Weekend thoughts: this time IS different for busted biopharm, part 2 (this time is better and a call to action)

This post is part 2 in my series on busted biotechs. Part 1 of the series, which you can find here, goes over some history and hypotheticals on the busted biotech thesis. I’d also encourage you to listen to my podcasts on Keros (KROS; disclosure: long) and Sage (SAGE; disclosure: long) for two real time examples of the types of opportunities in the space. I think those are two of the absolute best examples of the types of opportunities I’m seeing in the space…. though I will admit that I am clearly talking my book when I encourage you to listen to those podcasts / say they’re the best examples!

In part 1 of the series, I mentioned that a key pushback I get on my “busted biotech” thesis is that there have always been biotech companies that trade for a discount to net cash. That is certainly true…. but the reason I think busted biotech is so interesting right now is because there are companies that are materially larger than the traditional “failed” cash shell biotech and that have assets that have clear positive value on top of their cash balance. That’s a potent combination that we have not seen in the prior waves of failed biotech.

I will give some examples in a second (though the SAGE and KROS podcasts above serve as fantastic examples!)…. but, before I do, let me talk about why the opportunity exists. It’s actually pretty simple: pre-commercialization biotech has been destroyed.

Now, the way most people track early stage biotech is with the XBI ETF. And if you looked at that, you might wonder what the heck I’m talking about when I say the sector is completely bombed out, as the index is down “only” 15-20% over the past year.

But here’s the thing: in summer 2024, the S&P changed the weightings for the Biotech index that the XBI tracks. The new weightings pushed the index much more to larger cap companies that were post commercialization (previously, the index was something like 100 companies all with a ~1% weighting and rebalanced pretty frequently; now it’s the 25 largest bios with >2% weightings making up the vast majority of the index). You can see the results in their current holdings:

I think the index methodology changes to the XBI are hiding a lot of the real pain in the smaller / pre-commercialization type stuff that I’m looking at. There, it’s absolute carnage. It’s hard for me to show just how bad it is because I don’t have a great index for it….. but I have two loose examples I can use just to give a feel for how bombed out things are.

The first is the BBC ETF. This is a very small ETF (its market cap is ~$10m!) that tracks the preclincal companies. That ETF is down >40% over the past year and ~50% over the past six months!

The other way I can show the pain in earlier stuff is even funkier. Someone on Twitter shared with me the custom index MSXNNCBP on Bloomberg. It’s an index designed for pre-commercialization biotech; it’s down 20% in a month and 45% over the past six months. True pain.

I’m not claiming either index is perfect; I’m not even 100% positive what’s in the custom index! But the god awful performance and insane recent drawdown is matching what I’m seeing in real time. The pre-commercialization space is just devastated right now. Companies are trading for larger discounts to cash than I’ve ever seen, and a ton of companies are trading at or below cash despite having assets on top of that cash that have clear positive value and we have recent proof points that the market is underestimating the strategic value of some of these assets.

To be honest, I think you could probably throw a dart at a basket of these companies and do pretty well from here. The discount to asset / strategic value (whether that’s just cash or some drugs that have clear strategic value) is just too large.

Let me give some loose examples of interesting set ups:

I mentioned STOK in a previous post, so I won’t regurgitate it here… but the stock has traded off in the current market meltdown so it’s now trading below net cash balance despite having the U.S. rights and international royalties on a drug that Biogen wrote a massive check for the international rights to.

TARA had $170m in cash at the end of 2024 thanks to a massive equity offering in December. That equity offering is really interesting; their stock closed the day before the offering at <$3/share, yet TARA had a bunch of sophisticated biotech investors pump $100m into the stock at $6.25/share. Today, the stock trades for $4/share, a discount to the company’s net cash balance and obviously a huge discount to where sophisticated investors put literally hundreds (ok, hundred) of millions of dollars into the company just a few months back.

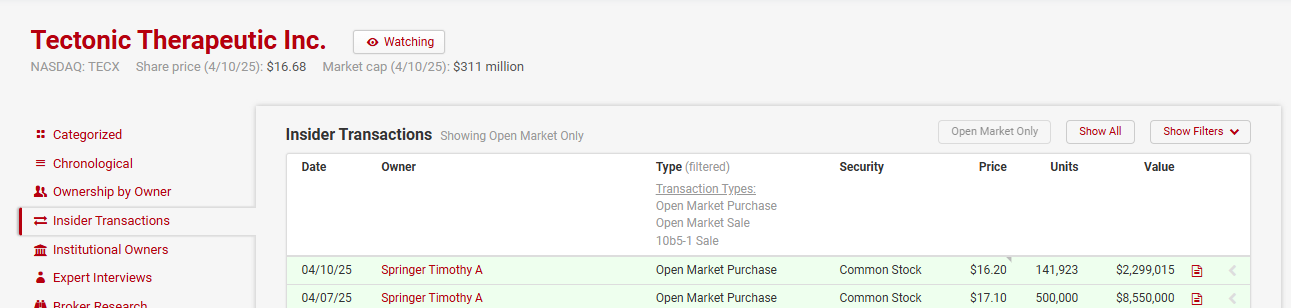

Similar to TARA, TECX had a who’s who of sophisticated funds PIPE in $185m at ~$50/share (about in line with the stock’s prior closing price; though the stock was volatile so it may have been a slight premium or discount depending on when they priced it); the stock has been smoked in the recent carnage1 and is currently trading for roughly cash value, and there’s a director / 10% owner who’s bought ~4% of the company in the past few days:

Those are three fascinating set ups. I don’t own any currently (I’ll discuss why in a second), but I’d guess that each of those is pretty positive NPV, and a basket of the three (and maybe a few like them) would do very well from here.

