Weekend Thoughts: Peloton's "weak" Q $PTON

Peloton reported earnings Thursday night. Apparently they missed consensus, and their guide was below street as well (I don’t really read or follow sell side, so I’m just basing that on headlines / what I see on twitter). They also disclosed they were cutting the price on their bike, and a “material weakness” in their accounting controls related to their inventory. Given inventory was up ~4x YoY (from $245m at the end of last fiscal year to ~$937m this year) and grew faster than sales, the material weakness was certainly not a good look!

I saw lots of people tweeting (and a few people pinged me) asking why Peloton wasn’t a lay up short now. Slowing sales growth and a big inventory increase + weakness generally signal an inventory write-down coming, and the price cut on the bike could signal continued growth issues and that competition is starting to catch up with them. Combine all of that with a rich multiple and continued headwinds as the country reopens and people are able to go back to the gym, and you’ve got a pretty compelling short term short thesis on Peloton, no?

I don’t have a big horse in this race. While I love / am obsessed with my Peloton, I don’t have a position in the stock. So maybe you could say I have a small pony in this race? I don’t know…. but here’s what I do know: if you’ve been paying any attention to the stock market over the past year, you know that shorting meme stocks is literally the dumbest thing on earth and a terrible risk reward (and, while nothing on this blog is investing advice, saying to avoid shorting meme stocks is about as close to advice as I can get!).

That rule has nothing to do with Peloton…. but a close second to that rule would follow if you’ve been paying attention over the past ten years. And that rule is do not short founder led companies that consumers adore simply because they’ve run into short term issues or their stock looks a little expensive. Outside of shorting meme stocks by selling naked calls options (do not do this; nothing on here is investing advice but that is financial suicide), I cannot think of a worse risk/reward than shorting founder led companies beloved by consumers.

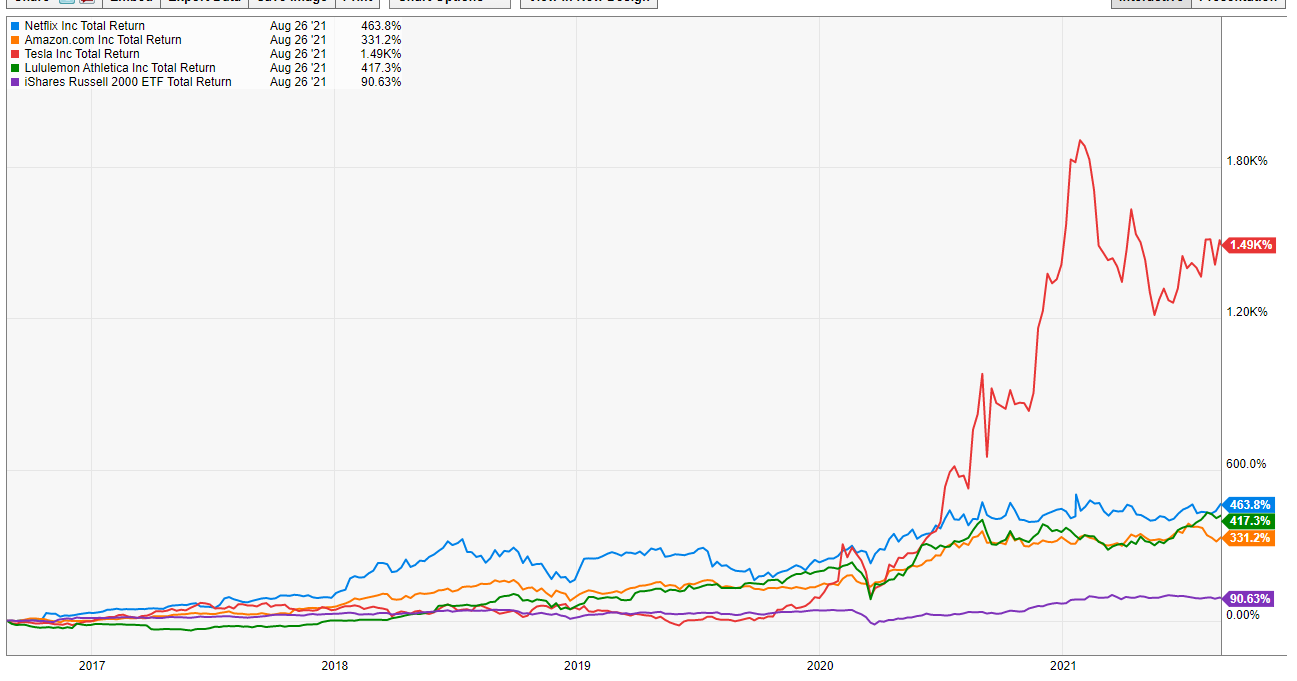

Consider:

You want to short Peloton because it’s expensive on near term numbers? How’d that work out for Amazon shorts ten or five or even three years ago?

You want to short Peloton because Apple is rolling out a competitor? How’d that work out for Netflix shorts?

You want to short Peloton because you think fitness is a fad? How’d that work out for Lululemon shorts?

You want to short Peloton because inventory is up and they identified a material weakness in their accounting over their inventory? How’d the “short Tesla because of their warranty” accounting thesis work out? Or the “short Tesla because the CEO lied about taking the company private” or “short Tesla because the Solar City deal got through only thanks to a Potemkin village” or any one of a thousand other short Tesla theses (almost all of which I agreed with BTW!).

Look, I’m not saying Pelton doesn’t face challenges, and the stock can do anything over the near term. But we live in a world of zero interest rates and massive returns to scale; the best companies with the best leaders can always pull a rabbit out of their hat that no one is expecting that creates billions and billions of value with almost no incremental cost. Maybe that rabbit comes from doing an incredible acquisition no one saw coming (Facebook / Instagram), maybe it’s releasing a completely new product that redefines the world (Apple / iPhone), or maybe it’s as simple as being years ahead of your competitors and coming to own a huge market because of your scale / distribution / ease of use (Netflix / Cable).

Peloton is one of those companies. I love it. Everyone I know who has one loves it. I have friends who haven’t worked out in years (or ever) who bought a Peloton, love it, use it four times a week, and have dropped 30 pounds in six months. You think they’re giving up that subscription anytime soon? You think they care that Peloton is $40/month and knockoff products go for $10/month? Gods no! They care that they feel better than they have in years, and that every time they run into someone the first thing they hear is “Wow, you look great!”

The market for fitness and health is enormous; Peloton’s market cap is <$40B. If they take that consumer love and pull one of those rabbits out their hats, this could be a >$200B company a few years from now. That sounds silly / outlandish, but it sounded silly when people said that about Apple / Amazon / Netflix / Tesla a few years ago as well.

So if you’re shorting Peloton, you’re playing for a little near term downside with the risk the stock 10x’s on you over the next few years… O, and btw, great companies with great brands always attract surprising multiples in a takeout, so you’re risking making a little in the near term and waking up to a takeout at a massive premium one day. Go look at the background to the STMP / TBA transaction and look at all the parties trying to throw huge premiums at STMP while short reports raged around them, and remember STMP is no where close to the company or brand Peloton is.

Short Peloton (or companies like them) at your own risk.