Weekend thoughts: space phone wars, mobile operators words don't match their actions, and $ASTS

Q1 is (almost) in the books. It’s been a strange quarter; the year started off with blind euphoria and growth stocks seemed to have an endless bid, but between the deepseek selloff and on-again/off-again tariffs, markets entered a mini-turmoil sometime in the beginning of March (one of the reasons this month’s book club will be Diary of a Very Bad Year!) and somehow European defense stocks went parabolic?

Anyway, the two industries I’ve spent most of my time thinking about this quarter have been cable/telecom (I always spend a lot of time thinking about cable / telecom, but maybe more so this quarter because of my call with Tom Wheeler) and busted biopharm trading below cash. I’ve had some random thoughts floating around my head on both that I wanted to put down; in today’s post I’ll hit on my telecom thoughts and I’ll hit busted biopharm in a follow up post. So let’s hop into telecom:

Telecom: space phone wars?

There are a lot of interesting things happening in telecom / cable right now. Convergence, potential broadcasting consolidation, spectrum auctions, etc. I hit on a lot of them in the call with Tom Wheeler if you want to check it out:

But one thing that we didn’t hit on too hard that is increasingly popping up on my radar: is there an opportunity in space (satellite) phones?

Satellite phones is obviously a crazy broad term; I’m not talking about companies that are making phones that have satellite service (an image of the big brick phone that was around in the 90s pops into my head; something like the phone on the far left below):

Instead, I’m talking about companies that provide satellite coverage to mobile operators. This is generally back up coverage that kicks in when you’re in extremely rural locations (and thus there’s no cell phone service; think about climbing the top of a mountain or being in the middle of the woods or something) or in the case of an emergency (i.e. a hurricane shuts down the grid).

There are a few companies providing this type of service. Domestically, AT&T and Verizon are partnered with AST SpaceMobile (ASTS), while T-Mobile is partnered with SpaceX / Starlink. I believe Dish / Echostar (SATS) will launch something in this space eventually too, but I’m not following closely enough to opine one way or the other.

Humorously, you could read that paragraph as saying there are ~3 big providers of satellite phone coverage (ASTS, SATS, and SpaceX), and all three are hugely controversial. SATS and ASTS are both battleground stocks, and SpaceX is private…. but given it’s connection to Elon Musk I’m going to go ahead and guarantee it would be a battle ground stock if it was public!

Of the three, ASTS is really the only pure play on satellite coverage / phone connection (SATS is much more about spectrum value and financial engineering at this point). I mentioned ASTS briefly in part 1 of my telecom outlook; it’s an absolutely heated battleground stock with very dedicated shorts and longs (and I know several very sharp investors on both sides of that debate). I have no position / horse in this race (though my first set of notes on the company date back to late 2023 / early 2024 when the stock was <$5/share versus ~$25/share now, so I wish I did!)…. but I will admit to always being more skeptical of the bull case. Why? A variety of reasons; many of which aren’t relevant to this article, but two main ones that are very relevant to this article are:

The base rate for any type of satellite communication is just awful for investors (and I have the scars to prove it!)

Terrestrial mobile networks are really, really eff’ing good. Adding satellite to them is only useful for really rural areas and as a backup in disasters. It’s hard for me to see how a service that fills those two use cases makes a lot of money, particularly once you start thinking about who controls the customer / who should get the majority of the money even if the service is valuable (remember, a really rural area doesn’t get great coverage because it’s not economic to build out to it; if the satellite phones started making any real money, the terrestrial networks could just build out to those rural areas!).

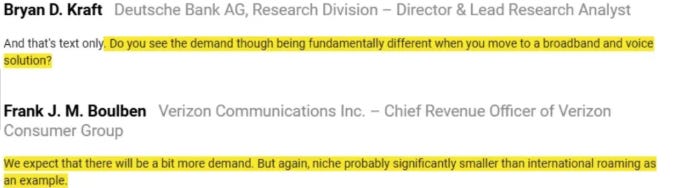

And my views seemed to be shared by the major mobile players. Verizon had a really, really detailed conversation about satellite phones at the DB conference earlier this month; putting a full clip here would just be too long so I’ll include it at the end of the post (along with some other conference clips), but I think the money shot here would be Verizon concluding the discussion by calling satellite coverage a “niche” that will be “significantly smaller” than international roaming.

