Weekend thoughts: this time IS different for busted biopharm, part 1 (history, hypotheticals, and examples)

Q1 is in the books. It was a strange quarter; the year started off with blind euphoria and growth stocks seemed to have an endless bid, but between the deepseek selloff and on-again/off-again tariffs, markets entered a mini-turmoil sometime in the beginning of March (one of the reasons this month’s book club will be Diary of a Very Bad Year!) and somehow European defense stocks went parabolic?

Anyway, the two industries I’ve spent most of my time thinking about this quarter have been cable/telecom (I always spend a lot of time thinking about cable / telecom, but maybe more so this quarter because of my call with Tom Wheeler) and busted biopharm trading below cash. I’ve had some random thoughts floating around my head on both that I wanted to put down; in last week’s post I hit on my telecom / satellite wars thoughts, and today I wanted to hit on my busted biopharm thoughts. In particular, I wanted to discuss one thing: Why this time is different for busted bios

Upfront note: I wrote all of this over the weekend…. on Friday, the FDA’s head of vaccines was forced out, creating panic among investors and sending the XBI down ~5%. The mood in XBI was already completely grim, and it got more so with that news / move, which I think actually reinforces everything I wrote in here / makes the bargains even more extreme, but just noting I wrote this without having full clarity on what it did to the sector!

Anyway, I’ve mentioned several times that I think there’s a borderline generational opportunity in busted biotechs right now. I am well aware of the history of busted biotech companies trading below net cash; there have always been small failed biotech that trade below net cash because insider ownership is pitiful and management and the board are incentivized to light all of the money on fire by taking increasingly desperate YOLOs and paying themselves huge salaries (I mention this in my original write up as well). It’s a simple incentive problem: if you’re the CEO or board member of a company with a huge pile of cash and you don’t own any stock in the company, that cash effectively represents both a call option and a short term dividend stream to you.

Let me use a hypothetical to easily illustrate this example. Pretend you are the CEO of a one drug biotech. The drug looks extremely promising in phase 2 trials, and the company goes out and raises $300m of cash on the promise of that drug. They spend $100m running a phase 3 trial…. but unfortunately the drug fails.

At this point, the company basically consists of $200m in cash; it has no other assets. Shareholders would clearly be better off if that cash was returned to them; the company has no other assets and no competitive advantage (or expertise!) in finding / acquiring / developing other molecules. Best to wrap it all up and go home.

However, let’s look at things from your standpoint as a CEO. Pretend that you don’t own any stock; all of your ownership was through stock options that were struck at the IPO price and are now way out of the money. From your standpoint, returning cash to shareholders is a disaster! You’ll be putting yourself out of a job for no benefit! As a CEO, you’re actually incentivized to do something with that cash. You effectively have a call option on that cash; if you somehow manage to turn that $200m into $2B of value, all of your stock options are deep in the money and you’re probably due for a huge bonus…. if you turn that $200m into nothing, then you’re no worse off than you are now (in fact, you’ll collect a salary for a few years, so you’re actually better off).

So your best plan as a non-stock owning CEO is to buy some sort of long dated lottery ticket that will pay multiples on the upside if it is successful. And remember: you have a call option on the stock, so you really only care about degree of upside, not NPV! Heads, you win; tails, shareholders lose. Your ideal use of that $200m would be buying and investing into some long shot early stage drug that will take ~5 years to develop and, if successful, would be worth $2B. Never mind that the odds of success might be 1%, so the expected value of that investment is $20m (1% * $2B = $20m, and once you factor in the time value of money and corporate drag / overhead it’s actually lower!), so shareholders are ~$180m worse off by the investment…. as CEO, you’ve just locked in five years of extra salary and a huge bonus at the end in the unlikely event your YOLO pays off.

