I love share repurchases.

I can show this in two ways:

I try to ask two questions on every podcast; the first is “the market is a competitive place; what is the the market missing that makes this a risk-adjusted alpha opportunity,” and the second is “Why isn’t the company buying back shares if their stock is such a bargain?”

I run a reasonably concentrated portfolio (~15 companies), and I believe there are only three companies in my portfolio that aren’t actively buying back shares.

Note the emphasis on believe in the second bullet; I say I believe because, while there are tricks to tracking intra-Q buybacks, it’s ultimately impossible to know if a company is repurchasing shares during quarters and so many companies like to buy back their stock when times are good and the stock is “dear” but then stop buybacks when their stock is cheap and the environment is more rocky (i.e. they’ll buy back stock at $100 but stop when the stock is $50).

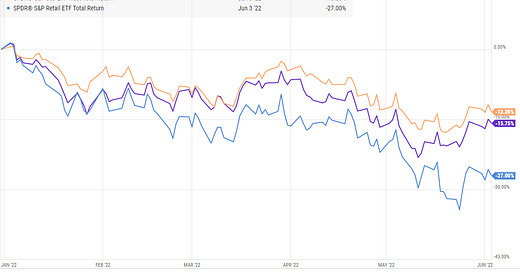

That “buy when times are good / stop (or dilute!) when times are rocky” tendency is always applicable…. but something about this year has made it particularly egregious. While the broad indices are only down ~15% YTD, that number covers a lot of pain and volatility under the hood. Several sectors have been hit much harder (for example, the retail sector is down almost 30%), and there are plenty of stocks that are down 50% or more. And, of course, many of those stocks have stopped buybacks now after going ham last year at much higher prices

So today I wanted to swing through a couple of the crazier examples of buying high / selling low I’ve seen this year.

I’ll start with my personal favorite: KIRK. Last year (FY21), they bought back 1.8m shares, approaching 15% of their shares outstanding, for >$20/share.

They followed that repurchase up with another 480k shares (about 3% of their shares) for ~$13/share in Q1.

But today trends are falling off a cliff, the company is stuffed with inventory, and they’re stopping the buybacks despite the shares trading for <$5/share.

To be fair to KIRK, they are stopping buybacks in part because they had to: they bought back so many shares, and inventory ballooned so high, that they had to draw on their credit facility and their credit facility restricts buybacks.

Honestly, though, that’s what makes this buyback so darkly funny. KIRK bought back so many shares at higher prices that they’re now precluded from taking advantage of these lower prices. Not only that, but they got so aggressive on buybacks that the financial future of the company is now at risk as they’re stuffed with inventory and liquidity has come down rapidly.

