There’s a lot of opportunity out there right now.

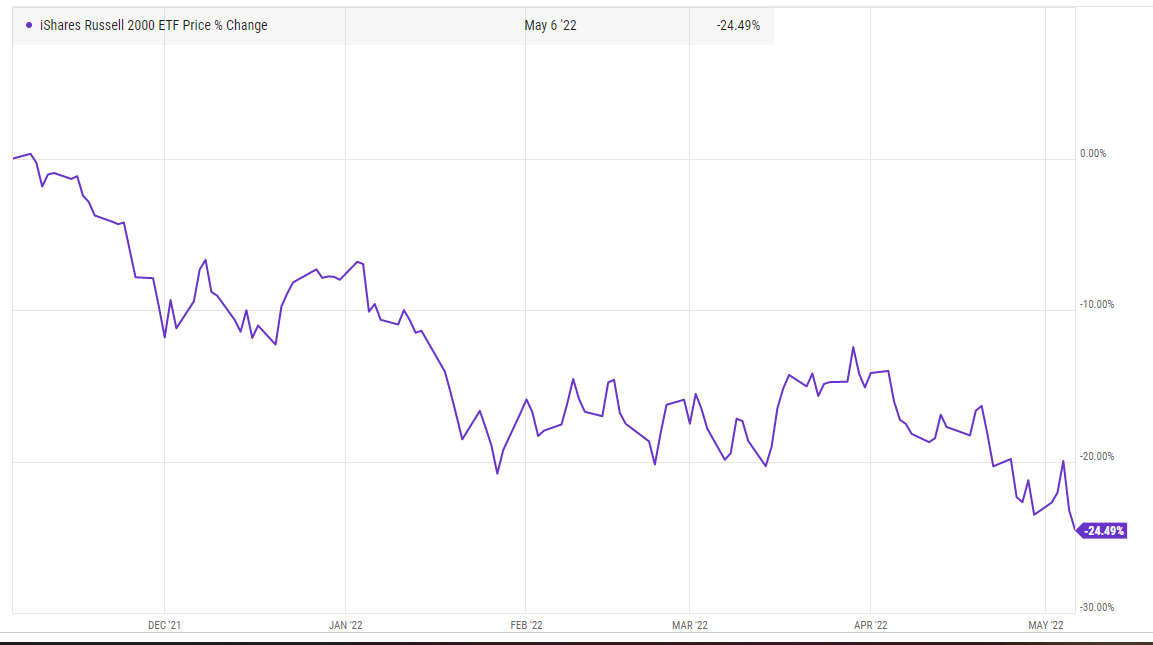

That’s shouldn’t come as a crazy surprise. Markets are down ~25% over the past six months (and, honestly, it feels a lot more brutal than that!), and it feels like everyone is bear-ish and prepping for a crash (count me out of that camp! I’m very bullish). With a drawdown that heavy generally comes a decent bit of opportunity.

So yes, there’s a lot of opportunity out there right now. Cable companies have been absolutely demolished for reasons I think are overblown, retail in general seems like it’s pricing in a depression (with several that are demolishing their share count while trading at extreme value multiples), and wide swaths of energy companies trade for a big discount to what they should earn given the current energy pricing.

But the opportunity set seems particularly rich in event land right now. Small and micro-cap companies in general have been destroyed, so maybe it’s no surprise small / micro-cap companies with an event angle trade pretty cheaply (though “pretty cheaply” is understating it for a lot of these companies IMO!). But even in the large or mega-cap space, I think there are really interesting situations that trade at really interesting risk / rewards. Consider these three:

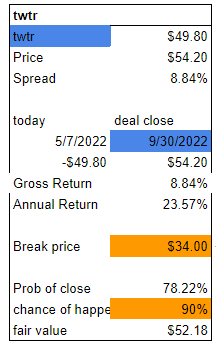

TWTR- In case you’ve been living under a rock, Elon Musk is buying TWTR for $54.20/share. As I write this, the stock is trading under $50/share. That’s an almost 9% gross spread and way higher annualized. Why’s it trade so wide? Well, bears would say “Musk might wake up on the wrong side of the bed and decide to walk away from the deal, and the U.S. regulatory regime isn’t exactly going to smile on the richest man in the world buying the most important social media platform in the world (from the perspective of moving markets / the political discourse).” Bears would also suggest that the Elon / TWTR merger contract is pretty loose; I’ve heard them toss around “it’s a PE style contract, and he can walk away from the deal with just a $1B break fee.” Ok, that’s all fine…. but if you assume the downside to TWTR is in the low to mid $30 (around where it was before the deal announced), then the stock is currently pricing in less than an 80% chance of the deal going through. That seems pretty low to me; I’m not aware of any other “PE style contract” that trade close to that wide. And nothing about how Elon is approaching the TWTR deal makes it seem like he struck the TWTR deal on a whim or is just going to walk away for no reason; from selling billions of TSLA stock to raising $7B from some of his friends, Musk is taking non-revocable actions that suggest he has every intention of going through with the deal (remember, he’ll owe hundreds of millions in taxes on those TSLA sales, so he’s already incurred a bill thanks to that!). And, yes, the regulatory environment today isn’t exactly conducive to rich people buying important companies…. but we still live under the rule of law, and regulators trying to block this deal simply because Elon is rich would be a very novel approach to regulation that would almost certainly be destroyed in court.