I wanted to highlight those three names because I think they’re a clear example of why this time is different / so much better in biotech. There have always been biotechs that trade for below net cash value, but in general the biotechs that traded at or below net cash were very small with no asset value on top of their cash and boards that were pretty misaligned / committed to lighting all of that cash on fire.

Today, the sector is so shelled out that you’re able to buy companies for below net cash and get their (often very) valuable strategic assets thrown in for free. And, while the board alignment may not be perfect, you’re often buying into companies where the board does have a meaningful stake or where you’ve seen board members buy stock in the recent past.

An analogy might help illustrate this: Ben Graham coined investing in net nets “cigar butt” investing, and it was just a perfect analogy. If you find a cigar butt on ground…. yes, it’s nasty, but you can have a free hit of a cigar, so the price is right if you’re just talking about getting a cigar fix for the cheapest way possible2. Net-nets are similar; the businesses that trade for net-net often have significant amount of hair on them, but they’re trading far below liquidation value so the price is right. Historically, net cash biopharms would qualify as perfect cigar butts; they had no real business and the corporate governance issues were real, but they were just so damn cheap that on the whole a basket of them couldn’t help but do well. I’d argue that comparing today’s net cash biopharms to the ones of yesteryear just isn’t fair; if yesterday’s biopharms were akin to a cigar butt that was really nasty but you got one free puff from, today’s biopharms are akin to brand new Cubans in an individual wrapper that are just being handed out for free. The quality is just that much higher.

Now, this blog is free (well, this post is free; there is a premium side that has a few more net cash pharma ideas that is very much paid!), which means I generally try not to throw out actionable ideas on it and instead keep most discussions to a high level / general investing thought. So a more skeptical reader may be wonder why did I just threw out three reasonably actionable / interesting / quirky ideas in STOK / TARA / TECX? Heck, you might be wondering why I’m throwing all of the details out on what I think is a generational opportunity in busted biotechs.

The answer?

Well, on the first question (why did I throw three reasonably actionable ideas out in quick succession): it’s because I wanted to highlight just how unique / different the opportunity set today is in some names that I will probably never own. Why? Because I will be the first to admit: I am not a scientist or pharma expert. All of the names I listed are very interesting, but they don’t trade at such an extreme discount to cash that you could justify an investment into them without having at least some understanding of the science, the go forward path, etc. Now, they’re cheap enough and a big strategic / sophisticated financial has written a big check recently enough that you could probably just buy a basket on the thesis that, on the whole, they’re likely to work out from today’s prices…. but I don’t just see any path to me personally feeling like I have a strong enough grasp on the science side to justify an investment in any of these. So I put these ideas out because they’re fantastic examples of the types of opportunities I think are out there and they are the types of companies that just aren’t in my wheelhouse / I would probably never buy.

But that bleeds nicely into the second question: why do I keep talking publicly about / detailing an opportunity that I keep calling generational? Shouldn’t I be hoarding it all to myself?

The answer is simple: if you believe my thesis, all of these companies are trading at a huge discount to cash (or NAV if you give them some credit for the drugs / pipeline that clearly have value given recent marks from strategics / sophisticated financials) in large part because the market is placing a massive corporate governance discount on them (and I do mean massive; in part 1 of this series I mentioned several companies that traded for less than a third of net cash!). Corporate governance discounts are fascinating to me because they are completely within the board of directors’ ability to remove, particularly in companies that are trading for less than net cash. All the company has to do is return the cash to shareholders and *poof*, corporate discount gone. Of course, there are other ways to remove the discount; for example, the company could work hard to convince shareholders they are going to be good stewards of capital. If the company is successful in convincing investors, then investors will bet on the corporate governance discount closing by buying the stock, and the buying pressure would push the stock up to net cash value (and beyond) eventually3…. but I will be honest that is a path that sounds easy but is actually very hard, and IMO a company that trades at a persistent discount to cash should really return capital and forcefully eliminate that discount.

If the company’s board refuses to eliminate the discount on their own, then shareholders can easily remove that discount by voting the current board out and replacing them with a new board who is committed to eliminating the discount. And often the threat of getting replaced is enough to get directors to do the right thing; if you’re a director and you know shareholders are going to vote you out if you don’t eliminate the corporate governance discount, why not go ahead and eliminate the discount so that you can tell future boards / investors how shareholder friendly you are instead of getting voted out and having that black mark on your resume?

