There’s nothing I love more than a good capital allocation story. There’s just something about buying a company that’s trading cheaply and where I know the controlling shareholders are going to be hyper rational with capital allocation (read: buying back lots of shares when the stock is cheap) that intellectually makes it a lot easier for me to invest in a company.

Anyway, a friend recently mentioned CNX to me. And they fit that mold perfectly: cheap, rational capital allocation, etc…. but they are so explicit with driving home how rationale they are that it almost got me seeing it as a red flag.

CNX is a nat gas company with a bunch of shale acreage in the Appalachian. They were spun out of Consol in 2017.

Investing in shale / nat gas plays has generally been the death of value investors. The story generally looks something like this: Nat gas companies always look cheap, but then the cycle turns and the companies plow all of their money into investing in uneconomical wells, or they can’t cut their fixed costs quickly enough to match the new price environment, and then the companies are forced dilute the heck out of shareholders to survive.

CNX’s big appeal is that they’re different. Their chairman is the author of The Outsiders, and they’re committed to running an Outsiders like hyper rational capital allocation playbook here.

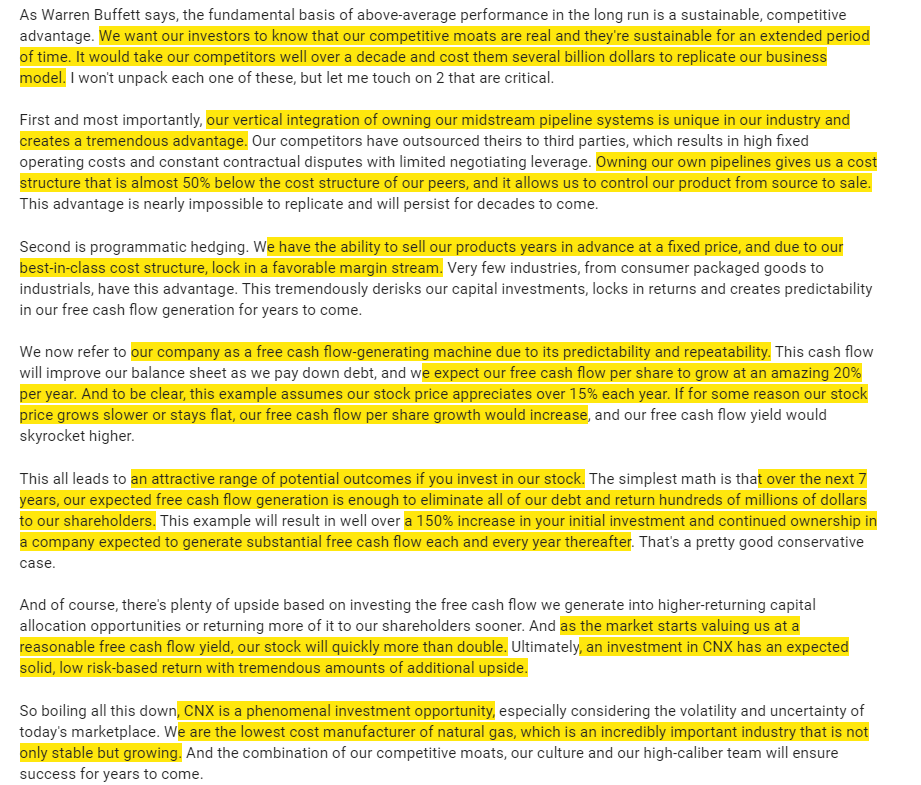

I’m honestly surprised I don’t hear more about them (until my friend brought them up, I don’t think I’d heard anyone talking about CNX since the spin a few years ago). Again, the guy who wrote The Outsiders is the chairman and the way they talk about capital allocation basically value investor porn. I mean, look at the clip below.

For those of you counting, that clip

Included a Warren Buffett quote

Mentioned competitive advantages that would take several billion and ten years for competitors to replace

Described the company as a free cash flow machine

Highlighted just how focused on rational capital allocation they are

Painted the company as a low risk, high upside play on the lowest cost manufacturer of nat gas.

