I will be honest: I find the market to be a very strange place right now.

I have been mentioning it for months in my monthly “state of the markets”, but I find there’s a huge discrepancy between “darling” stocks that are tied to the the market’s favorite growth trends (generally AI, though GLP-1 weight loss drugs and a few other growth areas could fit the bill here) and everything else. The growth darling / secular winners trade for pristine multiples that imply a very rosy future, while just about everything else trades for prices that (in my mind at least) imply we’re due for a deep and imminent recession.

So I do think there’s a lot of value out there in a lot of different areas…. but there is one particular area that I find just absolutely fascinating right now: small cap biopharma. I’m not sure I’ve ever seen an entire sector trade as washed out / below obvious strategic or financial value as I’m seeing in biopharma right now. And I am not talking in a “if you have a specialized PHD, you can find some interesting molecules in phase 2 that are more likely than not to succeed but are priced for failure” way; I mean this in a “there are dozens of these companies that are trading far, far below their extremely obvious asset value” way.

Whole sectors washing out can happen, and when they do it’s generally pretty lucrative to be long. The last sector I remember washing out was banks on the heels of the First Republic / SIVB blow ups in 2023; I was very long banks then, and with the benefit of hindsight I should have been much longer (and held on for longer too!). I think you could make similar “washed out arguments” about real estate (particularly focused NYC real estate) in 2022/2023, and those stocks have all generally been screamers as well. I’m sure there’s a few other smaller sectors you could make the argument for more recently…. but the reason I like using banks as an example is because they are a huge sector that was generally trading below an obvious metric of value (tangible book value), so it was easy in real time to suggest the sector was undervalued / dislocated (note: saying it’s easy in real time to say the sector is undervalued is not the same as saying it’s easy to invest in the sector or make money investing in it; I can promise you in the moment it is both stressful (“is this time different?”) and easy to look silly!).

I mention this history because history doesn’t rhyme, it repeats…. and what’s happening in biopharma seems like a repeat of some of those wash-outs except on steroids. There are large swaths of biopharma companies that are trading below the value of their net cash despite having assets in addition to their net cash that obviously have significant positive value. I’ll provide one or two examples later in the post, but a really nice example (though admittedly one I am a bit biased about!), is SAGE (which I am long, and which I did a premium write up and podcast on recently). SAGE has ~$8/share in net cash in addition to a 50% ownership stake in a potential blockbuster drug that’s already run-rating at >$100m/year in sales. In addition, they have a few early stage pipeline assets. So it should be clear that SAGE has positive asset value over and above their cash value…. yet SAGE trades for ~$7.30/share, or a ~10% discount to their cash!

Now, pessimists might say “this is biopharma. There’s always a handful of stocks trading below net cash because insider alignment is awful and insiders will just keep collecting paychecks and yolo’ing the company’s cash away on hair brained R&D and dumb mergers until all the cash is gone. They don’t care about shareholder value; they care about collecting their paychecks for as long as possible.”

And there is definitely a kernel of truth to that pushback; there have always been a handful of biopharms that trade below net cash because they’re just plowing all the cash in NPV-negative science projects (I believe Greenblatt customized his “little book that beats the market” screens to exclude net cash biotechs for exactly this reason, but I have not read the book in a while so I could be mistaken).

But I think this particular washout is uniquely different versus that history for two reasons:

I don’t have specific stats on this, but I’ve followed a lot of biopharms over the years…. and I can’t remember seeing this many company trade below net cash. Yes, there were always a handful, but it feels like half the sector is trading that way today.

It’s not just small, poorly run companies that are trading for a discount to their net cash; there are plenty of companies trading for a discount to their obvious (and just marked) strategic / asset value. An example might show this nicely:

Consider STOK. This week, STOK announced a deal to collaborate with Biogen on STOK’s key drug, Zorevunersen. In exchange for giving Biogen the rights to commercialize the drug outside of North America (STOK retains the rights for the U.S., Canada, and Mexico), STOK got $165m upfront plus another $385m in potential milestone payment plus tiered royalties on drug sales from Biogen plus Biogen will cover 30% of the development costs for the drug going forward (with the drug about to enter phase 3 trials, this commitment could easily be worth another >$50m).

STOK is basically a one asset company (they do have a second drug in phase 1, but I think it’s fair to ignore that for this article’s purposes). They had ~$240m in net cash at the end of their last Q (September 2024); cash burn has averaged ~$20m/quarter recently so let’s say they ended they year with $220m. Throw in the $165m from Biogen and they’re currently sitting on ~$385m in net cash, or ~$7.26/share (they have ~53m shares outstanding).

STOK last traded for $8.33/share, so they’re trading for maybe $60m (just over $1/share) above the value of their net cash. Does that make any sense?

