This Thursday (November 18th) is Liberty Media’s investor day. It’s one of my favorite events because you can learn so much about so many different industries. Liberty and particularly John Malone (Liberty’s founder / controlling shareholder) have their fingers in so many pies (media with Discovery, music and podcasting with Sirius, global cable / telecom with Charter + Liberty Latam + Liberty global, sports with the Braves and Formula One, internet / travel with Tripadvisor, etc.) that they end up talking (with an insider’s perspective) on a ton of different industries, and Malone is incredibly sharp (I once heard Will Thorndike, author of The Outsiders, get asked which CEO he would chose to invest with out of all the outsiders, and he chose Malone. High praise!) and willing to be very open with his thoughts so you can get some really insightful takeaway that you wouldn’t get from a more buttoned up CEO (a few years ago, Malone said on national television that Charter had put its “hand in the cookie jar” and bought back shares at an inopportune time to boost their share price; how many control shareholders would berate their CEOs on national television like that!?).

So I’m always excited for Liberty’s investor day because it’s a chance to learn so much…. but I’m particularly excited for this one for two reasons

A group of investors (including me!) is meeting up after the investor day at The Joyce Public House (315 W 39th St), and you (yes, you!) are invited if you’d like to come put some faces to names. I’ve got the space scheduled to start at 2, but I’m sure a few people will show up early / right after Liberty Day ends. If you’re around, I’d love to see you there (particularly so I can get a picture and prove to my wife that all of these online friends I claim to have actually exist); I think some of fintwit’s favorite people will be there as well (Bill Brewster and Mike Mitchell got the ball rolling on the meet up, though I think several other fintwit luminaries will be joining as well, and some people on the Liberty side might make an appearance!).

I sprung for some passed apps to make sure we had the space reserved, so there will be a little food… but Mike warned me that value investors and Liberty stans are absolute hooligans if you promise them free drinks, so you’ll have to order your own drinks!

Speaking of hooligans, I unfortunately have plans that night so I’ll only be able to stay for a couple of hours, but I would not be surprised if a few investors ride the post Liberty highs to shutting the bar down (or at least posting up there long enough to rival the Liberty meeting’s length!).

There’s an awful lot going on in Liberty land right now, and I think the company’s set themselves up to make a lot of announcements this week.

Point #1 speaks for itself, so I want to dive a little more into point #2. Over the past month, Liberty has made a lot of moves or hinted at a lot of moves, and I can’t help but thinking that Liberty is prepped to make a bunch of announcements at their investor day (Liberty loves to announce things at their investor day; last year they announced Liberty SPAC on their investor day).