Here’s what I expect a live shot of many of you reading that combo looks like:

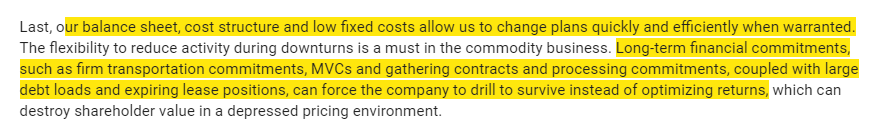

One more compounder porn quote (from a presentation last July):

Anyway, the company’s interesting but one thing from those clips caught my eye: the two major competitive advantages they outlined. Those advantages were:

Owning their midstream pipe gives them a “tremendous advantage” and a “cost structure that is almost 50% below” peers

Programmatic hedging that lets them sell products a few years in advance at a fixed price.

Both seem a little flimsy to me.

I’ll start with the second advantage they list: programmatic hedging. I’m not sure how programmatic hedging can be a major competitive advantage. Yes, it’s a nice thing to have in a commodity industry, but hedges are broadly available to anyone in the industry (it’s not like only CNX has the opportunity to hedge). If everyone can do it, how can executing a hedging strategy be a competitive advantage? Now, you and I and the company could sit here and argue about why a hedging strategy is a smart thing to do and why competitors don’t do it… but that’s a different argument. There’s no advantage that comes from hedging; in fact, while hedging might smooth your returns, there is trading cost / friction associated with it, so you could argue hedging makes you a little bit more of a higher cost producer (though one with a lot more visibility). If I remember correctly, one of the first things Buffett did when he bought BNSF (the railroad) is he told the CEO to stop hedging oil as it was a wasted cost and Berkshire was willing to stomach the volatility to increase longer term returns (I’m having trouble finding the source of that so I could be mistaken; if someone sees it and sends it to me I’ll link it later).