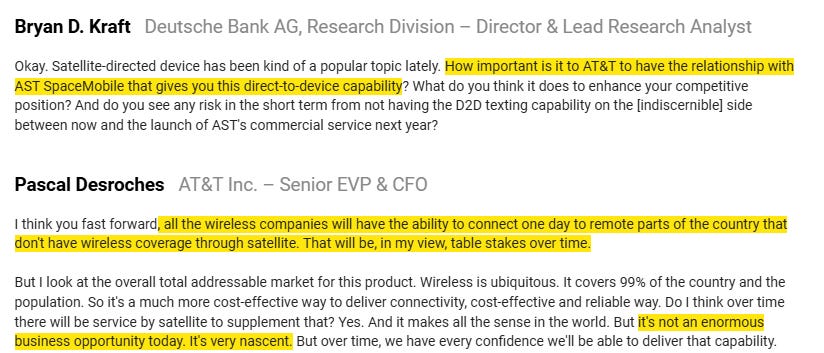

That view tends to jive with what AT&T has been saying; ate the same conference, they described satellite as “not an enormous business opportunity.”

But here’s where things get kind of interesting: the mobile operators words don’t seem to be fully matching their actions. Each of them are downplaying the potential of satellite… but both of them have written big checks into ASTS: ~$100m for Verizon, and approaching $50m for AT&T. Now, $50-100m isn’t quite as big at Verizon and T as it is for a normal company (for example, T highlighted they’ve “invested over $140 billion into telecom infrastructure, including nearly $40 billion in mid-band spectrum” over the past five years at a recent conference)…. but those are still sizable checks that aren’t going out without major buy in across the organization!

And, on top of their checks, the operators are showing signs that consumers consider satellite important. Consider the strange batch of news stories / press releases that crossed last Thursday:

The domestic wireless industry is an absolutely enormous market…. but it is a relatively concentrated one. You basically have three and a half nationwide competitors: the big three nationwide (Verizon, T-Mobile, and AT&T) and then a regional cable player competing in most markets (i.e. Charter competes in their markets, Comcast competes in theirs, etc…. so they’re not national but between Charter and Comcast they cover more than half the nation!).

If you believe my math that there are 3.5 competitors in the market, on the same day you had 2.5 of them (Verizon and T-Mobile plus both of the largest cable players!) touting / fighting over their satellite capabilities and marketing claims.

If satellite coverage is such a small / unimportant industry (as VZ and T are implying above), why are they writing such large checks into it? Why are Charter and Comcast feeling the need to launch a service for it? And why is VZ fighting TMUS so hard on their satellite claims?

Is it possible they’re seeing real signs that consumers value the satellite connection?

I think the answer is of course they have to be seeing some signs consumers value satellite coverage to promote / fight over it this much. In fact, you could paint a pretty interesting story here: wireless operators know their networks cold and know that basically no one needs satellite backup coverage because the networks are so robust / have so much redundancy…. but they underestimated how much consumers value the satellite backup anyway just for peace of mind if something crazy happens.

There are plenty of precedents for this type of consumer behavior. Consumers pay up for all types of suboptimal insurance (warranty extensions and a host of other ones) just because they want the peace of mind. Heck, in telecom, you’ll see a ton of households pay for the absolute highest speeds (2 gigs or more) even though I doubt there’s more than a handful of families who need that much speed (you’d need to be streaming a heck of a lot of videos at them same time / playing a ton of computer games to even come close to needing that much speed!). So you could imagine that the most informed people (the telecom execs) saw a product that would almost never be used and thus is worthless… but consumers saw something that they could buy as almost telecom insurance and place value on it.