Alright, hypothetical over. I feel a little dirty just pretending to be in that CEO’s shoes. But, again, these types of cash shell / YOLO issues have always existed in biotech world, and it’s particularly bad in very small cap companies. Why? If a large cap company has $2B in cash on their balance sheet and plans on lighting it all on fire on YOLOs, that’s a lot of money to burn, and there’s a lot of incentive for an activist. Let’s say the company with $2b trades for 50% of cash, so a $1b market cap. An activist could buy 5% of the company for $50m. They could then spend $10m hiring all of the best lawyers and proxy advisors, win a proxy fight, and liquidate the company. Let’s pretend the company is burning cash the whole time and the cash balance drops from $2B to $1.8B while the activist is pursuing their plans. They’ll have invested $60m ($50m to buy the shares plus $10m in legal costs) to get back ~$90m. That’s an uncorrelated 50% return (even better if the company reimburses their proxy battle costs, as typically happens if you win the fight), and because they just took down a multi-billion dollar company they’ll have built a huge name for themselves!

But that same math simply falls apart in small cap land. Pretend that everything is the same, except instead of having $2B in cash the company in question has $200m in cash and trades for a $100m market. Suddenly, an activist has nothing to go on. If they buy 5% of the company, it only comes out to a $5m stake. Hiring the top tier advisors in our first hypothetical cost $10m; that’s clearly out the window with a stake this size. And while it’s really hard for a failed pharma company to burn down a $2B cash pile; it’s really easy for a failed pharma company to burn a lot of a $200m cash pile; proxy costs and normal corporate overhead are really going to whittle that pile away while the activist tries to run a process! There’s also a bit of a freeloader issue here: if you have a company with $200m in cash trading for $100m, it would behoove all shareholders to write a $10m check to hire the best advisors to get the company to liquidate if that’s what it takes. Shareholders as a whole would be ~$90m better off. But that’s not how activism works; one activist has to bear the cost burden and all shareholders get to freelance on their efforts.

Put it all together, and the small size of pharma serves as a natural barrier to activism. If you’re running a small, failed pharma company and you’re hell bent on burning all of that cash in some way, shape, or form, you’re probably going to be able to do so. The costs of stopping you are simply too daunting.

There are literally legions of examples of companies like this. To name just a few:

Nektar (NKTR) is probably my personal favorite current example. They have $270m in net cash and a market cap <$150m…. and they just filed an 8-K prepping them for a $75m at-the-market (ATM) offering. Bulls can push back and say the company is just doing it for good housekeeping / to use if their stock goes up on good drug news, and that certainly may be true…. but it is very rare for a company to go through the trouble of establishing an ATM and not almost instantly start using it, and I’m not sure I’ve ever seen a company file to potentially dilute themselves by half when they’re trading at almost half of net cash; it’s almost comedic in how bonkers it is.

Sutro (STRO) is probably the most popular example right now, thanks in large part to this Stat+ article. The company has >$300m in cash on its balance sheet and a market cap of just ~$65m. Why? They just “deprioritized” their lead drug, and rather than return their cash to shareholders they are investing in some very early stage drugs (and burning a lot of cash along the way). Does what they’re doing with the cash burn and early stage drug investment resemble the lottery strategy for executives who don’t own a lot of stock I laid out above? I’m not close enough to the company or the science here to have an opinion, but at a high level it certainly seems like it, and the Stat+ article would probably suggest that’s exactly what’s happening here:

Even with the expense reductions that will slow its cash burn, Sutro will still need to raise money at the beginning of next year — without having much clinical data, if any, to justify the continued investing in its preclinical drug candidates.

Perhaps there’s value to be teased from Sutro’s very early pipeline, even though neither of the drugs are novel. Sutro should not be charged with finding out. It’s insane to allow this company to continue to exist, spending another $300 million or more after burning through $800 million with little to show for it.

Yet, Sutro executives and its board have all the power to do what they want. Shareholders have little or no say.

