A quick mini-rant.

Every time the market drops by more than 1% two or three days in a row, or anything weird happens in the market, you’ll inevitably hear about a pod blowing up. This normally comes from a few dozen twitter accounts tweeting “hearing a pod is blowing up,” but it comes in other forms (i.e. it could be twitter accounts just tweeting, “did a pod just blow up?” or you’ll get a bunch of panicked texts / Bloomberg messages from people speculating on / asking about if a pod is blowing up).

Do pods blow up? Sure!

Can a pod blowing up cause weird correlations? Of course.

But if a pod blew up every time I saw “hearing a pod is blowing up” tweets, we’d have 30-50 pods blowing up every year. And remember, these pod blow ups wouldn’t be just any old pod exploding; they’d have to be pods big enough to blow up and impact the market.

I somehow doubt that’s close to the case. Heck, if pods were blowing up that frequently, there wouldn’t be anymore pods left to blow up!

And another funny thing is you rarely hear about pods blowing up on up days. Pods generally run market neutral, so huge up days can be just as scary as huge down days (in fact, they may be more scary, as lower quality names that are likely short candidates can really rip on up days). Yet, for some reason, you really only hear the “hearing pods are blowing up” rumors after the market has been down a few days.

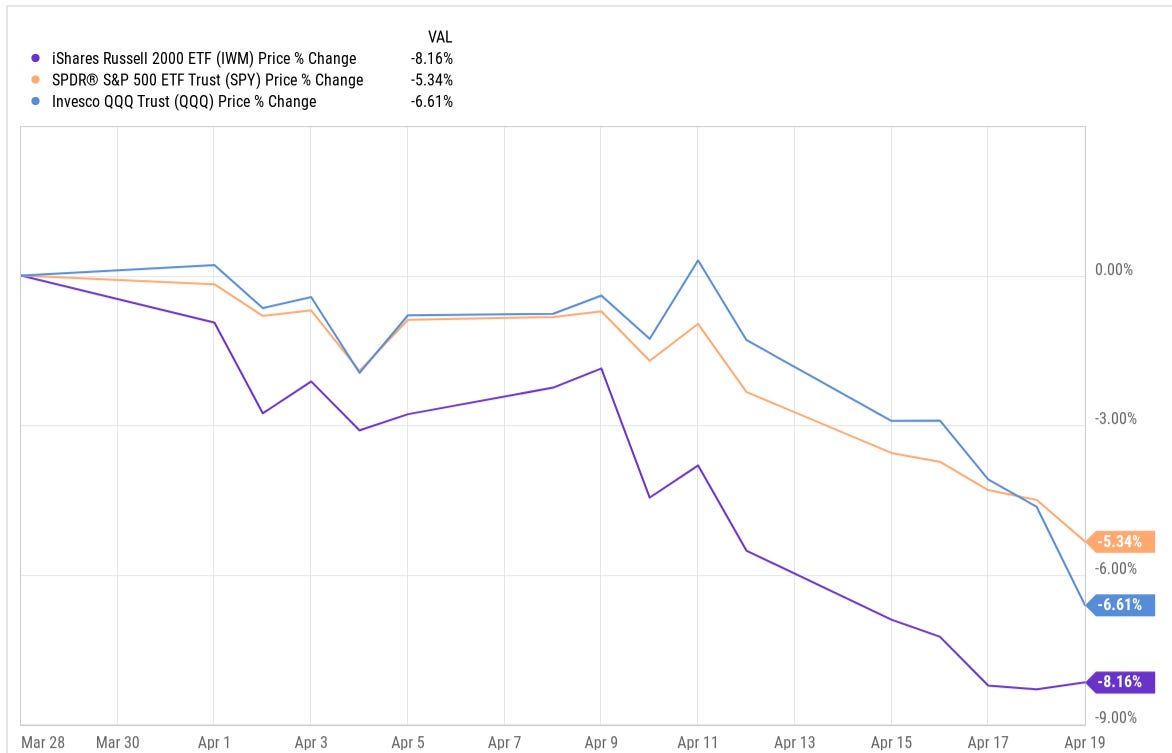

What I suspect is happening is pretty simple: these tweets all come out after the market has had a sharp drawdown. Take the current market; the major indices are all down >5% in ~3 weeks. That’s a decently severe / fast drawdown. It’s honestly not surprising that we’re starting to see some strange moves; the market’s getting just a tiny bit distressed and you’re probably seeing some faster money deleveraging a bit.

Anyway, I can’t tell you how many times over the years I’ve heard that XYZ pod shop is blowing up or in distress, and I’ll get serious calls from investors asking what it means or if this is the start of a Lehman moment or something. Here’s the thing: thinking about pods blowing up is really not worth the headspace it takes up. If you’re not on a trading desk, there’s precisely one way that a “pod blowing up” can effect you, and that’s if the pod has an oversized position in a stock you follow and needs to liquidate (or cover) it, sending the price to some temporarily depressed / elevated level.

When a stock drops randomly 20% in a day, it can be pretty scary. Perhaps it’s a pod getting liquidated or some large seller exiting for non-economic reasons…. or perhaps someone has a check that something has gone disastrously wrong at the company and is getting out in front of the news. Quick drops are often fleeting and it’s hard to tell the difference between a forced sale or some negative news that is just filtering through…. so if you know for sure it’s a big pod blowing through a block, that can be a very profitable opportunity (i.e. you know the drop is a technical, not some huge negative fundamental news, so you can safely buy the drop in size).

Outside of that rather rare and very particular case, it’s probably not worth spending the time worrying or wondering about what the pods are doing.

End rant!

Obviously, you are correct. But if we replace "blowing up" with "unwinding in a forced, but non-panic-ed fashion" I think it is frequently correct and does explain a lot of the dynamics seen over past decade. Factor volatility and who-has-same-positions-volatility has become more important than simple market exposure. The times when I make (or lose) money on both sides of my book on no news are too numerous to count. And to my mind, the most important factor has become who-has-same/opposite-positions factor.

sorry to be so naive, but can someone let me know what exactly a "pod" is?