Weekend thoughts: this time IS different for busted biopharm, part 3 (a tale of two busted bios and $TSVT proxy review)

This post is part 3 in my series on busted biotechs. Part 1 of the series, which you can find here, goes over some history and hypotheticals on the busted biotech thesis, while Part 2, which you can find here, goes through why I think this time is better than historical opportunities and implores shareholders to reach out to boards with their views on value maximization. I’d also encourage you to listen to my podcasts on Keros (KROS; disclosure: long) and Sage (SAGE; disclosure: long) for two real time examples of the types of opportunities in the space. I think those are two of the absolute best examples of the types of opportunities I’m seeing in the space…. though I will admit that I am clearly talking my book when I encourage you to listen to those podcasts / say they’re the best examples!

If I’m being honest, part 2 was supposed to be the end of this series…. but three things made me want to write more. They are:

There’s been two really interesting and divergent examples of corporate events in the space

TSVT’s proxy came out, and I was rather shocked by the background

I’ve had so many shareholders reach out to me with different thoughts / questions / pushback.

Given those three items, I wanted to put a bit more pen to paper. Today, I’m going to discuss the two interesting / divergent examples and the TSVT proxy, and then next week I’ll post my final (?) piece in this series addressing some of the shareholder inbounds. Let’s hop to it.

So the two examples I want to highlight are THRD (disclosure: long; I wrote it up on the premium side back in February) and Spruce Bio (SPRB; no position and no plans to initiate one, but let me be clear that this is an insanely small penny stock so go check out our legal disclaimers before even thinking about looking at this). These are two fascinating examples because I think they illustrate the upsides and pitfalls of these types of opportunities so clearly.

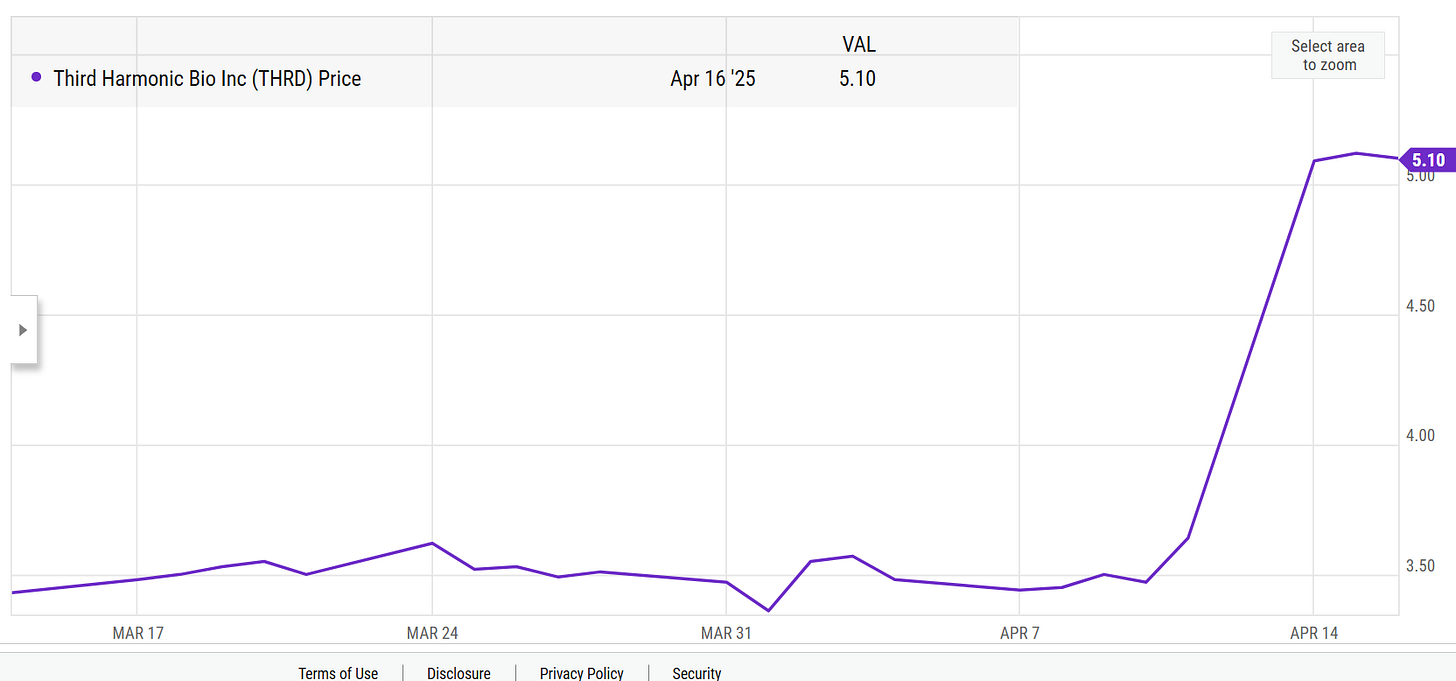

Let’s start with THRD. At year end, they had $285m in cash (~$6.30/share), and in February they announced a strategic alternatives process. Despite that announcement, the stock traded at a huge discount to cash value (~$3.50/share), so the market was clearly skeptical that management would do the right thing and return cash to shareholders if there was no better path forward. And, benefit of hindsight, the market was clearly wrong; on Monday, the company announced they’d be liquidating and returning >$5/share in cash to shareholders, and the stock was up ~50%.

