This is part 3 of my weekend thoughts on the TMTG / DWAC Spac deal. This part will dive into the winners from the TMTG deal; you can see part 1 (on what DWAC means for the SPAC world) here and part 2 (on the TMTG deal itself) here.

In this part, I wanted to mention three somewhat counter-intuitive companies that I think are clear winners from the DWAC / TMTG merger: Virtu (VIRT), Fox (FOX), and Twitter (TWTR).

I’ll start with the simplest first: Virtu (VIRT). I’ve mentioned VIRT a few times on the blog (most recently here), but VIRT is a company that benefits from increased trading volume and volatility. When GME and the meme stocks went bonkers in Q1, VIRT printed ~$2.04/share in EPS. That’s a quarterly number, not annualized. VIRT’s stock price is currently ~$26.50/share, so in one crazy quarter VIRT earned about 8% of their current market cap.

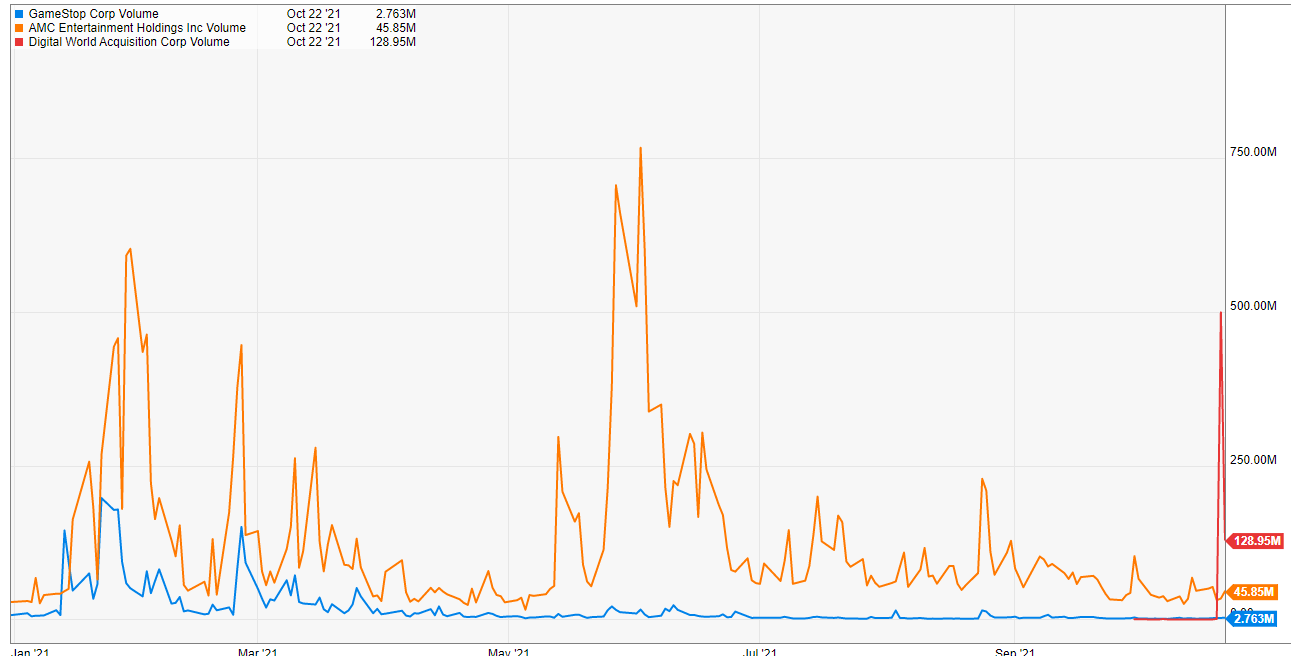

I tweeted this out day of, but DWAC traded just shy of 500m shares on Thursday (the day the deal was announced); that’s an insane amount. At its peak, GME never traded more than 200m shares in a single day. AMC appears to have broken 500m shares a few times this year, but the DWAC volume is still incredible and, while DWAC probably won’t approach Thursday’s lofty levels again, I’d suspect the stock remains incredibly volatile (and very heavily traded) as Trump is nothing if not a marketer and he will be sure to keep DWAC and TMTG at the front of the news as often as he can (plus, I believe DWAC options start trading Monday, which will likely add fuel to the fire!).

Anyway, I’d guess DWAC alone contributes a nice bit to VIRT’s Q4 earnings. Heck, I wouldn’t be shocked if the success of DWAC caused a mini-resurgence for the meme stocks (which would benefit VIRT from continued elevated trading volumes / volatility). But, moving past the immediate trading dynamics and thinking longer term, I think DWAC / TMTG shows the power of getting brands into the stock market in some form. I mentioned this in part 1, but I think we’ll see a wave of brand / SPAC mergers that are similar to DWAC / TMTG, and I’d guess all of them trade with elevated volume (though likely no where close to DWAC’s!). So DWAC is nice as a short term bump for VIRT, but I think it’s also the start of something that will provide an ongoing trading tailwind.

The second winner is FOX. The thinking here is simple: if TMTG launches “truth” (their social network), Trump will have his microphone back, and that’ll be great for generating content and engagement for Fox News.