Obviously no. Biogen just wrote a huge check to get the ex-North America commercialization rights to this drug. Biogen is clearly valuing this drug as worth way more than the $165m they spent upfront; remember, they’re covering 30% of the development costs, and obviously the milestone and royalties have real value (though they are dependent on approval). I don’t think it’s crazy to say that Biogen’s deal valued the ex-U.S. worldwide rights to STOK’s drug at ~$500m risk-adjusted NPV1.

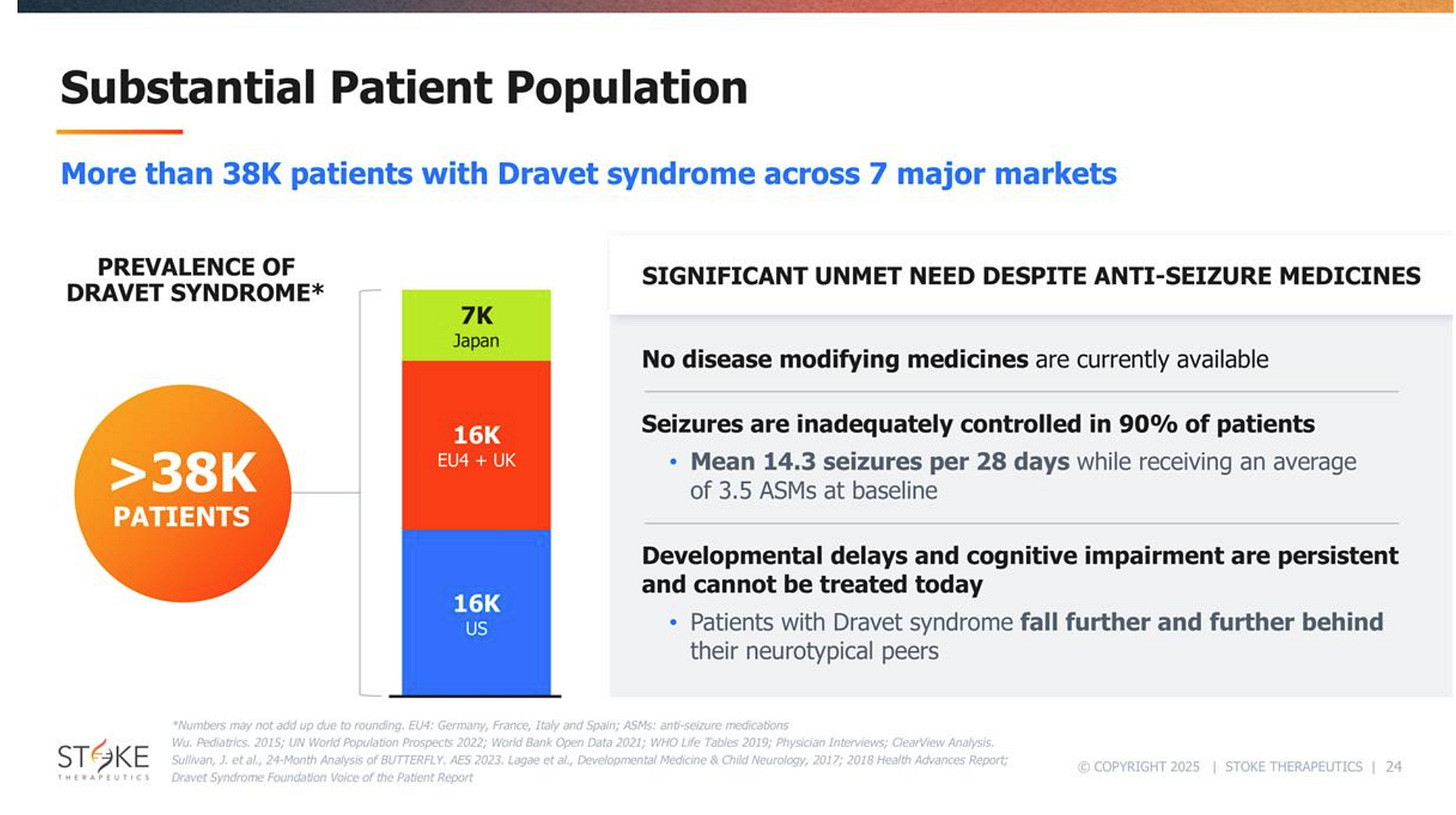

Remember, STOK kept the U.S. rights to the drug in the deal; the patient population size in the U.S. is ~70% as big as the rest of the world (see slide below from STOK’s recent presentations). I’d guess U.S. rights are more valuable than the rest of the world just because you generally get paid more in the U.S., but let’s just keep it simple and say the U.S. rights are worth 70% what the rest of the world’s rights are.