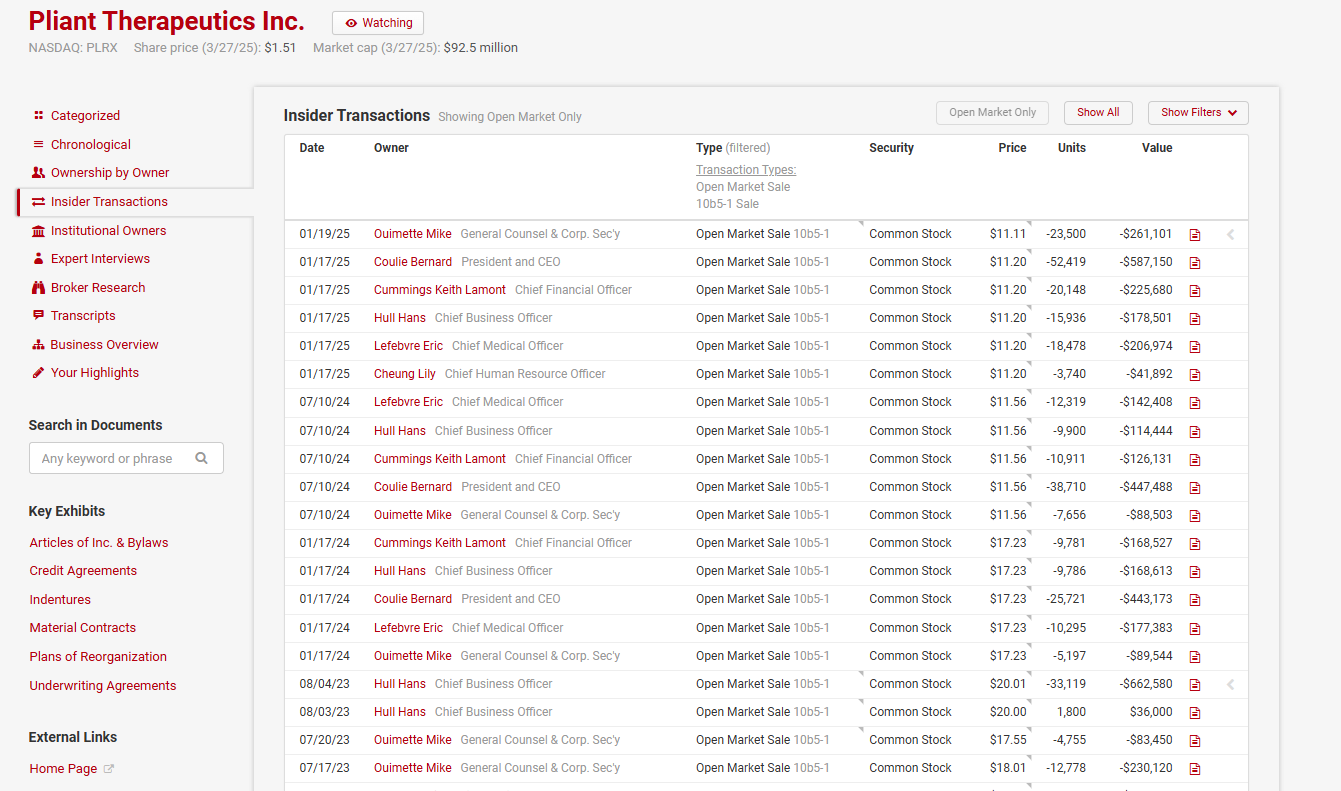

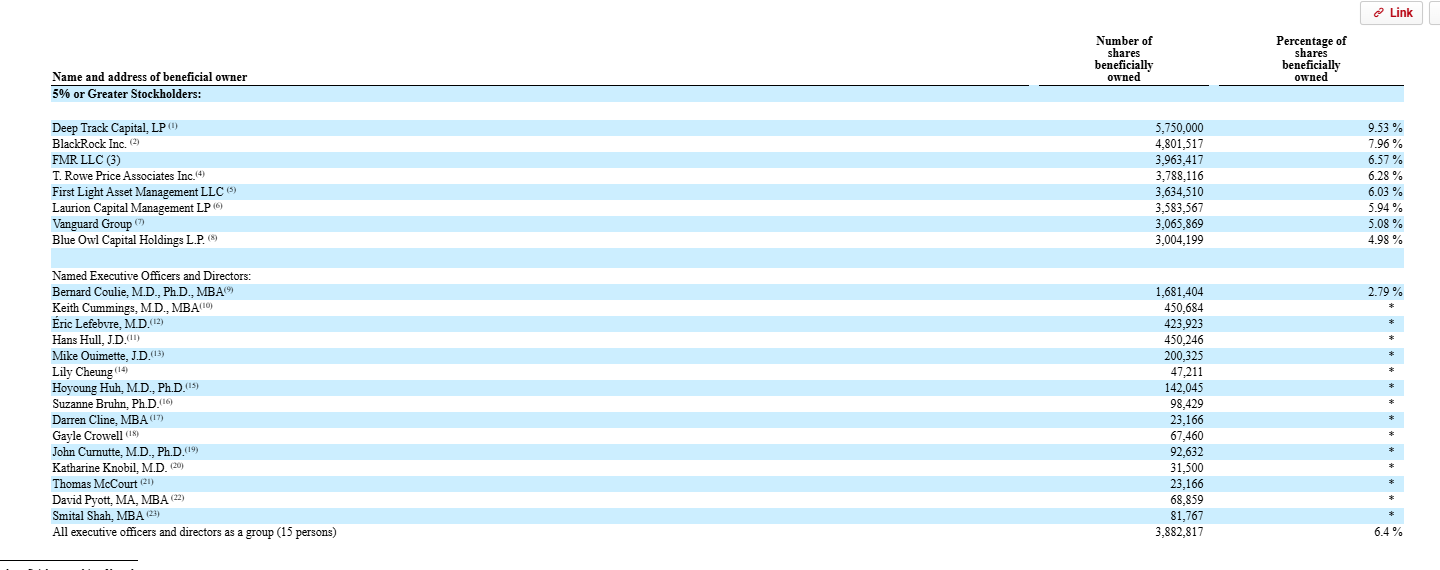

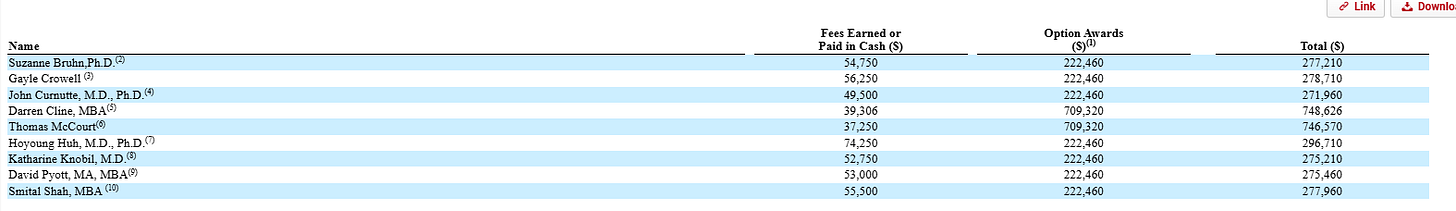

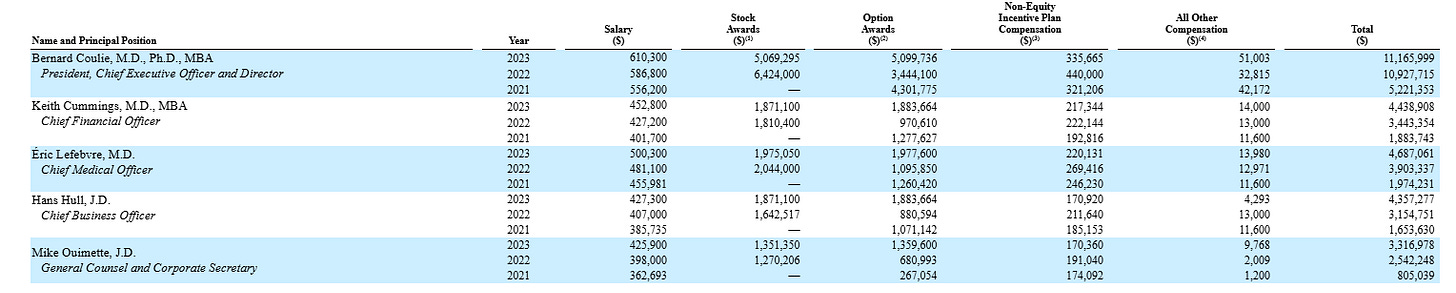

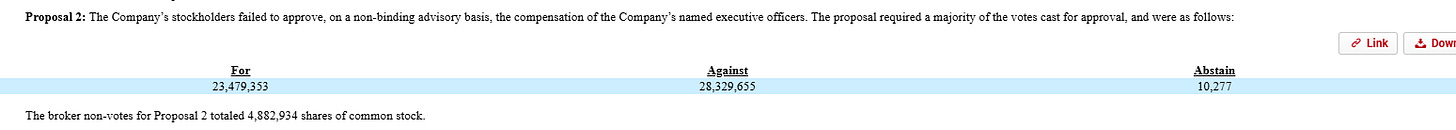

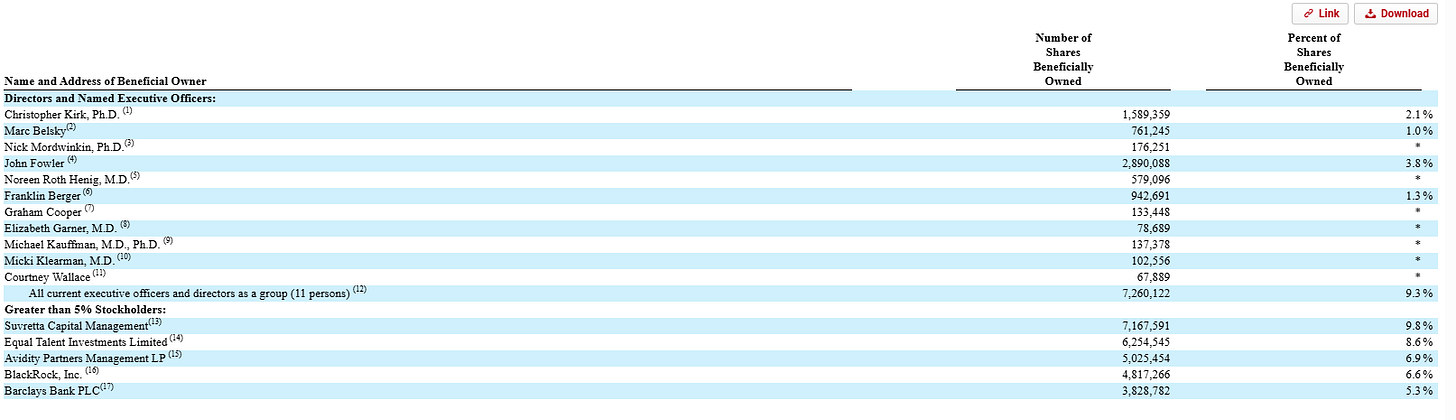

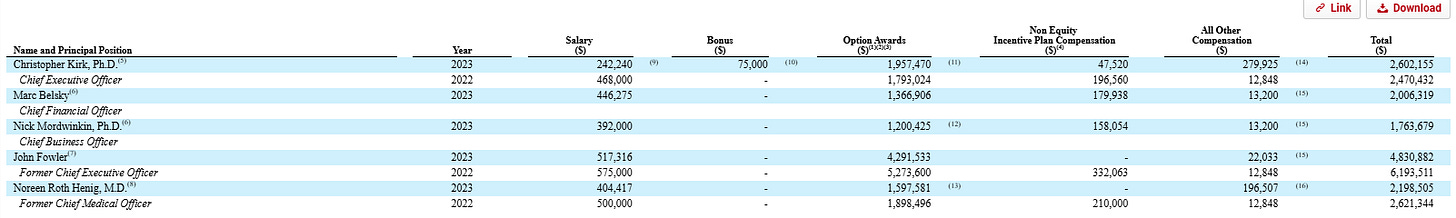

Pliant Therapeutics (PLRX; disclosure: I have a small position) had to pause trials on their lead drug on the recommendation of a safety board…. but not before the company basically said “we don’t believe the panel that the drug has an issue” and then spent more money on a commission to investigate the drug and realizing there was indeed a safety issue. The company has >$350m in cash and a market cap of <$100m. Insiders have been consistent sellers of the stock and insider ownership is basically nothing (almost all the insider ownership you see in the screenshot below is from far out of the money stock options). Rather than return cash to shareholders, the company seems interested in spending the cash pursuing some very early stage drugs in