Weekend Thoughts: Diamonds, Tail Risks, and the Assumptions We Take for Granted

The Engagement Ring Epiphany

Seven years ago, I proposed to my wife. Like many “finance bros,” I had sworn I’d never spend a dime on something as irrational as an expensive engagement ring—right up until I faced the reality of actually proposing and found my mother and a few girl friends quickly disabusing me of my thrifty notions. I didn’t break the bank, but buying the ring was still a meaningful sum.

Another way I fit into the “finance bro” mold: I never buy extended warranties, travel insurance, or the like. Generally, I find insurance to be a negative-EV trade (the house always wins!), and I knew jewelry insurance was about the worst priced insurance you could get. Yet, despite telling myself I’m not the type of person to buy overpriced insurance…. after picturing the nightmare scenario of losing the ring just before the wedding and having to pony up more cash for another one, I caved and insured the ring.

For almost seven years, that ring insurance auto-renewed—until now. I finally canceled it this month. Why?

We never actually used it, nor did we really ever have a “o my god I lost my ring” scare…. so it seems like the odds of us needing it are small

The insurance wasn’t cheap; it runs at 2% of the ring’s appraised value…. but somehow the appraised value was way higher than retail, so I believe it’s closer to 4-5% of the original retail cost. So, to break even on it, we’d need to imagine losing the ring once every 20-25 years (ignoring deductibles and difficulty of processing claims, which are real costs / headaches that should be factored in!). Not crazy (I only have a sample size of ~7 years so far), but also probably too high.

But the thing that really pushed me over the edge? I looked at the prices of lab grown diamonds, and saw I could replace the ring if I ever lost it for a fraction of the cost I originally paid (and it wouldn’t come with the “this diamond was mined with children’s blood, sweet, and tears” ethical baggage a natural diamond has!). Even if I cancelled the insurance and quickly lost the ring, the hit to my bank account would be much smaller! If insurance was running 5% of the natural ring’s value, the insurance may have been 20% of the cost I was seeing for lab grown diamond rings of similar quality. Suddenly, the breakeven of losing a ring wasn’t once every 20 years; it was once every ~5 years! No chance we’d lose a ring that frequently!

My experience got me thinking. The diamond-as-a-store-of-value concept is quite “Lindy”; people have been doing it for ~3k years. There aren’t many financial actions that you could say would make sense if they happened in the early 2000s, in the early 1800s, or the early 1600s….. but a rich family giving their kids diamonds as a store of value / to pass wealth from generation to generation is certainly one of them!

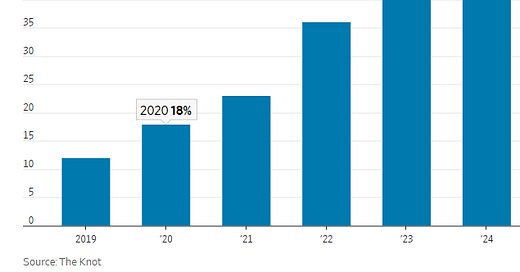

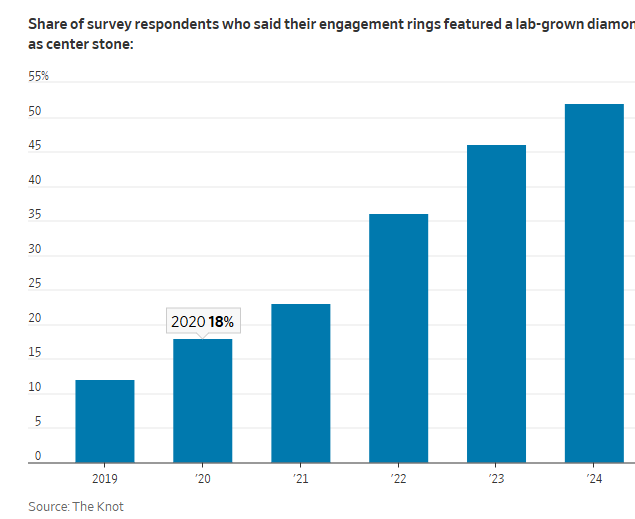

Lab-grown diamonds might break that concept. This WSJ article is filled with all sorts of interesting stuff on lab versus natural diamonds but this chart showing the number of people with a lab-grown engagement ring ~5x’ing over 5 years is probably the money shot; it’s hard to imagine a world where people are completely comfortable switching to lab grown diamonds yet diamonds somehow still retain a “store-of-value” property.