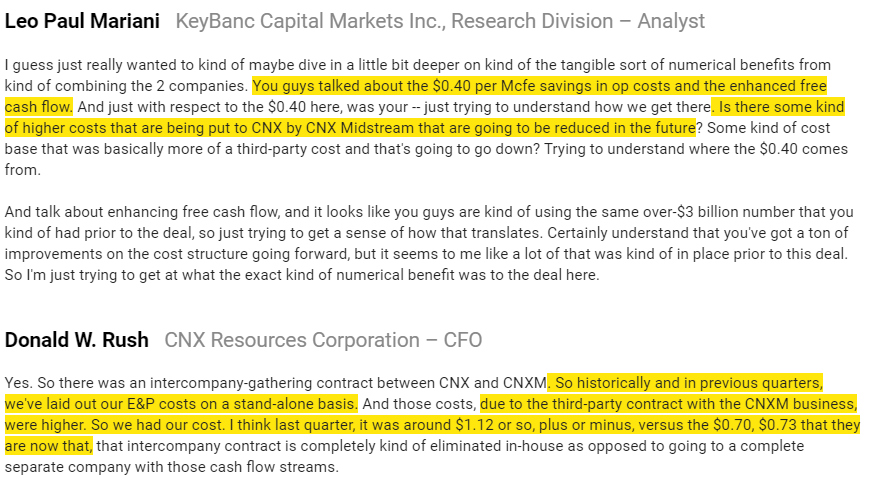

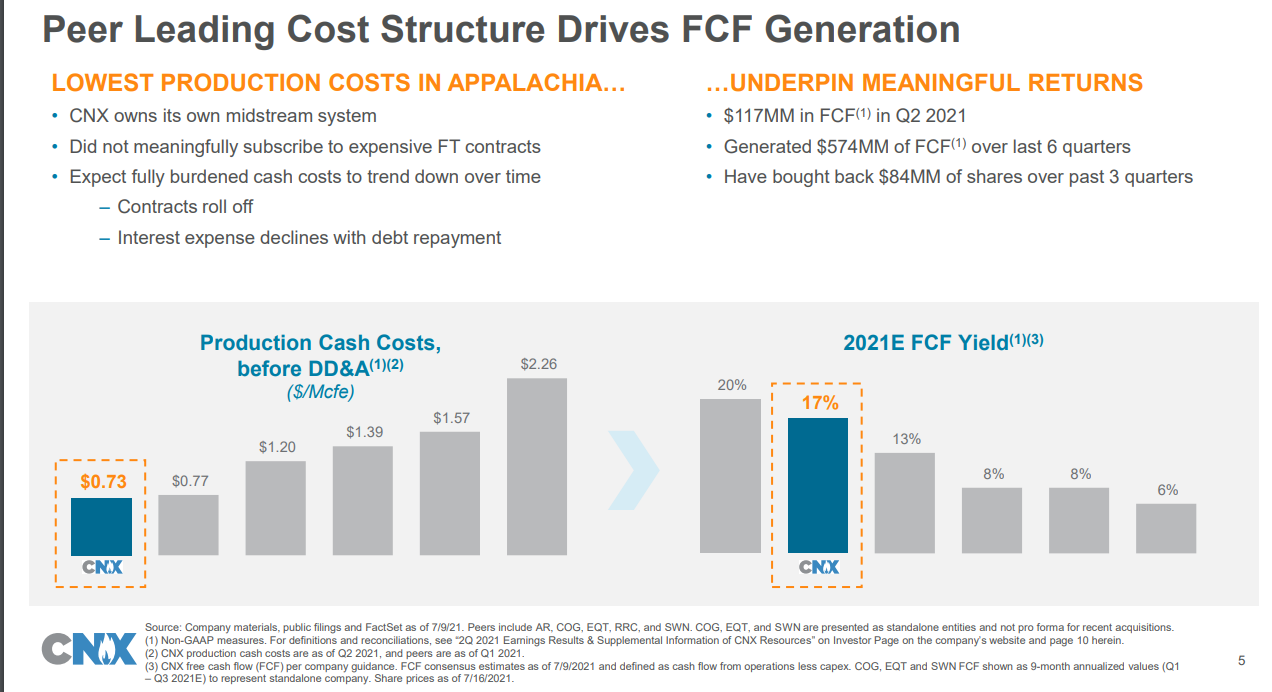

Moving on to owning the midstream pipe: CNX bought their pipe last year, and they’re arguing doing so gives them a cost structure 50% below peers.

Again, I’m just not sure how that can be true. Yes, I get it’s probably nice not having to negotiate with an external company who owns the only pipe that can transport your gas, but it’s not like the pipeline operates cheaper if someone else owns it versus you own it internally. Most commodity players don’t own their distribution; I don’t spend tons of time in commodities, but I’ve never heard anyone suggest owning distribution gave them a real cost advantage. I haven’t heard of steel companies going and buying railroads in order to drive their distribution cost down; in fact, if one did, you’d wonder what the heck they were smoking.

So it’s not impossible I’m wrong here, but does seem like that’s what’s driving the company’s “big” cost advantage, and it just strikes me as unlikely that owning pipeline delivers that big of a cost advantage to CNX.

Perhaps the issue is a measurement issue. CNX argues that their Production costs before DD&A lead peers. If you own your pipeline, the expense for it will be buried in DD&A, while if you “rent” one that will be a cash cost. So, in a similar way that a retailer that owned all its real estate would have better EBITDA margins than one that fully leased, maybe CNX is just benefitting from turning a cash cost into a non-cash cost.

Perhaps that’s the case, but if so it strikes me as very disingenuous. When people argue “our costs are lower”, they generally mean all in costs. Having lower costs because you are depreciating an expense instead of flowing it through the income statement is an accounting advantage, not a real moat. The CNX guys strike me as very sophisticated; it’s strange that they would pitch this as an edge.

But I could be misreading the whole thing! And it does seem like CNX is still a low cost provider even if you factor in some capital charges and such:

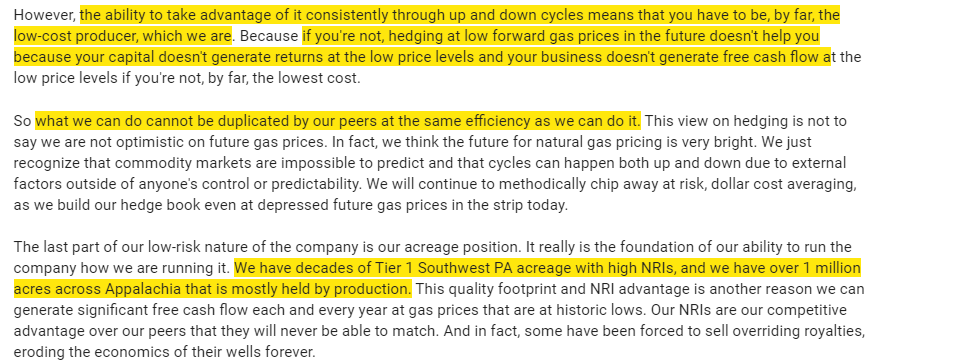

And they argue that low cost position is an important reason why peers can’t match them:

Still, feels a little off to me.