their pipeline…. does that decision have anything to do with the miniscule levels of insider ownership, the ~$250k in annual board fees each board member gets, or the >$25m/year in combined comp for the top executives (a number so egregious shareholders voted against it at the least annual meeting)? Seems at least plausible to me!

Kezar (KZR) has >$130m in cash and a <$40m market cap. The company has been in a slow burn for years since a “setback” to their main asset in 2022. After they finally discontinued that asset late last year, Kevin Tang offered to buy the whole company for $11.10/share plus a CVR (note: the offer price says $1.10/share, but they’ve since done a 1 for 10 split I’m adjusting for). Instead of taking that offer and wrapping everything up, the company seems committed to pursuing some earlier stage drugs that the market…. does not seem as excited about. Could insiders be more interested in pursuing the drugs because their stock ownership largely consists of out of the money options and they don’t want their seven figures of all-in annual comp to stop? Perhaps!

So there are four really solid examples of the type of historical net cash companies, and I haven’t really cherry picked there. Those are just four I’ve been following / done some work on, but I think there are several dozen more like them. These are the types of net cash biotechs we’ve seen historically: trade at a huge discount to cash, but with a lot of questions around what will happen with that cash. They are probably positive EV given they are trading for enormous discounts to cash and with discounts that big it really only takes good news at one of them to pay for a whole basket of them. Of course, the range of outcomes is really wide and a lot of the thesis depends on if the companies do the right thing / if shareholders can figure out a way to get their cash back. The nice thing about KZR and PLRX is that both already have a shareholder who has taken the first step to rationalization (KZR already has an offer from Tang to buy / liquidate them, and Tang also owns ~10% of PLRX), while STRO and NKTR seemingly don’t have any pressure on them…. doesn’t mean one basket works or one basket doesn’t, but I do think shareholder pressure is critical in these!

Bottom line: I think the whole sector is just completely bombed out right now (and I wrote most of this before the FDA’s top vaccine official was pushed out, which certainly won’t help sector sentiment), and I think you can find a slew of opportunities right now. Those type of deep discount to net cash companies are one such opportunity…. but I actually think discerning investors can do better than those examples, and that’s the type of opportunity I’ll discuss in part 2 next weekend. Till then!

RGNX is another one worth a look with a flurry of positive news lately, a negative EV, and a tanking stock price

Need ten more Kevin Tang's in the biotech sector...

I like TARA and ABUS, although ABUS is pivoting to being a patent troll (which I agree with and have paired with ROIV). Truly have to investigate what management is doing, as you illustrated.