What I thought was so interesting about THRD (and the reason I had a position) is that the company didn’t just announce strategic alternatives… they announced strategic alternatives and said that they planned to have ~$265m in cash at June 30, 2025. I thought that was a really interesting disclosure; I don’t think I’ve ever seen a net cash bio disclose a forward cash balance, and by disclosing it the company made it really difficult to pursue any plan that didn’t result in shareholders getting something approaching that level of cash in value. Not impossible, but difficult!

So for the past few days I’ve been kind of kicking myself: THRD was trading for two-thirds of a conservative liquidation value and I had a reasonably unique insight that the company was going to do the right thing. Why didn’t I have a bigger position? This was risk free, right?

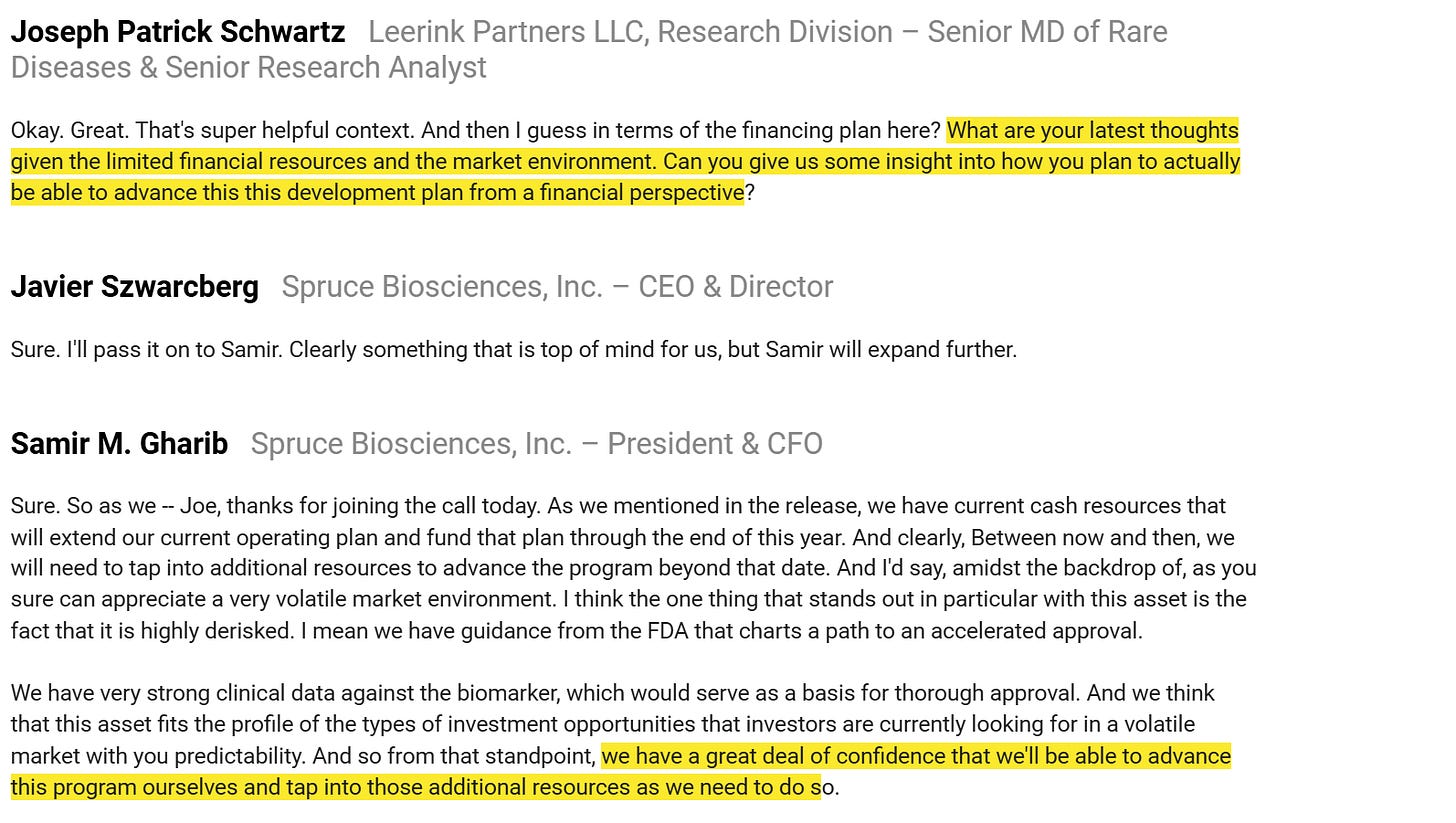

Well, I think I can answer that question with my second example: Spruce Bio (SPRB). Spruce Bio has historically attracted some investor interest (see, for example, this VIC write up) because they trade for a large discount to cash. However, management has clearly shown time and again that they are more interested in using that cash to pursue science projects regardless of IRR than they are in returning the capital to shareholders (it was a true “cigar butt” in the Ben Graham terminology I mentioned in part 2).