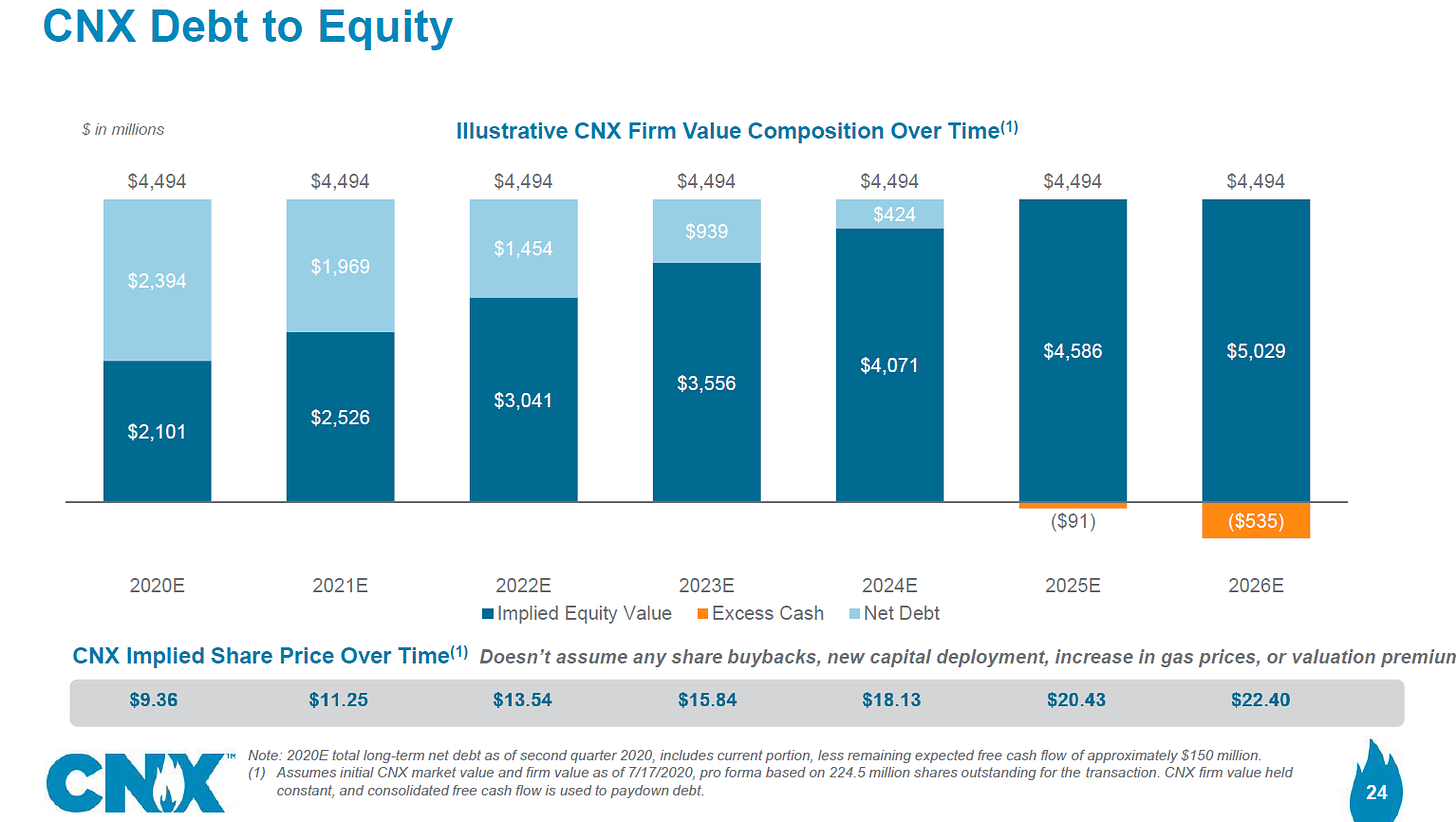

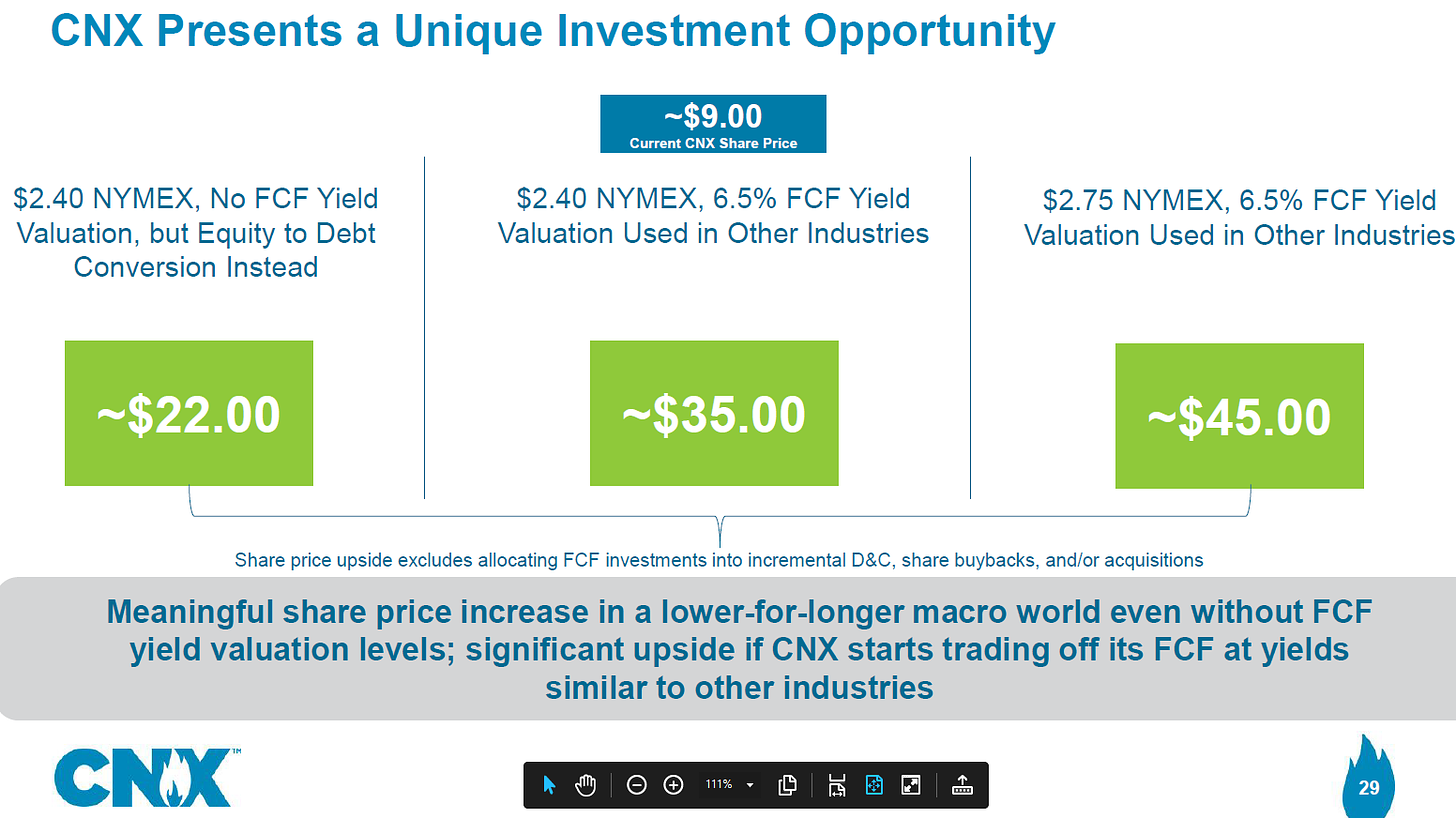

One other nitpick while I’m here: the slide below is from July 2020, when CNX struck a deal to buy their midstream pipeline. It’s a simple enough slide; it just says “hey, our current EV is ~$4.5B; look how good it is for our share price if our EV stays constant as we use our cash flow to paydown debt.”

Again, it’s a simple slide…. but I find it a little misleading, and given that I know the CNX team is very sophisticated I worry that putting out a misleading slide like this is some type of red flag.

