For years, utilities were generally among the most sleepy industries, and for the most part most active investors didn’t look at them at all. I talk to a lot of different investors, and I knew very few who would look at a utility unless there was some real type of distress / special situations angle (i.e. looking at California utilities after the fires). The reason so few investors were interested was simple: utilities can be divided into two buckets, regulated utilities and unregulated utilities, and neither was likely to have the right combination of “cheap” and “in a non-specialized investor’s skill set.” Why?

Regulated utilities are basically bond equivalents. They have a state regulated monopoly and that regulation includes the state approving exactly how much the utility can invest in their network, charge for their investment, etc. Given that regulation, investors could forecast with pretty high degrees of accuracy what the company’s earnings would the company’s earnings / economics would look like for the medium to long term. Combine that degree of stability / forecastability with high dividend yields (for a variety of reasons, utilities tend to pay out most of their earnings as cash, and then raise debt / equity for any projects they need to invest in), and utilities tended to be the sleepiest investments and were generally owned by dividend seeking investors.

Unregulated utilities were basically bets on weather and commodity prices1. Why? Electricity markets follow a normal supply / demand model: the price of the whole market gets set by the marginal supplier. So if it costs $10 to produce the last unit of electricity that’s demanded, then everyone gets $10. That meant there were really two ways to benefit / bet on unregulated utilities

Commodity: Pretend that the marginal supplier of electricity in my example above is a natural gas plant. If natural gas prices double for some reason (a pipeline breaks, a huge cold snap causes demand to soar, etc.), the marginal cost of production goes from $10 to ~$20. Now pretend you owned a coal plant that makes electricity for $8/unit. When natural gas doubles, your prices don’t really move…. but your revenue/unit goes from $10 to $20, so your profits go up 6x (from $2/unit to $12/unit). Those financial characteristics made unregulated utilities a fantastic way to make levered bets on commodities!

Weather: Again, power prices are set by the marginal producer…. however, what happens when there’s a sudden surge of demand. Say you live in Texas and suddenly the temperature hits 110 degrees and everyone turns their AC on? In a normal market, you’d see surge pricing which would encourage people to tamp down their usage in some way…. but electricity is unique in that retail customers aren’t really expected to monitor electricity prices / demand minute by minute, so a big weather event can cause demand to surge past supply and send power prices literally to infinity. This issue is obviously very well known, and state regulators tend to implement some pricing caps just to avoid pure infinity…. but you’ll still run into funny things where an unregulated utility makes more in one hour on a particularly hot summer day than they will make for the rest of the year, and traders can make a bunch of money buying/selling unregulated utilities betting on if the hot day will happen or not.

