So Trump won the election last week. Based on the popular vote, his win leaves slightly more than half the country somewhere between pleased to ecstatic and slightly less than half the country somewhere between displeased to despondent.

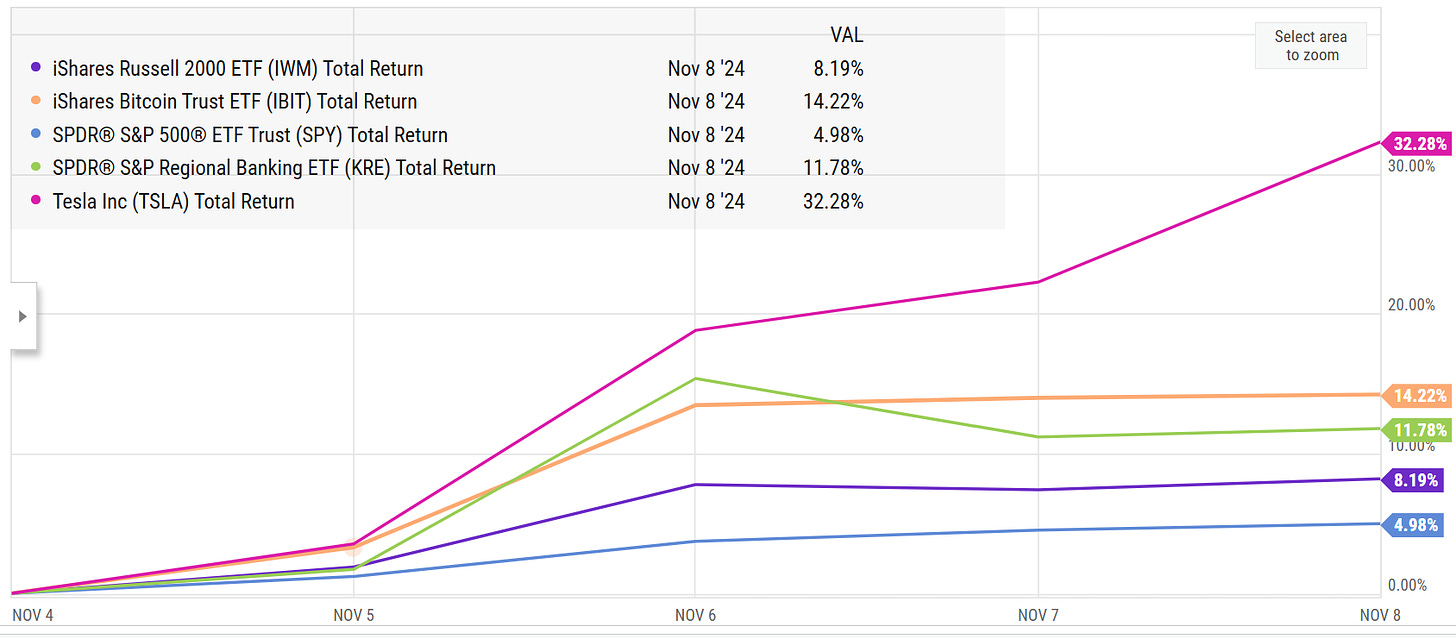

While the country may be mixed on the results, the market’s been pretty clear in its response to Trump’s win: complete euphoria. It’s hard to find a sector or company that hasn’t been screaming higher over the past week:

With the election aftermath seemingly on everyone’s mind, I wanted to share a few quick thoughts post election.

First, let’s start with a quick warning. I got dozens of emails after it became clear Trump was going to win (and likely in a clean sweep taking Congress too) asking about themes to play the Trump win.

I will be honest: if you weren’t long whatever theme you wanted to play heading into the close Tuesday, I suspect the market had already adjusted for it by Wednesday morning. For example, it’s pretty consensus that Trump is going to be good for regional banks…. and that consensus is reflected in the regional bank index up ~10% over the pats five days and 15% in a month. That’s not to say you can’t generate alpha buying regional banks, but if you are you’re making a bet that Trump will be more bullish for the market / regional banks than is already priced in. You can make similar arguments for crypto plays or twenty other industries.

That whole paragraph might seem obvious, but I was really surprised by how many people emailed me asking about Trump trades and, in my opinion, ignoring that the market is pretty quick to incorporate who is going to benefit / not benefit.