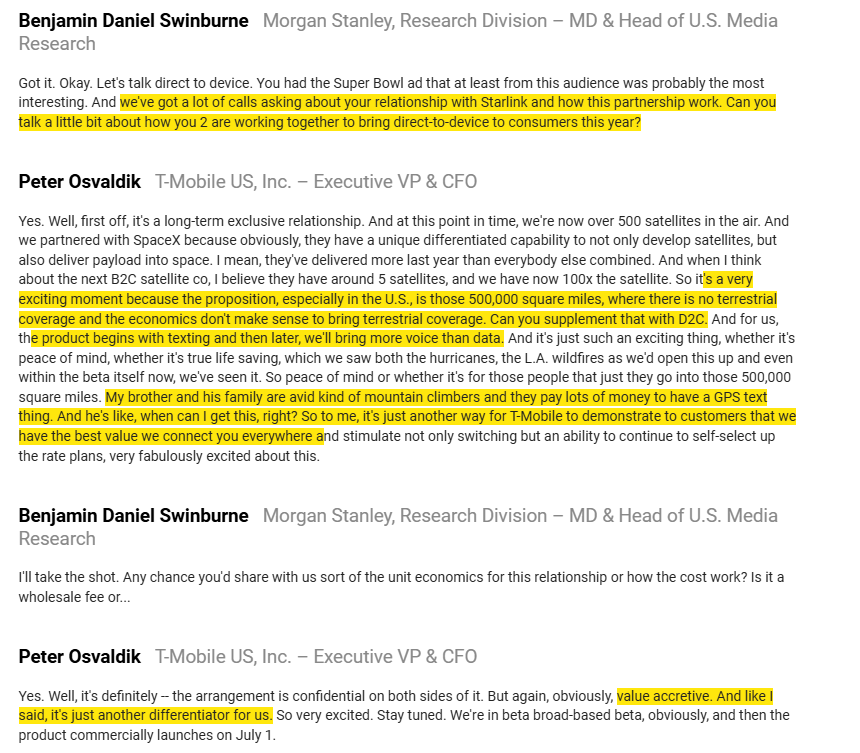

With all that in mind, the quote below from T-Mobile (who is partnering with SpaceX) is really interesting because it splits the line so finely between “this is just really good for marketing” (i.e. you get it just for the piece of mind) and “this is actually a value add” (i.e. it covers those 500k square meters of deadzone for rock climbers and during disasters):

Anyway, as with many things in investing (and life!), I don’t have any firm answers here. And I will admit to remaining a bit skeptical on ASTS2 for a variety of reasons…. here’s a small one: why is T-Mobile, the only mobile operator not using ASTS, also the only operator who seems to be talking up the value of satellite coverage? But, of course, a bull could push back that T and VZ are publicly talking about the business being niche but their actions are looking a lot more like they believe in TMUS’s this is value accretive / a differentiator thesis. And ASTS would probably push back that they haven’t even rolled out their full capabilities yet, so it’s too early to make a comparison / if TMUS is chirping about the results from SpaceX, imagine what will happen on the full ASTS package:

Again, no position…. but I find this an absolutely fascinating case of a battleground stock / thesis where there’s not just bull and bears debating every point, but the customers themselves appear to be laying out conflicting view points / expressing the bull and bear thesis!

Appendix:

I included a few quotes from the telecom operators on satellite coverage above; I found several others (from Verizon specifically) in recent conferences, but didn’t want to include them in the article because it would make the article just way too long. Here they are in case you’re interested:

Disclosure: I am long Charter

This article is by no means intended to be a full write up of ASTS. Again, I’m skeptical but have no position either way, so I don’t need to have strong views or do a full write up! I really only wanted to highlight the divergence between T / VZ’s actions and words here and how interesting I think that is!

Full disclosure, I own $ASTS (smallish position). Completely agree that the retail "mob" on Twitter is as rabid as any group I've witnessed. Short position is huge and agree they're not idiots. Data point of 1, but I disagree with your contention that terrestrial cell phone towers do a good job of blanketing most of the relevant points that people need coverage. I live in the suburbs of San Diego county; I can't walk my dogs without losing coverage. Tried both Verizon and ATT. Regularly hike and camp, always losing service. Outside of NYC, dead spots are everywhere. Now imagine my self-driving car needs connectivity, am I supposed to rely on cell towers? In the future people are going to demand a network with belt-and-suspenders service -- and I want one now because when I'm working from Yosemite the last thing my clients want to hear is that I'm on vacation and can't answer their call. Quick second thought, it's not just Verizon and ATT that have thrown themselves behind ASTS, but also Google, Vodafone, Rakuten and many others -- which suggests to me that the experts in the industry don't want to pair themselves with Elon Musk. Which is doubly true for any military applications.

How does the cost for building out this infrastructure compare to building new towers in developing countries not currently covered?