This isn’t to say the TWTR deal is risk free! Obviously regulators could try to block (I think they’d lose pretty easily in court, but they could do it anyway because they really believe the case and/or to earn political points), and part of Elon’s funding is coming from a TSLA margin loan so you still have the risk that TSLA stock just epically collapses and he uses that to walk away (though TWTR would still get the break fee and could likely sue for more). Even considering all of that, this spread still seems priced too low given how seriously everyone involved seems to be taking the deal

There is a sneaky TSLAQ conspiracy theory that Elon is buying TWTR as an excuse to sell a ton of TSLA stock before it rolls over. Maybe! But he’s already sold a lot of TSLA stock, and between the stock he’s already sold, the TWTR stock he already owns, and investors appetite to fund any deal Elon does…. it feels like the odds financing is an issue for Elon are more in the 5% range, not the 15%+ that it seems the market is giving it!

TWTR current deal spread and implied close probability below.

KSS- I’m not sure I’ve ever seen a company with this many public bidders before. Starboard backed ACTG put out an SEC filing that they bid $64/share for KSS, FRG all but confirmed their KSS bid an earnings call, and we know of several other bidders (Simon / Brookfield’s JV, Sycamore and Hudson have both lobbed in bids, and Leonard Green is sniffing around as well). Maybe nothing comes of all these bids… but Kohl’s is currently in the middle of a bruising activist fight. Their stock is currently in the mid-$50s, and most of the bids we’ve seen are in the high $60s. If Kohl’s flat turns these offers down, I’d guess the stock is heading below $40. Maybe Kohl’s board can win the activist battle this year and turn down all of the bids after that…. but if they do and the share price gets destroyed (which it would), I think the board would be highly, highly likely to get replaced next year. I also think the board knows that, and in the end they’ll have to sell to the highest bidder.

BTW- the FRG bid is really interesting for what it says about KSS. FRG bought W.S. Badcock for $580m last November, and they basically funded the whole thing with debt. Per their most recent earnings call, they have since sold off non-core Badcock assets of over $660m. So they’ve taken out more than they put in, they did it all with leverage, and they still own the remaining business. FRG was also asked about Kohl’s on their earnings call and responded “I think management for us is always the key. I think you heard me talk about management a little bit ago of the businesses we have. We have really investable management teams at Franchise Group.” Put it all together, and I think FRG likes the Kohl’s management teams, and I’d guess they see a path to getting a huge chunk of anything they put into KSS back by quickly selling off non-core assets (I’d guess other bidders do too!). That combo is powerful; all the bidders probably see the non-core stuff, but that FRG seems to like the KSS management team could give KSS an out where they can sell to a bidder and keep their jobs. (Note that FRG also suggested on their earnings call they won’t raise equity at current share prices; given FRG buying KSS is a fish swallowing a whale (hidden great finance book BTW), that makes it seem like KSS has a bunch of easily financeable assets…)

Keeping that FRG bid in mind…. it seems like KSS is kind of cheap even on its own (i.e. without the potential deal)? Yes, the stock goes down if they reject all these bids, but this is a company with a bunch of real estate assets that earned >$7/share last year and has a consistent capital return program (read: they buyback shares). Yes, maybe 2021 was uniquely good for retail so KSS over-earned, but run their earnings back to pre-COVID and it doesn’t seem crazy. And, again, all these financial buyers are telling you there’s value above today’s share price.

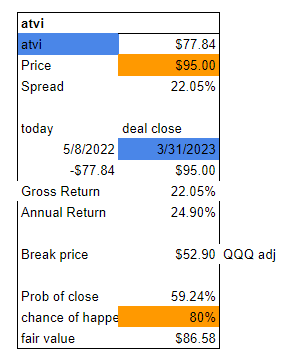

ATVI- This has been a popular topic of conversation for the past week since Buffett revealed he bought almost 10% of the company for the arbitrage. ATVI is getting acquired by MSFT for $95/share; investors are worried regulators will block the deal so it trades for a massive spread. ATVI was trading in the mid-$60s before the MSFT deal news broke, but the QQQ has been a disaster since the deal announcement so I’d guess downside in a break is in the low $50s (they’d also get ~$2.50/share in cash from MSFT if the deal fails to close, which is pretty significant at those break prices!). At current prices, that means ATVI is trading at ~60% chances of closing. That seems too low to me; the video game market is enormous, and I think the DOJ would have a very tough time proving MSFT buying ATVI is going to stifle competition or creativity in the industry. I’d guess MSFT would be a 2:1 favorite to win in court if we got there, so at current prices investors are baking in 100% chance the DOJ sues to block and pricing ATVI with worse odds of winning then I think they actually have. It feels a little reminiscent of the T / TWX deal to me; investors all along were worried the DOJ would sue to block but thought the DOJ would lose in court if they did, and that all ended up proving correct (the DOJ sued and then got wiped in court).

ATVI current deal spread assuming a $53 break price below

Bottom line: I think the event land is just over flowing with opportunities today. I listed three here, and yes, I think all of those are really attractive. But this is not the limit of the event set! If there are any names you think are particularly interesting, my DMs are always open.

PS- Rangeley’s founder Chris DeMuth is coming on the podcast Monday (May 9th) to talk about the current set up in event land. I think we’re going to turn his appearance into a monthly thing. If you’ve got any questions on these deals or any others, feel free to lob in some questions!

have you looked at hmtv as a risk arb?

I've seen so many offers hanging out there like low fruit, but with equities selling off so much and interest rates rising, that it begs the question: will it get to the point where the PE firms are credit crunched and won't be able to raise debt for these deals? TWTR being an outlier, I'm thinking about TROX, LAZY, BALY (TO), SRT, to name a few. In other words, at what point do the PE firms back off, let the stocks get hammered and buy in at even lower prices?