In March, I wrote crypto, mania, and reflexivity. I wanted to do an update to that piece because I think some of what we’re seeing in the space is so astronomically insane that I can’t believe it, and while plenty of people have pointed out how bubble like the behavior is I don’t think anyone’s fully connected the dots on how insane it is.

Let me back up to the original piece from March. The piece had two main points:

Bitcoin could be in for a “reflexivity” bubble in two ways

With Bitcoin ETFs now available, and bitcoin having screamed higher since the ETFs became public, any financial advisor who was an early adopter of Bitcoin would outperform people who had not. This could cause capital flight as people chased performance and the early adopters grew AUM, which would send more money into bitcoin…. and it might also cause the non-adopters to feel like they needed to chase and buy bitcoin to keep their clients!

With MicroStrategy (MSTR1) trading for a premium to its underlying Bitcoin, and recent “copycat” Microstrategies (like SMLR) having seen their stock rise significantly when they announced a Bitcoin treasury strategy, we could be on the beginning of a reflexivity bubble where the stock market sends stocks up when they announce they buy bitcoin, so more companies announce they’ll buy bitcoin, the buying pressure sends bitcoin up, which sends the companies up, which causes more companies to buy bitcoin, which….. you get the idea.

As detailed above, the success of MSTR would inspire a wave of copycats…. and the wave of copycats would naturally bring MSTR’s premium to NAV down. Issuing stock to buy bitcoin isn’t exactly a hard strategy to replicate, so the thought here was that if MSTR traded at 2x NAV and there were 15 copycats trading at 1x NAV, that spread would be too wide and would have to eventually compress.

With the benefit of hindsight, it’s fun to look at those predictions: the first part (that we could have a reflexivity bubble in Bitcoin) seems spot on, while the second part (that MSTR couldn’t sustain a substantial premium to NAV as copycat players rushed to copy them) couldn’t have been more wrong (at least so far) at MSTR’s premium has inflated quite a bit.

Anyway, as I said at the top of the post, I wanted to write this follow on piece because some pieces of the reflexivity bubble / MSTR copycats is getting insane, and I don’t think people have properly digested just how wild it is.

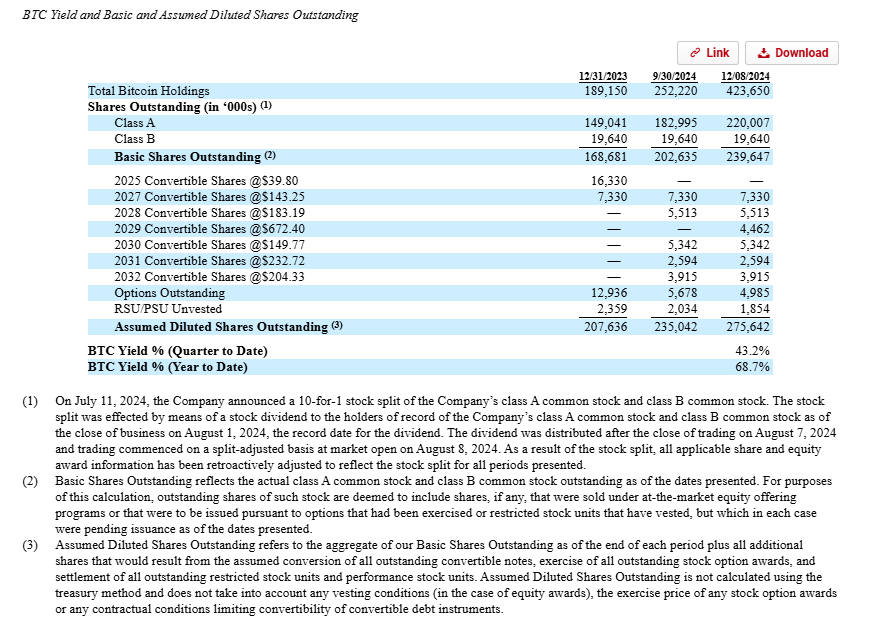

The first thing that’s insane about the bubble is it seems, in part, fueled by the companies hyping their BTC yield. For example, here’s MSTR detailing their BTC yield in a recent 8-k:

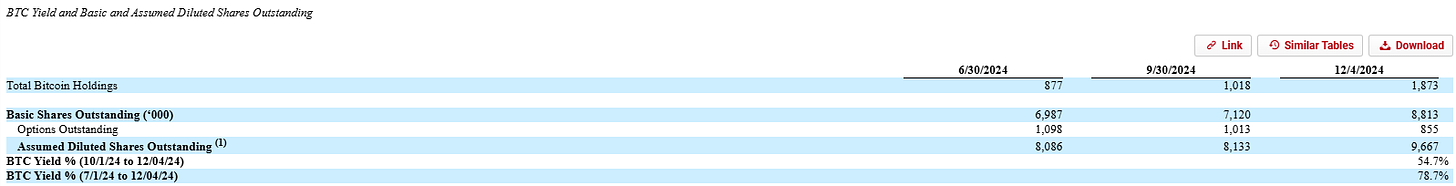

Just about every company that’s trying to copy MSTR has adopted the “BTC yield” terminology; for example, here’s how SMLR has presented it:

When I first saw the “BTC yield” metric, I thought it was pretty crazy. MSTR is trading for approaching 3x the value of their bitcoin; if they issue stock and use all the stock to buy bitcoin, of course it’s going to cause their bitcoin holdings per share to go up…. and even more so if they issue debt and use that to buy bitcoin and then judge themselves on a per share basis! Taken to its extreme2, if you thought BTC yield was truly the be all, end all of value creation, and the higher the BTC yield the better, then any company following a pure BTC yield strategy should lever themselves up to the maximum amount possible, no matter the terms, and use all of the proceeds to buy BTC. Obviously no one does that because it would be insanity and eventually banks would stop lending, but I illustrate that only to show that purely maximize BTC yield is clearly not value maximizing….

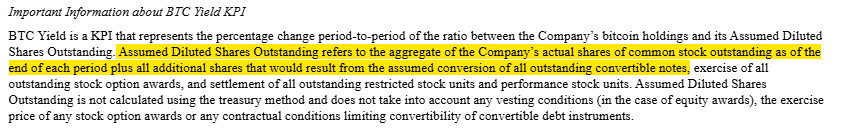

But, if you look at the fine print, BTC yield is even crazier than simply suggesting increasing BTC per share is the only value creation metric that matters. If you really look at the MSTR BTC yield table above or read their disclosures, you’ll notice that the BTC yield assumes that all of their convertible debt converts.

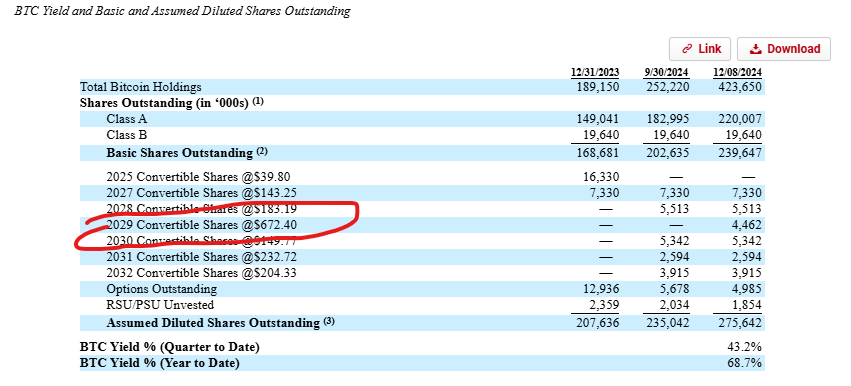

So, go back to MSTR’s BTC yield table; they have a set of 2029 converts that convert at $672.40/share. Those are far, far out of the money (MSTR’s stock trades for ~$400/share as I write this)…. yet MSTR’s BTC yield assumes those converts are in the money / will convert for their BTC yield.