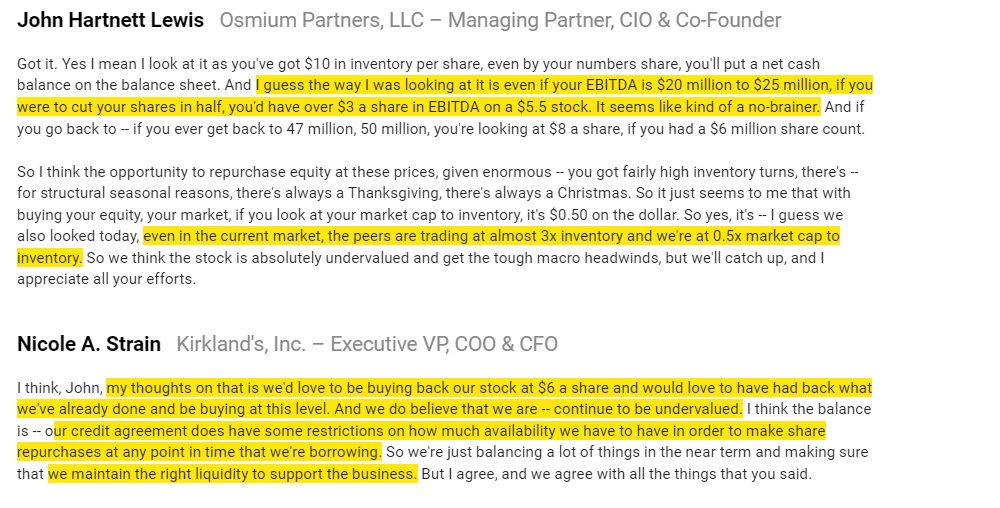

The cherry on top for the KIRK story is they had an activist (Osmium) who filed on them in April suggesting they tap their credit line to buyback more stock. Ignoring that the credit line precludes buybacks when drawn, the stock was at ~$7.50 when they made the suggestion. If the company had instantly done what the activist suggested (drawn down the full facility to buyback an enormous amount of shares), the company would have bought back a ton of shares at prices much higher than they currently trade at and they they’d likely be on the brink of bankruptcy right now.

To be fair to Osmium (who I generally find interesting / I like to look at all their ideas!), they’re probably taking a valuation view longer than this quarter / year when asking for repurchases. There’s no doubt the company is cheap; it’s trading under tangible book value (book is a touch above $5/share versus today’s price of <$5/share). You generally don’t value retailers on book value because of operating leases and how squishy inventory is in a liquidation, but the company is cheap on earnings basis too. Adjusted EPS was $1.40/share in 2021, so if you believe those results are sustainable / repeatable after the current malaise is over you’re buying them for <4x P/E and you can probably have pretty good confidence they’re going to hammer the share count with buybacks if and when they stabilize.

Of course, bears would point out 2021 was an absolute record year, and valuing KIRK off those levels is more than a little generous. Plus, in order to be valued on stable earnings, a company needs to make it to stability, and given KIRK’s current results and balance sheet there’s no guarantee they’ll survive to stability.

Anyway, I don’t want to turn this whole post into a bull / bear on KIRK. They’re just my favorite example of buybacks gone bad because the company bought back so much they put themselves into financial distress, and they have an activist egging them on to go harder. FWIW, the activist reiterated their call for share buybacks on the Q1’22 call (i.e. after the awful current results had been reported).

KIRK is far from alone in buying back shares at highs and then pulling back as things got rocky. Consider BIG, which bought back just shy of $450m shares in FY21 at an average price over $50/share. Today, BIG is trading for well under half that price (<$24/share), giving them a market cap of >$750m. At current prices, BIG would retire almost 60% of their shares if they executed their share buyback as aggressively as they did last year. Needless to say, results have fallen off a cliff this year, and the company has stopped share buybacks (Note: I’m a shareholder / bagholder of BIG, and I’m furious that they’re not buying back shares at these levels, so I highlight them to show camaraderie with Osmium and KIRK / show that I am certainly far from immune to having this happen to me!).

