I have a confession: for most of this month, I’ve been really annoyed by the less efficient market paper Cliff Asness published.

Why?

Well, to start, I hadn’t read it… but all this month I’ve been having or hearing conversations about how markets have gotten more inefficient over time, and those conversations generally seemed to imply one of two things:

The market is more inefficient today than it’s ever been, so it’s easier to generate alpha than it’s ever been.

Basically, when I hear people arguing for this, it sounds like they’re saying there’s easy alpha lying around everywhere, and it’s easy to put up insane annualized returns with almost no risk. While that scenario would certainly make my job easier, I’m not sure I know a single person who puts up good or even middling returns and suggests it’s “easy.” If you do think it’s easy…. well, one of my favorite Munger quotes would probably apply1

The market is more inefficient today than it’s ever been because AI stocks trade for nosebleed valuations while a bunch of energy stocks trade for really low multiples2

I think both of those arguments are some combination of laughable and lazy, and given the pickup in those conversations recently I just assumed those arguments were the core argument of Asness less efficient market paper.

After a particularly frustrating talk earlier this week, I did something crazy: I actually read the paper that was driving me so nutty…..

And I have to tell you that I really enjoyed it.

Contrary to my assumptions (and the takeaways that I think a lot of people are making when they read it3), the less efficient market is not about the market being easier to beat / generate alpha today versus yesterday. It argues… well, it argues a lot of things, but I’d say the core argument is that, for a variety of reasons but particularly because active management has gotten so hollowed out, markets today are not quite as good at pricing things efficiently over the medium term, and investors who are able to stick the active course and invest alongside a set of principles with a medium to long term view will be rewarded more than in the past. Note at no point does the paper say that it will be easier to generate alpha, but it does say that the reward for working hard and generating alpha will be greater.

But don’t take my word for it; go read the full paper and come to your own conclusion.

Now that you’ve read the paper, I wanted to put down three thoughts that were running through my mind when I read it. Those thoughts are:

Active alpha is a “shipping” market now

The semi-liquidity discount and the liquidity smile curve

Capex in the ground: where I think there’s a lot of market inefficiency currently.

Let’s start with the first: active alpha is a “shipping” market now.

The following rule applies to a lot of cyclical / commodity industries, but in shipping there’s a rough rule of thumb: 8 or 9 out of ten years, your fleet will operate at roughly breakeven…. but in that tenth year, there will be some sort of supernormal profit cycle that will pay for the whole ten years and then some. The whole trick to the shipping industry is making sure that you’re around / maximally exposed when that supernormal year happens (I believe it was The Shipping Man that first introduced me to that rule of thumb, but obviously the rule has been around a lot longer than that!). That sounds easy in theory, but in practice it’s awfully difficult. No one can predict when the super normal cycle happens as it’s often caused by things completely outside of ship owners control (wars, natural disaster, etc.) and thus comes on unexpectedly and suddenly. It’s very easy to lose your exposure to that super normal cycle right before it hits: if you’re financing your boats with leverage and a “trough” cycle runs long enough, you could need to sell ships in order to cover interest or loan payments. Or you might be tempted to lock your boats up on long term contracts at a slight premium to spot markets that lock attractive when markets are just bumping along but that will preclude you from taking advantage of the super-normal spikes.

You’re probably wondering what the heck super normal profits in shipping have to do with a paper on inefficient markets. Well, there was one line that really stuck out to me in the paper. It was actually buried in a footnote (footnote 64); the line was:

if you’re on the right side of this divide it will be harder to stick with in this “less efficient” world, as periods of bad performance become more extreme and last longer (though, again, ultimately more lucrative if you can).

That model reminds me very much of the shipping supernormal profits cycle model I laid out above. It basically suggests that, if you can stick with active management, the return stream going forward will probably consist of long stretches of underperformance followed by brief, glorious periods of huge outperformance, and that as more money leaves active management those brief periods will become more and more lucrative.

Intellectually, I think that’s kind of interesting: if active management has become somewhat commoditized, than having long fallow periods before making a ton of profits in a super normal period would actually make sense. Think of it this way: in shipping or any other commodity industry, what generally happens is you have boom/bust periods. During a bust, no one builds any new supply…. in fact, supply comes offline as older / more inefficient assets are retired. Eventually, you get to a supply / demand equilibrium and the market chugs along at roughly cost of capital style returns…. until you have some extraneous shock (either a demand shock, like geopolitical instability requiring boats to sail all the way around Africa and thus adding two weeks to each ships voyage and creating a sudden shortage, or a supply shock like a hurricane wiping out a fleet of ships). That shock causes super normal profits, which incentivizes new supply to come on and thus seeds the start of the next bust when the supply comes online and the market becomes oversupplied again…

If you apply that model to the market / active management, you have a market where for years active management will generate no or slightly negative alpha…. that period of time leads to “underinvestment” in active management, until eventually you hit a super normal cycle where active managers make wild returns, thus incentivizing people back into the active management field and starting the whole process over again.