That is an insane assumption that casually assumes MSTR’s shares almost double3. And, again, by taking this assumption to its extreme, we can see how wild it is. Like all things, convert debt involves different trade offs; for example, you could get a higher strike price by taking on a higher interest rate (i.e. if your strike price is ~$670 at a 0% interest rate, you could probably push it up to $770 by taking on a 3% interest rate or $870 by taking on a 6% interest rate4). MSTR has issued all of this convert debt deals at 0% interest rates, which is a great pitch ("we’re borrowing for free, we don’t have to pay a carry to buy BTC, etc”)…. but if BTC yield is all that matters, MSTR could start issuing convertible debt with really high interest rates, which would jack that strike price of the convert up, thus decreasing dilution and increasing the BTC yield. So, for example, if MSTR offered a set of notes similar to those 2029s but with a 10% interest rate instead of 0%, the strike would almost certainly be well over $1k, thus almost doubling the BTC yield of that particular note.

MSTR fans would say “but raising converts with interest doesn’t make sense; it’s no longer free money / now it has a carry cost.” And I understand that argument…. but convertible debt isn’t free money either, and I just do this to highlight how insane BTC yield is as a be all / end all metric!

So that’s point #1 that I wanted to make…. and, honestly, while I don’t think it’s well understood by everyone, I think most serious investors who look at MSTR and the debt realize how wild the BTC yield definition is, so I’m not breaking crazy new ground here.

But the second point I wanted to make is just how insane the capital allocation at the companies that are adopting a BTC yield strategy (or, as MSTR’s CEO likes to put it, companies that are on the bitcoin standard) is.

These companies are issuing equity and convertible notes at an astronomical pace and instantly plowing all of it into Bitcoin with Bitcoin sitting at all time highs.

Consider MSTR: last week, they issued >5m shares for ~$2.1B, and instantly plowed all of that into buying bitcoin. Even assuming that all of MSTR’s convertible debt converts, in one week MSTR increased their shares outstanding by ~2% and used all of it to buy bitcoin with bitcoin sitting at all time highs.

MSTR is not alone in this strategy; every company on the “bitcoin standard” is proudly issuing converts and equity as fast as they can in order to buy bitcoin indiscriminately. SMLR has increased their diluted shares by ~20% in two months with all of the proceeds going into bitcoin. RIOT5 issued $525m in convert debt and instantly plowed it into BTC. The list goes on and on…. and what’s crazy is that every company on the BTC standard will cheer on every other company that adopts the BTC standard and starts plowing money in BTC (just follow Saylor’s twitter account and watch as he proudly announces any company that adopts the strategy); in fact, these companies even seem ok getting front run…. many are announcing equity raises or converts with the express intention of immediately using all of the proceeds to buy BTC, which seems quite exploitable by traders / market makers.

It’s a wild strategy that would be insane at any other company. Imagine gold companies issuing equity as aggressively as possible to buy spot gold at all time highs and cheering on any other company that does it. Again, insane… but that’s exactly what’s happening at BTC.

Now, there is one difference at BTC: if gold spot prices got high enough, eventually the world would find more gold (i.e. if gold spot goes to $6k, then people start selling their gold jewelry…. if spot goes to $60k, then we start trying to mine deep sea gold deposits… and if spot goes to $600k, maybe it’s economical to send some rockets to the moon or Mars or an asteroid to find gold!). But the supply of BTC is limited; there’s about 20m BTC out with ~450 new BTC getting mined each day, and eventually the number of BTC will cap out at 21m.

So BTC is limited in that sense…. I don’t think that changes the insanity of a half dozen or so companies issuing equity / converts and using it all to plow into BTC at all time highs, but it does create some pretty interesting angles on the back end. In particular, you could imagine two endgames to all of these companies plowing into BTC.

The big squeeze: at ~$100k/BTC and with just shy of 20m BTC out, bitcoin’s “market cap” is ~two trillion. The companies that are on the bitcoin standard are plowing huge dollars into BTC (MSTR alone is plowing ~$2B/week into BTC)…. a few billion is a drop in the bucket against a two trillion market cap, but BTC’s free float is a lot smaller than two trillion once you account for all of the BTC that’s been lost or is apparently getting HOLD’d. It’s not hard to imagine a world where a few more months of companies plowing as aggressively into the BTC standard creates a squeeze on BTC.