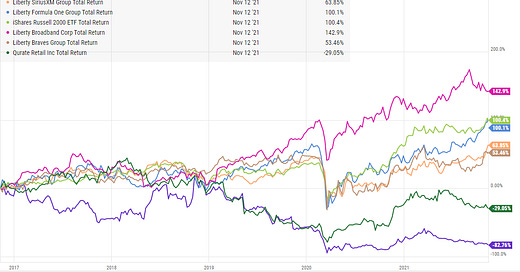

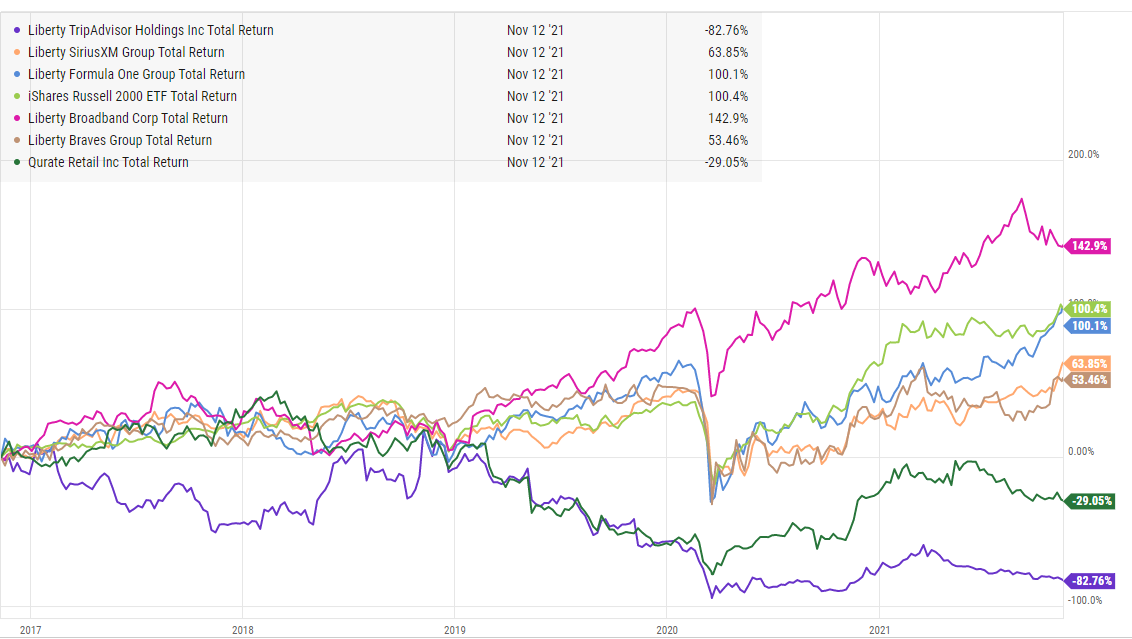

I’d also note that Liberty’s more recent track record isn’t exactly fantastic. I’ve got the performance of their major holdings versus the index (IWM) below. Liberty Broadband is the only stock that outperforms the index over the past five years; every other major holding underperforms, often dramatically so (in QRTEA and LTRPA’s case, they catastrophically underperform the index).

Again, it’s tough to look at just the five year track record since it ignores absolutely world beating investments like Charter in the early 2010s and SIRI in the financial crisis…. but the guys at Liberty are competitive, and between the sustained underperformance over the past few years and the absolute bungling of the capital structure of LTRPA and FWONA during COVID (I know a lot of investors who have started to suggest Liberty’s various stocks are getting assigned “Maffei discounts” because of the financing issues during COVID and the generally weak returns over the past few years), I think there might be a little extra incentive to come out strong during the investor day.

The four particular places I see the potential for something to happen in the Liberty universe are at Tripadvisor / Liberty Trip, Liberty’s SPAC (LMACA), Liberty Braves (BATRA), and Liberty Sirius (LSXMK) (and, I couldn’t help myself, I threw in a bonus thought on Qurate (QRTEA) at the end). Here’s my reasoning for each:

Company #1: Liberty SPAC (LMACA)

The most obvious / likely candidate for something to get announced is Liberty’s SPAC (LMACA). Liberty’s SPAC priced in January 2021 and has a 24 month life span (I.e. it has to complete a deal with 24 months, or else it needs to return its cash to shareholders). There’s a little wiggle room in that timeline, but there’s not much. And SPAC sponsors and target companies both know it’s better to announce deals earlier in the SPAC’s life span so that it doesn’t look like the SPAC sponsor is just throwing stuff at the wall to try to get any deal done and preserve their risk capital. Given Liberty’s deep pockets and rabid fan base (including me!), maybe those concerns don’t bother Liberty as they know they can get a deal done regardless of when they announce it…. but I follow both Liberty and the SPAC market closely and something in my gut says that they’ll be announcing a deal in the next few months. Why not time it for the investor day?

What will they target: I have no clue. Liberty’s SPAC is sized perfectly where they could reasonably go for a company of just about any size. That said, there are two businesses that may be on the block that Liberty has a lot of history with. I think either is highly unlikely, but you never know and I wanted to throw both out since the stars could be aligning with them (as you’ll see in a second, pun very much intended). The two businesses? Starz and Tripadvisor’s experience assets. Why do I think that?

Potential target #1: Starz: The Liberty team does have a lot of history with Starz, which LGF is looking to spin. Could Liberty anchor an investment to spin them out of LGF? At the right price, why not? But Malone and Maffei know the media industry very well; they know subscale media players are in for a really tough time going forward. I doubt Starz is the target, but the timing does match up enough that I wouldn’t be totally shocked if they did a Starz deal.

Potential Target #2: Tripadvisor Experience assets: TRIP’s talked about spinning off some of their experience assets (Viator and The Fork). Liberty controls TRIP through LTRPA; it’s possible LMACA SPACs the assets out of TRIP. I’ll focus on TRIP more later in this post, but a dal could make sense; one of the best reasons to SPAC something (and a reason that the market has tended to like) is if it’s a COVID affected business that needs capital to cover the shortfall while waiting for demand to return post-COVID. TRIP’s experience assets would certainly qualify.