Now, you might be worried that Trump / TMTG will eventually pivot to media and particularly news (as the deal slides make clear they intend to), which will create a serious competitor for Fox’s audience. I’m cognizant of that risk, but honestly that risk has been there for the past five years (remember that many people thought Trump’s original plan for the 2016 campaign was to run for President and then use the campaign to launch a Fox News competitor after he lost). I think launching “Trump News” to compete with Fox News was the easiest path to a real business Trump had. The fact he’s launching TMTG now means Trump will be too busy launching a social network to launch a news competitor in the near term (or, if he did, it’d be a half hearted attempt with no chance of sustained success). That’s a bonanza for Fox News: their largest potential competitor is not only busy doing something other than launching a competitor; he’s actually busy doing something that will give Fox News enormous amounts of content and boost their ratings / relevance, and he’ll probably be partnering with Fox News to do so (by going on their programs frequently to talk up the app and try to drive downloads). That’s a huge win!

In the longer term, I’d think Fox benefits from TMTG regardless of if TMTG is a success or failure. If TMTG is a failure, then Trump will be too busy cleaning it up to launch a Fox competitor (or, again, he might launch one, but it’ll be a half-hearted distracted effort with no chance of serious success). If TMTG is a success, then TMTG will probably always trade at a crazy multiple, and using their equity currency to buy Fox out would probably make more sense for all parties involved than TMTG actually trying to launch a news service from scratch. For TMTG, a merger would give them an instant inflow of a business that spits off cash flow (if TMTG’s plans to launch competitors to Twitter, AWS, and Netflix are to be believed, that will call for an enormous amount of cash burn!), and for Fox they would sell to someone who represented a massive potential competitor in the long term and likely get a huge premium for doing so.

The third winner from TMTG is Twitter. That might be a little counterintuitive, given TMTG is set on launching a Twitter competitor and now has a ton of buzz and a huge market cap to fund that competitor launch, but bear with me. I think DWAC / TMTG helps Twitter in four ways:

Comparable valuation: I mean, TMTG has no revenue or users. It’s valued at around $20B. Twitter does billions in revenue and is profitable; it’s valued at only $50B. I get that TMTG is currently a speculative trading sardine, not an actual business, but that valuation discrepancy simply can’t stand forever. Eventually, someone’s going to figure out a way to do a relative value trade shorting TMTG and long TWTR (not investing advice! Do not short meme stocks or really any stocks!). Heck, if the valuation discrepancy gets too crazy, TMTG could try to launch a hostile stock offer for Twitter to close the gap (and maybe get a working product that they didn’t allegedly rip off?). Do I think that a TMTG offer for TWTR would have a chance of succeeding? No*, no chance in heck! But it’s fun to think about.

*Why would a hostile offer not have a chance of succeeding? A hostile offer from TMTG to TWTR would need to be an all stock deal, and company boards can reject even very lucrative all stock deals if they believe the target company’s stock is overvalued. Say TMTG got to a $100B valuation with no revenues and offered to buy TWTR for $100B so the equity is split 50/50 between TMTG shareholders and TWTR shareholders. TWTR’s board would obviously do everything by the book so they don’t get sued (or at least don’t lose in an inevitable suit), but get a few drinks in the board and I’m sure they’d be laughing at how silly the offer was and how they never seriously considered it.

Highlights the strategic nature of twitter: Just look at the TMTG slides. The whole thing is built around recreating and replacing Twitter, and everything else follows from there. Twitter is the world’s loudest and most powerful microphone, and its market cap is $50B. Twitter literally has the power to launch someone’s career, boost market caps and values by billions of dollars (look at how the market responds to Elon’s tweets), and connect experts from all over the world. Almost literally everything I do on the public side (this blog, the podcast, etc.) uses Twitter as the backbone for its sourcing and distribution, and the vast majority of media creators I know use Twitter in a similar way. One day, Twitter is going to find the right way to capture some of that value for itself, and when it does $50B is going to look way, way too cheap.

Highlights the power / network effects of Twitter: On the heels of the DWAC / TMTG announcement, twitter was absolutely a buzz. I counted three different spaces (including my own!) discussing the deal, and almost certainly tens of thousands of tweets. I know it’s silly, but having that much knowledge and discussion coming in one space just reiterates how Twitter is the place to go discuss breaking news.

Might push Twitter heavier or into more creative ways to monetize: Say what you will about Trump, but the man knows how to get people to give him money. I’m skeptical TMTG ever launches a real / functioning product, but if they do I can promise the one thing they will have buttoned down instantly is a way for their users to give money to Donald Trump. Maybe that’s donations, maybe it’s follows, maybe it’s tips…. I don’t know, but I promise they will be creative in ways to take money from followers and that they will make it very easy to give money. The great thing about owning a dominant social platform is you can easy copy innovations that competitors make (just look at all the core Facebook / Instagram features that they took from SNAP). If TMTG comes up with clever ways to monetize, TWTR is going to be fast at copying them (and, if they’re not, an activist will step in and force them to). Twitter has famously been called a clown car that fell into a gold mine. My guess is TMTG is a dumpster fire, but it might be an instructive dumpster fire that shows the clown car how to mine gold.

Anyway, DWAC / TMTG has presented a wild few days, and it’s been less than a week. I can’t wait to see the company file their proxy and try to get this past the SEC, and I’m looking forward to the product eventually launching. There should be plenty of news and stuff to write about, and I’ll try to cover it all (well, most of it!).

If you see something I’ve missed or have different thoughts on DWAC / TMTG, I’d love to hear from you! The great thing about DWAC / TMTG is it’s such a blank slate that you can pretty much paint any narrative on it, and all the narratives tend to be really fun! So please, let me know if you think I’ve missed something or if you think there’s another angle to this; when $20B in market cap is created out of thin air, there tend to be interesting angles and trading opportunities for people willing to think carefully about the playing field!

Why is no one ever mentioning the risk that Trump gets totally destroyed by all the civil and criminal investigations/lawsuits? Not that he's not great at escaping justice, but sometimes luck runs out...