If all of that is correct, then STOK’s U.S. rights are worth ~$500m (the NPV of the Biogen deal I mentioned above) * 70% = ~$350m, or ~$6.60/share. So, when you buy STOK for ~$8.33/share, you’re getting 3 sets of values:

The ~$7.30/share in net cash on their balance sheet (~$385m post Q4 cash burn + Biogen upfront payment)

The ~$6.60/share from retaining the U.S. commercialization rights (~$350m, as estimated above)

~$6.30/share in risk-adjusted NPV from the remaining Biogen payments (the 500m in NPV I mentioned less the $165m paid upfront, dividend by 53m shares out).

For a grand total of ~$20.20/share in asset value.

Now, bears might quibble with my numbers. That’s fine! Play around with them all you want; I actually think I was conservative when you start thinking how big Biogen had to think the risk-adjusted opportunity was to write a check this size.

And bears might also say “yeah, but a lot of that cash is going to get spent on the phase 3 trial, so the cash balance is dwindling.” That’s definitely true…. but you have to think that cash burn is at least value neutral NPV given Biogen literally just wrote a huge check into the company. There are a lot of biotechs that have a ton of cash and are hellbent on spending it investing into a drug that’s a science project with no commercial potential at the end, so I can understand being skeptical…. but, again, Biogen just wrote a huge check which seems to suggest there’s a real pot of gold at the end of this rainbow if the phase 3 goes well, and I don’t think it’s fair to look at cash burn as 100% value destructive all the time when it’s going to investing into a phase 3 drug that a proven strategic party clearly sees huge value in. Besides, even if you just zero’d out the cash, you’d still be looking at ~$13/share in value at STOK versus today’s ~$8.30/share price.

I don’t think the STOK example is particularly unique in biotech right now; I chose it because the Biogen deal was announced literally this week so the numbers are extremely fresh / obvious…. but I see plenty of companies that are trading around or below net cash despite very obviously having assets worth significant positive value, and STOK makes for a nice / fresh example of highlighting all of that.

Are there negatives to these investments? Absolutely, there plenty. I think the two biggest are:

Corporate governance issues: biopharms have a long history of taking every last dollar of shareholder capital and spending it on increasingly YOLO like bets on R&D in order to justify continuing to cash paychecks

Risk of a trial: sometimes, even the best trials / drugs come up snake eyes. Using the STOK example, Biogen clearly sees value in the drug and a path to success on the current data…. but it’s just about to enter phase 3, and phase 3 trials are basically a coin flip. If the coin flip comes up negative, all of the milestones / royalties go to zero, and the cash burn was for naught.

Yes, this is a risk…. but I would contend that if you buy a basket of companies well below net cash or asset value where a major, sophisticated player like Biogen had recently written a big partnership check into the drug, in the long run your drugs are much more likely to succeed than your random biopharm phase 3 trial, and you’ll probably do quite well.

But I think both of those risks are more than covered by the insanely cheap prices we’re seeing (and, as I may discuss in a future post, I do think we’re seeing some encouraging signs of biopharms that have failed being willing to return that cash to shareholders….. though often that willingness comes because a large shareholder has the proverbial gun to their head).

Right now, I’m spending (almost) all of my time digging through biopharma land. I’m just seeing too many parallels to the “shelled out bank” trade in early 2023, and I want to make sure I’m swinging with appropriate aggression. I’ve discussed SAGE (again, long) publicly, and think that’s a really unique situation. In addition to SAGE, I’ve written up two really interesting net cash plays on the premium side (I’m long both of those!), and I’ve got ~a dozen others I’m really keeping my eye on / may invest in or write up at some point.

If there are any biopharma stocks you’re looking at that fit the bill that I laid out above, I’d love to swap notes! Feel free to leave a comment (or just shoot me a note).

I actually think that’s pretty conservative; remember, ~$225m of this is coming right upfront from the cash plus the 30% development spend, so you’re really discounting those outyear payments to get to a $500m NPV…. but I’m no expert, and we don’t really have enough data on the rest of the numbers to make a firm estimate, so it’s not worth splitting hairs over!.

I've seen the same thing on bios and tend to find this as a great time to use a basket of them. I have TARA and a combined ABUS/ROIV position. TARA is well less than cash and has an early stage Phase 2 that's metrics are trending better than comps and the ABUS/ROIV is basically Chris DeMuth's thesis which I buy. STOK seems like one of the better setups here; I look at VYGR as well but started to get the feeling it is a me-too Alzheimer's drug and not a leader. With the basket, if you get one that hits it covers the others and some and if you get real lucky you do quite well.

The math is compelling but looking at SAGE, when I check 13F holdings, I see no positions held by any of the major biotech focused HFs such as RA, Baker, Orbimed, etc. STOK is about the same but Baker has a tiny (0.55% of AUM) position. Possibly concerning?

Also, this might help you find other bargains; pull up the 13Fs on the above mentioned HFs, sort positions by current price, low to high, and take a look at all the cheap ones. Baker for example has 26 positions trading < 5 (based on 12/31/24 close) and eye-balling it, looks like on average, prices are down ~at least 75% from their estimated cost.