Now, if you had asked me about Spruce Bio at the beginning of the month, I would have told you I had no real opinion on the company / stock…. but if you had put the proverbial nerf gun to my head and forced me to give you an opinion, I would have acknowledged how poor all that background was but said they were probably interesting right now just because the cash balance was running so low they didn’t really have the ability to pursue anymore science projects. At year end 2024, the company had <$39m in cash, which gave them less than one year of cash runway. With the stock trading below net cash and the company already a micro-micro-cap, I thought maybe management’s hand would be forced and they would need to shut down the science simply because there was no place left to go for funding.

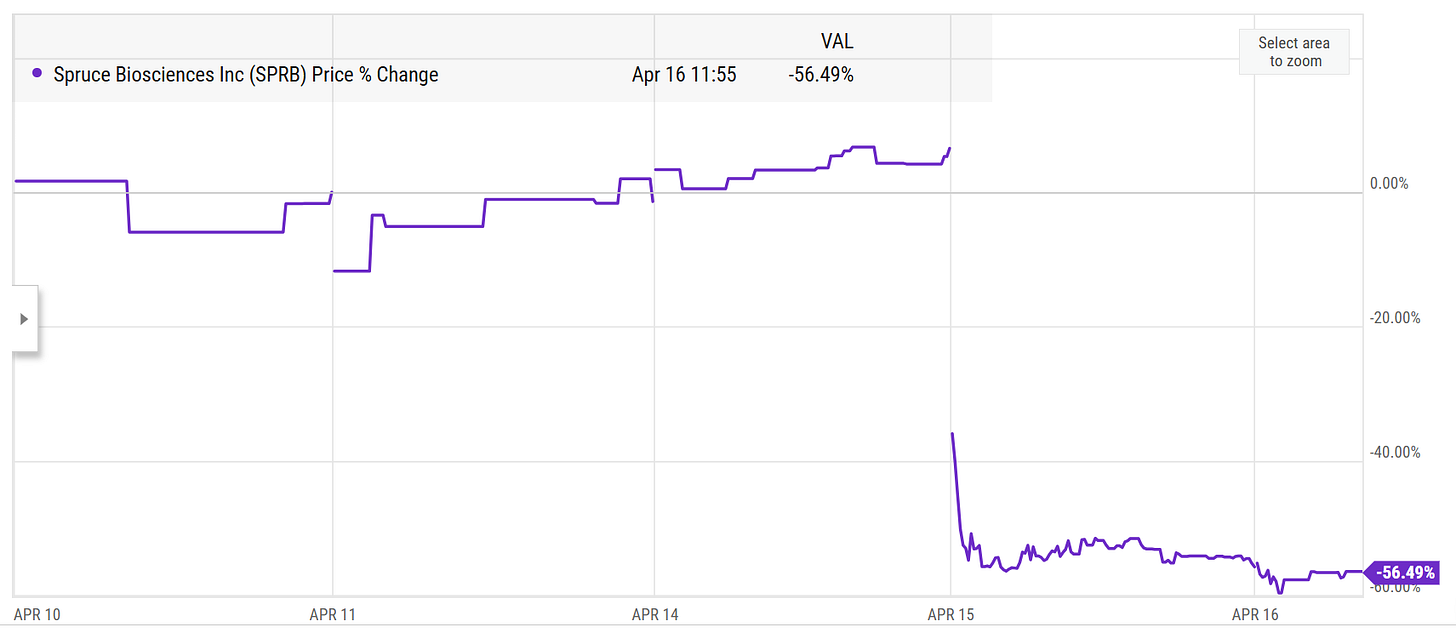

Boy would I have been wrong. On Tuesday (April 15), SPRB announced a “new corporate strategy” and acquired another molecule. This was a spectacularly…. well, let’s use the term “bold” decision given the limited resources the company has. Most companies with less than a year of cash runway are desperately looking for ways to cut cash burn and raise money; I use the term bold to describe this deal because SPRB appears to have decided “to heck with it; we think we can structure deals that are so smart investors will rush to finance us despite our huge discount to cash and the crazy market environment.”

