The longer I invest, the more I think real money is made (particularly on the event side) in pattern recognition1.

Pattern recognition looks something like this: you follow a company for a while thinking it’s interesting, then you see some unique filing or statement from a management team, it reminds you of a similar situation you saw before that had a hugely successful outcome, and you pull the trigger on an investment.

A lot of investing tropes and mantra are actually, at their core, pattern recognition:

Buy high dividend yield companies? That’s pattern recognition that companies with a high dividend yields tend to be cheap and out of favor

Ditto for stocks with a low P/E, low P/B, or any type of low multiple

Follow Greenblatt’s you can be a stock market genius’s advice and buy spin offs? That’s pattern recognition that spin offs tend to be unloved, have some type of forced selling, and/or have a newly incentivized management team that will unlock value.

Buy stocks where insiders are buying? Pattern recognition that insiders tend to have good insight into intrinsic / strategic value of a company, and when they’re buying it’s a sign they think value is a lot higher than the market price!

One place I find interesting? When you have an entire sector with insider buying across the board. For example, in the wake of First Republic and SIVB failing in early 2023, you saw a ton of different regional banks with huge amounts of insider buying. On the whole, that worked out well for them… but that’s only one example. I’d be interested if anyone can think of other historical examples where this “buying across a sector” signal has / has not worked (or if you can think of any current examples; I can think of one industry I may write up in the near future!).

Most event investors I know pay particular attention to company 8-Ks relating to change of control packages because, when you see a company randomly update their top brasses change of control packages, it’s often a signal the company is running a sales process. That’s pattern recognition that random change of control updates often come from a sales process getting ready to get kicked off!

Those would all fit into what I would call “rules based” patterns, and the list of rules based patterns you can look for and follow are basically endless.

However, those rules based patterns are not the reason I wanted to write this post. I don’t think they’re where the big money is made (though they can, of course, be useful signals!).

In my opinion, the best use of patterns (and where the big money can really be made) is when you use a pattern to match a situation today to something that happened in the past that isn’t the exact same but has loose parallels.

Let me give you a recent example that I think illustrate this nicely: when a company massively deviates from their normal earnings cycle, it’s because something major is happening, and the stock price is probably going to move. A hypothetical example might show this best: most small cap companies on a calendar fiscal year will report their Q3 earnings in early to mid-November, and they’ll generally do it on the same day and time (i.e. the first Thursday of November in the afternoon, so this year it would have been after market on Thursday, November 7). If the company comes out and announces they are reporting in mid-October, somethings likely up, and the stock is probably going to move quite a bit.

Now, this pattern is a tough one to implement. As far as I’m aware, there’s no screener that tells you when a company makes massive change to its earnings2, and companies don’t exactly come out and say “we’re reporting in October instead of November because we’ve got something big to tell you!”. The way I’ve generally found it has been quite manual (i.e. I follow a company for a while and notice that they’re reporting at a time different than when I expect them to), so it’s rare to find one…. but, when I have spotted it, it’s been quite profitable. Let me give you two examples to illustrate.