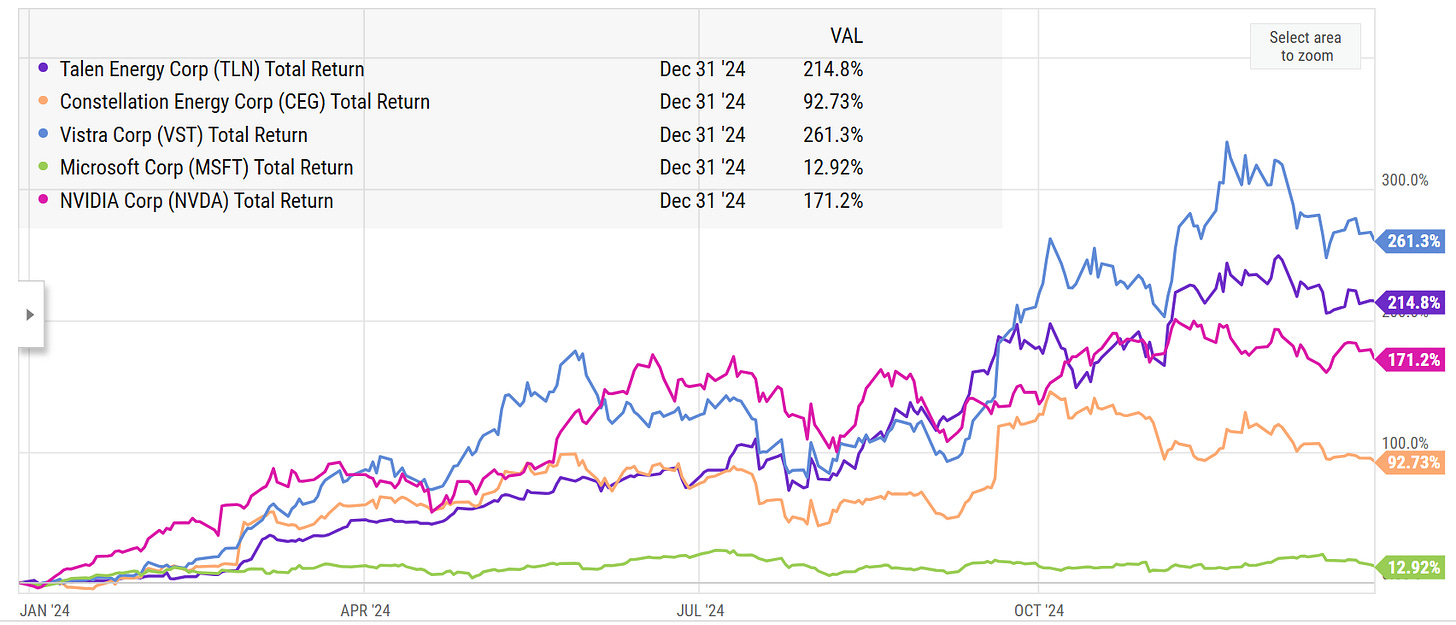

That history has completely changed with AI over the past 18 months. Suddenly, the U.S. is experiencing real electricity demand growth for the first time in decades, and the rush for AI players to secure an enormous amount of electricity for their big AI datacenters has left the U.S. short electricity and scrambling to reopen old plants. The combination has created a bonanza for utilities; the whole sector screamed higher in 2024, and many of the utilities proved to be better AI plays than MSFT or even NVDA in 2024!

Why do I mention this?

Not because I’m kicking myself for missing the power play moves (though I am obviously doing that!); I mention it because I think that’s a really interesting set up to pattern to match / look for in the future. Find a staid, boring industry that most investors won’t look at that trades for a reasonable multiple (as utilities did pre-AI boom), and buy them just before a demand shock. You could argue if you do / time it right your downside is protected (it’s not like the stocks are going to go down when a demand shock doesn’t come; they’re not pricing one in!), and if you’re right you can make multiples of your money.

It worked for utilities in 2024, and it worked for all sorts of COVID beneficiaries in 2020/2021 (cleaning products, home gym equipment, etc.).

Now, there is one interesting wrinkle to this thesis: industries with long lead times benefit the most from a demand shock. Consider power: if you have a demand shock on the power side, then you eventually need to build more power plants to handle that shock. Building power plants takes a long time; I’d guess it takes 3-5 years from start to finish to build a baseload natural gas plant, and probably 20 years to build a nuke (if you can even get one built!). So a demand shock in power can create super normal pricing for a very long time. Most other demand shocks can be responded to much faster. A simple example: a demand shock in oil can be met relatively quickly; it only takes a few months to start spinning up new Permian wells!

So I’m trying to think of other industries that could benefit from the types of demand shocks that utilities saw in 2024…. but, in particular, I’m trying to think of ones that would have a very long time to bring on new supply so that they could enjoy an even longer period of demand shock inspired super normal profits.

I’ll follow up next week with an example or three that I think of that could fit the bill, but in the meantime, I’m curious…. what’s your best idea for a company / industry that could benefit from demand shock but is priced as a staid value company?

Obviously this is a bit of a simplification…. unregulated utilities in particular are some of the more complex industries to research. If you want to do it right, you really need to look plant by plant and understand that specific market’s dynamics, regulation, etc. But this is a very directionally correct simplification!

Offshore drillers

Miners

Per gpt, there are quite a lot sectors that fit your description:

1. Semiconductors (building or expanding fabrication plants can take 2–3 years or more)

2. Aerospace (design and production of aircraft, satellites, etc. involve multi-year timelines)

3. Shipbuilding (constructing a new ship can easily exceed a year and often involves a backlog)

4. Pharmaceutical manufacturing (especially biologics, which require specialized facilities that can’t be quickly repurposed)

5. Defense industry (long development cycles and government procurement procedures)

6. Construction and real estate (permitting, land acquisition, and actual building can introduce multi-year lags)

7. Heavy industrial equipment (e.g., large turbines, specialized machinery with few global manufacturers and long build times)

We should exclude #1 which is already at cycle peak, #2 also realized with AL, AER, WLFC soaring in 2024, #5 got a demand shock especially for drones, causing drone manufacturers shares spiked in 2024; so we are left with 3, 4, 6, 7.

#7 is interesting IMO.