From Diamonds to Tail Risks

This led me to a bigger question: What other deeply ingrained assumptions could break on a dime? In markets (and society in general!), there are always some assumptions that everyone just takes for granted. When one of those assumptions fails, look out below! For example, consider the Global Financial Crisis (GFC). One major cause of the GFC was the collective assumption among regulators, investors, and the American public that housing prices always go up. That assumption turned out disastrously wrong.

What are some other assumptions that could turn quickly? Here were a few off the top of my head:

Three Potentially Shaky Assumptions

U.S. Government Debt Is Entirely Risk-Free

We’ve come shockingly close to debt ceiling crises several times over the past ~decade. Yes, lawmakers have always pulled back from the brink. But keep dancing near the cliff’s edge, and eventually, you could topple over (and our current administration is on the record saying a default “could be maybe nothing”). A true U.S. default—if only for a brief moment—would rewrite global financial history.

I wrote this article mainly on Saturday… on Sunday, Trump threw out the idea of fraudulent treasuries, which seems to be inching into selective default territory, so we may see this assumption tested in the near future!

Gold Will Always Be the Ultimate Store of Value

If diamonds can lose their luster when lab-grown options flood the market, is it impossible to imagine gold losing its timeless appeal? Thanks to physics, “lab-grown gold” probably isn’t a risk like lab-grown diamonds are…. but in a digital age, is Bitcoin or another crypto asset more practical than a heavy metal that sits in vaults? Would it be crazy for investors to say “I’ve already seen one jewel lose its store of value luster in diamonds; why not just switch from gold to Bitcoin?”

Tax Codes Can’t Be Retroactively Changed

Could a new administration come in and say, “All the tax incentives from the previous regime are null and void, retroactively—and anyone who received one owes back taxes”? Under current law, that’s off the table and in fact seems downright crazy. But we’re already seeing the current administration try to undo everything the previous administration did; is it too insane to start applying that to tax codes?

Sanity Check: Are These Insane? Maybe… But That’s the Point

When everyone believes something can never happen, that’s precisely the scenario where a “tail risk” can strike the hardest. If you told an investor three decades ago that lab-grown diamonds might disrupt a 3,000-year-old industry, they’d probably have rolled their eyes. But today it’s a reality, and the diamond supply chain, jewelers, and maybe even the jewelry insurance industry (if you believe my anecdote!) are facing a reckoning.

What other bedrocks of finance might be vulnerable to a swift change?

Join the Conversation

Those are my weekend musings on “crazy” tail risks. What do you think?

Do you have any “unbreakable” assumptions that could actually be on shaky ground?

Are there smart ways to hedge against or capitalize on these potential disruptions?

I’d love to hear your thoughts in the comments!

Like this post? Sharing it with a friend is the best way to grow this blog and thus keep more posts coming!

I recently got engaged. The guy helping me through the process said they now sell 90% lab grown. He brought out 2 diamonds, a 2.2 karat natural and a 2.7 karat lab grown of similar quality. He said the natural costs $20,000. The lab grown costs $900.

When considering the costs of a wedding / down payment for a home all happening in the next 12 months, it makes the decision very easy. We're in our 20s and the shock of older people looking at the ring who don't understand the lab grown business is pretty funny.

A pet idea of mine is that the equity risk premium will eventually vanish or go negative, and stay that way. If interest rates go back to <=2% then we could see US equity indices trading at 50x-100x earnings.

The logic is that while individual stocks are clearly much riskier than fixed income, a diversified stock portfolio is in many ways much *less* risky. Consider the Treasury default scenario above, the 2021-22 bond crash, and the looming prospect of confiscatory taxation of bond coupons or other forms of financial repression as demographics ruins the government's fiscal position.