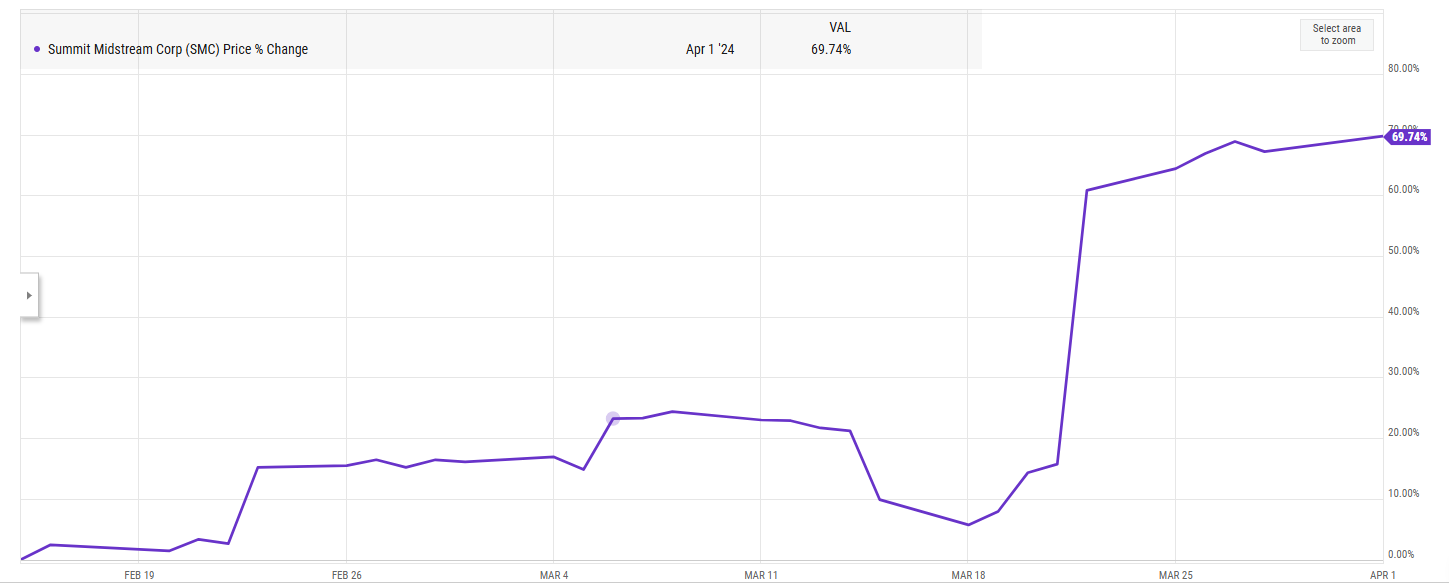

The first one is a simple historical example (which I was lucky enough to follow / write up in real time on the premium side). SMLP (which now trades under SMC, and I am still long) scheduled their Q4’23 earnings for March 15 this year… That was pretty strange to me, as the company had a very consistent earnings schedule and had almost always reported Q4 earnings at the end of February3:

If you were following SMLP, you would know that in October 2023 they had announced a strategic review while noting “our current unit price does not reflect the true value of the Partnership and that the best way to maximize unitholder value is to explore our options.” So, my theory at the time was that SMLP was in late stage negotiations for a deal, and the earnings delay was to allow time for a deal to conclude.

This trade did not work quite perfectly; the company announced Q4 earnings without a deal….. but they did note they continued to actively pursue options, and if you listened to their earnings call they were very clear the options were coming in the very near term (For example, “we remain very excited about the opportunity set to further maximize value for our unitholders, and we look forward to providing a more fulsome update in the near future.”). Sure enough, a week later (on March 22) the company announced a series of sales and a C-Corp conversion that sent their stock screaming higher.