What do those potential deals have in common? Again, I think either a TRIP or Starz deal with LMACA are highly, highly unlikely. But each potential deal has one thing in common: Liberty knows the assets well (as they currently control them or have controlled them in the past), and the sellers of the assets have been very clear that they want to maintain a strategic relationship with the assets if they dispose of them (LGF wants Starz to keep taking their movies and buying their TV shows; TRIP wants the European assets to continue to monetize TRIP’s traffic funnel). As a SPAC, LMACA would be perfectly positioned to do separate the businesses while maintaining those relationships (as opposed to a strategic buyer, who may want to break the relationships in favor of their own).

Company #2: Liberty Sirius

On November 3, LSXMK did a share swap with Berkshire. LSXMK gave BRK shares of LSXMK in exchanges for the ~43.7m shares of SIRI BRK owned. LSXMK has always complained about their discount to NAV, but they had good reason to do the swap now: taking BRK’s SIRI shares took LSXMK over 80% ownership of SIRI, which means SIRI’s dividends accrue to LSXMK tax free now (note that LSXMK did the swap on November 3, and SIRI went ex-dividend on November 4. I am 100% sure that timing was not accidental as it let LSXMK dodge the tax on the November div!).

Sirius literally just raised their dividend by 50%; again, I don’t think it’s a coincidence that Sirius is raising their dividend pretty substantially right before LSXMK did this swap!

Here’s how Maffei described the transaction on their earnings call:

“We undertook a transaction where we did a tax-free exchange to make an ATB out of this. Our famous line around here is no plan or intent and that's one we -- if you ever visit my office, you'll see I have some pillows, which say that thank you courtesy of Courtnee. But look, our whole idea is to create optionality, we have nothing to announce today about that. We would have gone over 80% probably with Sirius' continued buyback. But the way we transacted with the tax-free exchange allowed it to become an ATB or something we expect will be an ATB and gives great optionality and flexibility. So no plans, but we always like having ATBs. You can't have enough of them.”

So it’s pretty obvious why LSXMK did the deal now instead of a year ago or something; SIRI had bought back enough stock that LSXMK could finally get over 80% and avoid dividend taxes by swapping with BRK (If they had done it last year, they would still have been just below 80% ownership).

But here’s the thing: LSXMK didn’t have to do this deal now. SIRI’s buybacks would have taken them over the 80% mark in the next ~12 months, or LSXMK could have bought SIRI shares on the open market. Swapping now with BRK is tax efficient, but given how wide a discount LSXMK trades at the BRK swap is also awfully dilutive to LSXMK’s NAV.

Which raises the question: why now? Was LSXMK in a rush to do the deal before year end for some reason? Sure, Malone hates paying taxes, so I’m sure he loves that doing the deal on November 3 saved them taxes on the November 4th div…. but I’m sure he hates the dilution more (the math gets kind of circular, particularly because I don’t think SIRI does the dividend raise before LSXMK hits tax free status, but I think the dilution from issuing LSXMK shares at a discount to NAV is worth more than a decade of the taxes from LSXMK’s SIRI dividends pre-consolidation…. again, this is an expensive swap that I don’t think they do unless they needed to get this done now for some reason).

PS- while I would have loved to be a fly on the wall to hear the negotiations here, I think it was a pretty simple phone call / deal. Malone and LSXMK wanted tax consolidation, and BRK was really the only shareholder with a chunky enough stake to get them over 80%. I’d guess Malone and Maffei called Omaha, said what they wanted, and BRK said “sure, we’ll do it at current market prices.” Malone and Maffei probably tried to argue “but we trade at a huge discount”, BRK said “tough cookies,” and the deal came together. Nice deal for BRK!

Go back and read Maffei’s quote on the deal again; note how he twice says the doing the swap gives them “optionality” and “flexibility” as well as another ATB (active trading business). I can’t help but wonder if LSXMK is prepping some type of move and needed tax consolidation of SIRI before they could make it. The urgency to get consolidation of SIRI now overwhelmed the dilution from “paying up” for BRK’s SIRI shares.

The most obvious move would be merging LSXMK with SIRI to collapse the discount…. but if you were about to do that, why dilute LSXMK at a discount now? That makes no sense, so that can’t be the move. Instead, I wonder if the LSXMK / SIRI / BRK move sets up a move somewhere else in the cap structure. Doing something with their Live Nation stake (which now sits at LSXMK) is a prime candidate, though every indication I’ve had is that Liberty likes Live Nation / believes in it / maybe thinks there’s synergies between SIRI and LYV long term. So I don’t think it’s a Live Nation deal, but never say never. I’d guess it’s some other type of corporate reshuffling, like a major merger announcement or selling an asset. Speaking of….

