That post generated a ton of interesting feedback, which I will hopefully get around to discussing in a follow up post next weekend…. but the post actually wasn’t where I was trying to take the conversation originally! My writing just flowed there and it pairs nicely to where I was trying to go, so I figured I’d put it up.

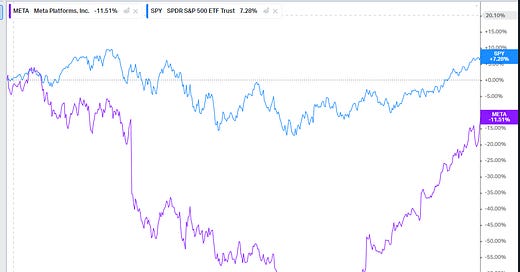

Where I wanted to take the conversation was to a discussion on doubling down on these stocks as they fall / get cheap. With Facebook / META stock more than tripling off the November lows, I see lots of football spiking from people who bought the lows.

And it’s fine to do so! Above all else, investing is a scoreboard driven game. Hopefully, you have a repeatable process that you can do for years that will drive consistent outperformance in the long term. But, as I’ve said before, if there’s one situation where you have unique insight and you make a huge investment and generate unreal returns, you don’t have to apologize for how it happened. Sure, it’s nice if you buy a company because you think they’re undervalued and the stock will rise and it turns out you’re right, but if you buy them because they’re cheap and the business implodes but the stock goes way up because it becomes a meme or has some crazy short squeeze or something and you make a fortune, there’s no shame in that! You can just point to the scoreboard, drop the mic, and retire to your private island.

Some of the people who are spiking the football on META’s big move started buying Facebook below $200. They (rightly, with hindsight) saw a company trading extremely cheaply with huge negative sentiment and some enduring businesses that would do well if the company could just get out of its own way / didn’t light all of their profits on fire. I think of people like my friend Evan Tindell (see his META thesis here) when I think of this type of investing. To me, regardless of outcome, this type of buying is a repeatable process (and one which I wish I had employed / followed; I saw how this could all play out pretty clearly at the bottom in November, but I didn’t pull the trigger for reasons that I refuse to understand or acknowledge at present).

However, there are other investors who are spiking the football on the big rise in Meta. I’ve coined them in my heads “the double downers”. They had a large position in Facebook in late 2021 (when the stock was over $300) on the thesis “Zuck can do no wrong / Metaverse domination”. They doubled down when the stock hit $250, then again at $175, then again at $100. Now, the stock has round tripped all the way back to where they held it a few years ago, but they have an enormous win because they doubled down constantly. It’s not apples to oranges, but I think of these investors as kind of epitomized by the recommendation and price target of the Jefferies’ META analyst:

I don’t read much sell side, but I just find that recommendation range too funny. He has a buy on the stock the whole time, but takes his price target from ~$450/share all the way down to ~$150/share before rapidly raising it again to ~$400/share. It’s pretty clear what’s happening; he’s decided the stock is a buy, and he’s just lowering / raising his price target to match where the stock is (here’s a dirty secret; that’s what most of the sell side does!). If you imagine each successive price target lowering as another “buy” point, that range follows a lot of how I think the “double downers” traded META.

Anyway, the thesis for owning Meta at $300 two years ago and $100 a few months ago were diametrically opposed. At $300, you were really thinking about Facebook’s growth opportunities and new markets. At $100, you were betting Zuck wouldn’t light the company on fire. And it’s probably worth noting that if you bought META two years ago, you’d be substantially underperforming the market even after META’s big run. Yes, you could have improved on that by adding all the way down…. but again, that was a big risk!

And this is where it connects back to my post on benjammin buttoning your process. In that post, I wondered about the style drift for the investors who generated huge returns buying MSFT at deep value in ~2012 and holding it as it became a juggernaut today.

Similarly, I wonder about the style drift for an investor who bought META at $300 in 2021 and then doubled down all the way down as the stock dropped in 2022. In general, I think the skillset to identify a world beating compounder (like you were buying META at $300) is very different than the skillset to identify a beaten up / corporate control discount company that will work out (like META at ~$100 was). Perhaps the answer to both is / was “Zuck is the GOAT and we’ll all get rich,” but it seems like a poor process to have that singular thought be your thesis when you buy something that you’ve ridden down ~66% and I think if you were really looking at the stock at both times dispassionately the risks and things you’d focus on should have been much, much different.

Speaking of the “different risk factors”, I also wonder about the process on doubling down on META. I’ve (unfortunately) had several stocks that have dropped by >66% on me. I can tell you that the hit rate on doubling down on a stock that drops like that isn’t great; in general, when a stock drops that much, it’s because your initial thesis was completely wrong and/or the world has changed. Can you make money doubling down? Sure! You can make money doing anything in the stock market…. but that doesn’t make it a positive EV investment. On the whole, I’d guess doubling down on a stock that’s dropped by >50% over the past year is one of the most negative EV investments you can make. You just bring too much bias and history to the investment to look at it clearly/rationally, and the mindset you used to make the initial investment often isn’t the one you should be underwriting it to (i.e. when you buy a stock at $100, the most important thing to underwrite might be something like “will long term margins be 30% or 40%”, but when it drops to $33 the most critical question might now be “will this business ever be profitable” or “is Amazon going to turn this business into a commodity”, but you might still be looking at it from that “what will long term margins shake out at” perspective).

Anyway, the answer can (again) just be “scoreboard.” But given META’s size and the very visible success a bunch of investors just had in doubling down on META, I’m worried that a lot of investors are going to takeaway from this “buy mega-cap tech every time it’s beaten down,” and that could prove very costly for a bunch of investors in the long run.

PS- One more thing while we’re here; I do wonder if these dramatic stock drops are actually part of the value of being public. In 2022, every time Zuck took his estimates for losses on the Metaverse up, the stock market was giving him direct feedback that was an awful idea. Zuck is one of the richest and most powerful people in the world; if Facebook was a private company, I doubt anyone would ever tell him directly to his face how bad an idea increasing spend on Metaverse stuff was. Contrast META last year with Twitter today. Twitter is currently limiting the usefulness of the website for anyone who doesn’t pay for verification. This is a terrible idea; social networks should want people posting / DM’ing / generally using their site as often as possible. If twitter was public, the stock would have dropped 30% on the announcement. Instead, Twitter’s private. Now, there are plenty of people online willing to tell Elon how dumb of an idea this is…. but I’d guess it’s pretty rare for someone to tell it to Elon’s face in person, so Elon can just say “those are online trolls who’ve never built anything. I’ll prove them wrong.” In contrast, if Twitter was public, everyone could point to the stock drop and say, “Elon, it’s not us! We think you’re great! But the market thinks you’re wrong!” That doesn’t mean the market is always correct, but showing the rich and powerful that “the market” disagrees with them and forcing them to constantly and actively explain why the market is wrong and why they are costing themselves / their employees wealth (at least on paper) serves as a self check mechanism against bad / dumb ideas.

This is the best post ever on averaging down. It should be chanted Gregorian style at every investment committee meeting:

http://brontecapital.blogspot.com/2017/01/when-do-you-average-down.html

it feels somewhat obvious, but isn’t it true that u can respect meta’s long term ability and still recognise the discount it was largely facing taking on due to Zuck’s metaverse craze? does it have to be diametrically opposed?