So my hope in publishing all of these notes highlighting the extreme discounts in biotechs is simple: by shining a light on the enormous discount some of these trade at and how simple it would be for corporations to remove these discounts in many cases, my hope is that I can convince some shareholders (whether those are current or new shareholders) to make their voices heard. I’m not trying to tell you what to do or form a group with you (or anyone!); I’m simply a believer in good corporate governance who is appalled by the willingness of many of these companies to continue to trade at huge discounts to cash and light hundreds of millions of dollars of shareholders’ money on fire while shareholders sit idly by and do nothing. It’s not only insanely frustrating, but ultimately in the long term it’s a disaster for the industry (and by extension a disaster for innovation in pharma / healthcare) because what investor in their right mind is going to write a check into a new company in the space when every existing company is trading for a fraction of cash and treats shareholder money like their own personal lottery tickets?

Thus, my call to action: if you’re involved in one of these biopharms, send a note to the management and board (it has to be both; if you only send it to management the board might never seeing it) letting them know what you think the path to maximizing value is. If you disagree with me and think the best path forward is pouring all of their money into R&D, that’s completely fine; let them know. But if you agree with me that these companies need to rationalize spend and return excess capital to shareholders, let the board and management know that as well… and let them know time is of the essence; the cash burn at many of these is enormous and every wasted day is another day of value destruction. Given that urgency, I think it would be reasonably to tell them you’ll vote against every director until the company comes up with a plan to close the discount and rationalize spend, and that you’d actively support any director (internal or external) who proposes a clear cut plan to address those issues.

Let me end this note / series by giving you one recent deal, because I think it’s such proof of concept for so many of the things I’ve discussed in this series. 2Seventy Bio (TSVT) has a long and very checkered past, but heading into this year it consisted of basically two assets: ~$3.50/share in cash, and a 50% stake in Abecma’s domestic stales (a late stage cancer drug they’re partnered with Bristol Myers Squibb on). Clearly, TSVT had value over and above its cash (Abecma did $242m in domestic sales in 2024), but, despite that clear value, TSVT did not trade for >$3/share this entire year…. until they announced a deal to be acquired by BMS for $5/share (a ~90% premium) in mid-March.

Obviously TSVT is just one (very successful) example (one I wish I had been involved in size!), but I think it’s a great illustration and reinforcement of the types of opportunities I’m highlighting. The cash value is firm, and the strategic value is real (as shown by TSVT)…. but no one cares because every biotech investor has been slaughtered and the market is going to put a corporate governance discount on all of them until proven otherwise. That is a potent combination on the way down that can fuel massive underperformance and waves of selling / liquidations, but it creates enormous upside if you can successfully pick through the rubble and find a few that are overly discounted or where the management teams will actually do what is right for shareholders and the company.

Markets on the whole are rocky right now. But while the broader markets are going through a correction / bear market thanks to the tarriff volatility, the biopharm markets I’m following are going through something between the financial crisis and the Great Depression. That’s lead to huge volatility and massive underperformance…. but I think it’s also set up the opportunity for incredible alpha that could be accelerated if any of these boards do the right thing. My mission for this year is to do my part in making that happen.

PS- The TSVT example basically perfectly mirrors my SAGE thesis, and my hope and expectation is that SAGE will play out similarly.

PPS- I think a great example of how dysfunctional / distrusting this market is how the market is responding to strategic reviews. Consider KROS: they announced a strategic review less than a day after I posted my podcast on them; obviously the timing was nice, but I think it speaks to the level of dysfunction / distrust in the market that a company could announce a strategic review and see their stock trade from ~55% of net cash to ~67% of net cash (with no value thrown in for their clearly very valuable royalties). Another example the came out literally moments before this article was THRD (disclosure: long; I wrote it up on the premium side back in February). In February, the company announced a strategic review after discontinuing their lead drug. Disappointed by the lead drug discontinuance, the market sold THRD to the mid-$3s/share…. despite the company having well over $5/share in cash. Sure enough, this morning the company announced they’d be liquidating and returning >$5/share (with some optionality for more) to shareholders. Shareholders who bought over the past two months simply had to trust management wouldn’t literally light that money on fire in the strategic review and they’d have enjoyed a 40-50% return inside of two months.

While I believe a lot of the sell-off is market related, I think a competitor discontinued a drug with a similar profile to TECX, so there could be some science related reasons for the sell-off too. I’m not close enough to the company / science to strongly opine!

Well, that ignores the myriad health issues that would likely come from smoking random cigar butts you find on the ground, but whatever!

I’d note that the insider ownership at many of these net cash companies is abysmal; if the company wants to convince the market that they will be good stewards of capital, a good starting point would be insiders signaling to the market that they believe they will be good stewards of capital by having every director and executive buy a significant amount of stock on the open market. After all, if you’re a director who is convinced you will not invest in such a disastrous way the every dollar under your command is worth fifty cents, what better way to make an enormous amount of money than buying your stock at 50% of cash before the market realizes how wrong it was to doubt you?

With such a large discount to cash value wouldn't it make sense for the BOD to make massive insider purchases and then push to to return the cash to shareholders?

Seems like this would almost be a legalised form of insider trading.