Why is that slide misleading? Well, CNX is an oil and gas explorer. That means you cannot hold EV steady as you operate your business, because operating your business involves pulling oil/gas out of the ground, which depletes your reserves. An oil and gas business is always in run off without continued investments into new fields / buying more reserves. So to say you’re going to operate your business, use cash flow from operations to pay down debt, and do all of that while maintaining the same EV… well, it just strikes me as misleading. But maybe I’m just being a stickler, or maybe I’m not thinking about that correctly. I don’t know, but something about it feels wrong.

Anyway, CNX is an interesting company, and I don’t believe I’ve seen a lot of discussion on them on fintwit or anything (h/t to the friend who pointed me their way; I’m happy to reveal him if he wants the publicity!). I’m still getting smarter on them (I’ve got a call with IR later this week; feel free to lob in questions if you have any!)…. but I’ll be mulling over that competitive advantage stuff for a while.

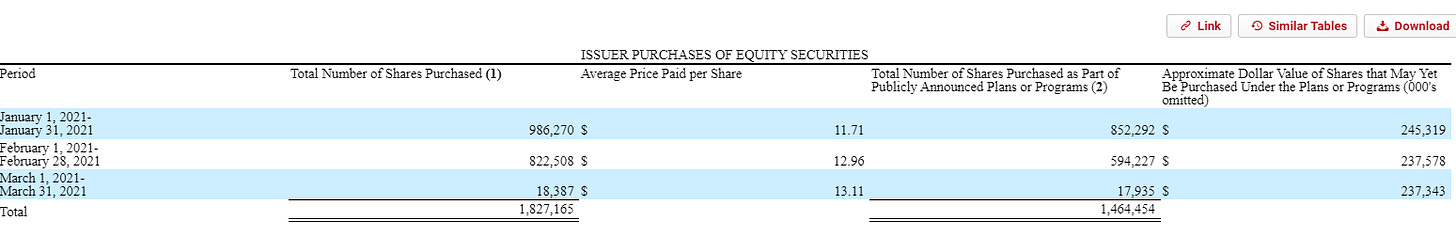

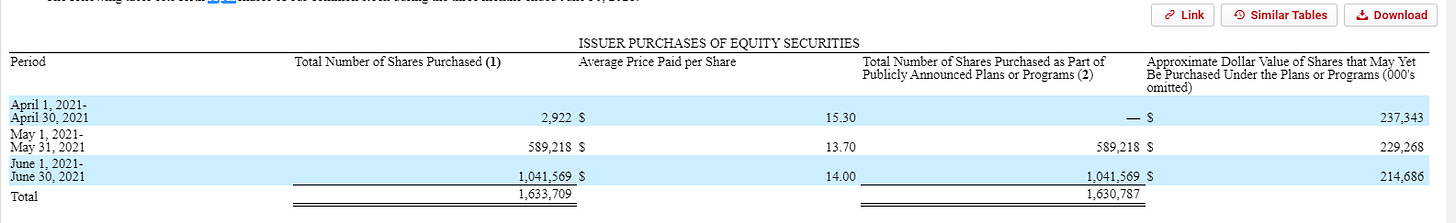

PS- here’s the company’s share repurchase chart from their last two 10-Qs. Look how they scale it down a little when the stock is stronger (aggressively buying in Jen/Feb below $13, almost stopping in March / April when the stock is running towards $15, and then going aggressive again when the stock drops <$15 in June). It really is a thing of beauty.