Company #3: Atlanta Braves

The Braves just won the World Series. They have maybe the worst RSN deal in the nation (Maffei noted on the Q3 call that their RSN is one of most profitable RSNs out there (a too profitable RSN means the RSN is paying the team too little), and that it’s the largest RSN territory baseball has). The RSN deal expires in 2028. That’s not that far away; if you’re a potential buyer running a 7 year DCF or financing strategy or something, that renegotiation is square in the middle of your projections. The Battery (the real estate around the Braves’ Stadium) is coming along really nicely (the Q3 earnings mentioned on time and on budget; a big worry given supply chain issues these days!), and I think it’ll be a nice trophy property for some pension fund or mega real estate owner at some point that gets a super low cap rate.

Anyway, I’m just loosely saying stuff here, but the bottom line is this: while I’m sure the Liberty team loved celebrating a world series win, they are a very unnatural owner of a baseball team. The win gives the team incredible momentum for season ticket sales and will give the Battery some nice wind at its back from increased foot traffic. I would not be surprised if we saw the Battery spun out or an announcement the Braves will be sold. I may be a little early on this, but the timing is starting to feel right.

Company #4: Liberty Trip / Tripadvisor:

Let me set the stage: Tripadvisor’s always had a monetization issue. They have a massive funnel of traffic, but they’ve never been able to properly monetize it (in many ways, it reminds me of Twitter, and it’s no surprise to me that lots of Twitter bulls tend to be Tripadvisor bulls). In the mid-2010s, Tripadvisor tried to correct their monetization issue with “instant booking.” Basically, instead of finding a hotel on Tripadvisor and then booking it on Expedia, instant booking let you book the hotel through Tripadvisor. Naturally, Expedia and other OTAs hated this product (it was a huge threat to their business), and Tripadvisor eventually had to cancel their plans as OTAs (who are TRIP’s largest advertisers) were going on a buyer’s strike. The stock price tanked.

In 2018, TRIP started righting the ship and the stock recovered. At Liberty’s 2018 investor day, John Malone pointed out that if TRIP wasn’t controlled by Liberty, TRIP likely would have had to run a process and sold themselves on the heels of that experience.

Of course, in 2019, TRIP started to stumble again… and then COVID hit. Liberty got margin called on their TRIP shares and had to do some distressed financing at the worst possible time.

Fast forward to today: TRIP’s much ballyhooed “Tripadvisor Plus” program is seeing struggles that, for longtime TRIP followers, seem very familiar to instant bookings struggles. Alongside disappointing Q3 earnings, Tripadvisor announced their CEO / founder is leaving. Their Q3’21 shareholder letter includes the line