Investors were not pleased with this decision. SPRB’s stock has been cut in half on the announcement….

What’s crazy about this drop is SPRB was already trading for a <$15m market cap, so you were already talking about a company trading for ~a third of cash. After the drop, SPRB is trading for less than 20% of cash! That’s wild! But the company just announced a deal that will require a ton of cash burn / R&D in the future despite their stock trading at half of cash, and when asked about financing they basically said “YOLO.” Perhaps the management is right and they’ve identified some crazy hidden jewel or something, but I’d suggest the base rate for companies exhibiting similar M&A tendencies would support a huge discount!

So, to bring this back to THRD, it’s easy with hindsight to kick yourself (or I guess myself) and say, “this was a company trading for just over half of liquidation undergoing strategic alts; why wasn’t I huge in it?” And I am kicking myself….. but then you see a situation like SPRB where the company trades for well under half of cash and keeps finding ways to pull demon rabbits out of its hat, and you remember that the corporate governance at many of these bios is just awful and all it takes is the board making one bad decision for the entire cash balance to get wiped out.

I want to switch gears and talk about one more example: TSVT’s recent deal. I mentioned TSVT in part two of this series, and noted they were a really good comp for SAGE. I had several people pushback on me, noting that TSVT had undergone a years long process to slim themselves down and get themselves ready for a deal with BMS (starting with the sale of their R&D pipeline to REGN), and that the board / management was way more willing to transact / aligned than at SAGE. So the investors were pushing back that TSVT wasn’t a good SAGE comp simply because TSVT was much more aligned with shareholders. I would probably have mostly agreed with those arguments…. well, I would have agreed, until TSVT’s merger background came out Monday afternoon. I was legitimately shocked by what I saw in there; in December, TSVT tried to spend ~half their cash balance buying an asset out of bankruptcy, and after that move failed TSVT got very late into deal talks on a merger of equals with an unnamed company. That merger eventually fell through in large part because TSVT’s merger partner was spending cash like a drunken sailor and wasn’t bringing the burn down fast enough, which eventually pushed TSVT to reach out to BMS and reach a deal that actually maximized shareholder value.

Why do I mention this background? Again, because a lot of investors have pointed to TSVT as a best case scenario for the busted bios. And, in terms of outcomes, it absolutely is a best case scenario: you had a single asset company that sold to their best buyer for a huge premium. But investors have suggested that TSVT had an aligned board who was destined to do right by shareholders, and the proxy background reveals how wrong that assumption was. TSVT actively pursued and came very close to completing two transactions that would have incinerated shareholder value (at least in opinion!). Even if you think I’m wrong on the value destruction, it’s hard to imagine there was any risk adjusted route that was better for shareholders than selling to BMS, and TSVT came very close to pursuing alternative paths multiple times.

So I mention the TSVT example in part as a cautionary warning to other investors and myself: these net cash ideas seem good, but even in the ones that seem most aligned the corporate governance can be an enormous risk. It’s just absolutely imperative that all shareholders practice good engagement and let their thoughts / views on value maximization be heard; the alternative is endless value destruction.

That’s actually a good place to end for now, because in part 4 I want to (hopefully!) wrap this series up by diving a little more into active shareholder engagement and preventing value destruction. Till then!

Agree with your conclusion on the risk profile of these 'failed biotech' strategic review situations - I have compiled stats for the last 3 years and they were pretty much 50/50 in terms of the outcome (positive vs. negative market reaction).

The problem is boards may actually think they are maximising shareholder value when doing reverse mergers/acquisitions/in-licensing since the NPV of these options often looks higher (though opinions may certainly differ). In fact, boards are supposed to maximise the value over the 'long-term' and for all shareholders (not just the special sits/activist ones looking for a quick return on a liquidation/sale). More cynically, another problem could be that compensation arrangements may incentivise transactions vs liquidation.

I owned both THRD and SPRB but thankfully THRD in far bigger size. For THRD's case it was clear in the transcript management appreciated that the market hated them continuing with their plans THB335 too which is rare in biotech.

SPRB was the stalking horse for the Eiger BioPharmaceuticals bankruptcy asset and if you look at who ended up winning the auction (AMLX) you'll see the market really liked the idea. It came down but it's still ~double from when AMLX won. So my thinking was maybe these guys aren't total idiots and it could work. Unfortunately they chose a really bad asset that the market is unwilling to fund so this is toast and I sold for a L.

Buying a new drug to develop can work out but it's far more random than just returning the cash. I really liked the THRD management and I would've liked to see those guys develop a new drug so I was a little disappointed to see them folding up shop, but cash is good with me too! :)