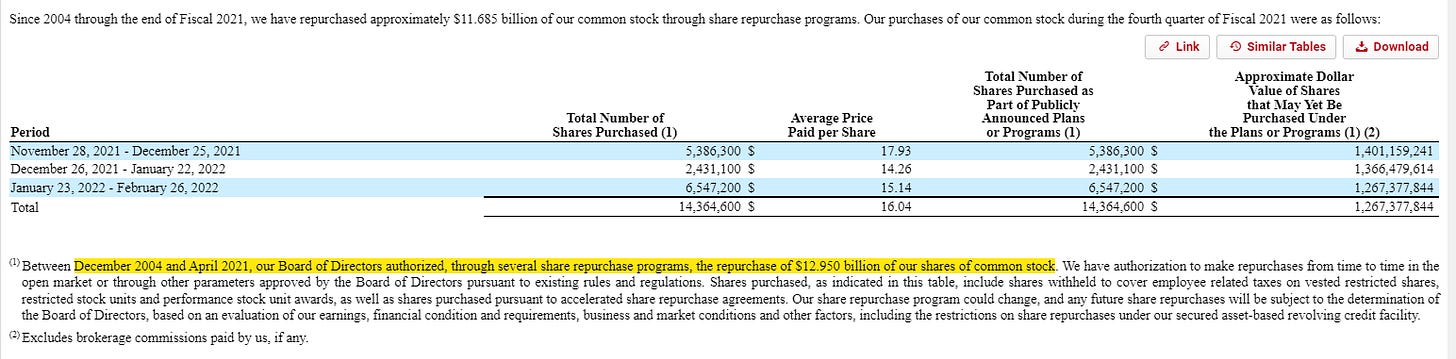

Or consider BBBY. Another fantastic example (and one I’ve highlighted several times). For the past few years, the company’s capital allocation could best be described as taking every spare dollar and plowing it into share repurchases at almost any price. Multiple times the company would be about to report an awful quarter well below their projections or analyst estimates, and the company would lean into their share repurchase during the quarter (i.e. they’d know results were going to be awful, but they’d accelerate their share repurchase as the quarter went on despite knowing how bad the results were and that the stock would likely puke when they reported). What’s more, insiders appeared to believe their hype: insiders across the board were buying reasonably consistently when their windows were open.

In fact, it wasn’t just the recent past where BBBY’s entire capital allocation program has been about share repurchases. Since 2004, the company has retired an astonishing $12.95B of stock at an average cost of ~$45/share.

You can probably guess where this is going: BBBY reported a disaster of a Q4, and the company’s stock has tanked down to ~$8/share. Its market cap is now ~$700m; to put that in perspective, BBBY spent over $900m on share repurchases in the past two years (FY20+21). And, despite shares puking to near all-time lows (outside of a few days at the depths of the COVID meltdown, the stock is trading for levels it hasn’t seen since ~1997!), the company was clear on their earnings call that share repurchases are currently on pause given the disastrous current results.

KIRK, BIG, and BBBY are far from the only culprits here. To chose one of many other examples, ANF spent $100m on shares at ~$30/share in Q1; their market cap is currently ~$1B and the stock is at $20 (though, to be fair, I believe they plan to continue share repos). What makes these three companies so unique is just how aggressive their share repurchases were when they had excess cash and how dramatically they’ve shut down as things have slowed down. In part, that’s because the companies are now in some form of financial distress (we can argue if it’s light, moderate, or severe distress, but there’s no doubt that all of these companies would be in serious trouble if current trends held for the next few years!)…. but you can argue a lot of the financial distress was self-inflicted thanks to the buybacks.

Many investors (including myself!) love share buybacks. We’re always clamoring for our portfolio companies to do them. That’s mainly because we think the stock is undervalued and share buybacks are a simple way for a company to create value (assuming, of course, we’re correct and the stock is undervalued!), but I also think there’s a small part of every investor that loves share buybacks because it reinforces your view that the company is cheap (“I knew the company was cheap! Management sees it too, or else they wouldn’t buyback shares!”).

Share buybacks can be a double edged sword. Aggressive share buybacks can signal a stock is undervalued…. but done at the wrong time / in the wrong company, aggressive share buybacks can be a quick path to financial distress and massive losses.

One of the insights John Malone had that made him so unique / wealthy was combining aggressive share buybacks and financial engineering with companies whose business was subscription like / reasonably steady and predictable. Things like cable companies, media companies in the cable bundle, and SiriusXM were all super stick and predictable thanks to subscription revenues. They spit off cash flow, and Malone used that cash flow to leverage them up and hammer their share counts. More recently, private equity and infrastructure funds have applied similar models to things like subscription software and predictable infrastructure assets of all forms (baseload power, toll roads, airports, etc).