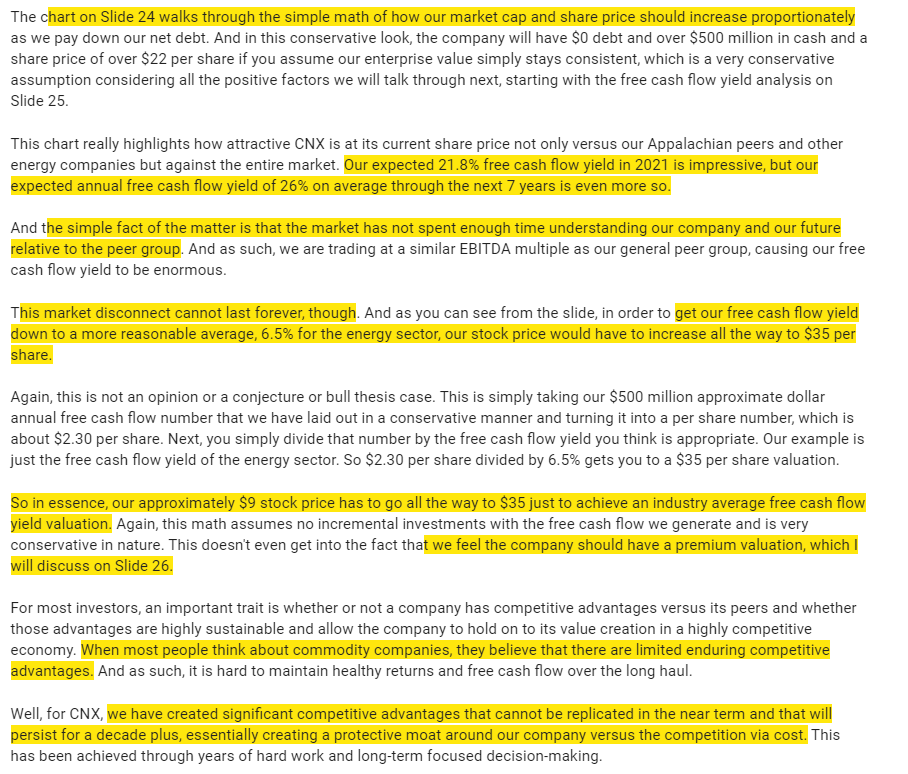

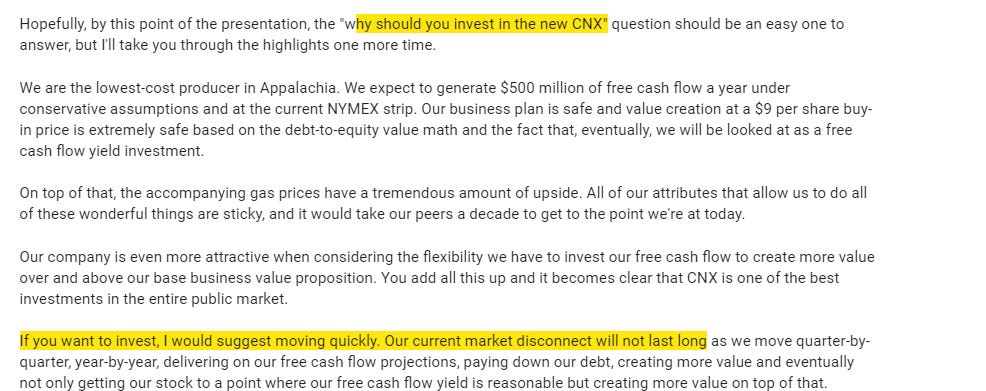

PPS Here’s how the company talked about their intrinsic value last year. Very bullish…. but maybe it’s because I’ve been burnt before, but you can see why this makes me a little cautious too! (The first part of the transcript refers to the EV chart I didn’t like above).

A few minutes later in the transcript, you can see the part that makes me particularly cautious / hesitant. I’m always scared when someone tells me “Invest now or you’ll miss that boat!” Having the CEO of a company say that….

That said, a few months later rumors broke EQT had submitted a bid for CNX. So maybe there really was time pressure to get into CNX before a bid!!!!!

PPPS- parts of this post may have come off a little critical…. but that’s actually because I’m really liking this story overall, and when I really like a stock / company, I tend to get more critical of possible red flags and risks because it means I’m thinking about investing and those red flags go from “hmmm that’s interesting to think about” to “O MY GOD I MIGHT LOSE MONEY IF THIS HAPPENS.” And, of course, if you’ve got thoughts one way or another on CNX (something I’m missing on the bull or bear side), please let me know!

I was chatting with a friend who read a draft of this, and I think our conversation summed it up like this: CNX’s capital allocation is great, and it’s worth highlighting…. but the company almost touts it too much; their assets seem to have advantaged decline curves. I wish they spent a little more time highlighting that!

Thought this was a good post by a Twitter account (@NextwaveEFT): https://docsend.com/view/ac9v44dswhtt4vbq

Not sure if you have encountered it, but highlights concerns over CNX's actual remaining inventory, figured I'd share

After the BNSF merger, Buffett talked to Mark Rose and told him not to hedge as a BRK subsidiary, but then Rose explained that the only hedges used were at the expressed desire of select customers who required fixed fuel prices over their contracts, so WEB made an exception.