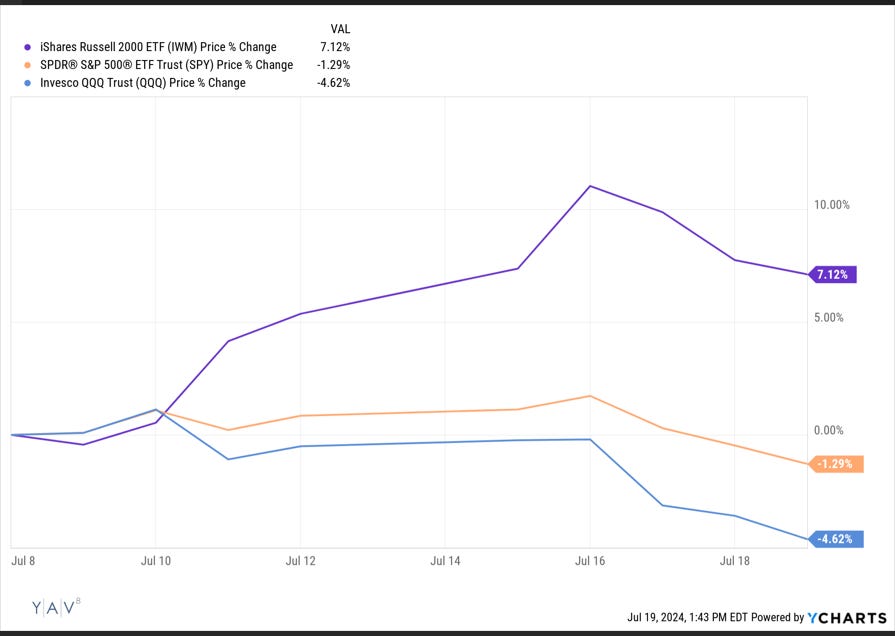

It has been a wild few weeks in financial markets. Over the past two weeks, small caps (which I’ll broadly define as the Russell 2000) have been absolutely ripping, while large caps and tech have actually trended down a bit.

This is a huge reversal of the trends from the past year, which have seen large caps and tech just absolutely dominate small cap.

And that’s not just a one year trend: large caps and tech have been beating the pants off small caps for the past ~decade.

So I’ve seen a lot of people on twitter screaming “I told you the reversal into small caps was coming.” Never mind that all of them (including myself!) have been saying that small caps looked cheap versus large for the past several years, so spiking the football on this small reversal sort of feels like the definition of this meme:

Anyway, this post isn’t about small caps or reversals or anything. In fact, it’s barely about the markets.

One of the things I find most stressful in this job is when your stocks are racing up. Don’t get me wrong; it’s theoretically a nice problem to have…. but if you’re running a reasonably concentrated book, you probably really like the names in your portfolio (at least, I hope you do!), so whenever they start ripping up it’s easy to kick yourself along the lines of “Why didn’t I own more? I was so convicted on this; why wasn’t this a bigger position.”

That mentality can be tough when it’s just one or two of your stocks working / going up, but when it’s all of your stocks? Man, it just feels tough to watch everything rip and to feel underinvested (My wife has told me a few times that the only time I’m more miserable than when all my stocks are going straight down is when all my stocks are going straight up).

And the pain can almost feel double as bad when everything is ripping because there will be things you liked and passed on, or liked and sold to buy something you liked more, and the passes / sales will inevitably rip even harder when the stock market races.

Investing is a long term game…. I try not to pay attention to the day to day moves of the portfolio or any individual stock, but that can be difficult when you do it for a living. The weird thing about investing for a living is that you can spend hundreds and hundreds of hours on research and work your absolute tail off…. but if your portfolio goes down, then you not only didn’t earn anything that year, but your return on time investment was actively negative. I’m not sure there’s any other profession that has that same possibility of generating negative earnings for sustained, deep work.

As much as I try, it’s hard to be completely zen about market moves when your income can be so dependent on them.

What’s the solution? I’ll be honest; I don’t have a great answer. Personally, if I find myself really overloading on stress (checking my portfolio too much, having real trouble unplugging from work), my answer is generally to take a weekend completely off (even that can be difficult; if I’m really trying to unplug from work, I find it takes ~48 hours to start to feel the difference…. and 48 hours on a weekend generally means ~Sunday night, so by the time I’m starting to come down a little bit it’s time to go back to work!).

Anyway, no big takeaways from me here…. but the stress of market rips has been on my mind (for obvious reasons) this week, and I’m pretty sure I’m not the only one who feels this way…. plus writing always helps me think through things, so I figured I’d put some thoughts down on paper.

PS- my wife and I took the kiddo to the zoo this morning, and that certainly helped with some of the stress, so don’t worry about me!

As someone who’s been in microcaps for almost a decade I can only say… I feel you 😅

In the word of a much wiser gentle than myself, predicting the stock market is futile (P Lynch)

Thanks for sharing your thoughts 😊

I recommend this podcast about unwinding and getting your brain reprogrammed by going offline for 72 hours: https://www.amazon.com/The-3-Day-Effect/dp/B08DDGKDDS