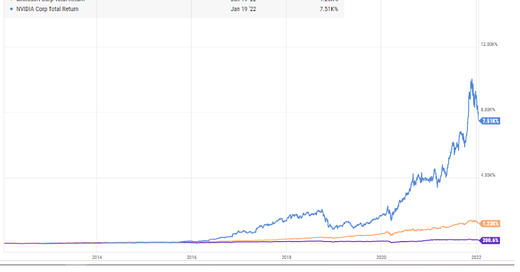

My weekend thoughts a few weeks ago were on stocks that could mirror the “epic” NVDA / MSFT run from ~a decade ago.

That post got a lot of responses. Interestingly, I’d say the most frequent response was suggesting Intel (INTC) as a potential candidate. Of the ~50 people who responded, maybe 30 of them included Intel as a candidate for a big multi-year run. Why?

Low starting multiple (INTC trades for maybe 12x P/E)

New rockstar CEO coming in after the last team probably mismanaged the business

Business / industry that definitely has market tailwinds (though we could argue if INTC is positioned to capture them!).

Anyway, just wanted to note that the responses for INTC were interesting, but that’s not what I’m thinking about this weekend.

What I am thinking about is my friend David Kim (author of the always excellent Scuttleblurb) responded to my piece and said, “Hey, I’ve had similar thoughts about NVDA / MSFT a few years ago!” Indeed he has; check out what he wrote up in his NVDA piece last July

There is a time and place for grandiose convictions. In 2005, pounding the table with: “Nvidia’s going to be the dominate stack for the biggest compute trends” would have been prescient but also, I submit to you, absurd and unjustified. But any thesis more specific than that would have mandated that you blow out of the stock. In 2007, the thesis that that Nvidia’s MCP business and Windows Vista would catalyze mainstream GPU adoption would have broke 2 years later. The same is true if in 2009, following a ~60%-70% decline in Nvidia’s stock over the previous 2 years, you believed mobile was the next gargantuan opportunity. In 2012, many analysts still thought Windows RT (Windows 8 for ARM) was going to be a the third major operating system alongside iOS and Android, and presented a vast growth opportunity for Tegra. No one at the time was really talking in earnest about megatrends like machine learning, big data, and “the metaverse” that would really come to make the difference.

The same could be said about Microsoft. Investors see where Microsoft is trading today and berate themselves for not buying in 2011 when the stock was trading at 12x earnings. But Microsoft is not only a different bet today than it was in 2011, but different in ways that were unknowable at the time. Central to most long pitches back then was that desktop Windows was a resilient cash gushing platform, that mobile wasn’t a real threat for such and such reasons or that Microsoft would carry its dominance of PCs into mobile or something. But MSFT has 10x’ed over the last decade for reasons (mostly) unrelated to desktop Windows and despite its failure in mobile. You can’t even latch onto the catch-all “culture” argument – i.e., “nobody knows what the future holds but this company has an adaptive culture and a great leadership team, so they will figure it out”. This was still the Ballmer era. No reasonable person looking at Microsoft should have cited “dynamic culture and management” as part of their pitch. Not even Microsoft knew what it was going to be at the time. We tend to focus on whether an investment decision turned out to be right or wrong rather than the degree of conviction justified by what was knowable at the time.

When researching a stock, I often mentally snap myself back to an earlier date and ask what a reasonable thesis could have been. But this is also a tricky exercise with no right answers

I read that piece when it came out, but I didn’t remember that part of it till David reminded me. I didn’t plagiarize the idea or anything (nor do I think David was accusing me of that! We were having a friendly discussion!), but I can’t help but wonder if having read that months ago planted the seed for me to have the idea / write it up recently.

I’ve been thinking about that “planting” of an idea a lot lately: we’re not going to remember most of the stuff we read today in a few months, but the information and thought process we read now probably buries in the back of our mind like a little seed waiting to sprout and connect at the right time / when the right prompt comes up (or it “incepts” us, for those who have seen inception).

That’s really powerful stuff, and it’s got lots of implications. But I’ve been thinking about it in one specific way: macro predictions when it comes to investing.

It can be really fun to debate and read up on macro stuff. Everyone wants to talk Fed policy, where interest rates are going, if inflation is heading higher or lower, etc. I get it. It’s really easy to have an opinion and debate on it, it requires a heck of a lot less work than studying up on a new company or something, and you can have a macro / fed conversation with basically anyone so it crosses borders really easily (i.e. I can have a macro conversation with someone who specializes in VC, PE, microcaps, biotech, or even someone who doesn’t invest! That’s certainly not the case if you’re looking at a company that’s not a household name). And, if you get a macro call right, the returns can be much faster than waiting for a company’s stock price to compound from a series of good earnings or something.

But I also think it’s dangerous. If you’re a fundamental investor and you’re spending any meaningful amount of time reading and thinking about macro stuff, it’s going to incept you. And, the fact is, most macro stuff tends to be overwhelmingly bearish; it’s just much easier to spin a wall of worry and talk about how everything is going to hell. That stuff gets way more eyeballs and sounds way better than saying “yeah, the world is scary, but humanity tends to find a way and stocks go up over the long term.” And if you’re reading bearish macro stuff (or any macro stuff), it’s going to start impacting how you’re thinking about and looking at companies.

Maybe that’s a good thing! Avoiding banks that looked cheap heading into the financial crisis would have been great. And my personal biggest regret as an investor is how I loaded up on stuff that was sensitive to COVID heading into the pandemic; I just never thought the world could stop like that.

But, in general, the best investors I know tend to find companies that are mispriced / misunderstood by the market, and then just buy them and ignore the macro noise (or any noise in general). I suspect that if you’re straying from that path by reading macro stuff, it’s going to “incept” you and you’ll start missing the forest (dramatically undervalued stocks you find) for the trees (worries that the market is going to drop by 10% in the short term, so why not wait till then to buy the stock?).

PS- one bonus though while I’m here. It’ll come as no surprise to any long time reader of the blog that I read a lot, and most of what I read is fantasy books (I have a monthly recurring feature in my monthly links article recommending fantasy books!). I’ve definitely been thinking about how getting “incepted” plays with all of the fantasy books I read, but I don’t have a firm view yet. Does it make me more creative? Does it make me more likely to live in a fantasy land outside of reality? I know lots of tech guys love sci-fi; does sci-fi incept them to think about the future in more fun and clever ways, or do they read sci-fi because they like to think about the future and sci-fi plays into that? IDK; very open to thoughts and suggestions here.

Cool post. I think about this too. Can be extended to all parts of life, and all media (music you listed to, movies you watch). I think Buffett's success to a large degree, and why people claims he does outright acquisitions of large companies with "no DD" is because he's incepted sooo much relevant knowledge gained from 70 years of sitting in a room, 12 hours a day, reading micro-related. So that coupled with brilliant pattern recognition + ability to draw relevant insights + photographic memory means he can act extremely quickly / decisively on investment opportunities.

I don’t think sci-fi makes you know the future, rather it’s a trait marker for people who like to think about it and thus a self selector I think.

Yo re:fantasy / reading, I don’t know if it makes you a more creative person but I definitely thought the point that Stephen pinker made about it decreasing crime because it helped create empathy seems... true ish? Not a fun read though.