The bag dump: if you follow the companies on the BTC standard, they all push as aggressively as possible for any and all companies to follow them into the BTC standard. In particular, you’ll see them pushing for deep pocketed corporates (like Microsoft) or sovereign governments (particularly the U.S. / Trump administration) to buy Bitcoin / create a Bitcoin strategic reserve. While the BTC standard companies say they’re going to HODL their BTC forever and want these companies / sovereigns to do it for national security purposes, the skeptic in me can’t help put wonder if this is simply an attempt to get a big buyer to give the HODLers exit liquidity (and their strategy may be working; the Trump admin certainly seems open to anything the crypto bros want them to do!).

Anyway, two last thoughts before wrapping this up.

First, I just mentioned the “big squeeze” potential at BTC. And it’s certainly there if all of these companies can keep issuing stock at premiums to NAV and buying BTC…. but I would note that we now have several companies issuing billions of equity per week to price indiscriminately buy BTC. Given the size of those buys, I’m a bit surprised Bitcoin’s price has kind of stalled out over the past few weeks (albeit at all time highs!). I’ve been wondering how much of BTC’s price is inflated by this mad rush to buy BTC by bitcoin standard companies, and what would happen to the price of BTC if the bitcoin standard companies had to pause buying for any reason (most likely because their stocks got hit and traded closer to NAV, removing the “free money” convert / equity raise options).

Second, as I mentioned earlier, the BTC yield that all of these companies present assumes that their convert debt converts, and that is a big / crazy assumption…. but it’s interesting to think about what will happen in five years. There is, of course, a world where BTC goes to $250k (or higher) and all of these stocks moon. In that world, the converts will be well in the money, and all of this worry will sound silly…. but there is also a world where BTC stalls out or drops over the next few years, and that world is really interesting. All of these companies are raising converts with 5-7 year maturities, so if BTC doesn’t moon and the converts aren’t in the money, you’re going to have all of the BTC standard companies facing a maturity wall at the same time. What happens then? I doubt they can roll the converts at anything close to the same terms (remember, cheap converts require high volatility, and if the stocks have stalled out for five years vol is going to be a lot lower), so they’ll either need to sell a ton of equity to paydown the debt (which will be tough; there probably won’t be much enthusiasm for the stock, and I’m not sure the market would be able to absorb the hypothetical amount of stock they’d need to issue without some enthusiasm)…. or you’ll have a wave of BTC standard companies all looking to sell down some of their bitcoin to payoff converts at the exact same time.

And, in that world, it’s worth remembering that the same squeeze dynamics that are so much fun when everyone is rushing in and the price is going out play out in the exact reverse when everyone needs exit liquidity.

Full disclosure: in small size, I am long bitcoin and MicroStrategy, but also short various options around MicroStrategy. The net position is roughly neutral / basically short volatility, but it’s pretty funky (and, again, small!). Note that none of that is financial advice, and options are insanely risky, so consult a financial advisor, see our legal disclaimer, etc.

Actually, this is not the full full extreme. My favorite full extreme comes from my friend Byrne Hobart, who suggested the best way to maximize BTC yield would be to lose all of your Bitcoin and thus take BTC yield to infinity.

Though, to be fair, I suppose a more insane assumption would be to raise a bunch of debt, buy bitcoin with it, and then just completely ignore the debt, as this table would if they did not assume the converts converted!

I’m pulling these numbers out of the air; there is a very mathematical formula for calculating fair value of convert bonds but I am way too lazy to build one for a quick post.

Full disclosure: I have a very small short in RIOT as a pair trade against a long in some other miners and BTC.

“If Something Cannot Go on Forever, It Will Stop“ -Herb Stein

A couple notes - first, while the bitcoin yield metric is undoubtedly insane, it's not the conversion assumption that makes it so - in fact assuming all the equity converts is actually the conservative assumption. You say convertible debt isn't free money - that's what they're accounting for by assuming conversion.

I also think that yes, while selling equity to buy bitcoin at ATH is pretty wild capital allocation, it's also perfectly rational if the market is valuing you above NAV as a bitcoin proxy. And selling 0% convertible debt, which if bitcoin doesn't moon is essentially free money and where if bitcoin does moon, they'll make more on the BTC than they'll "lose" on the conversion, is also pretty rational.

From what I've heard, certain institutions like the convertible bonds because they get exposure to BTC without a downside except the opportunity cost of 0% interest. What I don't understand is what they expect to happen if bitcoin goes down - what money they expect to be paid back with. Maybe I'm missing something.