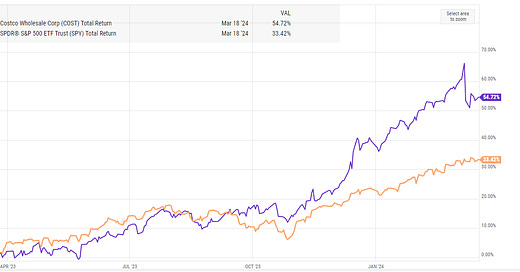

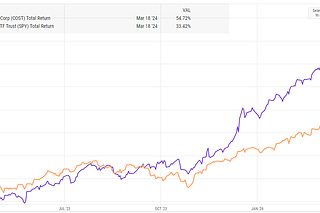

In fact, I think you can see some evidence of that model just in the way the past ~25 years have played out. Active management (and particularly value investing4) was incredibly fertile on the heels of the dotcom bubble (call in 2000 - 2003); in fact, it was so fertile that many active investors have underperformed the indices for the ~20 years since but still have a track record of outperformance simply because they smashed the indices so hard in those years. You could also point to the market immediately post-COVID as well as the market immediately post-GFC as times when a lot of fundamental investors smashed the indices.

Again, I’m not an academic…. but I think you could look at those historical results and value / active investors smashing during those times and then kind of plodding along in the periods between and see a lot of rhymes to a “shipping” boom/bust cycle there.

Let’s say I’m right about that thesis and active management is now following a boom bust cycle; is there any way to think about that / improve on your process as an active investor?

I think the answer is yes. There are a few things that jump off the page to me.

First, this sounds trite: but longevity is the name of the game. The worst thing that can happen in shipping is to have to give up your ships / exposure during a fallow period and miss out on a boom. Something similar will apply to active management: the worst thing you can do is cut your exposure during a fallow period, because you’ll have paid the cost (the underperformance during the fallow period) without the commensurate reward (you’ll miss out on the brief, glorious boom time).

Second, it suggests that active managers should probably be a little more tactical / opportunistic with exposures than most managers I know tend to be (or perhaps I’m projecting and critiquing myself). In commodity industries with booms and busts, the best managers sell assets at premium prices in good times (thus reducing exposure) and are willing to sit on their hands / wait for a distress cycle until they buy more assets. Similarly, active managers might consider significantly reducing exposure in some way, shape or form on the heels of a good run. Note that does not necessarily mean going fully to cash; I could see some argument where after a period of outperformance an active manager should just stick it all in an index type vehicle for a few years and wait for all of their competitors to start folding up before ramping up exposure to active again. I’ll also note that this is much easier said than done; again, perhaps I’m projecting, but to actively manage you have to be a bit arrogant, and I doubt there are many active managers who can say “I’ve had a good run, but man the active field is crowded right now…. let’s shift to passive for the next few years and wait for the opportunities to get juicy again.” I’d also note that active management requires a lot of work and effort, and I think it’d be difficult to put those in / stay at the top of your game if you were going passive for a long period of time. Anyway, not saying to do this (or do anything!); just saying it’s an interesting thought / possibility if you really believed active will follow a boom/bust cycle.

Finally, it’s worth noting that the three best periods I can remember for active management all came on the heels of a strong run and then a crash (the dotcom bubble, the post-GFC market, the post-COVID market). With boom/bust commodities, it’s generally some type of extraneous shock (a weather event taking supply offline, geopolitics, etc.) that shifts the supply/demand curve and creates a boom cycle. It may be that active management and the market is following a similar cycle now, and that most alpha will be generated on the heels of some type of shock.

Ok, this article has run long…. I’ll do a follow up post on points #2 (The semi-liquidity discount and the liquidity smile curve) and #3 (Capex in the ground: where I think there’s a lot of market inefficiency currently) in the near future (editor’s note: part 2 is now live here). Until then, I’d love to hear your thoughts on the less efficient markets (or your thoughts on my thoughts on it!).

I specifically called out AI and energy stocks, but I’m not wedded to those specific sectors / I only chose them as buzzy examples. You can insert whatever high multiple stock (Mag 7! TSLA!) and low multiple stock (banks! cyclicals!) you want!

More likely the people I talked to were doing what I did: not reading the paper, but just reading the title and saying “look, smart academic says this!” and using it to support their preconceptions.

I believe there is a little room between the Asness piece and what I refer to here as he is (I beleive) generally referring to active management as a field and particularly quant driven active management, whereas I’m much more referring to value investing (concentrated stock picking, which I believe he refers to as Graham & Dodd investing). Still, the two tend to be correlated enough I’m fine just lumping them together.

One thing that worries me about this sort of alpha is that the "one in ten years" opportunities are also going to come with a lot of political backlash, in particular, charges of "price gouging" (or "war profiteering", if it's due to war). I think there's a real risk you wait for ten years only to see the rug pulled once opportunity finally does come.

And I'm not even sure that these charges are wrong. The "cure for high prices is high prices" only seems true if we can *quickly* produce more supply, which is often not the case in an emergency. I think you could make an argument that a more efficient market would have higher prices during the regular nine years so that these sorts of price spikes don't happen or aren't as large.

It’s my understanding that insurance for shipping vessels has increased markedly and this has also led to higher insurance costs for everyone, including other business coverages and personal home, auto, etc. policies.

Also, I am wary of listening to anyone. A lot of managers or pundits are just trying to make excuses for nosebleed valuations. I’d rather miss out than some unknown event that could spark more than just a correction. And there is nothing to suggest that buying something cheap can’t get cheaper.

Also a lot of the names I see here on Substack, mostly via micro-caps have been consistently cheap in bull and bear markets. However, I still keep an eye one them because you know they can always have one good puff left in them