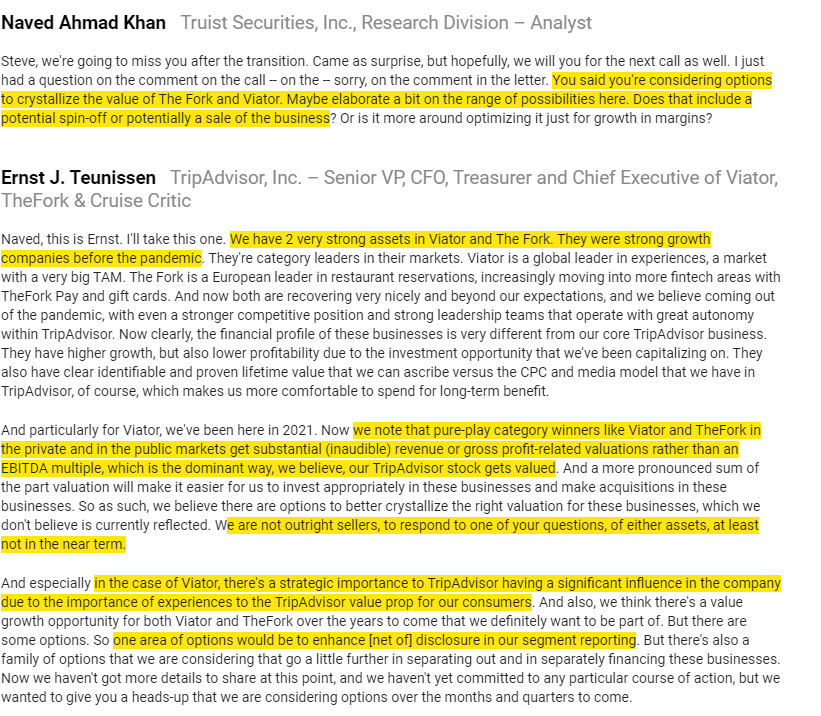

“As we look forward to 2022 for this segment, we are more convinced than ever that we have a significant value creation opportunity for our Viator and TheFork businesses. We continue to see an attractive growth profile, market opportunity, and competitive strength, and we are considering options to better crystallize their inherent value.”

This is just my gut feeling…. but I think Liberty is sick and tired of TRIP, and Trip+ stumbling out of the gate was the last straw for Liberty. After years of not doing a lot at Trip, suddenly in Q3 they announce a CEO change and strategic options for two key TRIP segments? That’s aggressive! It wouldn’t be surprising to me at all if these steps are the natural progression towards Liberty putting all of TRIP up for sale.

Alternatively, as mentioned in the SPAC segment, I wonder if Viator and/or The Fork are candidates for some type of deal the LMACA (Liberty’s SPAC). Check out how TRIP described the two assets and what they want to do with them on their Q3 call below; it seems like TRIP wants to get their value more accurately reflected in TRIP’s stock price without losing the strategic optionality that comes from having them attached to TRIP. Merging one (or both? I’m not sure on valuation here as they haven’t fully broken the business out yet) into LMACA would put the assets in very friendly hands and let TRIP get a mark for them while continuing to benefit from them strategically.

Somewhat related to the above, it’s worth noting that Maffei effectively paid Malone to grab TRIP’s controlling shares back in 2015. The stock and company have obviously been disasters since then; I wonder if there’s some lingering pride issues or anything that could serve as a barrier to a transaction (or make them more likely to sell just to wash their hands of the whole situation).

Bonus thought: Qurate (QRTEA)

Speaking of Maffei / Malone share swaps, it’s worth noting that Maffei offered and subsequently bought Malone’s QRTEA control shares earlier this year. I know lots of people are very bullish QRTEA, and it makes sense; the company is shockingly cheap, and they’re aggressively returning capital to shareholders through special dividends. I’ve always been a little skeptical though: I can’t remember another Malone or Liberty company that pursued dividends so aggressively (or at all, given they are inefficient from a tax standpoint), and that QRTEA (which used to be a mammoth share cannibal) has pivoted from repurchases to dividends makes me suspect they’re very cautious on the long term of the business. I only mention it because the last Malone / Maffei control swap at TRIP ended poorly for the business; I wonder if something similar is playing out at QRTEA…..

Another thing that worries me about QRTEA? After 16 years, their CEO is leaving. This was well telegraphed (the announcement was made in November 2020 that he would leave at the end of 2021), but if you follow QRTEA’s path they basically stop share buybacks in ~2019, the CEO decides to leave in 2020, and alongside that decision the company shifts from a levered buyback story to a big dividend payout story. There’s no doubt the company’s cheap, but everything about that combo screams to me “insiders are worried about the future and trying to get cash out.:

I’ll note I’m not following QRTEA as closely as I did a few years ago; I know plenty of very sharp investors who are very bullish on the stock. Again, the company is crazy cheap, and they’re going to get all that cash back to shareholders. In general, that’s a good combo. But writing about the TRIP stock swap and subsequent disaster made me think of QRTEA now, so I figured I’d put some thoughts to paper. I have no position; I’m happy to be told how wrong I am!

Heck, QRTEA has their own investor day on Friday (the day after Liberty’s). Maybe I’ll be told how wrong I am and end up buying the stock!

Closing thoughts

I’ve followed Liberty for a long time and reading the tea leaves here just makes me feel like something (or multiple somethings!) is about to be announced. Could it be something I mentioned above? Sure, I feel like everything above makes sense! But the world is big and predictions are difficult. Calling any specific transaction or deal is always a huge long shot. So I’m probably off on the predictions but right in the general direction that something is brewing.

Bottom line: I can’t wait to see what happens at Liberty Day, and (if you can make it) I look forward to seeing you in person afterwards.

Excellent summary! Looking forward to the meeting and the multi-beers afterwards!

It looks like the current tracking stock structure is coming to an end soon!