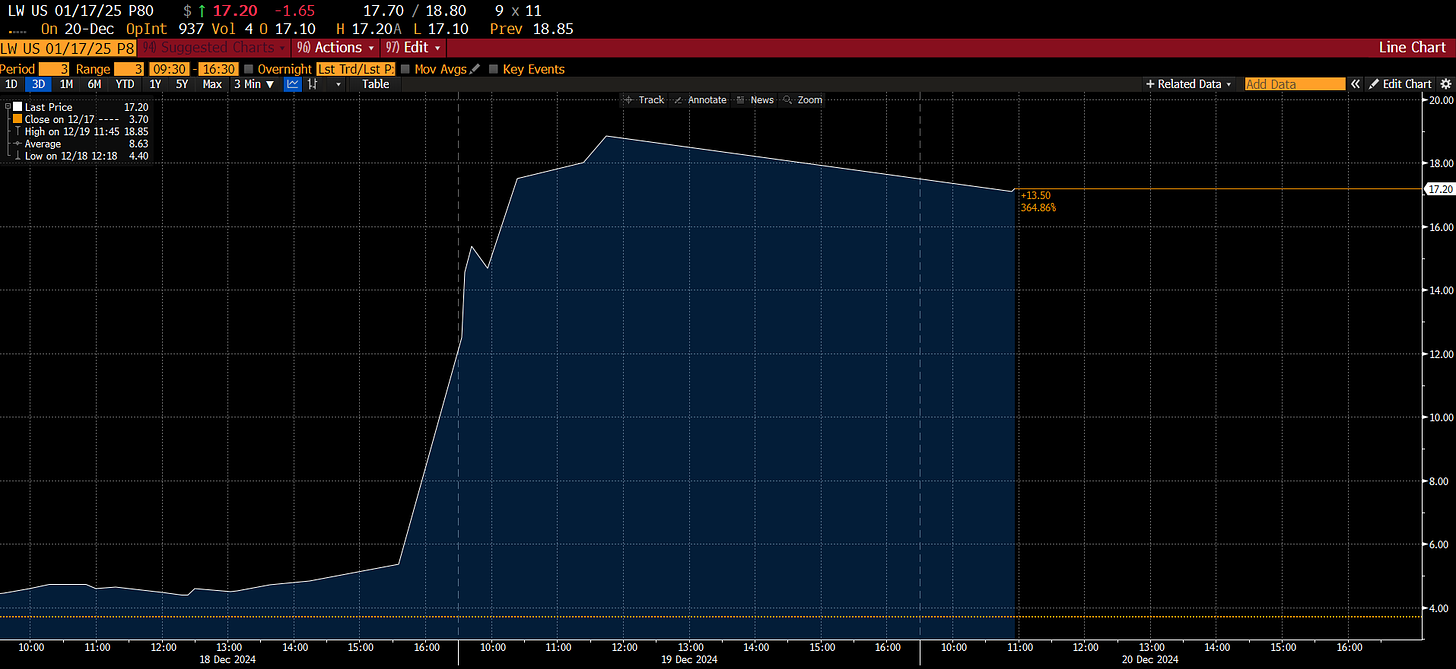

So that’s a nice historical example (and one I remember very fondly, except for kicking myself wondering why I didn’t size it up larger!). Let me give another more recent example that I had/have no position in: Lamb Weston (LW). LW has an off-calendar fiscal year; their most recent quarter is their fiscal Q2’15 ending in November 1014. On December 12, LW announced they’d scheduled Q2’25 fiscal earnings for December 19 (i.e. on December 12 they said we’re announcing earnings December 19).

That was a very strange announcement! Since LW became a standalone public company in late 2016, they have always reported Q2 earnings in early / mid January. For example, the first quarter they ever reported as a standalone company was a Q2; that report was January 10, 2017. They did basically the same every year since, including fiscal 2022 (january 6) and 2023 (january 5) and 2024 (january 4).

So, given the strange timing, it seems like LW had decided to rush their earnings out. Why would they do that? Well, LW has two really interesting things hovering above the company. On the activist front, Jana has been engaged with the company for a few months and officially filed a 13-d and sent the board a letter on December 16. On the corporate front, on December 13, reuters came out with a piece that Post was exploring a merger with LW.

Given everything swirling around the company, I would near guarantee you that LW was going to make some massive announcement that would have a material effect on the share price when they announced earnings. Sure enough, the earnings report was a disaster that saw the stock fall 19%. That’s an enormous move for any company4, but it’s a particularly large move for LW, which has a pretty stable / staple business that should be reasonably forecastable.

Now, I have no position in LW, but I will be intellectually honest: If you had given me the string of events leading up to earnings, I would have guessed LW was more likely to announce a massive beat, a sales process (or perhaps a sale to Post!), or something that drove the stock up than a disastrous earnings. My logic would have been simple: management’s feet were getting held to the fire, and management teams generally respond to that by putting their best foot forward.

So I probably would have bet the wrong way on LW, but I would have pattern recognized this: LW did not decide to report earnings a month early because they wanted to tell the market “it’s just another day here; nothing major to report!” They were either going to blow the doors off or get blown up, and I don’t think the market properly accounted for this.

Let’s use a hypothetical to show this. There is a way to bet on a stock making a big move one way or the other; it’s called buying a straddle (buying a put and a call at the same strike / expiration; let’s pause here to note: I have no position in LW, and options are extremely risky! Consult a financial advisor, do your own work, see our disclaimer, etc.). If you were following LW and noticed that they were going to report way off cycle, you could have bought the January 2025 $80 straddle (i.e. January calls and puts with an $80 strike price) for ~$11 before earnings, and they’d be worth >$18 right after earnings were announced and the stock dropped to ~$62 (note: you could have done better and expressed this view more clearly by buying the December options, but the December options expired December 20 and I’m writing this December 21/22 and am too lazy to figure out how to pull expired option pricing on Bloomberg!). That’s a pretty nifty return from recognizing

Ok, let’s pause here. I will be honest about two things:

I, unfortunately, do not have any great in the moment examples of companies that are off-cycling earnings that I’m interested in…. but most companies don’t report earnings during the holidays! I would not be surprised if there’s one good example when companies start reporting earnings fully in late January through February. I also don’t know of a good way to track or screen for these…. so if you’re looking for them / know of a good one and want to swap thoughts, my DMs are always open (as is my email if you reply to this post!).

Writing about LW’s earnings blow up is not where I expected to take this post! I had other things I wanted to say about pattern recognition and the like…. but I got side tracked writing on LW’s earnings! So I’ll have to save those pattern thoughts for a follow up post next week.

Till the follow up post, have a great holidays (and, if I get behind on the follow up post and don’t post till the new year, have a great one of those as well!).

I could swear I’ve written an article on this before, but I can’t find it…. so perhaps I’m repeating myself, but it’s a thought that’s been floating around my head and I wanted to get it out.

If I’m wrong, I’d love to hear of a way to track this! And I’m always open to swapping thoughts on companies massively changing their earnings dates if you see one!

You may notice the one exception to the rule is in early 2021, they reported Q4 earnings in early March instead of late Feb…. given everything that was going on with COVID, and early March being much different than the literal last day to report earnings (which March 15 basically is), I figure I can grant a small exception and say it still fits the pattern!

Well, it’s an enormous move for any company that doesn’t touch crypto / AI / quantum computing. For those companies, it’s just another afternoon!

interesting post - I'd be interested in seeing how common it is to see increased option purchases/sales before a rescheduled earnings vs regular earnings schedules.