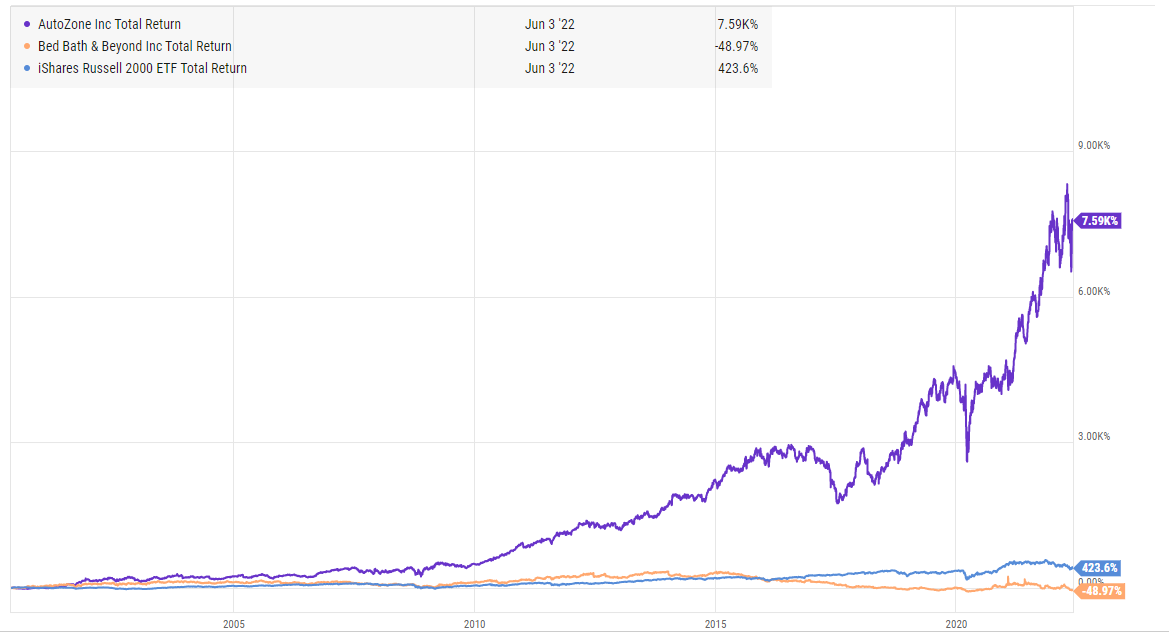

Many investors (including myself) see a retailer trading at a cheap multiple and buying back shares aggressively and see the potential for the next Autozone or RH (both of which combined large share buybacks with consistent growth to drive enormous stock returns). But the model needs to be applied carefully; while Autozone smashed the indices, BBBY pursued a similar model and their stock has now produced negative returns over since the turn off the century!

PS- speaking of cable companies and buybacks gone wrong, I’d be remiss if I didn’t mention ATUS in this post just for their sheer arrogance in their buyback program. The quote below is them talking about share buybacks in December 2020.

I assure you this is not the only quote ATUS gave about how awesome share buybacks at the then price was; long time ATUS followers will remember how often they’d discuss the financial arbitrage between their stock (which had a >10% free cash flow yield) and their cost of debt (which was <5%).

Since all of those quotes and their massive tender offer to buy back billions of stockre in December 2020, ATUS has dropped from ~$35 to ~$11 today. The EBITDA multiple they were bragging about has declined significantly, and their free cash flow yield has exploded… but the company no longer wants to buyback shares. Instead, they want to play all of their cash flow into upgrading to fiber and deleveraging. What changed?

The company would argue that they needed to focus on their fiber upgrade, but that’s absolute baloney. The company has known about / had the opportunity to upgrade fiber for years, and they were still aggressively repurchasing shares despite that opportunity. What’s actually changed is their piss poor management finally caught up to them; their operations were shitty for years, and churn finally started to tick up as customers fled for a fiber competitor. Now the company can’t repurchase shares because they need to finally invest into their infrastructure.

Lol, seriously?? You were a permabull on ATUS all throughout 2021

This is from your own article where you claimed ATUS is worth $50 a share!!!!

I stand by everything I said in the first post (as well as the August update and this podcast). To sum up: yes, there are issues, but Altice is simply way too cheap. At current prices (~$22.50), Altice has an EV of ~$35B. They pass ~9.2m homes and LTM EBITDA is ~$4.5B, so you’re paying ~$3.8k/home passed or ~8x LTM EBITDA. Charter, the closest pure play, is trading for ~$4.5k/HP or ~12.5x EBITDA. That’s just too big of a multiple discrepancy, and given Altice is >5x levered any snap back in the multiple will have huge torque on the share price. I’m personally of the view that cable companies are worth >5k/HP or somewhere in the 13-15x EBITDA range; the low end of that range would put Altice’s stock well over $50/share.

What is your current position/opinion on ATUS?