Second, I just wanted to share a mini-story. My initial instinct whenever I see a big move up or down is to want to fade it. The market can be really volatile; there are plenty of stocks that will drop or rise 30% on bad/good earnings but I generally think it’s pretty rare for an earnings report to really cause a business to be worth 30% more/less than it was the day before. Similarly, my initial instinct is to fade big election moves for most companies; obviously there are a few companies that will be big winners or losers but I suspect the market massively overestimates the numbers of companies that will be dramatically impacted.

But I mention this because it can be really easy to see a big move and want to fade it / say “this is dumb,” but the market can be doing some pretty complicated 3-d chess when making big moves. My favorite example of this is Tesla’s big move last week. Up >30% because Musk is tight with Trump? That seemed silly to me…. until I was talking to a friend and they walked me through some logic very similar to this VIC post: if you think Tesla is priced not like an auto manufacturer but as a call option on the company winning a multi-multi-trillion dollar autonomy opportunity, then Trump winning is a massive deal for Tesla. A lot of autonomy rules / regulations are going to come from the NHTSA, and the head of the NHTSA is appointed by the President. Imagine a world where Trump lets Elon pick the next head. How much would that improve TSLA’s chances of winning autonomy? If full autonomy is a winner take all $10T market (I have no clue; I’m just pulling a number out of no where) and Tesla put on ~$300B in market cap last week, then the market is saying Trump’s win increases Tesla’s odds of winning that market by just 3%…. honestly, that feels low1!

You can run similar math for a lot of other companies and industries that had big moves. The market might not just be factoring in lower taxes; it’s often factoring in estimates of what a lighter regulatory touch or increased ability to get merger through (or a hundred other things) are going to improve cash flows. Again, not saying I believe the size of any of these moves, but just pointing out that you probably want to do a bit more thinking on how these moves could benefit a company before instinctively fading them!

So I certainly would respect that the market might be approximating some deep thinking when it’s making these big moves in the wake of a new regime. That said…. if you have a company you’ve been following for years and you really like, I’d be cautious about panic selling it just because you think it might not be in favor under the new regime! For example, for the past few months, one friend of mine and i have been swapping notes on a company that has a lot of interest rate sensitivity (i.e. if interest rates go up, their value goes down). Him and I talked Thursday and he basically said “I had to sell all of my stock in the company; interest rates are going up under Trump.” I had similar conversations with friends on different companies in sectors that might not be as in favor under Trump. Look, if you’re following a company and they are directly in the cross hairs for what a regime might be trying to do, you need to think long and hard about that as a tail risk for your company and their intrinsic value may be much lower today than it was last week.

But, I’ll be honest: if you were massively long a stock last week, and you’re selling it all this week because it’s interest rate sensitive despite interest rates not having really changed since Trump’s election…. well, I think you’re probably letting politics drive your investing. That’s fine if you’re running some type of geopolitical / macro fund…. but if you’re a value investor and you’re making huge changes because you think the macro has massively changed under a new regime, I’m not really sure that’s your game (and I’d suggest you should just make the more direct bet and bet on interest rate changes rather than sell something you think is undervalued!). For example, I look at Icahn suddenly looking to take CVI private and buying UAN (disclosure long) in the open market the day after the election. Icahn says he’s making those moves because he’s seeing extreme valuations, and I suspect he thinks those companies are insanely cheap…. but I can’t help but notice he made those moves the day after the election, and I wonder how much politics had to do with Icahn suddenly flipping into an aggressive stance….

If I had to sum this post up so far, I’d hope I’ve gotten something like the following across: “a new administration can cause big swings in business value / outlooks, and often it can do it in deep and convoluted ways…. but the market adjust for those quickly, and if you’re a value investor you probably shouldn’t be trading on those changes unless the company you’re looking at is a very clear beneficiary / risk from those moves.” And I believe all that…. but I want to wrap up with one last thought: the market moves last week were the first order thinking where the clear beneficiaries / laggards in a new administration were punished. Going forward, the real money is in finding the second order beneficiaries: stocks and companies that will benefit / be punished by the administration, but often in ways that aren’t so obvious at first blush. I’ll give you one example I’m thinking of: the market instinctively blasted anything that touches green energy last week. And that’s probably right…. however, I’d note that a lot of green energy results in big benefits for the agriculture / the farmers, and a consistent theme of the first Trump admin was trying to find ways to get subsidies to domestic farmers / ag. I would not be surprised if there were a few companies that got sold off on a “panic out of green energy” thesis but are ultimately huge beneficiaries of subsidies to domestic ag / farmers.

Note I’m just using these numbers as a pure hypothetical; not saying I believe any of these specific numbers!