up with a question: what are some of your favorite companies that trade at reasonable / value multiples but have the potential to catch a “bubble bid?” If you leave some in the comments (or email me), I’ll try to do a follow up post with a few of my favorites in the next week or three.

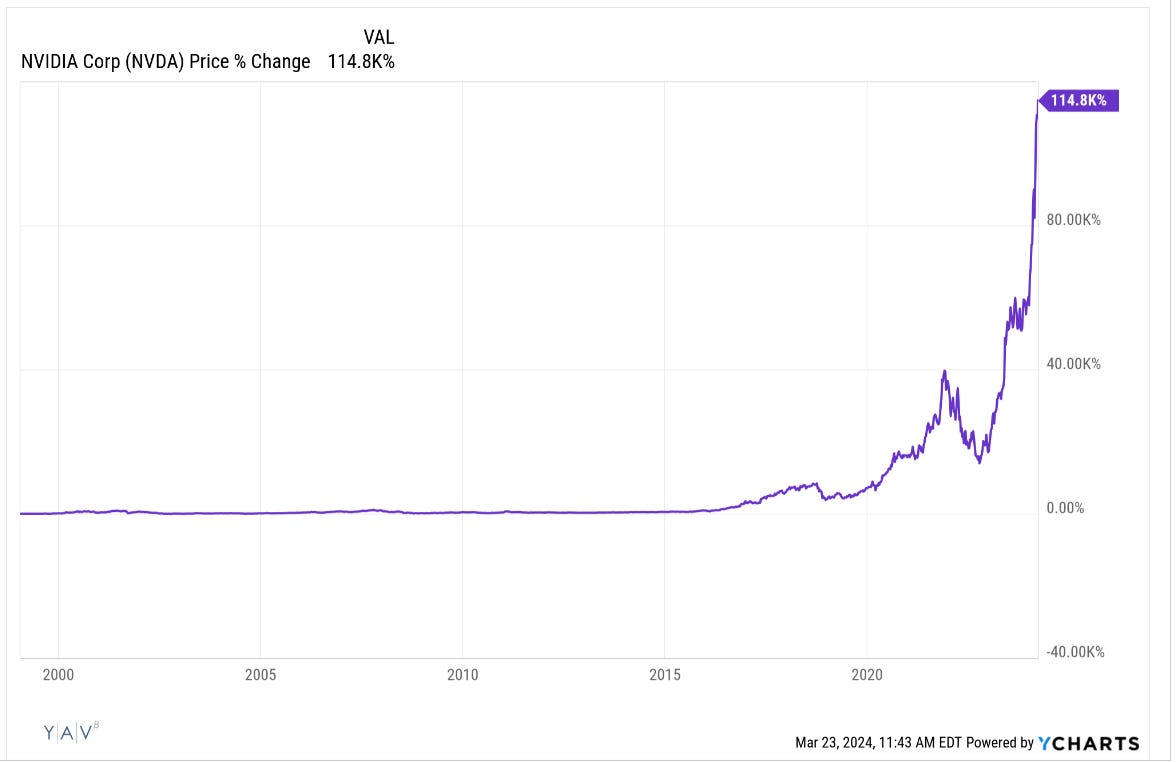

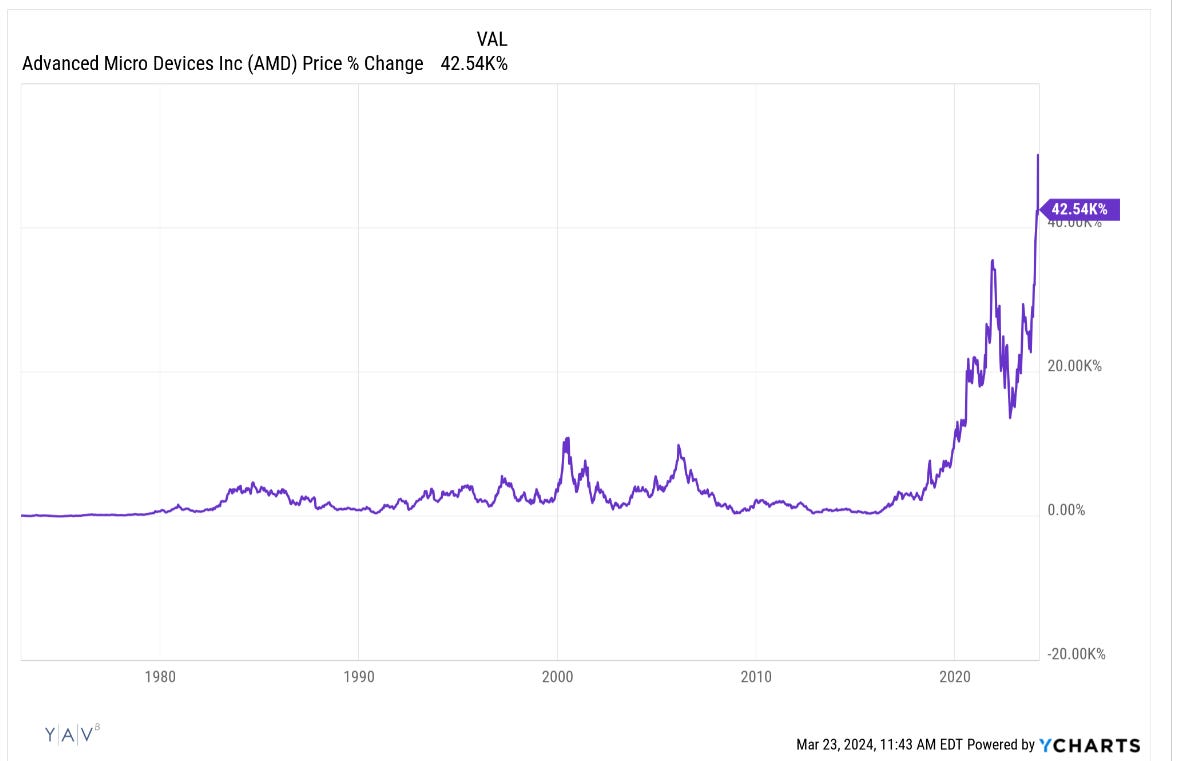

PS- one thing surprised me when I was writing this article. When I was discussing “former dotcom darlings that caught a bid this year,” I was near positive I was going to be able to use NVDA and maybe AMD as an example. But, interestingly enough, NVDA didn’t really grab a dotcom bid, and AMD has well surpassed its dotcom highs. I’m not familiar enough with either company and how they were positioned in 2000 to comment on their dotcom bubble performance / positioning, but it was just surprising as I kind of thought both would have been towards the center of the dotcom bubble.

Mark Gomes (aka "Moneymark") has a concept I love and have adopted in my investment thinking. That is: the three stages of a small company, 1. Great Find, 2. Wait Time, and 3. Gold Mine. The idea being when a stock is bubbling up on sudden awareness of infinite possibilities, it is a Great Find. Then comes the Wait Time. Think a biotech getting an approval, but now has to build a sales force, arrange reimbursement, etc...doing the "hard" stuff. Followed (maybe) by the point where their customers are climbing over each other, paying whatever asked, to get the product (NVDA today)...that's "Gold Mine". It is the Wait Time that tries men's souls.

CERS is a stock that went public in the late 1990's, providing a solution to the spread of AIDS via blood transfusion, developed at UCSF. I suppose a bubble stock needs The Big Theme behind it, and since AIDS is yesterday's news, CERS "bubble days" perhaps are not to be repeated. 25 years of "Wait Time". Their solution did get developed, did get approved, and did succeed in becoming a recurring revenue monopoly. Now it is a real business that is at the end of cash burn days, with a significant new product driver just kicking in, and a third product coming 2026. Each product is a bigger TAM. The only two shareholders who seem to care are ARK and Baker Bros. The BTIG analyst (Hold) suggested 3Q 2023 might have been the turn. I postulate 1Q 2024 could be the confirmation of that, and maybe enter "Gold Mine" stage.

I get your thesis, but as a financial newsletter is this sound advice? It's like being at a roulette table and red has come up six times in a row, time to bet black? Surely it must be due... Hopefully, no one gets burnt by this line of thought but someone likely will. I had a friend who turned a few hundred dollars into 13k in a few weeks during the covid mania. I said pay off your car. He lost it all a few months later. Chasing FOMO is great until it isn't. Better to gain wealth slowly than to be rich for a few months.